da-kuk

Thesis

In the past weeks we have started reviewing converts CEFs. The last name on our list is the Calamos Convertible & High Income Fund (NASDAQ:CHY) which we are going to review in this article. Furthermore, we will provide an analysis of all the converts funds side by side and derive take-aways.

The vehicles we have reviewed so far are:

- The Calamos Convertible Opportunities & Income Fund (CHI) which we reviewed here

- The Advent Claymore Convertible Securities & Income Fund (NYSE:AVK) which we reviewed here

- The Calamos Dynamic Convertible and Income Fund (CCD) which we reviewed here

- The Virtus AllianzGI Diversified Income & Convertible Fund (NYSE:ACV) which we reviewed here

CHY Review

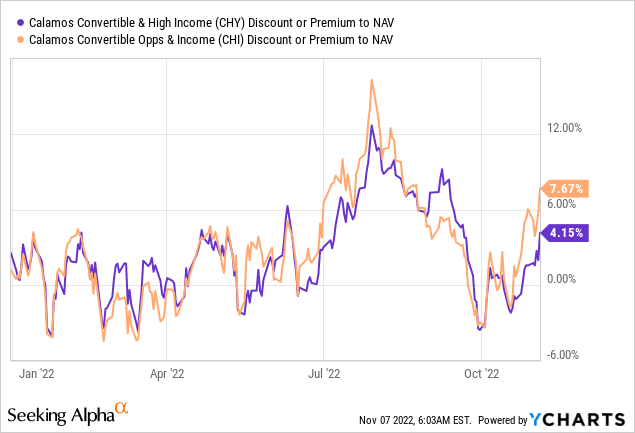

The Convertible and High Income Fund is another converts CEF from the Calamos family. The fund has an extremely similar build and total return profile as CHI.

CHY Holdings

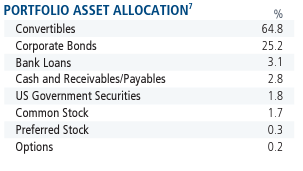

The fund exhibits the same 60/40 build as CHI:

Holdings (Fund)

Around 64% of the portfolio is allocated to convertible securities, with the rest split between bonds and cash.

From a sectoral standpoint the fund is overweight the information technology sector:

Sector Allocation (Fund)

On the bond side we see the same allocation as CHI, where the fund invests mainly in high yielding bonds:

Credit Quality (Fund)

CHY Performance

CHY exhibits an almost identical total return profile as its sister fund CHI:

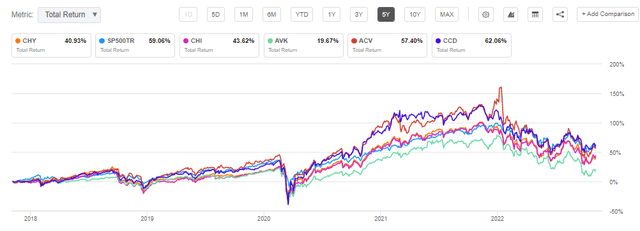

5Y Total Return (Seeking Alpha)

We can see the two funds closely tracking the S&P 500 total return profile during the past four years, with a slight underperformance in 2022. It is interesting to note that using a 60/40 portfolio via convertibles and leverage layering, the portfolio manager is able to obtain a total return profile that matches the index quite closely.

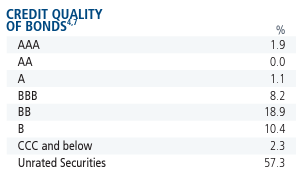

CHY Premium/Discount to NAV

The fund usually trades at values very close to net asset levels:

We can see that in the past 5 years the fund has spent most of the time at levels flat to its net asset value. There is a market beta component to the fund, where we saw a substantial discount to NAV during the 2020 Covid crisis and a surprising premium to NAV this year. We do not think CHY should be trading at a premium. The 12% premium to NAV seen earlier this year should have been sold into.

