xijian/E+ via Getty Images

Author’s Note: This is the shortened version of an article published on iREIT on Alpha on March 28th 2022.

Real estate investment trusts (REITs) work in some countries across the world. The USA has the most of them. Great Britain has some. Spain and France also have versions of them. Even Germany has what is known as G-REITs.

Vonovia (OTCPK:VONOY) is not a REIT. Vonovia is a Real estate company that owns 565,000 apartment units.

In this article, we’ll explore the intricacies of German real estate, and what makes it such a complex story to invest in. I’ll show you why most German investors, including myself, are very careful about investing in the space.

Vonovia – A Presentation

On the surface of it, Vonovia is the perfect European Real Estate company.

Germany, like many Western modern markets, has an extreme supply/demand imbalance in the property/real estate sector, especially in metropolitan areas like Berlin. Berlin is also, incidentally, where Vonovia has a lot of assets.

There is a housing shortage in most areas in Europe. Berlin and Germany are no exception. Faster than expected growth in the German population coupled with heavy immigration and increases in urbanization has driven demand sky-high here.

This company, with a €25B market cap is set to profit from this supply imbalance. The company’s roots go back to the end of the 1990s. The German government decided to privatize railway workers’ homes as part of a reform, and Nomura Holdings (NMR) and a German subsidiary sought to acquire them. Years and years of talks later, the company received a significant share of the homes and started from there. It went on to expand through smaller holdings from Allianz (OTCPK:ALIZY) and the utility RWE (OTCPK:RWEOY). When E.ON (OTCPK:EONGY) put its real estate portfolio up for sale, the subsidiary then known as Deutsche Annington became a market leader with 150,000 apartments.

Deutsche Annington became public – not because it needed to or necessary had planned to do so, but because of the financial crisis in 2008 and onward. Had it not been for this, and if we’d seen continued cheap access to debt, I don’t believe Annington would have ever have IPO’ed, and Vonovia as we know it, would not have existed.

Vonovia came from a merger in 2014 between Annington and parts of GAGFAH (the remainder still exists), which owned properties in Dresden and Berlin primarily. The takeover was completed in 2015 for almost €4B, and the resulting company was then called Vonovia as a part of modernizing it. It moved its headquarters.

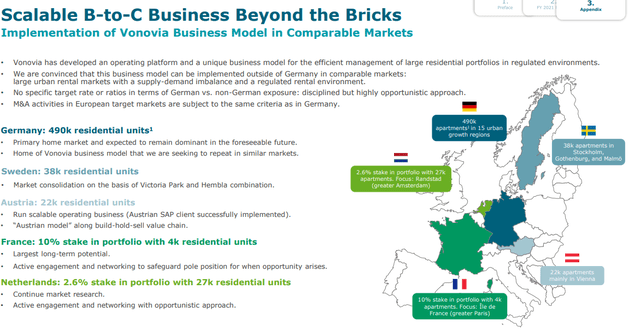

After failing an initial bid for Deutsche Wohnen, Vonovia initially set its targets outside of Germany. First came French Housing Company Société Nationale Immobilière. Later came Austria, with Convert Immobilien and BUWOG making Vonovia the leading real estate group in Austria. It has taken over Swedish Victoria Park and the rival Hembla in 2019/2020.

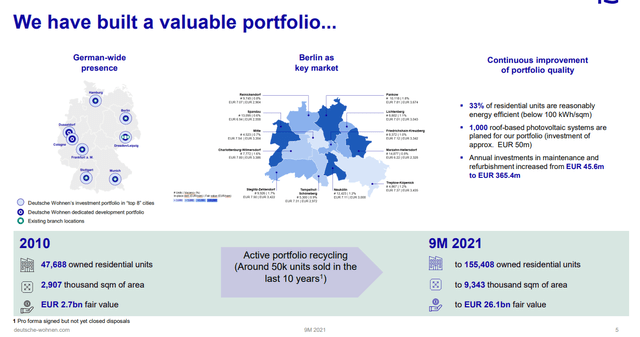

In 2021 came the big blowout. The company now owns the majority of the shares of Deutsche Wohnen, turning Vonovia into an essential oligopoly for the Berlin housing market.

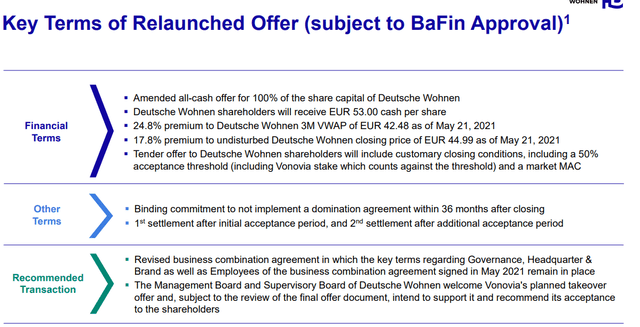

Deutsche Wohnen Offer (Deutsche Wohnen IR)

However, this is where some of the issues with the German housing market really come to light (and we’ll look into that later).

