juliannafunk

The evidence is becoming increasingly clear that the housing bubble has burst, and home prices are in decline. With mortgage rates at elevated levels and home prices only beginning to budge from their highs, now is likely not the time to be purchasing new investment properties. In contrast, REITs (NYSEARCA:VNQ) have already plummeted from highs and look to be a general bargain, especially if interest rates remain in a lowish band over the long-term. As a result, we believe that real estate investors would be better served by investing their capital into the REIT market instead of buying new rental properties right now.

Why The Housing Bubble Is Bursting

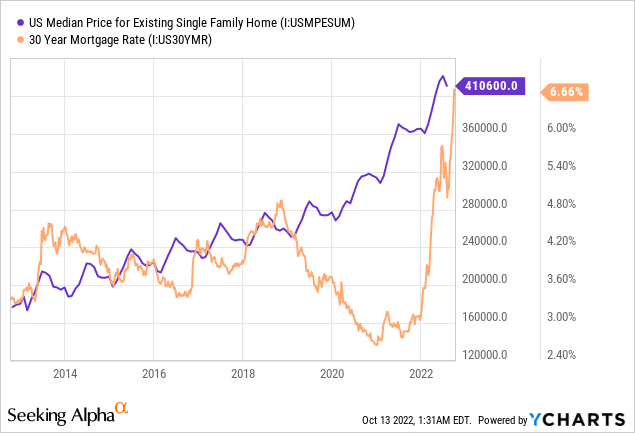

The short and sweet of it is that housing prices remain near all-time highs even as mortgage interest rates have soared:

As a result, we have a situation where the price tag of a house is not only near all-time highs, but the monthly mortgage payment has soared even more. This is because 30-year mortgage payments start out as being majority interest payments. As a result, mortgage payments are extremely interest rate sensitive. When mortgage rates nearly triple over the course of a single year – even without the aforementioned housing price growth we have also seen over the past year – the monthly mortgage payment soars higher.

What does this mean? Effectively it means that more and more prospective buyers are now losing their appetite for purchasing a home and tilts the equation increasingly in favor of renting since rental rates have not kept pace with mortgage payment growth. Not only that, but many buyers are being priced out of the market as banks will simply not approve them for financing given that safely servicing such high mortgage payments is becoming increasingly challenging in the current housing market.

Additionally, persistently high inflation that is also outstripping wage growth is also beginning to exhaust buyer budgets. With everything else costing meaningfully more right now, potential home buyers can afford less home than they did previously, thereby reducing demand for housing.

Another metric that indicates that home prices are likely headed lower is that housing units per capita are approximately in-line with where they were back in 2008 levels (aka right before the epic real estate crash of that era), only this time home prices are far higher.

Meanwhile, the Federal Reserve is set to raise interest rates further and Chairman Powell declaring at a recent press conference that the housing market may very well have a correction in store for it:

There was a big imbalance … housing prices were going up at an unsustainably fast level. For the longer term what we need is supply and demand to get better aligned so housing prices go up at a reasonable level…and people can afford houses again. We probably in the housing market have to go through a correction to get back to that place.

This means that housing prices are much more likely to continue falling than they are to continue rising, at least in the short-term.

A final important consideration for would-be single-family home investors is that one of the main reasons why purchasing single-family homes is so attractive as an investment is that they can purchased with fixed rate 30-year mortgages, thereby juicing returns considerably. However, this works both ways. If you were to buy a home with 20% in equity as a down payment today and the home value were to fall by just 10% over the next year, that would translate to a 50% loss on your equity. A 20% decline in the home value would fully wipe out your equity investment. While over the long-term the home value will likely recover (or at least this is what past history suggests), the short-term losses could be very severe. Why set yourself up for this initial setback when the writing is so clearly on the wall and there is a much cheaper and easier way to invest in the real estate market right now via REIT ETFs like VNQ?

Why REITs Are Attractively Priced

While the bullish case for single family homes is increasingly difficult to make, at least for the near future, the case to buy REITs is quite strong.

