Andreyuu/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the Vanguard Utilities ETF (NYSEARCA:VPU) as an investment option at its current market price. The fund’s stated objective is “to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector” and is managed by Vanguard.

This is a fund I have owned for a long time for a multitude of reasons. I cover it regularly, most recently suggesting investors continue to own it back in May. In the interim, VPU has indeed been performing well and I see this momentum as continued support for owning in heading into the final stages of the year. While I would caution investors from getting too aggressive here because it is near its highs for the year, there is still a bull case that can be made. I will discuss the rationale behind this in detail below.

Utilities Are Performing Well Under The Radar

To begin, let us take a moment to reflect on broader equity performance in 2022. It goes without saying this has been a difficult year. Many equity positions are in the red, led by sector declines in the majority of areas. Of course there have been some bright spots – the primary of which is the Energy sector. As demand rebounded and oil and gas prices rose, the Energy sector was a primary beneficiary on a global scale. This has dominated headlines this calendar year – and for good reason. The sector is currently up over 44% year-to-date. This is an astounding return in isolation, but it is even more impressive when we consider nine of the eleven major U.S. equity sectors are in the red.

While that story is certainly one to influence investment decisions heading in to Q4, notice that I only said nine of eleven sectors are in the red. The remaining sector is also in the green (albeit not to the same extent as Energy). Still, the Utilities sector has posted a strong gain that has been partially under the radar since it has been overshadowed by Energy:

YTD Sector Performance (State Street)

I bring this up because I think it is an important point. It validates the Utilities sector as a hedge both in terms of diversification and contrarian performance. When the broader market is down, as the S&P 500 is, Utilities can often perform well. That is precisely what has happened in 2022, although it has gone under-appreciated due to Energy’s strong rise.

The conclusion I draw here is that Utilities remain as relevant as ever before. The sector continues to hold a small weighting in the S&P 500, so investors get some nice diversification by owning it directly anyway. When I couple in the low correlation the sector seemingly has with the S&P 500 for the time being, that is an added bonus. Finally, many of the same factors that have impacted equity markets in 2022 remain in place to this day. These include rising interest rates, high inflation, geo-political risks in Europe and Asia, among others. Utilities has been relatively steady through these hurdles, and I view this as merit for owning it going forward as well, whether through VPU or any other avenue.

Why I Added To VPU, Not BUI

Regarding VPU in particular, my followers likely remember I own both VPU and BlackRock Utility & Infrastructure Trust (BUI) for Utilities exposure. These are two very different funds, but my objectives for owning them are often aligned. These include diversification, income, and to hedge against downside in the Tech-heavy S&P 500. Despite being Utilities-focused, BUI differs from VPU in that it is not a passive, US-only index fund. It has global exposure, is actively managed, and employs call writing strategies to boost current income. I have found over time that the two funds complement each other, despite being primarily focused on the same sector.

With that in mind, I want to emphasize I have been adding to VPU over the past few months and not BUI for a couple of key reasons. I have mentioned in a few recent articles that I want to remain focused on developed markets – but that comes with a catch. I am avoiding both emerging markets but also developed markets in central and eastern Europe due to the ongoing military conflict in that region. This is my primary concern regarding BUI, since the fund is not as domestic of a play as VPU is. The geographic exposure of BUI is shown below:

BUI Geographic Breakdown (BlackRock)

I am not trying to be alarmist here. I still own a small position in BUI and I generally have view the fund positively in the past. But it is the European exposure that concerns me. When branching out of the U.S. right now I am focused mainly on Canada, Australia, and the U.K./Ireland. These are areas with mature markets that are also fairly isolated away from the Russia-Ukraine conflict. That just simply isn’t a risk I want to take at the moment.