For now, all you need to know is that Vonovia has taken over Deutsche Wohnen.

Deutsche Wohnen Property Portfolio (Deutsche Wohnen)

Vonovia is a dividend-paying company that recently increased the dividend to €1.77, and has a decent dividend tradition. Its yield, at current levels, is around 3.5%. As with most fortress-like US REITs, Vonovia has excellent safety in the form of a BBB+ credit rating from S&P Global.

The company is well-capitalized. Real estate companies, as we all know, lean on debt, and they don’t often fully repay their debt. I’d go so far to say as it’s a good way to play with interest rates. 62% of Vonovia’s debt is bonds, and the remainder is straight bank loans.

Vonovia has one of the best capital structures on the market, and consequently borrows at less than 1.5% interest on average, with a 50%+ rate of unencumbered assets in FY2020. The company’s LTV ratio has been going down steadily, and is less than 50% as of 2020/2021E, with a gross cost of the gross debt trending downward as well.

Point of fact, the company’s debt, and LTV should be even lower, given the massive reevaluation on the positive side Vonovia has been seeing. However, steady M&A coupled with increasing amounts of modernization CapEx as well as a growing dividend has made certain that the company’s debt hasn’t gone down more.

All in all, Vonovia has no issue whatsoever funding whatever it deems necessary, and there are no “major” players left on the German market to take over in its proximity.

Let’s delve deeper into the specifics and issues of this market.

The German/Vonovia Housing Market/ Issues with the Market

The German housing market has several trends and implications. First, there’s a deep scarcity of units, that has been driving residential market prices for the past 10 years. A unit today is 100% more expensive, on average, than 10 years ago. Secondly, there has been an extreme under-investment trend from 1990 after reunification, essentially all the way to post-crisis 2010. That’s when the refurbishing wave really began.

As a comparison, you could rent a 60 sqm unit for less than €300/month in 2007. Today, you can’t get anything below €600-€700, especially in larger cities. A few trends contribute to this:

- An aging population and household downsizing, requiring a higher volume of homes.

- Strong migration waves in 2010-2020, requiring more houses.

- Urbanization.

- Buyer solvency/lower interest rates, pushing end prices.

Vonovia focuses on the most profitable cities, which further pushes the outperformance and valuation here. The view that there will “always” be a shortage is of course wrong. However, the indisputable fact is that like Sweden, not enough homes are being built in Germany to meet the demand, which means that this imbalance is likely to remain for some time. This will likely serve to inflate rents even further, but there is of course a stopping point here at some point in time.

There is also the small matter that the German tenant mobility is lower than virtually anywhere in Europe. Due to population concentration, jobs are readily available within driving distance to most areas, not necessitating a move. People in Germany consider a drive from Hamburg to be a “long commute” of around 30-50 km. Where I’m from, a “long” commute is anything above 100 km.

Distances in Germany are less because the country is smaller and far more densely populated.

Remember, the nation of Germany is smaller than the US state of Montana but houses 25% of the population of the United States, and is one of the most important western industry nations in the entire world.

Vonovia’s strategy is not to “buy cheap and refurbish”. Rather, it’s to buy the expensive assets available on the market and refurbish further where needed, and then work with rents. This is a segment of the market that requires a great deal of capital, which Vonovia has no shortage of. This makes them a serious player to contend with.

Where this is the USA, I could see my way to granting this company a massive premium due to market dominance and a basically-unstoppable trajectory towards growth, even in a base or negative case when it comes to rent increases.

Vonovia’s portfolio vacancy is essentially zero (By that I mean around 0.1-0.5%, with a record vacancy of 3.05% in Westphalia). New construction starts are extremely low. For now, this seems to indicate a continuation of the development of the past few years.

However, this is where some of the issues come in. Germany is not the USA. It’s not even Sweden. In a way, this is a market more hostile towards landlords than any single market in the world.

Remember how I wrote that the initial portfolio was comprised of Railway worker apartments?

Well, the only reason the company was even allowed to take part in those was due to their response to the public criticisms from the tenants, the unions, and the politicians. Their response was exclusive rights, such as a lifetime right of residence and a voluntary restriction on rent increases as well as allowing tenants to essentially own their property.

Imagine anything like that in the US – and that’s just the beginning.

