jittawit.21

Thesis

Vanguard Real Estate ETF (NYSEARCA:NYSEARCA:VNQ) is a highly diversified REIT ETF, offering investors exposure to 168 holdings across various REIT themes. Therefore, investors would not be subjected to some critical risks in typical REIT investments, such as operator/tenant concentration risks, which could markedly impact AFFO performance.

Despite that, VNQ’s TTM dividend yield of 3.07% may not seem attractive to REIT investors who are used to much higher distribution rates. However, we urge investors to consider assessing VNQ’s proposition through a total return framework, given its strong medium- and long-term return over time.

Investors should also note that VNQ has a robust long-term uptrend, corroborating the strength of its underlying holdings, with the appropriate weighting applied. Therefore, we believe investors who would like to gain exposure to REITs, but without a specific industry focus can consider leveraging the VNQ, given its proven performance and broad diversification.

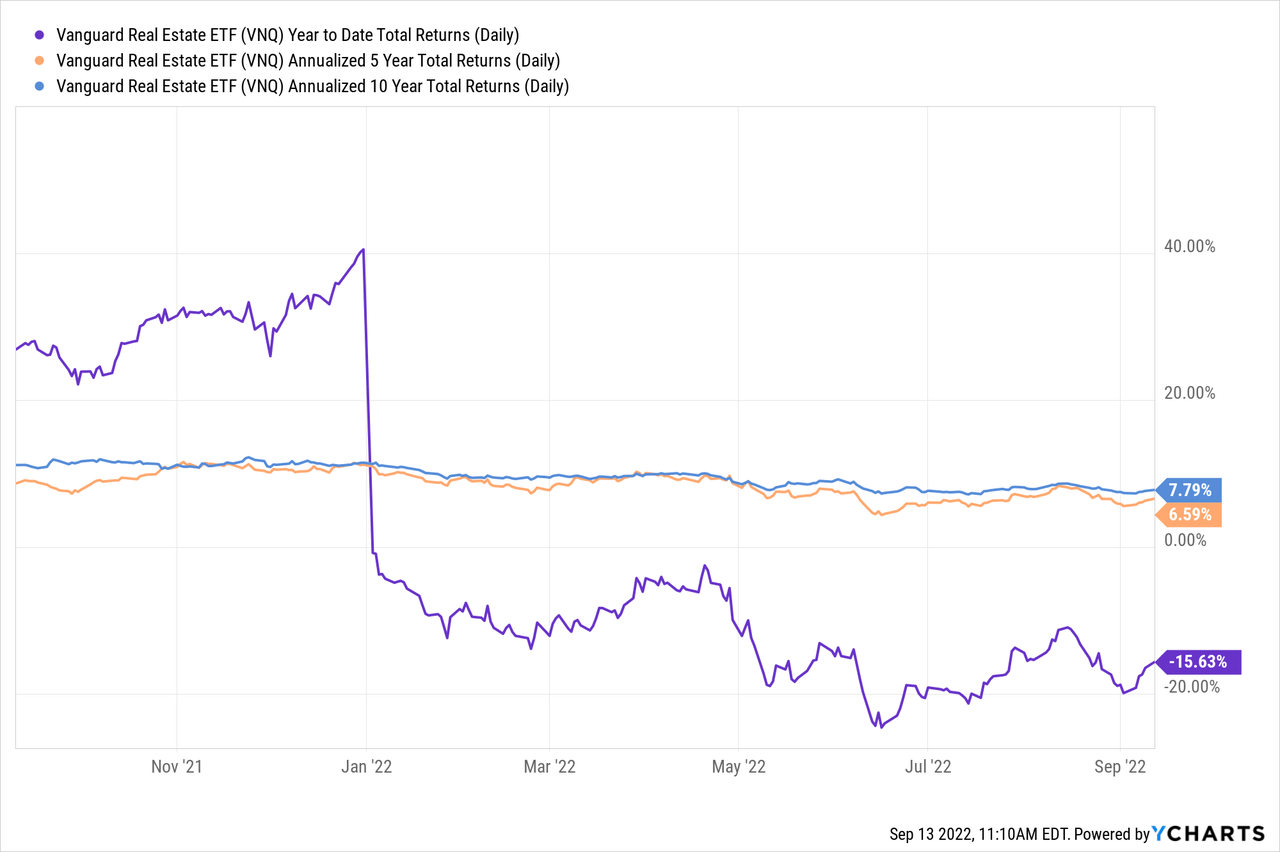

VNQ’s YTD return has also fallen well below the 5Y, and 10Y mean of its total return CAGR. Coupled with constructive price action, which suggests a medium-term bottom in June, we believe adding exposure through the recent pullback is appropriate.

