Fahroni

A merger in the used vehicle ecommerce space. Shift Technologies (SFT) is buying a peer CarLotz (NASDAQ:LOTZ) in an all-stock transaction. The exchange ratio is ~0.69 and at current prices implies a 41% spread. The main reason for the widespread seems to be SFT borrowing fees which now stand at 45%. Borrowing fees have lowered since the transaction announcement on August 9, however, there is still a risk that they spike to much higher levels which would erode the current spread in a hedged trade. Another risk is that of a forced buy-in if borrow would disappear. Current fee level would reduce the spread to 17% assuming the merger closes in Q4’22 as expected by the companies. The exchange ratio will be adjusted at closing but any changes should not be material.

SFT Borrowing Fees (Interactive Brokers)

Overall, the transaction seems highly rational for the buyer. First of all, the merger is basically an equity raise for SFT as the company will issue new shares worth $74m to receive $112m in LOTZ’s net cash. SFT currently has $100m in gross cash (-$156m in net cash) while the business has recently been burning ~$40-$50m in operating losses per quarter. Notably, the buyer’s cash burn should be somewhat lower going forward as the company has recently shifted its strategy to cut corporate overheads and perform most sales through online checkout sales. Nevertheless, the transaction will supply SFT with much needed liquidity. SFT’s management projects that after the merger no further financing will be needed to fund the operations through 2024 when the company is expected to reach profitability.

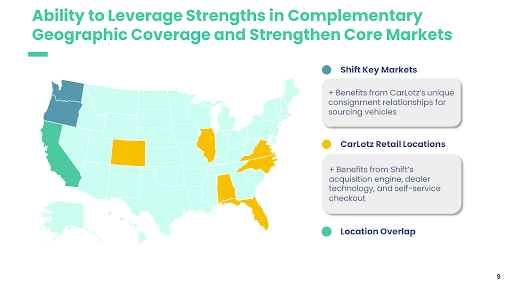

Operationally, the merger appears to be equally synergistic. The companies have virtually no geographic overlap as LOTZ runs its business in mid-Atlantic markets whereas SFT primarily operates in West Coast states, suggesting that SFT’s platform launch in East Coast areas post-merger is likely. Moreover, given somewhat similar businesses, cost synergies coming from lower overheads and enhanced processes are expected to be significant (see below for more details on strategic rationale).

Shift Technologies Investor Presentation, August 2022

Merger is subject to buyer and target shareholder approvals as well as a minimum net cash position of both companies upon closing. These conditions, however, are likely to be satisfied:

-

LOTZ shareholder approval. 25% of the outstanding shares are held by PE firm TRP Capital Partners (19%) and sponsor Acamar Partners (6%). The Board, where directors from both TRP and Acamar have seats, has unanimously approved the merger. Other institutional shareholders, such as Tremblant (7%) and Vanguard (3%), are likely to approve the deal given premium to current share price and an all-stock deal which will allow to capture post-merger synergies. Adding other institutional equity holders, the count should easily exceed 50%.

-

SFT shareholder approval. The management, which has already approved the merger, owns 9%. Another 16% are owned by Lithia Motors which is likely to vote for the merger given that it has been a strategic partner of SFT since 2018. Lithia helped the company obtain floor plan financing and has allowed SFT to use its facilities for car reconditioning/storage. Approval from institutional shareholders (the largest one is Nantahala Capital Management with an 8% stake) seems very likely considering the strategic rationale and LOTZ’s net cash position.

-

Minimum cash amounts. The merger requires the companies to have at least -$10.5m (for Shift) and $58m (for CarLotz) in net cash if the merger closes in 2022 (the condition does not deduct long-term debt). Currently, SFT has $6m in gross cash less flooring line of credit, implying that the company can burn ~$16m by year-end to satisfy the requirement. This is admittedly a low figure given recent cash burn of $40-$50m per quarter. Despite the fact that management expects the new business strategy to yield $80m in standalone annual SG&A cost savings, an equity raise will likely be needed. The company has not provided any information on a potential equity raise so far. Meanwhile, for LOTZ the threshold implies that the company can have a cash burn of $25m per quarter and still make the cut. The company has recently had operating losses of $27m-$30m per quarter (excluding $11m in Q2’22 restructuring expense). However, in June LOTZ closed 50% of its stores – the move is expected to lower cash burn by ~$5m per quarter conservatively assuming the stores cannot be sub-leased. It is worth noting that if merger closing is delayed beyond year-end, the minimum cash threshold will be lowered by $5m for each additional month in 2023 for both companies.

Spiking borrowing fees remain a risk in the setup. However, I believe this merger arbitrage might be worth playing without a short leg as LOTZ’s net cash position provides a margin of safety unless merger closing extends into mid-2023. Notably, there are still risks given SFT’s lackluster financial/liquidity position, the fact that SFT traded at breakeven price only recently and potential equity raises that the buyer might have to perform. Moreover, SFT would likely drop sharply in case of a deal break.

LOTZ is currently trading below the pre-announcement price of $0.62/share.

Businesses and Strategic Rationale

While both companies operate in the used vehicle commerce space, the business models are slightly different. SFT runs an end-to-end service, meaning that the company provides a full spectrum of car services, including test-drive, purchase, maintenance and selling services. Whereas SFT has inventory and operates like a car dealer, LOTZ’s model is more asset-light – the company connects sellers to the retail car buyers, pocketing a commission from each sale.

Having said that, there seem to be several ways in which the transaction benefits the combined company besides SFT’s expansion into new markets:

-

SFT’s technology, including in inventory acquisition and online checkout, is likely to lead to significant cost reduction for current LOTZ business. For instance, both companies use proprietary software to perform assignment, re-conditioning, and sale of vehicles from their suppliers, however, SFT’s technology appears to be much more advanced. Apparently, obsolete technology compared to SFT has been one of the main reasons for the merger from the target side. LOTZ’s CEO:

“What became clear is that from a technology and, and product perspective, we were really behind some of our competition. And so over the last few weeks, we’ve had an opportunity to, to talk to Shift. And what you’ll see announced today is we’ve agreed to merge with Shift.”

[…]

“So what we’ll really be able to take advantage of is all the investments they’ve made into their technology over the last eight years. So Shift was founded primarily by a bunch of product guys from Google. And so they’ve made significant investments into, into their technology.”

-

LOTZ has consignment relationships with numerous corporate vehicle suppliers. In particular, LOTZ sources inventories from three large vendors which together have made 45% of total vehicle purchases in 2021. This provides an alternative way for SFT to source its inventories which is likely going to be very important as the company both expands its operations and shifts towards value (older) vehicles going forward.

-

LOTZ has numerous physical locations where it serves its customers, with some of them in prime areas. After the closure of several hubs, the company now operates 11 retail locations. In the short-term, it is possible that SFT will decide to sublease more of the retail outlets, however, the company’s strategy is to eventually provide a full spectrum of services, including maintenance, for which retail locations are going to be key.

Conclusion

SFT-LOTZ merger offers a 17% return likely realized before the year-end. Shareholder approvals and other merger conditions seem very likely to be fulfilled. While a spike in borrowing fees remains a risk, an unhedged trade is an option here given LOTZ’s net cash position. Though risky, an unhedged position would mitigate spiking short-selling cost risk.

Be the first to comment