The company’s history has been fraught with protests from tenant associations, unions, and politicians for every single deal they made. This was brought to its apex in 2021 when a public referendum was held in the city of Berlin as a result of goings-on in the sector.

DW tenants (DW)

The result was clear, and the residents of Berlin voted in favor of nationalizing the housing stocks of large residential companies such as Vonovia. This was, of course, a non-binding vote, but it showed politicians which way the wind was blowing. The nightmare of this socialist-era type horror scape was only brought to an end when Vonovia agreed to sell 14,000 apartments to the state of Berlin.

The legal background is as follows:

Article 14 of the German constitution states that “property entails obligations. Its use shall also serve the public good”. There’s a legal precedent where the passage has been used to advocate for pauses on rent increases or expropriation of high-volume property ownership.

Article 15 states the legal basis that “Grund und Boden [..] können zum Zwecke der Vergesellschaftung durch ein Gesetz [..] in Gemeineigentum.. überführt werden”[6] (Land, natural resources and means of production may, for the purpose of socialization, be transferred to public ownership or other forms of public enterprise by a law that determines the nature and extent of compensation). However, this article had never been used to this effect prior to this referendum before.

Imagine a REIT having to appease cities or states, and sell the property back to them, at arguably a bribe-level sort of price to prevent a legal tornado that could deadlock Vonovia for years, if politicians picked up on it.

So – those are some of the complications and characteristics of the German housing and renting market, as it stands. It’s an extremely appealing overall market, fundamentally speaking. But it comes with plenty of political challenges that Vonovia must manage in order to play it effectively.

So far, so good – unless you count those 14,000 apartments.

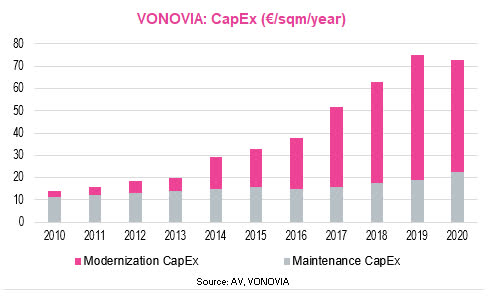

Vonovia’s historical CapEx increase up until today has been massive, and illustrates the historical understanding in this area.

AlphaValue, Vonovia (AlphaValue)

The company’s strategy remains very M&A-heavy, so its LTV ratio is core. Through a progressive rolling of its installed base, selling non-core units every year, Vonovia kept the most promising assets in its portfolio, improving the average quality/location. The company’s current portfolio is a direct result of a superb execution by management. Its CapEx strategy allows for rent bumps during times when tenants move out.

The company has, as mentioned, been an active player in the practice of asset stripping, or reverse M&As. They sold on average 13,000 units per year from 2013-2020, including so-called exceptional disposals, with a recurring forward planned rate of around 4,000-6,000 per year in 2021 and forward, coming to around 1%-1.5% of its current consolidated portfolio.

The company’s strategy to appease those crying for the nationalization of apartments has been the inception of a company-based development arm. This development arm currently has 50,000 units under development. This is not something I consider to be massive growth potential for Vonovia. It’s a direct political answer so that the company can point when Politicians ask.

It’s a necessity, and perhaps even an unfortunate one for Vonovia, who otherwise prefers to be M&A’er rather than developers.

Also, remember that the nationalization demands do not need to succeed in order to affect the companies such as Vonovia. By delaying rent increases or even freezing them, these issues directly impact the profitability of the companies. Legal responses regarding these issues have been mixed. In April 2021, the High Court of Karlsruhe declared the rent-freeze in the City of Berlin unconstitutional, and this has reopened debates. In early May 2021, the City of Berlin announced a low indexation there (Mietspiegel). This was also part of the catalyst for the referendum. This wave of political dissatisfaction has not yet spread to other German metro areas to any major degree, and Vonovia, at the consolidated level, has less than 10% Berlin exposure, but the implications of these moves could be far-reaching.

Now, a quick word on this legal risk from a very sobering perspective. I’ve been following the legal side of the story for years, and it seems unlikely at this point that Germany will be able to actually institute any sort of rent freezes or non-payments of rents, as these have been declared unlawful by every court they’ve been taken to. The core of the matter is that people are trying to bring it as a “state” matter, where matters concerning this issue are a “federal” matter, and on the German federal level (like in Karlsruhe), it’s been clearly pointed out that only the government has the power to do this.

There is no current political majority to do this in Germany.

We’ll have to see the full effects of these moves in a few years.

