Natali_Mis/iStock via Getty Images

Buying into falling knives can be a risky proposition in the short run. That’s why some investors prefer to get in on the action after the dust has settled, and the share price has plateaued.

I find this to be the case with Comcast (NASDAQ:CMCSA), which has been rather rangebound over the past several weeks, since falling from the $50 level in February. This article highlights what makes Comcast a good Buy at present, so let’s get started.

CMCSA: Your Opportunity Is Knocking

Comcast is a global media and technology company that provides broadband and streaming services to 57 million customers across the U.S. and Europe. Its broadband, wireless, and video services include Xfinity, Comcast Business and Sky Brands, and its media empire includes Universal, Sky Studios, NBC, Telemundo, and Peacock streaming.

It achieved record high revenue, EBITDA, adjusted EPS, and free cash flow in 2021, with contributions coming from across the company. This includes its Broadband and Wireless businesses, which helped drive an impressive 11% adjusted EBITDA growth and 190 bps of margin expansion in Cable.

Comcast’s traditional Cable TV business faces headwinds from the continued rise of streaming services, including Netflix (NFLX) and the newly formed Warner Bros. Discovery (WBD). However, its Internet service provider business remains the dominant provider in many parts of the country and produces high margins that provides a strong offset to the decline in traditional cable.

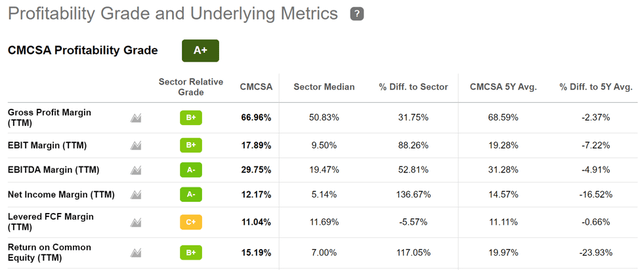

This is reflected by CMCSA’s strong A+ profitability grade, with sector-leading gross, EBITDA, and net income margins, as shown below.

CMCSA Profitability (Seeking Alpha)

Comcast has also been able to provide competitive wireless packages through its recently enhanced relationship with telecom giant, Verizon (VZ). This is a relatively new business expansion opportunity for Comcast, as it enables strong bundling offerings that combine wireless and Internet services, which could lead to stickier customer relationships.

Furthermore, Comcast is seeing a strong recovery to its Universal Studios theme parks as leisure travel has come roaring back after an easing of restrictions. Plus, CMCSA’s Sky acquisition gives it another avenue to deliver NBCUniversal’s content overseas.

Looking forward, management plans to boost investment in its Peacock streaming platform over the next couple of years, as it plays catch up to larger streaming rivals such as Netflix, HBO, and Disney (DIS). This comes with both risks and rewards, as highlighted by Morningstar in its recent analyst report:

NBCU plans to double Peacock content investment to $3 billion in 2022, ramping to $5 billion annually over the next couple years. We aren’t as confident that this investment will earn attractive returns, though the effort is necessary in our view.

NBCU needs to widen this business to hedge the declining pay television business, but Peacock ended 2021 with only 24.5 million monthly active accounts, including 9 million paying customers, far behind rivals Netflix, HBO, and Disney. Given the content and resources at NBCU’s disposal, we believe it can catch up, but stiff competition for customers and content will likely hurt profitability over the next couple years more than we had expected.

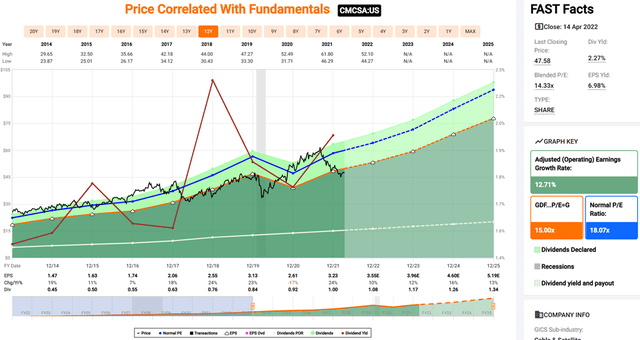

Meanwhile, I see potential headwinds as already having been baked into the current share price of $47.58. This price appears to be attractive, as it equates to a forward PE of 13.4, sitting well its normal PE of 18.1 over the past decade.

Analysts expect EPS growth ranging between 6-17% over the next 4 quarters, and have a consensus Buy rating with an average price target of $60.63. This implies a potential 30% total return, including dividends.

Lastly, CMCSA also maintains a strong A- rated balance sheet, and the 2.4% dividend yield is well covered by a safe 31% payout ratio. While the dividend yield isn’t high, it comes with a robust 12% 5-year CAGR.

Investor Takeaway

Comcast is a high-quality business that continues to generate impressive results, while also expanding into new areas such as wireless and streaming. It trades at an attractive valuation and offers a solid dividend yield with strong growth potential. As such, I believe it represents a compelling investment opportunity for long-term investors at the current price.

Be the first to comment