tifonimages/iStock via Getty Images

I’ve covered International Paper (IP) to a rather extensive degree and for several articles. Sometimes bullish, sometimes not, but I’ve usually held a position in the company, as I do today.

In this article, I’ll provide an update on what I view as an excellent dividend company in the basic materials/paper business.

International Paper International Paper Presentation

How has the company been doing?

It should come as little surprise that a company like IP, active in carton and paper, has done well in the recent pandemic. Surges in omnichannel sales, e-commerce and high demand for shipping have resulted in high demands for the company’s products.

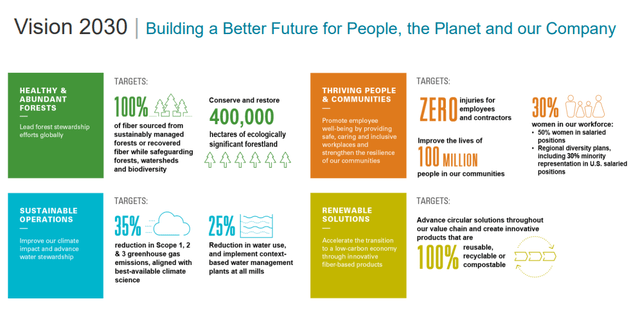

International Paper remains one of the world leaders in fiber-based corrugated packing and absorbent pulp. These products will always have a market, and they are well-positioned for the new ESG-based focus and economy we’re moving into. For its ESG, the company has a “vision 2030” that describes its renewable and people-focused targets. This might be interesting to some who focus on investing in sustainable businesses.

International Paper – Sustainable Targets International Paper Presentation

The fundamental thesis for investing in a company like International Paper is an “easy” one to me.

You’re investing in:

- An established operator in an appealing, resilient market, with low-cost assets and records of good operations. Recent years and mill conversions have resulted in increased flexibility in terms of products, and IP’s assets and business means that the company has access to low-cost sustainable fiber.

- There is an attractive market growth rate, essentially tied to world population/GDP growth, which is continuing. The supply chain issues don’t really impact IP to a negative extent like others, given that they are the producers of some of the things that are missing/in short supply.

- The company has proven strong, sustainable FCF and returns well over the cost of capital based on a higher ROIC than WACC, as well as delivering a solid 3%+ yield with a well-covered dividend, while being investment-grade rated.

What more can an investor ask for?

IP has been lowering its debt to around 2.9X (from 4X in 2016), while at the same time repurchasing shares, maintaining CapEx and lowering costs. Its pensions are sufficiently funded to handle what may come, and FFC, given the current economy, is up significantly to $2.3 billion for the full year of 2020.

The company maintains an average 2020 WACC of around 7.5%, and has consistently, for every year except 2009 and 2006, beat their WACC with ROIC of as high as 13.2%.

It takes a lot to bring this business down.

Recent results do absolutely nothing to change this positive outlook. EPS is up significantly, almost 2X the level of YoY, with significant margin expansion due to large price/mix increases because of demand. IP is seeing some SCM constraints for volumes, and higher input costs, but these are currently being passed down the chain.

The company managed further debt reduction, superb dividends, and finished its printing paper spin-off.

Everything as it should be, in short.

Having reviewed and calculated the numbers, there is nothing worrying across its cash flows, balance sheet, or income statement that bears mentioning here. Margins in terms of adjusted EBITDA are somewhat below some of its public comps, but they also have a different structure – and 16.4% is still what I view as good enough. One of the main arguments for IP is its superb flexibility in production facilities and mills across the entire nation.

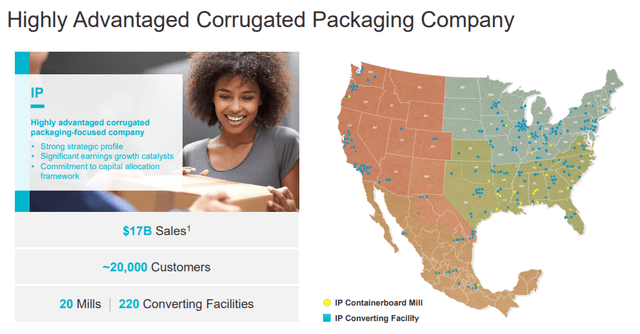

International Paper Asset Base International Paper

220 facilities and 2 mills, with 2 million box designs and over 20,000 customers make the company one of the most significant in the business. IP has 20 mills with 90% of the capacity in 1st-quartile cost at a very high degree of flexibility. It is furthermore, one of the more diversified NA businesses here abroad, with $2B in sales from its Ilim JV, as well as $1.3B in sales in the EMEA segment. Export and international appeal is a focus for the company – not just NA.

In terms of containerboard in NA, IP owns a market-dominating 31% share of the producer positions, with the second being WestRock (WRK). Looking at the way earnings flow over time, you can clearly see a trend in the upwards direction that is expected to continue as long as the fundamental trends that underlie it continue as well.

