luchschen/iStock via Getty Images

The Vanguard Mid-Cap Value ETF (VOE) has been up 9.3% in the past year. But, that performance does not tell the whole story. It has had a volatile year with multiple 5% or more losses and considerable gains of 8% or more. I analyzed the returns and dividends of the top 150 stocks in this ETF, looking for beaten-down stocks that offer promising long-term prospects and a dividend yield more significant than the S&P 500 (VOO). There are a total of 204 stocks in the Vanguard Mid-Cap Value ETF.

Fifteen stocks in this ETF have lost over 20% of their value in the past year (Exhibit 1).

Exhibit 1: 15 Stocks in the Vanguard Mid-Cap ETF have Lost Over 20%

15 Stocks in the Vanguard Mid-Cap ETF have Lost Over 20% (Barchart.com, iexcloud.io, author compilation.)

Note: You can download the performance data for the 150 top stocks in the Vanguard mid-cap ETF from my Google Drive.

Whirlpool – a Leader in the Appliance Segment – has Sold-off

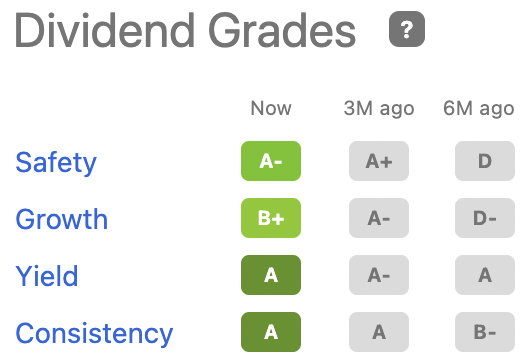

Whirlpool (WHR) is a good candidate on this list to add to a long-term portfolio. This company has great brands and has a dominant market share in the home appliance segment. But, fear of a recession and a slowdown in home construction and mortgage applications have pushed the stock near 52-week lows. It is trading at a forward EV to EBITDA multiple of 4.95x against its five-year average multiple of 7.3x and a sector median of 8.6x. It has low debt levels with a debt to EBITDA ratio of 1.7x. The company offers a 3.95% dividend yield with a low payout ratio of 18.9%. It gets good dividend grades from Seeking Alpha, with a “B+” grade for dividend growth and an “A” grade for consistency (Exhibit 2).

Exhibit 2: Seeking Alpha Dividend Grades for Whirlpool

Seeking Alpha Dividend Grades for Whirlpool (Seeking Alpha)

The U.S. recession between 2007 and 2009 was one of the deepest in the country’s history. The subprime lending in the U.S. housing market caused that recession. In 2009, Whirlpool saw its revenue decline by 9.5% compared to the fiscal year 2008. But, its gross margin increased by 60 basis points from 13.3% in 2008 to 13.9% in 2009. In 2010, gross margins had risen further to 14.7%. The company’s gross profit decreased in 2009 compared to 2008, which contributed to lower net income.

Lenders tightened standards for mortgages after the great recession, and today mortgage lending is much safer than during the recession. Also, adjustable-rate mortgages [ARM] are a much smaller portion of the total mortgage market. With mortgage rates crossing 5%, there is a slowdown in mortgage applications and home building activity. However, the consumer is in much stronger shape, and today’s home loans do not pose a systemic risk to the economy. Inflation is another headwind facing this company that is eating into its margins. The company is projecting a 500 basis point hit to its EBIT margins due to inflation in 2022.

Cloud Business can Continue Growing for Western Digital

Western Digital (WDC) is another promising company on this list but does not expect to see its share price bounce back anytime soon. It seems like the company is enduring much negative sentiment with analysts almost unanimously lowering EPS estimates. It has lost 31% of its value in the past year. Analysts have downgraded the stock expecting weak demand for the company’s products in the future, and have lowered their EPS estimates. The consensus EPS estimates stand at $8.01 for 2022. If the company achieves this EPS, it would be trading at an ultra-low PE of 5.7x.

The consumer market may slowdown in the near term, but its cloud division is still growing well. Its cloud division may have multiple years of growth still left in it even if there is a slowdown in the near term due to a recession in the U.S. The company has a burdensome debt with a debt to EBITDA ratio of 3.7x, but it is working hard to reduce its debt. It is looking to lower its ratio to 3.5x and targets a debt to EBITDA range of 1x to 3.5x. The company paid down $2.4 billion worth of debt in the past 18 months and received an investment-grade rating from Fitch. The stock, at $46.34, is trading near its 52-week low price of 43.85.

The company does not pay a dividend, but I am glad it is focused on paying down its debt and earning an investment-grade rating. The company delivers good financial returns with a return on equity [ROE] of 18.5% and a return on invested capital [ROIC] of 10.3%. Its competitor Micron (MU) has a return on equity of 20.4%. Micron has over 600 basis points higher return on invested capital than Western Digital. The company plays in multiple attractive end markets, pays down its debt, and has good growth prospects in the future. This company’s stock should do well in the coming years.

An Iconic Company – Corning – is on Sale

Corning (GLW) is another excellent company that has lost over 22% of its value in the past year. I first bought its stock at the height of the COVID-19 panic in March 2020 at $23.21. I sold some of my holdings at $37.28 for a profit of about 60% in November of 2020. I will continue holding on to the rest of my shares. I would violate my cost basis if I added to my holdings at current prices, but the stock has sold off recently. I would consider buying if the price drops below $28.

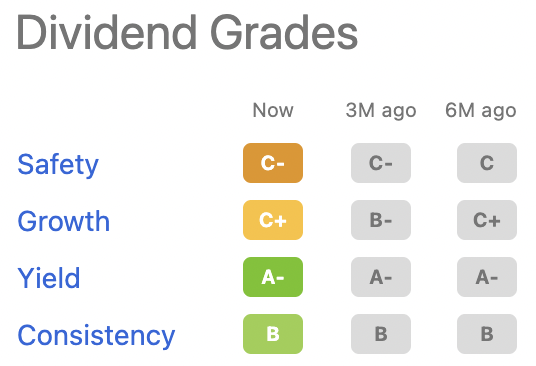

Corning is one of the most iconic American companies. It has been around for over 150 years, and its products are part of the internet [fiber optic cables] and the iPhone [Gorilla Glass]. I was a fan of this company even before I heard the legendary story of how Steve Jobs asked Corning to make the glass for his iPhone. The stock is currently at $33.69, 8.8%, and 10% below its 50-day and 200-day SMA. The stock offers an extraordinary dividend of 3.2%, which is 2x more significant than the dividend provided by the S&P 500 index. Its payout ratio is 49%. From Seeking Alpha, it gets a “C-” for dividend safety and a “C+” for dividend growth (Exhibit 3).

Exhibit 3: Seeking Alpha Dividend Grades for Corning

Seeking Alpha Dividend Grades for Corning (Seeking Alpha)

Wall Street analysts have mixed feelings about this stock, with nine increases and five decreases in EPS estimates in the past three months. It has good financial performance with a return on equity [ROE] of 16.3% and a return on invested capital [ROIC] of 9.4%. Its EPS estimate stands at $2.35 for 2022, which would give it a PE of 14x. The company’s five-year average and the sector’s median PE is 18.6. Corning would be an excellent stock to own on any further pullback.

The Vanguard Mid-Cap Value ETF has performed better than the S&P 500 index ETF (VOO) by 269 basis points in the past year. But numerous companies in the mid-cap ETF have sold off. These three companies – Whirlpool, Western Digital, and Corning – are among the ones that have sold off a lot but have good long-term prospects. These would be good candidates to hold for the long term.

Be the first to comment