The company currently has one of the lowest dividend yields in the entire sector – and American companies are certainly better with yields than Vonovia is. The company also has a lack of asset mix, which means that it’s a play entirely on the residential sector, and mostly on apartments. Its peers are apartment REITs. The only diversification potential Vonovia has/goes for, aside from development (if it can be considered as such), is the expansion outside of Germany.

There’s also the very real consideration that rent levels might have peaked. If not yet, then very soon, given the tenant ability (or lack thereof) we’re seeing. The amount of legal and national pushback against further increases in Germany speaks volumes of this, and once that peak is reached, the company’s growth potential, even with massive redevelopment CapEx, is capped.

The future for Vonovia

The future for Vonovia is something to consider. What we’ll likely see is the company pushing into more German markets through M&As and developments, increasing its national portfolio. The more interesting play and a better diversification for the business is of course expansion outside of Germany.

The company seems to know this because Vonovia has actually been reducing its exposure to individual locations substantially. Vonovia has around 400 locations compared to over 800 less than 7 years ago. Such a reduction not only simplifies things but also drives improvements in management cost. Through digitization and vertical integration in terms of the Value-add business, the group can see more savings and productivity gains here.

As an example, the average management cost on a per-year/unit base went from over €800/year/unit to less than €400/year/unit, almost in lock-step with the number of locations. There seem to be further efficiencies to be made here. The reduction in management costs, stability of non-capitalized maintenance expenses per sqm (c.€340m p.a.), and very strong modernization Capex already contributed to leveraging the EBITDA margin, increasing by almost 10% in less than 10 years.

In short, there’s a lot of future potential here. The scale effects as Vonovia grows are not to be underestimated either. In less than 10 years, the company has reduced its debt costs by almost 4% in terms of average interest rates, and this is likely to improve with further scale.

The company is likely to benefit from a continued supply/demand imbalance, even if rents can’t be pushed that much higher. There’s an entire continent of 40+ countries to expand into, and Vonovia has the muscles to play this game. This company is one of the only “safe” investments in European Real Estate. I say this because of its scale, because of its integration, and that it has already handled something of the “nationalization” debate that is ongoing, and will likely be increasing as tenant payment issues grow more significant.

The valuation of Vonovia

In valuing Vonovia, we use a mix of different approaches. We use NAV comparisons, yield comparisons, public comps, growth estimates, book valuations, and earnings/cash flow multiples. Remember, this is not a REIT, so REIT-specific valuation metrics don’t really apply well here.

Vonovia’s peers include apartment/residential-specific real estate companies. There aren’t many European ones that qualify. We use end-level valuations for Deutsche Wohnen, the company’s primary peer prior to the M&A, and also look at Covivio (OTC:FNCDY) and Icade (OTCPK:CDMGF), both French real estate companies in similar sectors.

For peers, Vonovia trades at a lower dividend yield than the peer group. At today’s price, the company’s 2021 dividend implies a yield of 3.8%. At one point, Vonovia might have been lower yield than most of its peers, but the recent decline in share price has really pushed this yield up, now to over 3.8%. This puts it above Deutsche Wohnen’s legacy yield of 3.26%, and in range of Covivio, and below Icade which pays over 7% (but is also far less safe).

The fundamentals are the primary arguments for investing in Vonovia. No peer has the size, vertical integration, or position that Vonovia has. It trades at a P/E of around 16.5X, compared to French peers between 11-16X and Deutsche Wohnen at around 23.3X. I would apply a 10-15% premium to Vonovia given its market position, size, and overall conservative approach.

A standard assumption is that Vonovia is a “bond proxy”. This is not really the case. Given its delivery of an asset and earnings yield, the spread between actual bonds and Vonovia’s earnings are as high as 7-8% historically. This company is far better, at least historically than a bond. Vonovia offers access to one of the most conservative, regulated residential markets on the planet, and I’m not exaggerating when I say that this is probably one of the best management teams in this space in all of Europe.

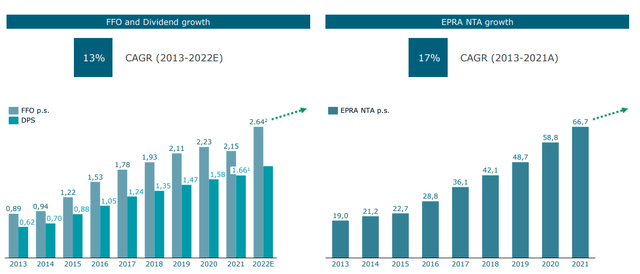

The company has delivered guidance upward of €6.4B in revenues, with FFO of around €2.1B and a continued dividend of 70% of group FFO after minorities. For 2021, the DPS increased marginally to €1.66/share.