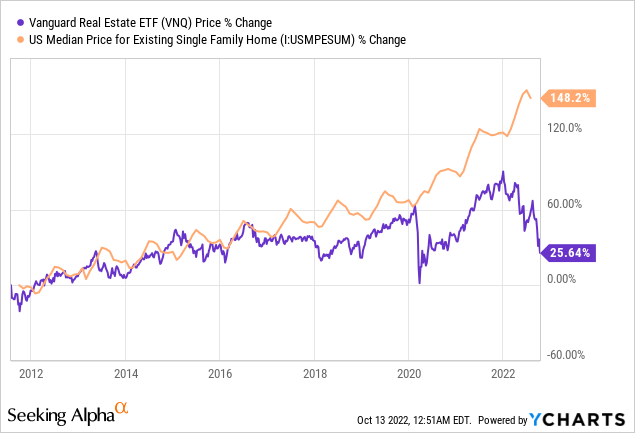

First and foremost is the simple fact that the value of REITs and single-family homes moved in virtual lockstep until the COVID-19 crash. What happened then was that REIT prices collapsed, and single-family home prices soared. While REITs recovered strongly in the wake of enormous monetary stimulus and historically low interest rates, single-family home prices continued to soar. However, in 2022 – with the Federal Reserve raising interest rates aggressively – REIT prices have plummeted considerably while home prices continued to soar and only just recently have begun to taper off:

If the historical norm resumes, VNQ will significantly outperform single-family homes moving forward.

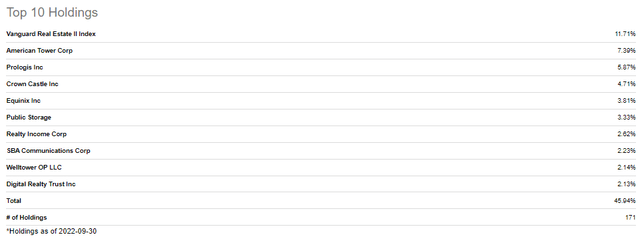

VNQ also looks very attractively priced when evaluating the valuations of its largest holdings:

VNQ Top Holdings (Seeking Alpha)

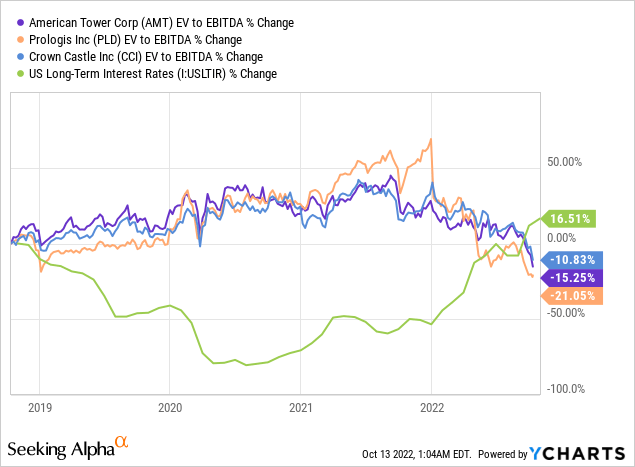

We can see from the chart below that all three of its largest holdings (American Tower Corp. (AMT), Prologis (PLD), Crown Castle (CCI)) which represent almost 18% of its total holdings are down significantly on an EV/EBITDA basis in recent years and – on a collective weighted basis – more than interest rates have risen during that time span:

Of course, if interest rates remain at current levels or rise even further over the long-term, this pullback in valuations is largely justified, but if interest rates pull back and settle into a lowish band for the long-term, then REITs as a general group are at bargain prices right now.

Regardless of which view investors hold to regarding the direction of interest rates, it should be obvious that REITs have largely traded in line with fair value relative to interest rates in contrast to single-family homes, which have soared far above the values they should have given where interest rates are.

Investor Takeaway

The housing bubble is clearly bursting before our eyes and prices are likely headed meaningfully lower before they return higher. As a result, investors – especially when considering the stratospheric interest rates being charged today for mortgages – would be best served to steer clear of buying more homes. Affordability is at an all-time low in the sector.

Instead, for those still wanting real estate exposure, REITs look like a much more promising option. With well-diversified, low-cost ETFs like VNQ, investors can buy shares that have declined sharply already this year and appear to have largely already priced in the rising interest rates.

At High Yield Investor, we are taking it one step further and investing in individual high yielding stocks and REITs that are even more clearly undervalued and are well positioned to weather a potential recession as well. For those wanting simplicity and complete passivity for their investing, however, VNQ looks like a solid Buy at the current price.

Be the first to comment