Darren415/iStock via Getty Images

Spread out your footprint, diversify across management teams, and include both premium and affordable products. By using these three techniques you may drop the correlation, and increase the risk-adjusted returns of your cannabis-investing portfolio.

“Diversification is the only free lunch”, says the quote attributed to Nobel Prize laureate Harry Markowitz. Prior to transitioning to cannabis, I spent the first 20 years of my professional life in the invest-management business. During this stretch, I thought about correlations every day.

With hedge funds, it is possible to find strategies with similar expected risk-adjusted returns and little correlation. This is due to the diverse range of financial instruments being traded (e.g., stocks/bonds/futures/currencies), and the wide range of strategies (e.g., event-driven/market neutral/trend following). These degrees of freedom make it possible to improve risk-adjusted returns by blending uncorrelated return streams.

When building an MSO portfolio, our means of diversifying are more constrained. We are just using stocks, only small caps, and in one sector. This drives up correlations and makes portfolio construction more challenging. However, there are important differences in this universe, and below are three techniques I use to diversify the Green Giants portfolio.

Geography

There are 37 states, plus Washington DC, that offer some form of legal cannabis. One of the biggest benefits of geographic diversification is reducing exposure to state-specific politics. We have seen this lately with New Jersey. This is a key new state transitioning to adult use and has undergone a series of delays. They voted for adult-use cannabis in February 2021, and finally on April 11th approved a number of MSOs to soon begin sales.

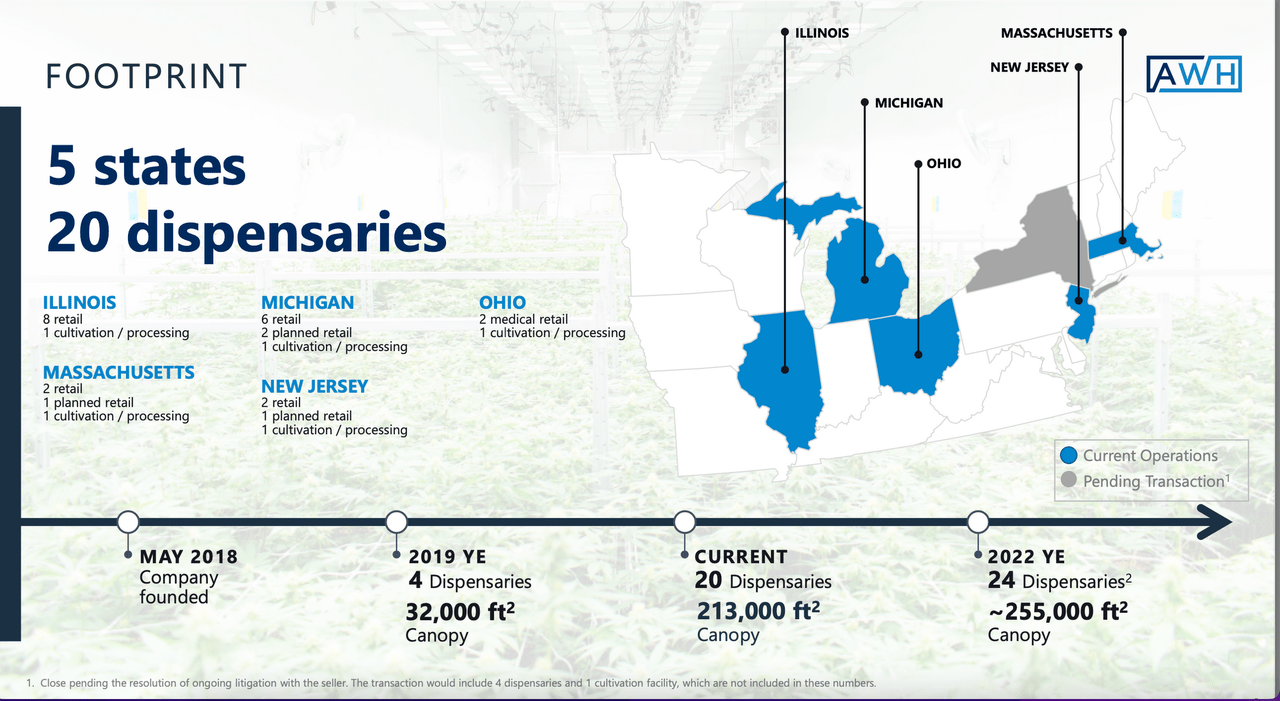

Among the most complementary footprints are Ascend (OTCQX:AAWH) and Trulieve (OTCQX:TCNNF). Ascend’s primary markets today are Illinois, Michigan, Massachusetts, New Jersey, and hopefully New York.