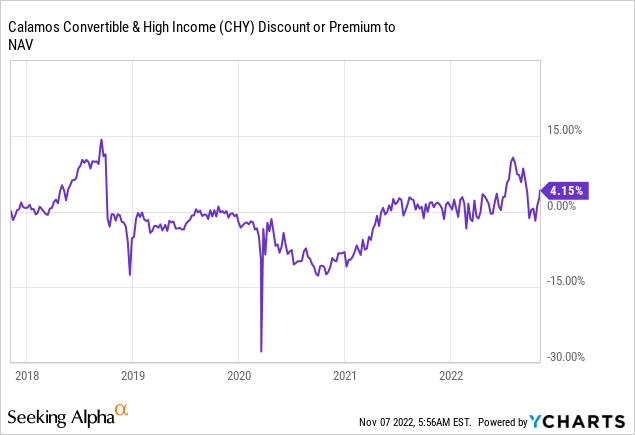

Investors are itchy for a recovery play, and it seems that when the market turns this fund will be bid up to a premium again. The CHY and CHI premiums should be very closely correlated, and a breakdown in levels should be traded given the close regression results for the two funds’ returns:

We can notice from the above graph how similar the premiums/discounts to NAV are for the two funds. The current divergence of 3% will be closed down, to the downside we believe.

Convertible Securities CEFs Comparison

We will now go through a comparison exercise for all the Convertibles CEFs we have reviewed in the past weeks. Let us have a look at a quick summary:

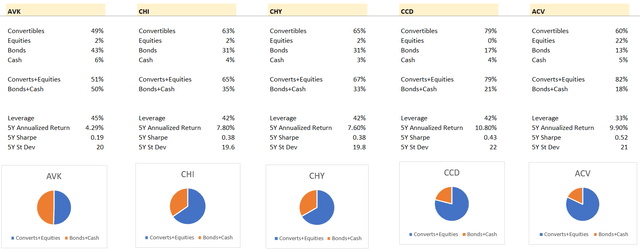

Comparison (Author)

We have arranged the funds in order of convertibles concentration. AVK exposes the smallest exposure to convertibles and equities at 51%, with ACV on the other side of the spectrum with an equities and converts exposure sitting at 82%.

Main Takeaways:

- All converts CEFs run high leverage ratios of around 40%

- The volatility of the funds is high, with the standard deviation increasing as the converts plus equity bucket gets larger

- CCD and ACV are the most aggressive funds from a composition perspective (i.e. highest converts and equities buckets) but also display the best long term total returns

- Converts is an accretive asset class, with no NAV destruction observed over time

- It helps that all of the analyzed funds have a U.S. centric holdings allocation

- Outside of AVK, all funds are overweight the Technology sector

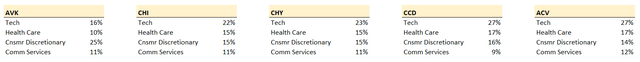

Sectors (Author)

If we look at the total return profile for the past 5 years, we can notice the same trends reflected in the performance graph:

5Y Total Return (Seeking Alpha)

- CCD and ACV, the more aggressive funds, significantly outperformed the cohort and the S&P 500 in the 2020 to 2022 period

- AVK, the least aggressive fund and the vehicle with the largest bond concentration, is at the bottom of the cohort and exhibits the worst long-term results

- CHI and CHY have almost identical results, and are mid-cohort

Conclusion

The Convertible and High Income Fund is another convertible securities CEF from the Calamos family. The fund has a 60/40 build, where 60% of the portfolio consists of convertibles, with the other 40% composed of bonds with a high concentration of high yield securities. CHY has a very similar total return profile to its sister fund CHI, and it is interesting to note how both vehicles closely mirror the S&P 500 performance in the past 5 years.

When putting all the reviewed convertibles CEFs side by side, we notice how AVK is on one side of the spectrum with a 50/50 build, while ACV is at the other end with an 80% convertibles and equities build. All the funds have high leverage ratios of around 40%. The more aggressive ones (i.e. higher converts and equities concentrations) have significantly outperformed during the zero rates environment that characterized 2020/2021, but have given back most of those gains. CCD and ACV are the higher beta funds and they also exhibit the largest Technology sectoral allocation.

Be the first to comment