Hispanolistic

The one thing that unites all human beings, regardless of age, gender, religion, economic status, or ethnic background, is that, deep down inside, we all believe that we are above-average drivers. ― Dave Barry

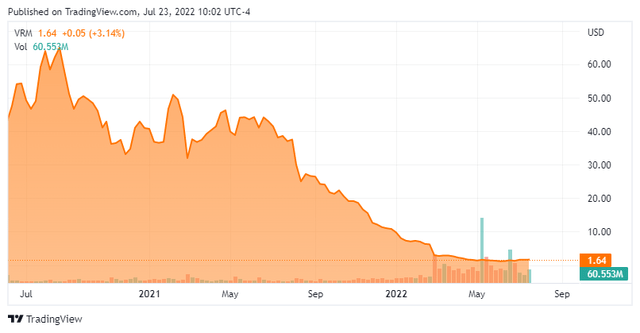

Today, we take our first look at a niche automotive retailer whom I am sure we have all seen advertisements from on television. While playing in the expanding sub-sector of e-commerce in the vehicle space, it hardly has been a smooth ride for shareholders since the stock debuted on the market two years ago. A new CEO is trying to refocus the company. Can the company execute a U-turn? An analysis follows below.

Company Overview:

Vroom Inc. (NASDAQ:VRM) is located in New York City. The company operates end-to-end e-commerce platform for buying, selling, transporting, reconditioning, pricing, financing, registering, and delivering vehicles. The firm began its corporate life as Auto America, Inc. before changing its name to Vroom, Inc. in 2015, about five years before it came public. The company recently completed the acquisition of United Auto Credit Corporation (“UACC”) and successfully completed their first auto loan securitization early this year. Shares now trade just above $1.50 and garner an approximate market capitalization of $225 million.

First Quarter Results:

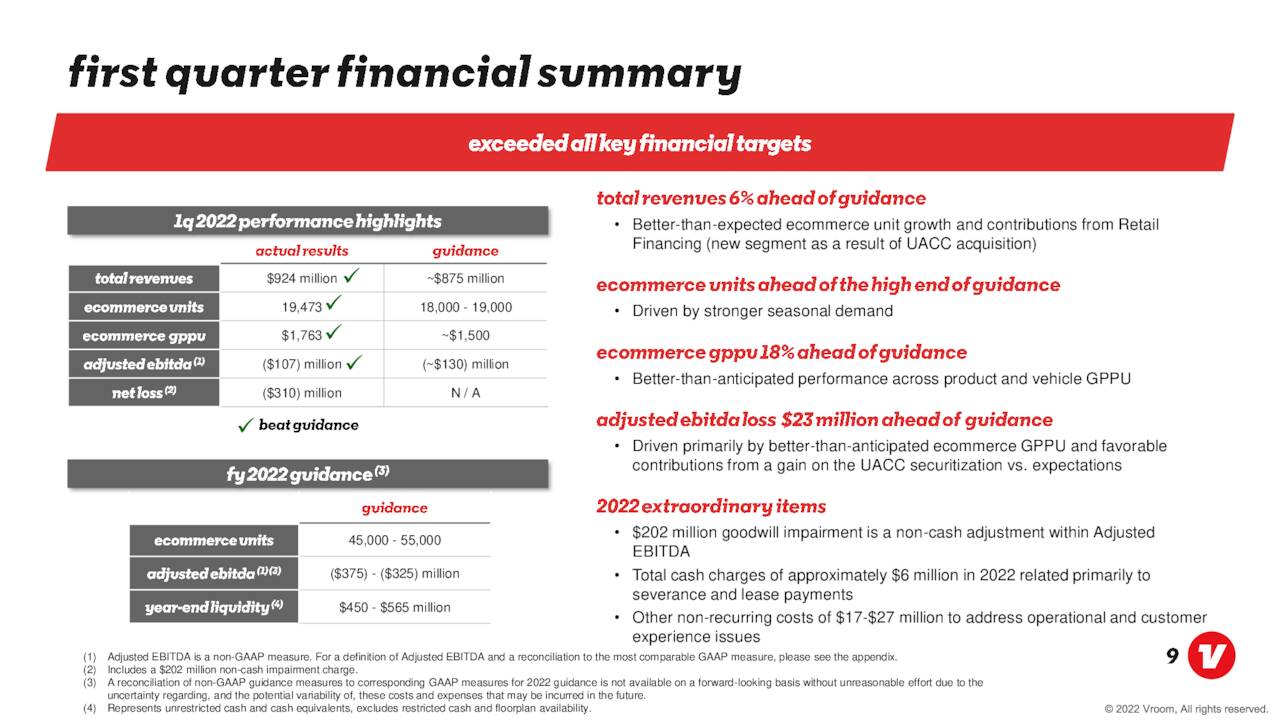

On May 9th, the company posted first quarter numbers. Vroom had a non-GAAP loss of 71 cents a share during the quarter as revenues roared ahead by more than 55% on a year-over-year basis to just over $923 million. Both top and bottom line numbers bested the consensus estimates easily.

May Company Presentation

E-commerce revenue came in at $675.4 million, up 60% versus the same period a year ago as e-commerce units sold rose 26% to 19,473. Wholesale units sold increased 17.0% to 10,113. This was primarily a function of ‘an increase in wholesale units purchased from consumers, a higher number of trade-in vehicles associated with the increase in the number of e-commerce units sold and strong wholesale market demand for used vehicles‘ according to the earning press release. Wholesale revenue was up over 18% from the same period a year ago to $140 million.

Retail financing revenue for the quarter was $47.7 million. It included a gain on sale of $29.6 million on a recent auto loan securitization transaction.

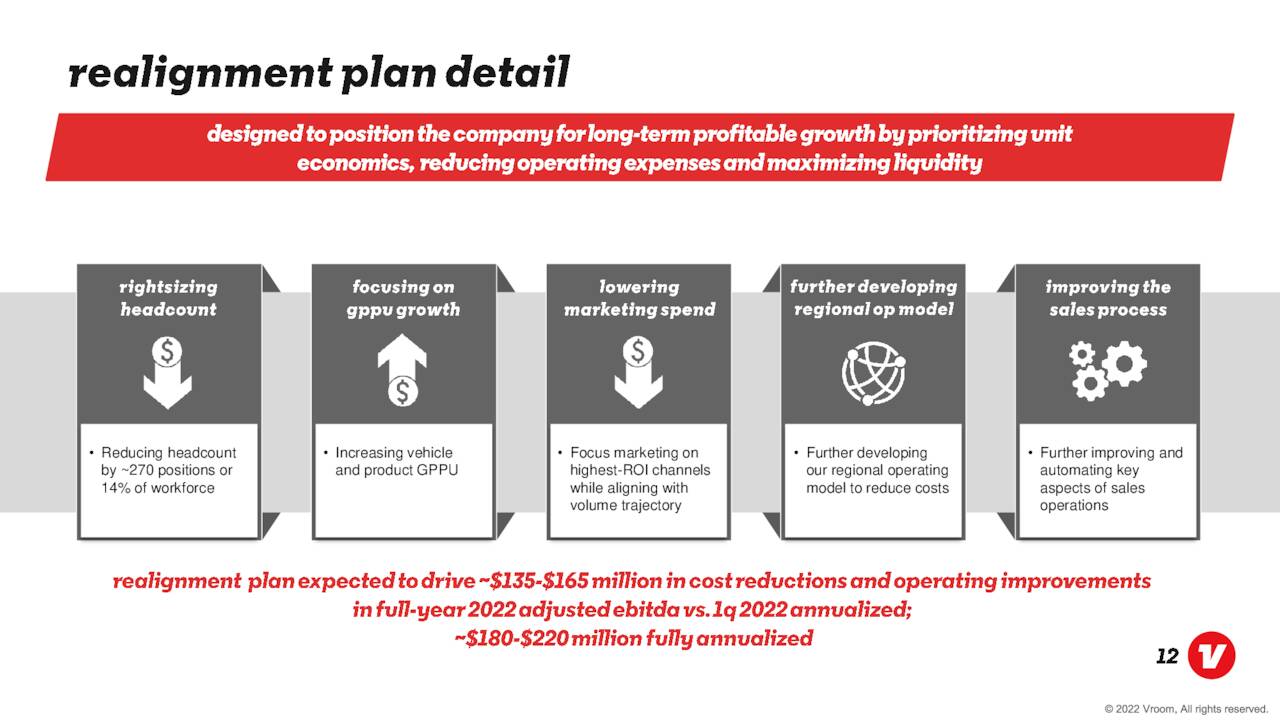

The company also announced a reorganization plan as part of its earnings release. This will result in workforce reduction and some other changes. These efforts are meant to prioritize unit economics, reduce operating expenses and maximize liquidity. They are expected to reduce operating expenses by $135 million to $165 million. The company’s COO recently became the company’s CEO replacing the previous leader who left for ‘other opportunities‘.

May Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community is not sanguine about Vroom’s prospects at the moment. Since first quarter results came out, four analyst firms including Stifel Nicolaus and Wells Fargo have reissued Hold ratings on the stock. Bank of America ($8 price target) and Robert W. Baird ($5 price target) have maintained Buy ratings on the shares.

Not surprisingly given the dismal performance of the stock, over one fourth the shares outstanding are currently held short. Two insiders have bought just over $350,000 worth of shares in aggregate since early March. This is the first insider buys in the stock since the company came public just over two years ago.

