Justin Sullivan

Shares of Vornado Realty Trust (NYSE:VNO) have been hammered over the past year as questions linger over the viability of office space. Additionally, higher interest rates have hit a broad swathe of real estate stocks, and given the nature of its debt, VNO is particularly exposed to this. While shares offer an outsized 9.5% dividend yield, this payment is not well-covered going forward, and investors should be cautious.

In Vornado’s second quarter, it earned $0.19 and generated adjusted funds from operations (AFFO) of $0.83, which was actually up from last year’s $0.69. Net operating income rose 7.1% from a year ago, and 8.4% on a same-store basis, as several retail leases commenced, and the environment improved from a year ago when many locations and offices were still closed due to COVID. As the overwhelming majority of VNO’s operations are in New York, it felt the impact of the pandemic harshly.

One thing that has aided its business is that office leases tend to be quite long in nature. While you typically rent an apartment for a year, Vornado rents out its office space for 11-13 years on average. This helps to insulate its business somewhat from swings in demand for office space. It also means during a period of declining demand, VNO’s results will lag the downturn. In other words, they will remain resilient until leases expire and do not get renewed. We may be starting to enter this cycle.

Office occupancy in New York has ticked down to 92.1% from 92.2% at the start of the year. Total occupancy in New York has fallen from 91.3% to 90.8%. Just given the nature of its long-term leases, occupancy will be very slow moving. However, Vornado has over 1 million feet of office (ex-Penn) expiring next year, and it expects about half to re-sign. That could reduce office occupancy by about 2-3%. Over the next couple of years, VNO faces headwinds from a weakening office market.

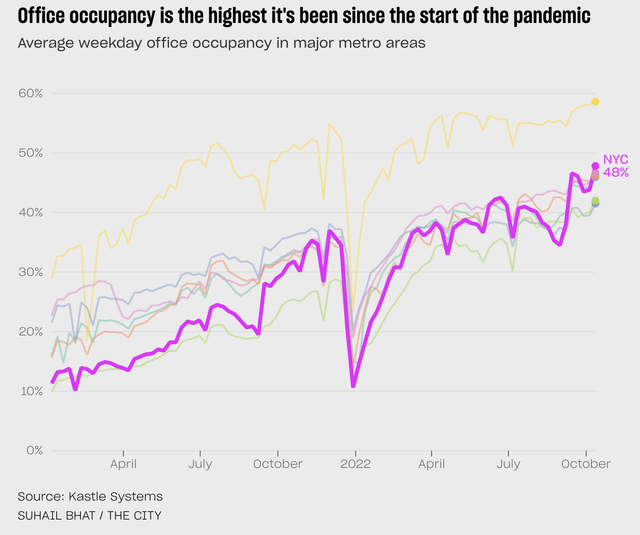

Ultimately, part of your view on VNO will come down to where you think “return-to-office” and “remote working” end up. While it has been rising, office occupancy still remains low in New York City at 48%. If many firms operate a hybrid schedule (which appears to be a widespread norm), over time they may seek to rationalize their real estate space. Do you really need 100% of the space if you never have more than 75% of your workers in the office on any given day? While the outlook is not as bleak as when occupancy was 25%, 48% is still a lot lower than VNO’s 92% occupancy. Given the high quality of its buildings, VNO should be able to outperform the commercial real estate market, but re-leasing over the next several years could gradually strain cash flow.

