Scott Olson/Getty Images News

Published on the Value Lab 10/7/22

AB Volvo (OTCPK:VOLAF)(OTCPK:VLVLY)(OTCPK:VOLVF) should have had a pretty underwhelming quarter due to headwinds across businesses, but instead produced growth. Pent-up demand in its flatbed markets should release as markets cool off, and service revenue bolsters margins to declines in consumer durables. China remains a more problematic exposure but overall Volvo looks to be a champion despite economic and structural headwinds. Overall, a commendable company and a relatively good buy within consumer durables, although we pass on the category for now.

Volvo Updates

The Volvo situation was not looking so good back in March. The company was concerned with semiconductor shortages, indicating that they would not be able to capitalise on flatbed demand coming from the logistics industry, revising down guidance by 20%. Moreover, China had just started to implement serious lockdowns and we were seeing more lockdowns in areas like Shenzhen which are important hubs for technology. Moreover, zero-covid policy could have hampered logistics further. Finally, China is also a major market for their construction equipment, where real estate crashed in China around that time and continues to be a concern on weakening economic outlook globally. Despite all this, Volvo has proceeded into the year with some strong quarterly results.

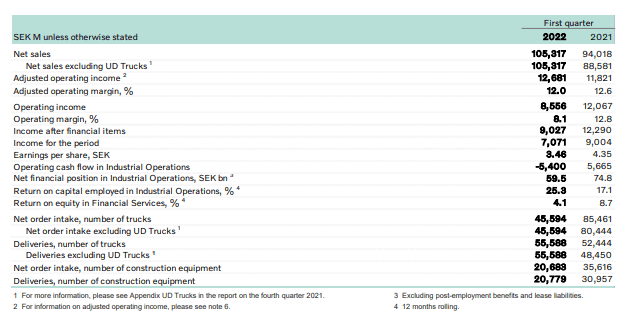

Income Statement (Q1 2022 PR)

Net sales increased by 11% and operating income similarly grew. Margins contracted on difficulties from the cost-side affecting all companies with inflation, but the company proceeded to create value.

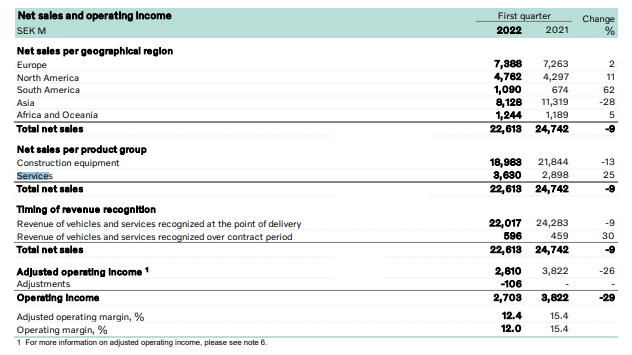

Segment Mix (Q1 2022 PR)

We note in particular continuing strong development in services revenue at 25%, which is a higher-than-average segment for the company, and benefits from growth in trucks and in Volvo Penta as well which creates a larger base of vehicles for them to generate revenue from. The adjustments that separated the operating income from the more correct adjusted figures are primarily one offs associated with the financial services division, but also other divisions, in connection with Russia provisioning effects on about 4 billion SEK in assets.

Order intake was hurt by issues with Russia, but also due to restrictions in order slotting as the expectation of long-lead times persists with all the supply chain issues.

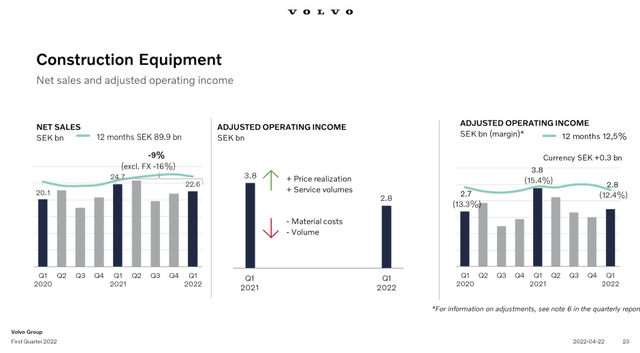

The big declines came in the construction equipment segment where the real declines were about 16%, all driven by the slowdown in the Chinese property market. This is an area of greater concern as we have no expectations of the Chinese property market to recover quickly. However, good pricing has limited declines in income from the segment despite higher material costs, as well as offsetting mix effects from greater service revenue contribution.

China Exposure (Q1 2022 Pres)

Volvo Mitigants

The things that Volvo has going for it are that the cooling off of the economy will allow for more ability to supply their trucks. While logistics will have to cool off in order for the rest of the goods market to cool off and for inflation to subside, with the capacity of the goods market having been strongly pushed, incentive to invest for the future in logistic capacity might be present in which case the shortage of flatbeds may be addressed even in a less ebullient market. Moreover, the good sales achievements of this quarter mean that there are more trucks out there to be serviced, with service revenue providing an automatic margin stabiliser in case consumer durable demand falls and sales of new trucks recede in the mix. Finally, China is in a trough right now, and with real estate being an important vector for government intervention there, construction equipment markets are unlikely to see much worse days in China. However, the worsened macroeconomic backdrop will have a meaningful effect on the Chinese economy, as the goods demand cools off and many of its exports become less valuable. Moreover, the Chinese property market has been subject to bubble criticism for quite some years now, with Jim Chanos having sounded the alarm on it already back in 2018.

Conclusions

Overall, Volvo has relatively resilient fundamentals. Assuming continued growth in accordance with the old economic forecasts in EBITDA the current multiple stands as low as 4.3x, and that isn’t taking into account the fact that the financial services-related debt is technically operating debt. Even if EBITDA stays where it was in 2021 the multiple would be at 5x. That gives investors a substantial margin of safety. The ongoing dividend without specials is 3.8%, which is well covered by the earnings yield of about 9%.

Overall, Volvo has a fair bit to offer investors in way of value and income. Naturally, there are risks. Volvo is a consumer durables company and they are particularly sensitive to recessions. However, consumer durables is a more stretched definition for Volvo because driving a truck is an enterprise, not for fun, so the markets are more commercial in reality. Nonetheless, trucks are an investment and investment cycles turn for the worse in a recession especially one driven by higher cost of credit. Moreover, Russian markets are a loss for Volvo. Finally, China exposure is problematic. But overall, there are mitigants, and Volvo has a decent amount to offer in way of income and value. It is worth considering, although we stay away from them for now while they trade at pre-COVID levels.

Be the first to comment