10’000 Hours

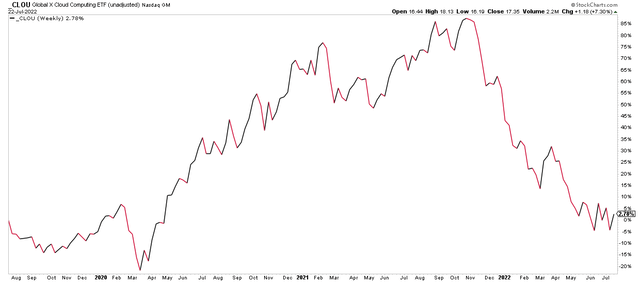

“The cloud” was a hot trade from the onset of the pandemic through much of 2023. Air quickly came out of the apparent bubble last year – some spots began selling off hard as early as February while others held up through early November. All, though, have succumbed to intense selling pressure recently. The Global X Cloud Computing ETF (CLOU) is more than doubled from its March 2020 low to the late 2021 peak but has now roundtripped to 2019 levels.

Cloud Stocks Not Weathering The Storm Well

One small cloud stock is RingCentral (NYSE:RNG). According to Bank of America Global Research, RingCentral offers a cloud-based solution for business communications that replaces legacy and expensive on-premises communications systems. It is delivered as an application that follows the user regardless of device (office phone, smartphone, desktop, tablet). Features include team collaboration, voice, text, fax, audio conferencing, and integration with document and customer relationship management systems. Microsoft (MSFT) and Zoom (ZM) are key competitors.

The $5 billion market cap company was once valued north of $40 billion. So many stocks like this were remarkably worth more than household-name industrial and energy companies, placing them easily in the large-cap camp. Those days were fleeting, however. The group has endured dotcom-like drawdowns. But is there value in a name like RingCentral?

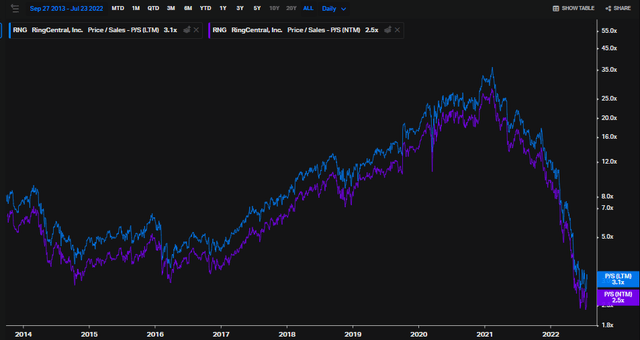

Consider that RNG’s price-to-sales ratios, both the backward-looking and forward multiples, have dropped back to reasonable levels. RNG’s trailing P/S ratio nearly hit 40x in 2021. That astronomical figure collapsed to just 3.1x today, according to Koyfin Charts data – that’s below pre-pandemic levels.

RNG Stock P:S Ratio Drops To All-Time Lows

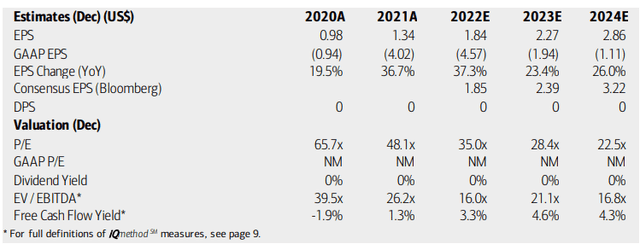

Looking ahead, BofA analysts see margin upside and positive free cash flow this year and through 2024. The research firm is optimistic about RNG capturing market share gains, but broad macro conditions could pressure financial performance.

Operating earnings are seen as growing quickly through the next two years while GAAP earnings remain negative. Using adjusted EPS, RNG’s P/E multiple could even drop under 20x should the stock price remain where it is as of last Friday’s close near $55. It still would trade at a lofty EV/EBITDA multiple, however.

RingCentral – Earnings and Valuation Forecasts

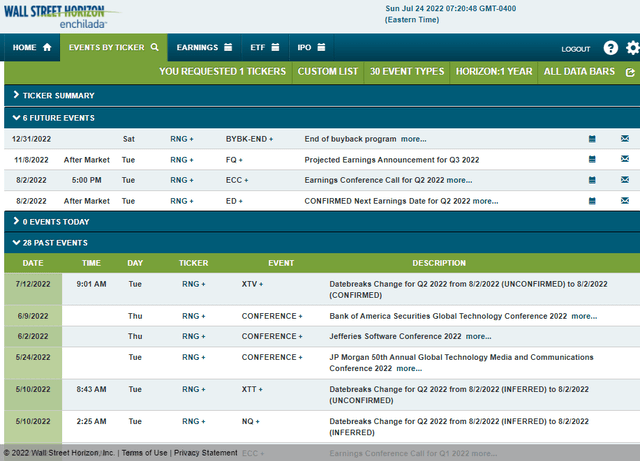

RNG has a Q2 reporting date confirmed for Tuesday, August 2, AMC with a conference call that evening, according to Wall Street Horizon.

RingCentral Q2 Earnings Report Due Aug 2

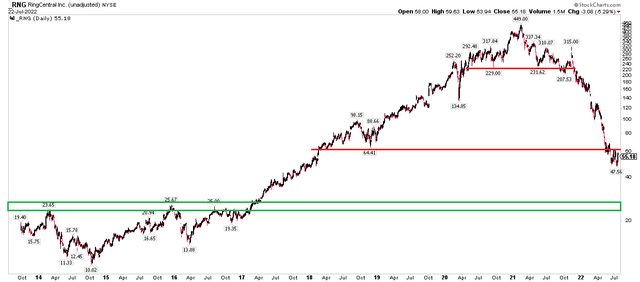

The Technical Take

What a wild ride for RNG. I see support significantly below the current price – with little to stop downside momentum here. While there is a tradeable low just above $45 from earlier this month, the current bounce might be just that – a bear market corrective move. I would avoid the stock until it gets back to the upper-end of its 2013-2016 range in the mid-$20s. On the upside, the low-$60s appears to be new resistance. All this bearish price action began when $230 broke around the turn of the year (and that was after a fall from almost $450).

RNG Stock: Lookout Below – Support Under $30, $60-$64 Resistance

The Bottom Line

While nearly 90% off the all-time high notched in early 2021, I see more technical downside risks with RNG. The upshot is that its valuation is arguably about the best it has ever been with a low single-digit price-to-sales ratio. Long-term investors and technical traders should keep an eye on the mid-$20s area to scoop up shares.

Be the first to comment