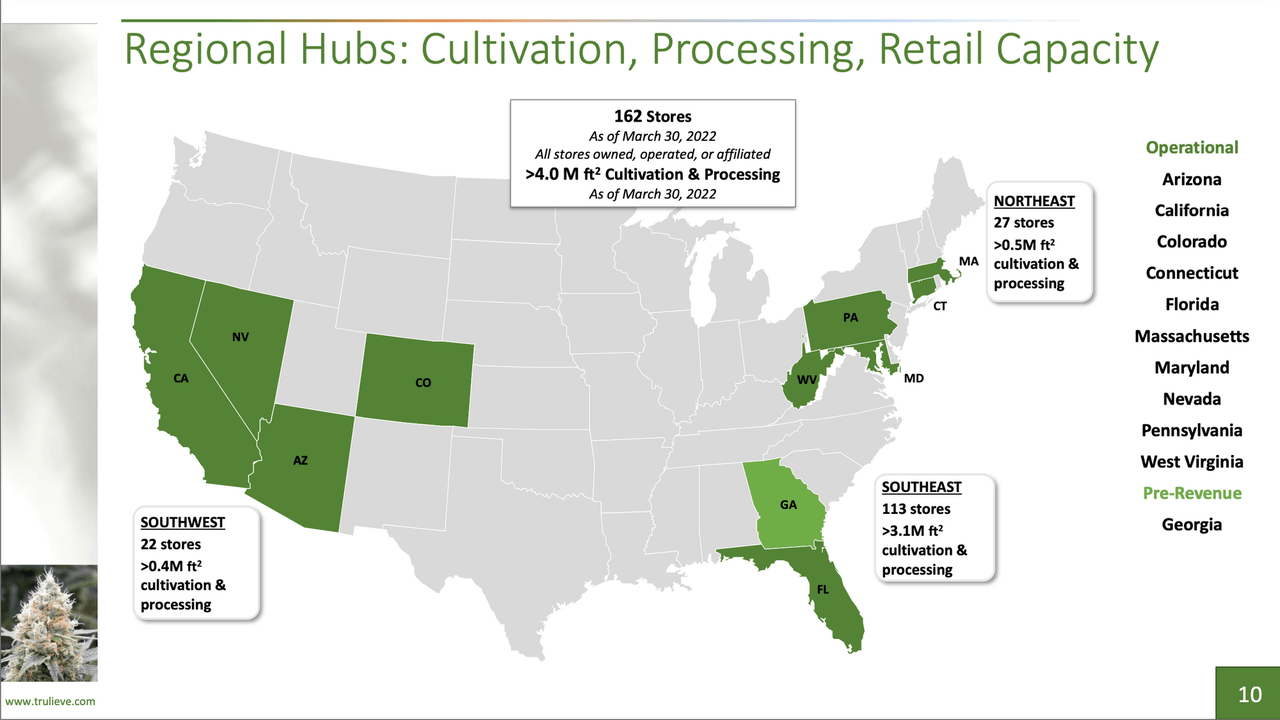

Trulieve is dominant in Florida and Arizona. While New Jersey has been suffering delays, Arizona (that voted for adult use the same day as New Jersey) is up and running and Trulieve has capitalized through their acquisition of Harvest. By owning Trulieve and Ascend, you would benefit from Arizona’s faster rollout, while waiting for New Jersey.

There is zero overlap in the footprints of Ascend and Trulieve, and their unique assets make them potential merger candidates.

Management Teams

We often talk about betting on the jockey, rather than the horse. This is especially important in newer industries, where initial execution is critical. Key questions like which states to operate in, what licenses to seek, what strategy to employ, and the means of execution are often influenced by management’s strengths and backgrounds.