Given that I don’t see a massive GDP or pop. growth slowdown on the horizon, I view investments in paper and basic materials companies of its like as core to my investment portfolio.

International Paper is well-managed, well-positioned, proven, and established, and has an excellent asset base of operations. At the right price, this company is an absolute “BUY” to me.

The valuation

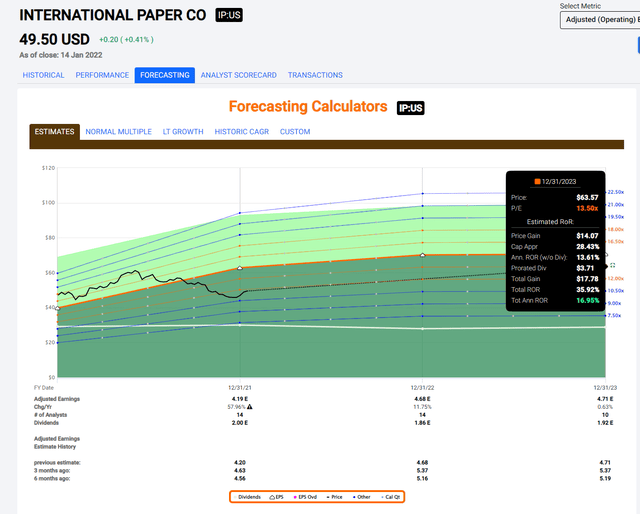

Based on continued expected earnings and cash flow growth as we move into 2021E-2022E, I am forecasting an EBITDA/cash flow growth rate of around 4-5% for the company in 2022 and beyond. This comes in line with the current S&P Global and FactSet targets as well and is based on somewhat lower growth compared to the large 2021 period. Margins are likely to continue increasing as a result of cost optimization and price hikes for products, at least for some time, offsetting eventual input and inflation increases. Current forecasts call for normalized EPS of around $4.5-$4.7 for the next few years. Based on the company’s positive historical ROIC to its WACC, I also don’t see any significant headwinds on the return front.

Now, International Paper certainly isn’t the most undervalued company you could invest in today – but it’s definitely undervalued to what I see as its earnings capacity and future estimated cash flow growth.

The company trades at an average weighted P/E of 12X while estimating its earnings to grow an average of 14.3% per year (Source: FactSet). Granted, these are somewhat front-loaded numbers, with no significant growth in 2023, but the 58% in 2021E and 12% in 2022E make it all the more clear that there is potential undervaluation here.

I’m not going to value a cyclical paper company at any sort of 15X P/E multiple – especially given that on a public comps basis, IP actually has lower operating margins than some of its peers – notably Packaging Corporation of America (PKG). It’s higher than WestRock, which means I would put it somewhere in the middle in terms of discounts I’m looking for.

Its historical P/E discount is around 13.5-14X on a 10-year basis. Forecasting a forward 13.5X to 14X P/E range with current forecast numbers brings us to annualized RoR of 17-22%.

F.A.S.T graphs International Paper F.A.S.T graphs

I would somewhat moderate these expectations to 10-15% on the high end, based on a trend for FactSet forecasts to be somewhat on the higher end and usually fail (50%+) on a negative basis. However, even on moderated expectations, the upside here is enough to be dangerous. At a 3.7%+ yield, you’re certainly getting more than average in this market situation.

You’re also positioning yourself with a company that’s bound to take advantage of the current economic circumstances. Even if a down would, like any cyclical, see IP suffer somewhat more than others, the substance in the company is more than sound, and it should be able to weather any trouble that can be thrown at it. Its geographical diversification also doesn’t make it overly sensitive towards climate risks or issues on a company-wide basis.

Overall, even if the company remains at today’s levels, the current valuation presents an appealing opportunity for this business – and I’m buying more at this level.

My own forecasts call for more conservative EPS/cash flow growth rates to FactSet, and I would view a 10-15% annualized RoR as more realistic, based on a sub-10% EPS growth in 2022, and none in 2023. However, under the current macroeconomic backdrop and with this company’s fundamentals, it is not difficult for me to consider this company a “BUY” with a price target of $56/share on a 2022E conservative basis. Above $56/share is where I would start reconsidering buying here.

Current S&P Global analyst estimates call for price targets ranging from $43/share up to $70/share, with an average of around €55.6 for 13 analysts (Source: S&P Global).

This calls for around 18-19% undervaluation based on today’s share price.

Thesis

My thesis for International Paper is:

- A fundamentally sound company in a very appealing macroeconomic situation with the right capabilities, customers, and asset base to be a beneficiary of the current situation.

- A proven company with good management and few “surprises” outside of typical sector cyclicality.

- IP is a “BUY” here at a price target, based on my goals, of around $56/share – though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

International Paper is currently in a position where #1 is possible in my process, through #3 and #4.

Thank you for reading.

Be the first to comment