To understand why, let us consider that Europe as a whole is facing a host of problems. The inflation story is global, but the energy supply shortage is being amplified by Russia’s tactics in eastern Europe. This has led to very aggressive inflation and projections for very high heating bills this winter. In fact, a recent report by Goldman Sachs suggests over 20% of Europeans household income is going to be eaten up by energy costs in the coming months:

Euro-zone Heating Bills (as percentage of household income) (projection) (Goldman Sachs)

This tells me there is quite a bit of risk in this arena in the very short-term. Sure, this could be a good deal for energy providers if prices rise and they rake in profits. But that is not the scenario I foresee. I would imagine Euro-zone governments are going to ask providers to eat some of this cost, stunting potential profit growth. Further, there is a wider chance of social unrest and political maneuvering given this reality (i.e. “windfall” taxes on the sector). I will admit I don’t know what the ultimate outcome will be, but this uncertainty is precisely why I am cautious.

VPU, by contrast, doesn’t offer me this risk to contend with. So I prefer in categorically going in to Q4.

M&A Activity Has Been A Tailwind

I will now dig into a couple of reasons behind the why in VPU’s strong performance this year. Understand the catalysts is important when gauging whether this performance can and will continue. For forward-looking investor, this is critical.

One reason in particular has been an uptick in mergers and acquisitions, both domestically and from foreign buyers. This has led to some consolidation in the space and also in the merging of synergies. All other things being equal, this can often be a positive for companies, shareholders, and the public. So seeing M&A figures rise in 2021 and so far in 2022 is a good sign, in my view:

M&A Volume (Utilities Sector) (US Treasury)

This helps illustrate that the U.S. Utilities space has been presenting attractive opportunities to invest. This has been a multi-year trend and I believe the current pressure placed on Utility companies to play a role in the clean energy transition will continue consolidation in the space. M&A often leads to premium equity prices and/or long-term benefits for the companies involved, so as an investor, this is encouraging.

Dividend Story Is Comforting

My next focus point is on the fund’s dividend. This is a simple takeaway, so I won’t spend much time on it. But it is important nonetheless and bears mentioning.

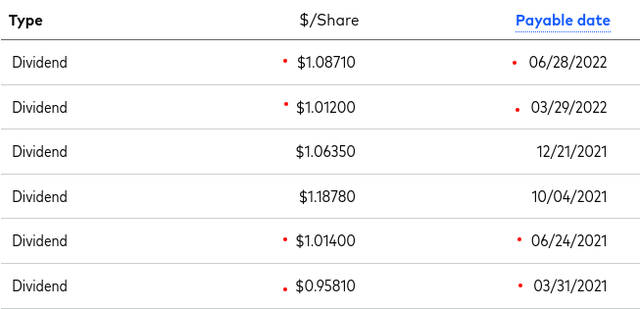

Specifically, VPU’s yield on the surface below 3% doesn’t look entirely enticing. But it is still near the 3% range, and more comforting is that both distributions in Q1 and Q2 showed growth on a year-over-year comparison:

VPU’s Distributions (Vanguard)

The takeaway is I view this positively and the dividend story helps justify a buy rating. The relatively low yield under 3% is primarily due to a rising share price (which is a positive), and not a fundamental problem in terms of earnings production and dividend deliverance on the part of the companies within this sector. For me, I am content to collect a rising income stream in this environment, and VPU offers that.

Clean Energy Tax Incentives Aid The Sector

The next topic is one that does impact VPU, but also the sector as a whole more broadly. This concerns the Inflation Reduction Act, which was recently signed by President Biden and suggests a host of new government spending is on the way. While we can debate the merits of this legislation to no end, the point of relevance here is that the Utilities sector stands to benefit. As a shareholder of VPU, that is a net gain for me.

The driver in this legislation is clean energy tax credits. These credits can benefit Utility providers (and therefore VPU) in a number of ways:

- Direct pay tax incentives so nonprofit utilities can invest directly in wind and solar – the way taxable utilities currently do.

- Almost $10 billion for cooperative utilities to add renewable energy, energy storage, and transmission lines to transition away from legacy power supplies.