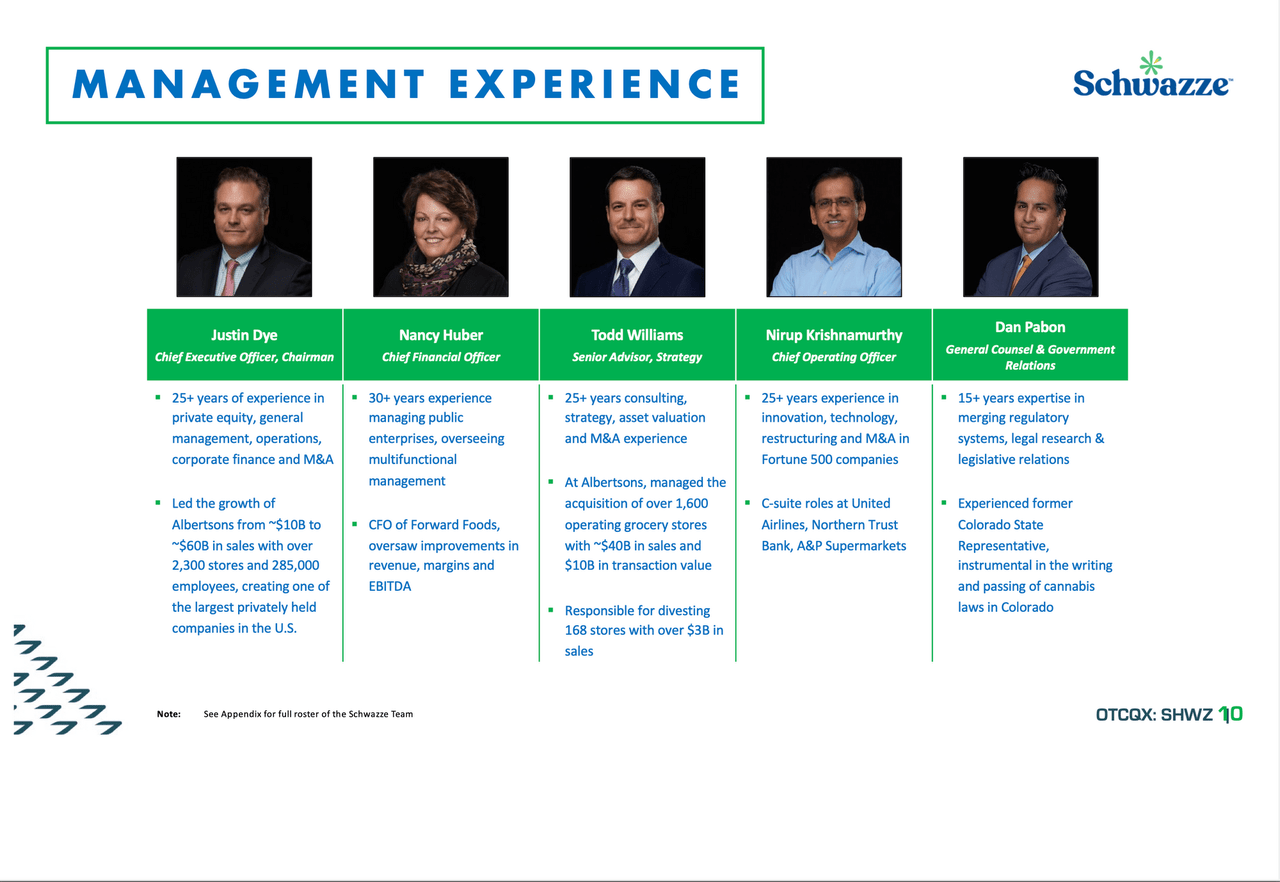

Schwazze and their CEO Justin Dye have roots in the grocery business. Justin was responsible for rolling up Albertson’s stores in the Midwest and his values shine through in Schwazze’s mindful approach to cash flows and strong margin profile. The grocery business is notoriously competitive and offers little room for error. I interviewed Justin on CEO Interviews and we discussed his roots and business tactics.

This is in contrast to a more aggressive operator like TerrAscend (OTCQX:TRSSF). Jason Wild made his money as an investor in the pharmaceutical business. Their new president Ziad Ghanem has a deep background at Walgreens and more recently Parallel. TerrAscend has historically been more comfortable raising capital, investing in newer states, and seeking higher returns. Jason also appeared on CEO Interviews with Fabian Monaco from Gage (OTCPK:GAEGF).

I don’t believe there is one right approach for growing an MSO. Instead, I am diversified across a basket of teams that are using their unique strengths to achieve similar long-term goals.

Products

It is key to hit different price points and serve the broadest customer base possible. When I ran a collective, we had patients always interested in the most affordable options, and we had ones that sought the top-shelf products. By offering a variety of prices, we were able to capture a wider patient base and more revenue.

Verano (OTCQX:VRNOF) focuses on the higher end of the market and premium indoor flower. They believe this will lead to superior margins and less price compression. There are also certain geographies (colder states) where it makes more sense to grow indoors, and these are Verano’s major markets.

