Vertigo3d

Investment Thesis

Coterra (NYSE:CTRA) reports Q2 results that investors welcomed. What’s not to like? A cheaply priced energy stock that is returning what annualizes as 13.7% total capital return, via a total combined yield.

Not only are natural gas prices in the US incredibly strong at approximately $9 MMBtu, but perhaps more importantly, Coterra’s free cash flow breakeven is at $2.25, despite the current higher inflationary environment.

Altogether, I believe that paying 5x free cash flow for this business remains very attractive. Even now.

Coterra’s Revenue Growth Rates Will Slow Down, So What?

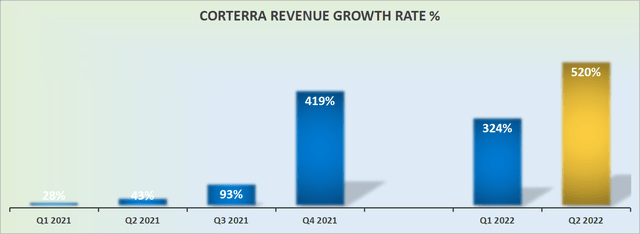

As you can see above, Q2 saw Coterra’s revenue growth rate explode higher. That’s great news, obviously. But as we look ahead, particularly to Q4, that’s when things will start to get difficult for Coterra.

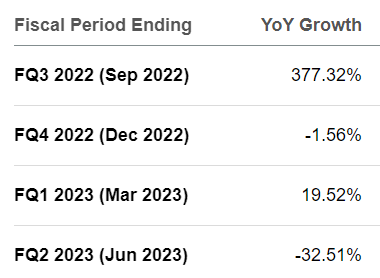

CTRA analysts expectations

As you can see above, Coterra’s Q4 is largely expected to post somewhere close to no revenue growth.

For a company that just come out of Q2 with such strong growth, for it to exit a couple of quarters’ time with no revenue growth speaks of a marked deceleration in its growth profile.

And that at that junction, investors will be pointing out “well it’s a cyclical energy company, what would you expect?”.

And that is part of the reason why the stock is so cheaply valued. But more on that in a moment.

Before that, let’s focus on Coterra’s use of free cash flow.

Capital Return Program: Near Clear or Flexible?

Coterra has announced that it intends on returning 50% of its free cash flow via a base plus variable dividend.

And then, after that, supplementing shareholder returns via share repurchases and potential debt reduction.

Understandably, Coterra has a somewhat opaque capital allocation strategy. Some investors may call it “flexible”. Essentially, the company is keen to return capital to shareholders, but it doesn’t want a “firm” framework that prioritizes a dividend, because natural gas prices are extremely fluid, trust me, I know.

And if the company forced itself into a corner, it would then be forced to pivot. And the last thing that investors want going when it comes to investing in commodity companies are companies that are “uncertain” and forced to change direction.

Sometimes I believe that when it comes to investing in commodity companies, uncertainty is actually more difficult to price in than bad news.

Moving on, in practical terms, that meant that Q2 saw a $0.65 total dividend, made up of a $0.15 base dividend, plus a $0.50 variable.

On top of that, Coterra’s share repurchase program returned $0.38 per share.

Altogether, this means that shareholders at the time of the Q2 earnings report would be getting around a 3.4% total return. This annualized at 13.7%.

At the end of my previous bullish article, I concluded with the following comment:

[…] there are only two aspects that Coterra’s shareholders should look out for when Coterra reports its Q2 2022 results in the coming few weeks. How hedged its book will be in 2023. What level of capital allocation will be returned to shareholders rather than debt holders.

All other details will be a distraction to the bull case.

While I still do not have the crystal clear framework that I wanted to have going into the Q2 earnings report, I do now believe that this is probably as good as it’s going to get in terms of visibility into the capital allocation program.

But what about Coterra’s hedged book?

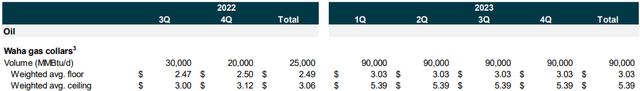

During the earnings call, Coterra stated that hedges are necessary are a safety measure in the current environment.

In the end, it’s much like buying insurance. We don’t have to have it, but it’s prudent to add some protection to the overall profile.

Indeed, as you can see above, Coterra has gone ahead and already started increasing its hedged book for 2023.

Meanwhile, Coterra openly notes that it’s in internal discussions about further increasing its hedged portfolio.

And this leads me to discuss the tough comparables for 2023 that Coterra faces.

CTRA Stock Valuation – 5x FCF

At its core, Coterra believes that it can get its free cash flow to approximately $4.5 billion in 2022. That’s a 5x to free cash flow, and that’s cheap, right? Well, here’s the problem.

While it’s practically impossible to predict natural gas prices for 2023, the fact remains that Coterra’s hedged book carries a weighted average price that’s 70% higher than it was in 2022.

And here’s where things get interesting. On the one hand, even though Coterra guides for $4.5 billion in 2022, it’s easily likely that Coterra could make just as much in 2023, even at lower natural gas prices.

Indeed, I argue that if natural gas prices were to fall to say around $6 to $7 MMBTU, not only will Coterra still be oozing free cash flow, but it “de-risks” the high natural gas prices, and makes the overall energy sector more stable.

Consequently, ironically, one could make the case that with lower natural gas prices in 2023, the market would be more stable and predictable and that the multiple that investors would be willing to pay for natural gas companies could actually expand.

The Bottom Line

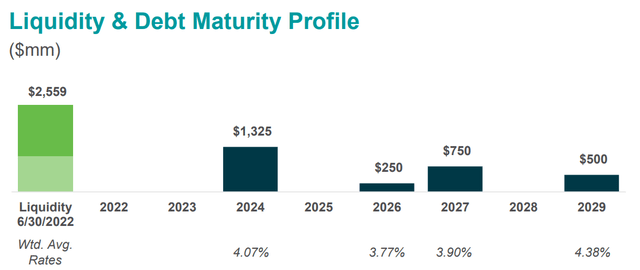

Coterra’s balance sheet is now very strong. I don’t believe that going into 2023, Coterra will be prioritizing debtholders over shareholders any longer.

Given that its next debt stack isn’t until 2024, I’m inclined to believe that Coterra will work to continue returning capital to shareholders, with its equity yielding approximately 20% compared with the interest on its 2024 debt carrying a 4.1% rate.

Indeed, the only quibble one has is the “uncertainty” of knowing how big a combined total return an investor is likely to make over the next 12 months.

But that’s a good problem to have. Buy rating.

Be the first to comment