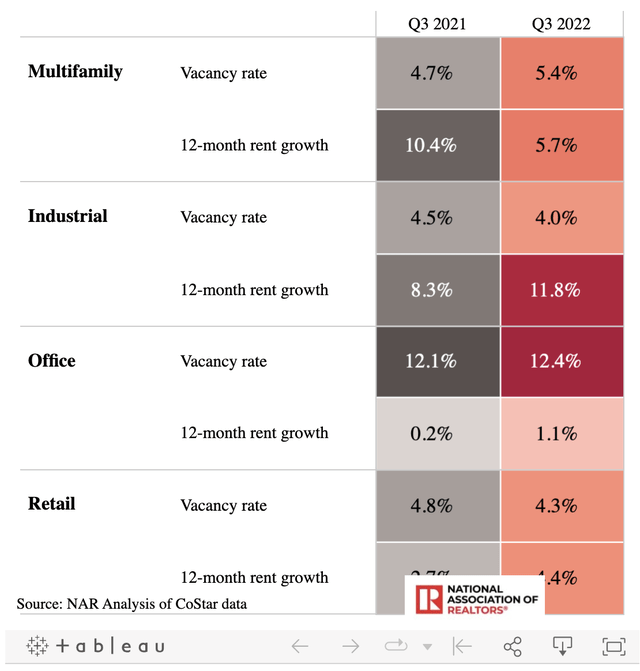

If there is an economic recession over the next year, companies will likely seek to reduce their real estate cost given the space is being under-utilized. Moreover, if headcounts fall, there is simply less need for as much space. We are seeing this weakness build nationally. According to the National Association of Realtors, office vacancy has risen over the past year, and rent growth is very slow. It is the clear laggard of commercial real estate sectors.

National Association of Realtors

While I see challenges for its existing real estate portfolio, what concerns me is that Vornado is aggressively expanding as it is a key stakeholder in the Penn District project to revitalize the Penn Station area of midtown Manhattan. Vornado has committed $2.4 billion to this plan, which will significantly increase office space in the area. With office demand already facing headwinds, how well this project does, or whether it just cannibalizes from existing buildings, is a major unknown. VNO is spending aggressively, and in the first half of this year, development costs rose from $270 million last year to $420 million. Given the rise in construction costs, there is also the risk this mega-project becomes more expensive and leads to a weaker return on investment for VNO.

Beyond the headwinds VNO’s main real estate leasing business faces, its capital structure is a concern to me. The company has over $3.5 billion of floating-rate debt. This is an aggressive strategy as long-term interest rates help to determine property values. As rates rise, properties are worth less, but if a real estate owner borrows via long-term fixed rate debt, the benefit on the debt hedges the lost property value. Floating rate debt is more expensive as rates rise, so not only do property values get hit, but VNO faces higher interest expense. This double whammy will be apparent as higher rates filter through to interest expense. Relative to Q2, this will be an over $140 million headwind for the company over the next year, reducing income and FFO by about $0.80. Plus, $750 million of floating-rate debt is hedged through October 2023 but will then float, adding to the impact thereafter.

Right now, its $0.53 quarterly dividend appears well covered by $0.83 in AFFO. But holding everything constant, given the rise in rates, AFFO will fall to $0.63 next year, providing just 1.19x dividend coverage, and leaving little cash flow left to finance its large growth spending, meaning it will rely on further debt financing at a time of higher interest rates. If occupancy falls by another 2% next year, that will be another $0.05 impact, leaving the company perilously close to not having sufficient AFFO to cover its dividend.

Because of its balance sheet policy, one does not need to believe that the office market will weaken that much in order for its dividend coverage to get too close for comfort. Now, if your view is the Fed will do an about-face quickly, then this higher interest expense will be a short-lived factor that Vornado can power through. Because so much of its debt is floating while its leases stretch over a decade, VNO’s cash flows are more quickly impacted by rates than office market conditions. Given the rise in rates, this provides a material near-term headwind while weak office demand will be, in my view, a meaningful long-term drag on shares. I actually think investors would be better off if VNO reduced its dividend to pay more of its cap-ex with cash flow and reduce its debt load, but I view that as unlikely.

Now, value investors may note that Vornado has a $27.19 book value per share, a 20% premium to its current share price. This essentially implies VNO’s real estate assets are worth $1 billion less than their carrying value, or about 10%. Given higher interest rates and challenged leasing demand, this does not strike me as meaningfully dislocated. VNO is at risk of being an asset with steadily declining cash flows, first as interest rates bite, and then as its leases gradually expire and are reset at lower rates, or not renewed at all. With about $2.20 in AFFO next year, shares are trading at 10x.

Given the potential for continued declines, I would wait for a 12% AFFO yield or $18.33 a share—this also would imply a 20% decline in VNO’s real estate assets vs their carrying level. At that level, investors are being compensated for the risk Vornado is a “melting ice cube.” In the meantime, investors should not get sucked into shares given its current dividend yield, which will see little buffer next year as higher rates take a toll on cash flow.

Be the first to comment