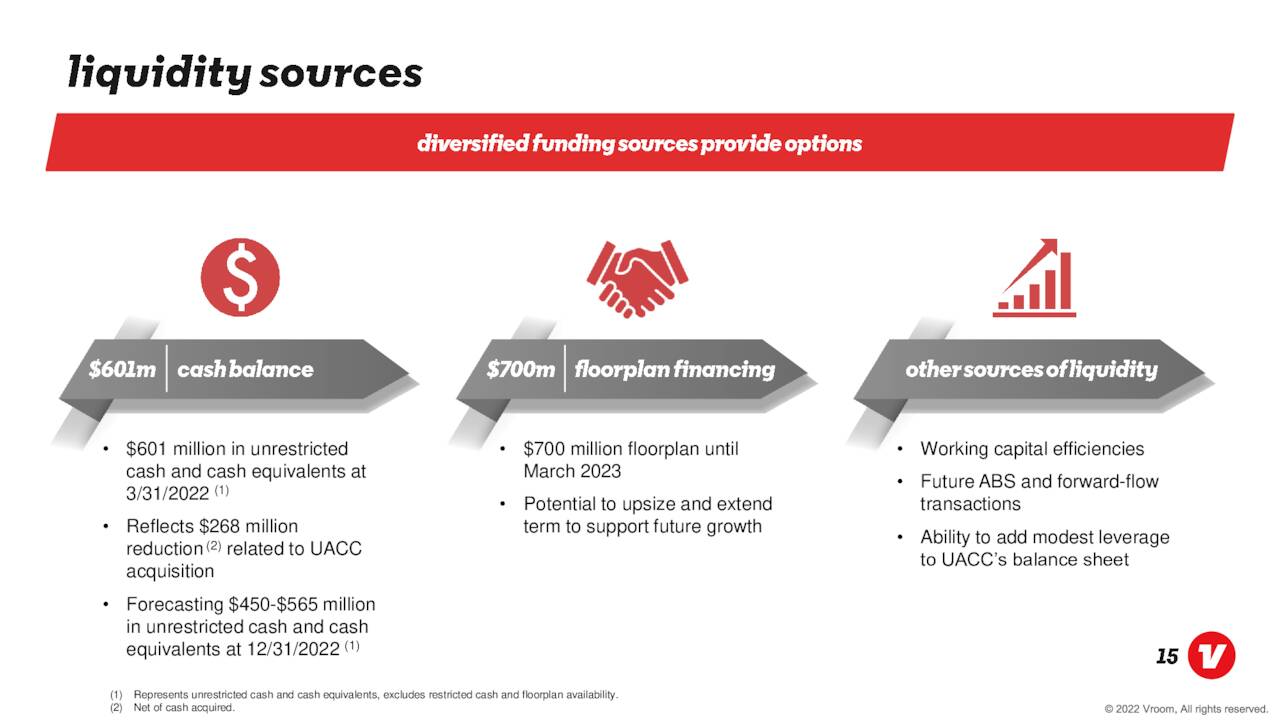

May Company Presentation

The company ended the first quarter with approximately $600 million of cash and marketable securities on its balance sheet. The company has nearly $700 million worth of long term debt. $550 million of this consists of 0.75% convertible senior notes due 2026 issued in a private offering in June 2021. Given the stock price was north of $30.00 a share at issuance, there appears little chance of conversion and dilution. The company had a non-GAAP net loss of $97.5 million for the first quarter after accounting for a just over $200 million charge for a goodwill adjustment.

Verdict:

The current analysis consensus has the company losing nearly three bucks a share in FY2022 as revenues fall just over 20% to $2.5 billion. They do expect sales to tick up slightly in FY2023 even as they project over two bucks a share in losses next fiscal year.

One key thing Vroom does seem to have going for it is a balance sheet that allows it some time to turnaround its business, despite the company’s large losses. Sales growth will slow markedly in the years ahead as the company’s new leader has no interest in chasing unprofitable sales for growth sake, unlike his predecessor. A recent article went into that dynamic more granularly.

The company should also benefit from rationality returning to the used car market after a year where used car prices had one of the largest surges on record and the lack of chip supplies negatively impacted new car production. Competitor Carvana (CVNA) has faced the same issues and even more heavily shorted than the stock of Vroom. Its balance sheet is not in as good a shape it should be noted as well. Carvana has a bit more cash on its balance sheet but also over $3 billion in long-term debt.

It is going to be a few quarters to see what impacts the new CEO, the restructuring and a new focus has on top and bottom line results. At best, Vroom is a ‘lottery ticket’ until substantial improvements are made to improve cash flow. As such, it only should be a small ‘watch item’ holding for aggressive investors.

Always focus on the front windshield and not the rearview mirror. ― Colin Powell

Be the first to comment