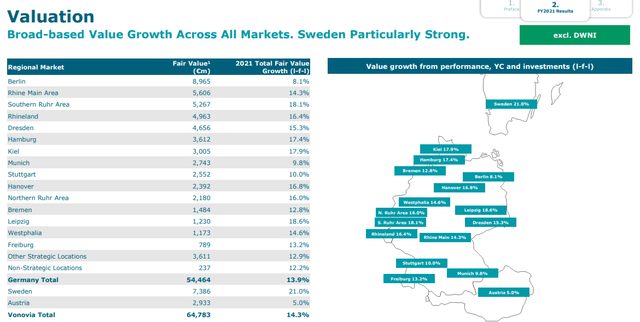

To the question of whether this growth could continue, as this impacts potential valuation, I would argue that it can and likely would increase on the basis of a 2021 fair value growth.

Vonovia Value Growth (Vonovia IR)

This strength is the backdrop for my applying a premium to the company’s valuation, allowing for a combined PT of 1.1-1.2X to a conservatively-calculated NAV and a decent P/E premium. On an average weighted basis, my PT for Vonovia comes to €50/share.

The opinions about Deutsche Wohnen vary wildly. Equity investors such as AlphaValue provide a target of no higher than €43/share for the company, considering the risks to the company relatively high. This is still an undervaluation, just not a high one.

S&P Global comes to the price range of €51 on the low side and €73 on the high side, including the consolidation with Deutsche Wohnen. Out of 16 analysts, 15 have either a “BUY” or “Outperformance” rating on the company at a price of €42.5/share.

You will notice that my own price is below even the lowest of these targets. While I disagree with AlphaValue about the ebb and flow of some of these factors, I do believe their general approach to Vonovia is correct. There is a high amount of risk to investing in this company compared to some of its American peers. The only way to currently do this is at a significant discount. However, accounting for the Deutsche Wohnen portfolio, we’re getting that here. The synergies and full integration of the combined entity are not to happen until early 2023.

I also believe that Vonovia deserves to trade at a premium suitable for the portfolio the company holds, and I don’t believe Vonovia is being properly accounted for here by some of these targets.

I want to emphasize that this company holds over half a million units across Europe.

Vonovia Business Presentation (Vonovia IR)

This is a very much proven business with a concept that works. It’s one of the few players with the financial muscles in all of Europe to move on these opportunities – and that’s why I’m wanting to push my exposure here. There’s a great deal of safety to be had here.

To those of you asking, “But US REITs seem better”.

That’s why my PT is €50/share.

Traditional US REITs have a definite advantage over Vonovia when comparing them as investments. However, if you fully include Deutsche Wohnen’s portfolio in the company, then the company’s current NAV comes to 0.58X (Source: S&P Global). There’s a massive discount to Vonovia 2023E here, and given that I know exactly what sort of properties we’re talking about, I know I want to own them cheap.

I’m not willing to pay any price. If this goes up above €60/share, I’d rather buy Realty Income (O) or other American REITs. But at this price, this is the definition of an advantageous diversification for me.

So – PT is €50/share, and I’m a “BUY” for Vonovia here.

Wrapping up

The mathematics of tears, which I refer to in the title eludes to the company’s risks with nationalization, tenant organizations, rent freezes, valuation caps, and the overall market in Germany, which is a dicey proposition at times. Don’t let the company’s diversification fool you – Vonovia is still at its heart a German business with a German portfolio.

The mathematics of tears refers to the risk that this market somehow changes, which is, to my mind, a real possibility if things get “bad enough”.

Accounting or discounting properly for this risk in a valuation model is nearly impossible – so I use a simple logic where I stick to lower price target ranges, despite this company inherently being qualitative. It’s like having a great company – but having that company operate in Russia. There are risks you can’t properly account for, at least not easily.

That is the mathematics of tears – and a gold star for anyone who can tell me what classic sci-fi show that term comes from!

However, at its heart, Vonovia is really one of the best real estate companies on the entire European continent. You combine conservative German management and a Portfolio with an LTV of less than 46%, a grade-A portfolio after 10 years of non-core/unsuitable asset stripping has left Vonovia with perhaps one of the most envied portfolios on the market.

And the company could go far, far further here.

That is the upside. And if you think that upside sounds more attractive than the downside, I agree with you. That upside is pretty damn great.

I believe the time has come to take a more active stance on Vonovia – and I’m calling that stance positive. I think the current geopolitical backdrop serves as an excellent opportunity to rotate capital to safe-type investments.

Vonovia is one.

I’m a “BUY” here with a conservative PT, and here are my targets for the company.

Be the first to comment