As such, we rate VNQ as a Buy.

VNQ’s Long-Term Bottom In June

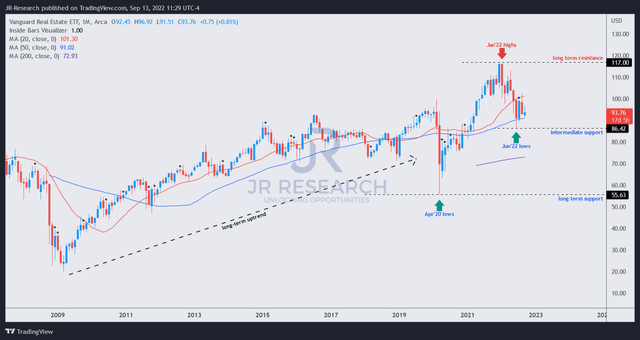

VNQ price chart (monthly) (TradingView)

For price action-based investors, we believe it’s easy to understand why VNQ deserves a place among REIT investors. Its long-term uptrend from the lows in March 2009 validates the robustness of the ETF’s performance and selection over time.

Even the COVID-19 bear market did not hinder its upward momentum, as it proved to be an astute bear trap (indicating the market denied further selling downside decisively) as it formed its March 2020 long-term support.

It then continued a remarkable rally to stage its highs in January 2022, before the broad market downturn sent VNQ tumbling nearly 26% to its June 2022 lows.

But, Is A 3% Dividend Yield Attractive?

VNQ TTM Dividend yield % (TIKR)

Some investors may ask why VNQ’s dividend yield is so low. As seen above, VNQ last traded at a TTM dividend yield of 3.07%, below its 10Y mean of 3.86%. Looking specifically from a dividend yield perspective, we concur that it doesn’t seem attractive enough.

However, that’s missing the whole point of investing in VNQ. VNQ’s relatively low dividend yield is also an outcome of its relatively strong capital appreciation over the years, as seen in its secular long-term uptrend in the previous price chart.

As a result, VNQ delivered a total return CAGR of 7.8% over the past ten years. Therefore, it’s pretty clear that VNQ relies on capital returns as a key differentiator on top of its dividend yield.

Investors need to remember that dividend yields are also affected by price appreciation/depreciation. Hence, some stocks with very high dividend yields may demonstrate a low total return if these stocks exhibit a long-term downtrend. Accordingly, we believe investors should apply the total return framework as the appropriate tool to assess whether VNQ is suitable for their portfolios.

Is VNQ ETF A Buy, Sell, Or Hold?

As seen above, VNQ’s YTD return of -15.6% is way below the 5Y, and 10Y mean of its total return CAGR. Therefore, we believe a mean-reversion opportunity is in store, delivering robust returns for investors at the current levels, given our thesis of its long-term bottom in June.

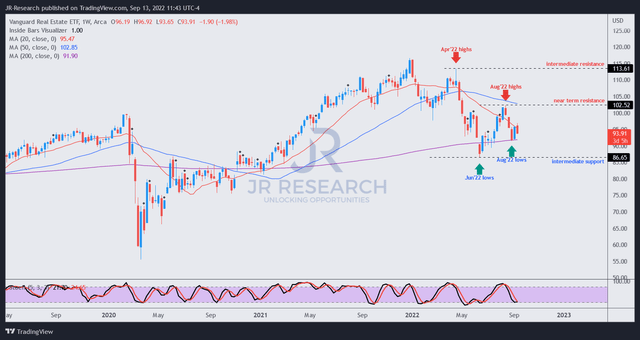

VNQ price chart (weekly) (TradingView)

As seen above, VNQ’s medium-term price chart indicates that VNQ has likely formed a higher high at its August lows, above our conviction of its long-term bottom in June.

For VNQ to resume its upward bias, it’s fundamental for VNQ to exhibit higher high and higher low price structures, with August highs as the next re-test level.

Therefore, we believe investors interested in REIT exposure should use the current pullback to add positions in VNQ. Not including its dividend yield, a potential move toward its August highs could generate a return of nearly 9%, above its 10Y total return CAGR.

Accordingly, we rate VNQ as a Buy.

Be the first to comment