- The ability to sell credits to capture their value without engaging in tax equity deals. This will help utilities profit from developing renewables.

- The extension of credits at their full value for at least ten years (providing a longer-term incentive).

I like this backdrop going forward. This Act was just recently passed and while shares have moved higher on the announcement, the actual underlying benefits have yet to be realized. As that comes to fruition, if successful, it could help boost the value of these companies higher in the years to come.

Let’s Not Be Blind To The Risks

So far in this review I have painted a fairly optimistic picture. VPU has indeed performed well over the past year and I do see some tailwinds that could keep that story rolling. But it would be naive to blindly ignore the risks facing the sector as well. Yes, VPU has seen a strong gain and more gains could be forthcoming. But let us remember that VPU is also sitting very close to its 52-week high. That alone should give readers at least some pause:

1-Year Performance (VPU) (Seeking Alpha)

The obvious concern here is “what goes up must go down”. While I think VPU can hold up reasonably well to round out the year, I would in no way suggest investors start getting overly aggressive here. The buy “hand over first” mantra is never one I subscribe to – and I certainly wouldn’t do so now. For those currently invested in VPU, I see merit to adding to positions (as I have myself) but doing so selectively. For those looking to gain exposure in this area, leave some room for error. Going “all-in” here is probably ill-advised. Start incrementally and see what the future holds. That’s my advice, at least.

Beyond just sitting at a high level, rising interest rates also remain a headwind. This is an interesting concept, since rates have risen here in the U.S. (and globally), yet VPU has performed extremely well. This result has tested the long-term trend of Utility shares moving inversely with interest rates. The challenge here is knowing which move we will see next. Will VPU keep bucking the historical trend, or will a new trend emerge where Utilities starts to move independent of interest rates? Only time will tell, but we must remain aware that the Fed is showing no signs of backing off its rate hiking plans. This leaves a key risk on the table in Q4 and in early 2022 as well.

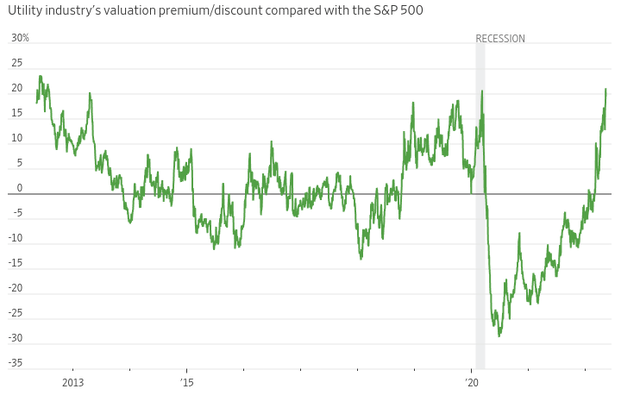

Finally, we must recognize Utilities are not cheap right now relative to the broader market. While the out-performance from VPU has been welcomed, this has resulted in a sharp premium jump for Utilities compared to the S&P 500:

Utilities Sector vs. S&P 500 (relative valuation) (Wall Street Journal)

The concern here is that all good things must come to an end. While I’m not overly concerned that VPU is going to see a big sell-off at the moment, this graphic helps illustrate why we must manage expectations. The valuation spread can only get so wide before a sector rotation begins. While staying the course with Utilities has made sense in 2022, we should recognize the long-term trajectory against the S&P 500 is rarely this wide. The takeaway for me is to keep a level head, add selectively, and adjust positioning as the climate changes.

Bottom-line

VPU has been a big winner in 2022 – in isolation and on a relative basis. While I have concerns about sector valuations and continuously rising interest rates, there are reasons to remain invested. The Inflation Reduction Act may prove to be a boon for the sector, dividend growth is encouraging, and VPU’s domestic focus helps protect investors against global geopolitical risks and slowing economic growth concerns. Add this all up, and I still view VPU favorably. As a result, I see support for a “buy” rating, and encourage readers to keep this fund on their radar going forward.

Be the first to comment