adaask

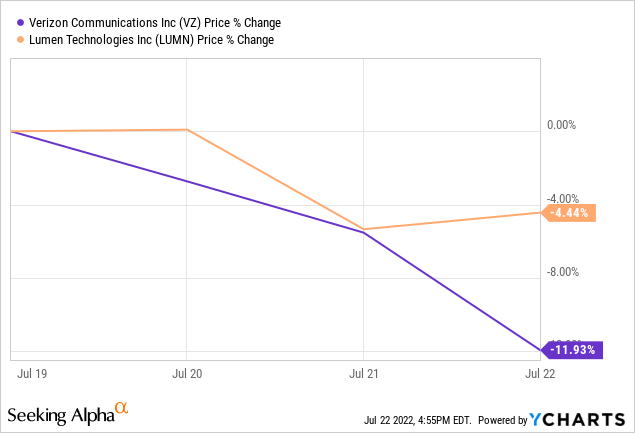

Verizon (NYSE:VZ) just sold off heavily after management released weaker-than-expected guidance, driving other telecommunications companies like Lumen Technologies (NYSE:LUMN) lower as well on expectations of similar poor guidance:

However, there are two clear reasons why investors should forget VZ and buy LUMN instead. In this article, we will look at VZ’s disappointing guidance and then explore the two reasons why LUMN is a better buy than VZ even if its guidance ends up being disappointing as well.

Verizon’s Disappointing Guidance

VZ did have some positives in its 2Q numbers. These included increasing its FWA net adds by 50% over Q1, adding a net 430,000 new strong wireless customers, expanded its private 5G and MEC ecosystem via new partnerships, achieved C-Band usage increase of 233% on a sequential basis, and was ranked the best wireless network quality by J.D. Power for the 29th time in a row. Furthermore, the balance sheet continued to improve, with net debt to adjusted EBITDA for the first half came in at 2.7x, which is down 0.2x year-over-year from the 2.9x number in the first half of 2021.

However, the good news pretty much stopped there. Guidance was downgraded in numerous areas. Service and other revenue growth guidance for 2022 was reduced from flat to slightly down at the midpoint. Total wireless service revenue growth was reduced by 0.5% at the midpoint of guidance. Adjusted EBITDA was expected to grow by 2-3% this year, but now is expected to decline by 0.75% at the midpoint of guidance. Finally, adjusted earnings per share was reduced by a whopping 5.5% at the midpoint. In fact, if adjusted earnings per share come in at the midpoint of guidance, VZ will have seen its adjusted earnings per share decline by ~4% year-over-year, which is terrible given how much the company is investing in capital expenditures.

Lumen Technologies Has A Wider Margin Of Safety

While LUMN has proven itself to be a serial underperformer as well – and we fully expect management to release disappointing guidance in its Q2 report – the good news here is that LUMN has a much wider margin of safety than VZ does.

Despite the sharp recent sell-off, VZ still trades at a premium to its five-year and ten-year average EV/EBITDA multiple, whereas LUMN trades at a steep discount to its own:

| Metric | EV/EVITDA (Current) | EV/EVITDA (5-Year) | EV/EVITDA (10-Year) |

| VZ | 8.47x | 7.68x | 7.37x |

| LUMN | 5.08x | 6.02x | 5.77x |

This means that LUMN can underperform to a substantial amount and still deliver satisfactory long-term returns whereas VZ is priced to perform at or above prior expectations.

In addition, LUMN currently offers shareholders a highly compelling 9.5% dividend yield, whereas VZ’s yield is only 5.8%. While it is true that LUMN’s yield is not as safe as VZ’s, it is also true that LUMN’s big dividend means that there is less pressure on it to generate growth in order to drive shareholder returns, whereas VZ needs to generate some growth on top of its dividend payout in order to deliver strong shareholder returns.

LUMN Is For Sale

An even more compelling reason to own LUMN right now is that its investment thesis is not entirely dependent on management execution. While it is true that management is investing aggressively in returning the top line to growth through its quantum fiber business and a few other segments, LUMN is equally focused on selling off non-core assets (or possibly even the entire company).

In the past 10 days alone, LUMN has generated the following headlines on Seeking Alpha:

Lumen gains on report considering selling some of its western markets

Lumen Technologies gains on report of bid for European unit

While these are unofficial reports, management strongly hinted that such transactions could be on the way in its latest earnings call. On that call, the following exchange took place:

Analyst: So I guess I’m wondering kind of as you come in with fresh eyes on the balance that we’re trying to strike with a fairly narrow margin for error in 2023 on cash, kind of how you perceive the willingness of the company to take up or the ability to take down leverage?

LUMN CFO: We hear you on the math. The reality is there’s other things that we’ve got to look at as well in terms of what assets do we keep? What assets do we not keep? Are the new assets we would add to the portfolio? There’s also the opportunity, I think, to continue to drive cost efficiencies as we go forward. So there’s a lot of things that go into baking 2023 guidance and as we move through the year, that will be part of my focus.

Analyst: You spoke about portfolio optimization and alluded to 2023 in the way you’re going to deal with the balance sheet. There’s some media reports suggesting that Lumen is exploring a sale of the European assets. Just wondering if that’s something that you would be considering?

LUMN CEO: I never speculate on any particular assets sales and never comment on anything. But I’ll point out that we administrated an openness to smart optimization of our assets. We’ve also demonstrated the discipline to get the right deal done, not just get a deal done. And so we’ll continue to do that. There’s no urgency for us to divest anything, but we’re always interested in figuring out the best ways to generate strong returns for our shareholders.

I’ll also add that any acquisitions or dispositions really must meet two fundamental criteria and the first is attractive valuation and the second is strategic benefit to Lumen. And so anything we do, we’ll have to meet those two requirements. As you look at our LatAm sale and our ILEC sale in the 20 states to Apollo, both of those transactions meet the attractive valuations and providing strategic benefit to Lumen. And so that’s the context in which we’ll look at any type of acquisition or disposition.

Reading through the lines, it definitely appears that further asset sales could be on the way and could materially impact the cash flow statement. If the two reported potential sales end up going through, it would be selling its Wyoming, Montana, Iowa, and North Dakota markets for $500 million in proceeds or maybe even more if the Iowa and North Dakota assets are included. Meanwhile, its entire European network could also be for sale and generate up to $2 billion in proceeds. Combined, these sales could make up 6.5% of the total enterprise value and 23% of the current market cap. As a result, they could look at buying back a ton of shares while also paying down additional debt if they did these sales. This could help to unlock significant value in the company while also further narrowing the scope of the company’s required capital investments, thereby making it easier to return the company to topline growth.

Investor Takeaway

VZ is a proven wireless provider and still offers an attractive and safe dividend. However, the forward guidance for declining adjusted earnings per share this year is a major red flag as it has been investing aggressively in driving growth, but has little to nothing to show for it. VZ also trades at a premium to its historical averages. As a result, it is hard to make a case for owning VZ here given that there are plenty of other similar dividend yields backed by investment grade balance sheets and defensive business models with better dividend growth prospects.

In contrast, though LUMN is also suffering from a declining bottom line, it pays out investors a much higher dividend yield, and trades at a clear discount to its historical averages and estimated sum of its part. As a result, management’s moves to try to sell off non-core assets at value-creating multiples and then plow the proceeds back into paying down debt and buying back shares is commendable and provides a viable investment thesis for investors to make money by being long LUMN.

Be the first to comment