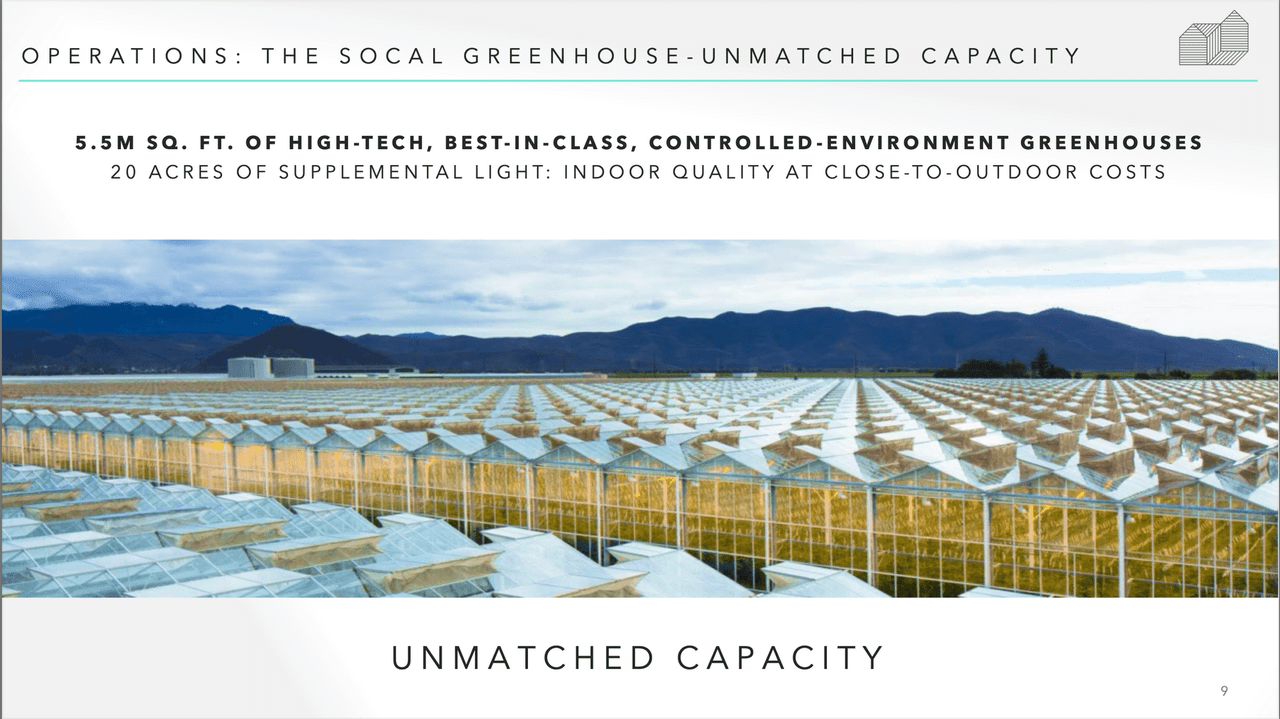

On the flip side, Glass House (OTC:GLASF) is located in California and specializes in more affordable greenhouse-grown flower. I did a Glass House series where I covered the basics, toured the greenhouses, and sampled the output. Their flower sells for around $30 and 1/8th, which is about half of the cost of premium indoor that Verano is producing. Given the ideal climate in which they operate, it makes sense for Glass House to focus on growing great flower for the masses at the lowest price possible.

By pairing Verano with Glass House, you blend two specialists in distinct categories. Plus, you accomplish geographic diversification in the process, since Glass House is only in California and Verano has no presence in the golden state. And, for a bonus there are also differences in the leaders of these businesses, making this one of the more compelling duos.

What About Size?

During the first quarter, smaller MSOs outperformed the bigger names. However, I feel this is a bit misleading and can be a trap for those deploying larger pools of capital, or more active traders.

For example, Harborside (OTCQX:HBORF) was up 67.6% in the first quarter, making it the top-performing US cannabis stock. The problem is they trade an average-daily-dollar volume of about $28,000. If you were trying to place more than a few thousand dollars, there is no way you could enter and exit a position and capture close to the headline 67.6% return.

There are also risk-management concerns with smaller names. What happens if negative news comes out and a bunch of people simultaneously want out? I also feel that if we do not get SAFE Banking, the smaller names are going to struggle with higher costs of capital.

If you want to speculate with smaller cannabis stocks, you may find some gems. However, for liquidity and risk-management reasons, I continue to focus my attention on the ten biggest MSOs and currently hold the six strongest names, with the lowest expected correlation.

Summary

Despite being concentrated in US stocks, only in small caps, and within one sector, there are ways to diversify your MSO portfolio. Spread out your footprint, diversify across management teams, and include both premium and affordable products. By using these three techniques you may drop the correlation, and increase the risk-adjusted returns of your cannabis-investing portfolio.

Disclosure: Ascend, Trulieve, TerrAscend, and Verano are members of the Green Giants portfolio.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment