simonkr

Dear readers,

We’re going to take a look at International Flavors & Fragrances (NYSE:IFF), a company in the sort of business as the name would suggest. It works with flavors, fragrances, and various cosmetic components, marketing the products on a global basis. The company is international, headquartered in New York, has roots going back well over 100 years, and is a component of the S&P500.

Let’s look at what IFF can offer investors such as us if we were to buy shares in the business here.

International Flavors & Fragrances – the company & operations

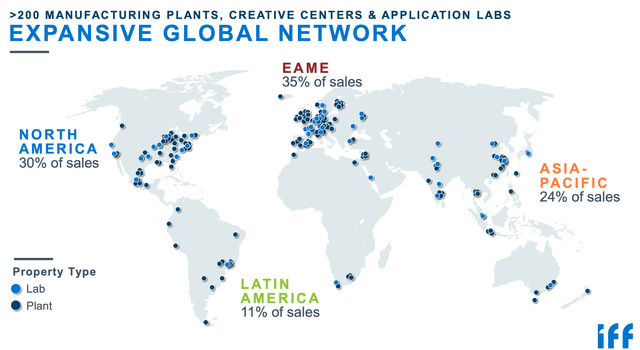

This is a giant in the industry – Indeed, one of the largest in its entire field. The company works worldwide with revenues of well over $11.7B for the year, with 50,000 worldwide customers, and over 28,000 different raw materials into 110,000 unique products. The company serves 150 countries, and operates in 65 of them with 50 R&D sites and 150 manufacturing sites across the world.

IFF employs 24,000 people, and on the $11.7B of sales, it generates $2.4B worth of operating EBITDA, coming to a margin of close to 21%. $1B of this is FCF – and as mentioned, these are global operations.

The company has an appealing sales mix, meaning no single geography is “too much” of sales, even if Europe and NA together are around 65% – and this gives you an idea of where the company’s sites are located.

The company furthermore has a fairly decent balance in terms of product mix. 54% of the company’s annual sales go to some sort of nourishment or food end product – the rest is split between Scent, H&B and PHS segments, with over 55% of sales going to developed markets. This leaves both a solid legacy base, as well as the opportunity to capture new, emerging markets.

IFF is a very high R&D spender. Few companies pour over 5% of sales in R&D outside of pharma, and IFF goes with 5.4%, well over $600M per year at the current rate. This money is spent on a significant number of patents, new master perfumers/employees, human trials, flavorists, sites, strategic partnerships, and other things.

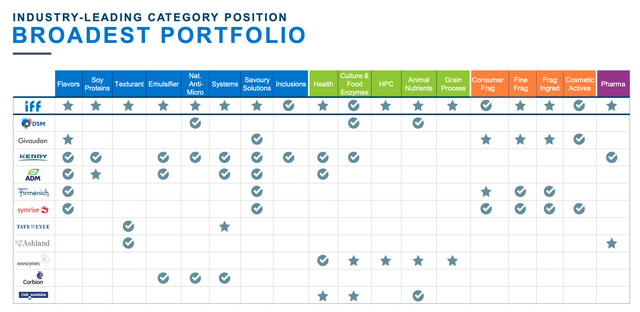

When you think about it, it’s quite remarkable how much in our lives is dictated by our scent or various types of flavors – this is what IFF works on. And for customers, the arguments for IFF are solid – and plentiful. No peer anywhere offers the company’s breadth and product diversity, making IFF a natural choice, all things being equal.

The company has attractive capital allocation priorities. Obviously, it’s not the biggest dividend payor – not with the sort of R&D spend it focuses on. But it does have a decent dividend, a share buyback program, active portfolio management, and offensive debt repayment policies.

And the results are good! The company managed a 2021 YoY sales growth increase of 10%, earnings growth, and debt down to 4.1x which is above its deleverage target, but on the way, and has delivered on its targeted synergies.

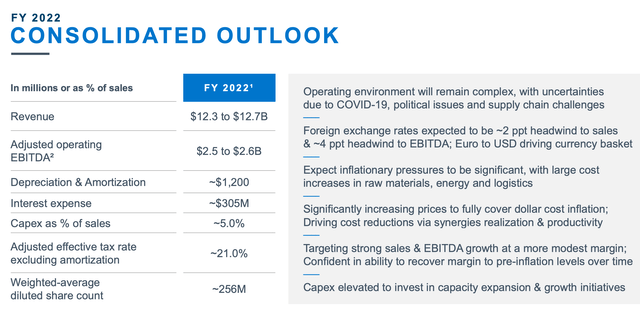

The company has also delivered a 2022E outlook that we can compare to.

The company’s obvious focus remains on strong sales momentum and execution. IFF needs to manage pricing and inflation, while capturing synergies and efficiencies as guided by the company. It also needs to continue to divest non-core assets if it seeks to keep up its plans – meaning IFF has its work cut out for it for 2022. How has this been going, given that we have 2Q22 to look at?

It’s going good.

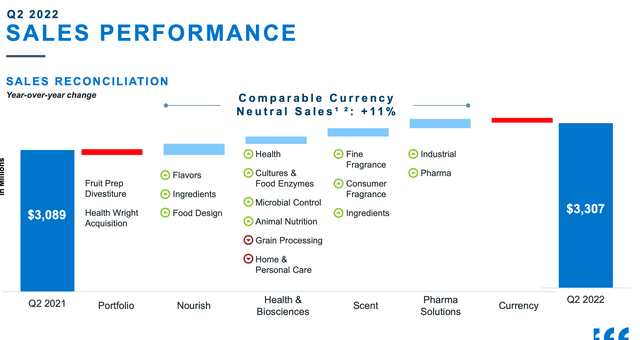

2Q222 saw sales growing by 18% year-over-year with EBITDA up 8% on a FX-neutral basis. The company bumped the dividend by 3% – though the debt is actually up to 4.4x as of the latest reported quarter, to adjusted EBITDA. The company also divested further non-core assets, in this case Microbial Control. The adjusted operating EBITDA margin is down slightly, but EPS is up on the basis of volume.

All in all, things are looking very well for IFF.

There were of course, very significant inflation and input effects – but these were more or less weighed up at almost a 1:1 basis through price increases, delivering YoY EBITDA increases for the company during this quarter.

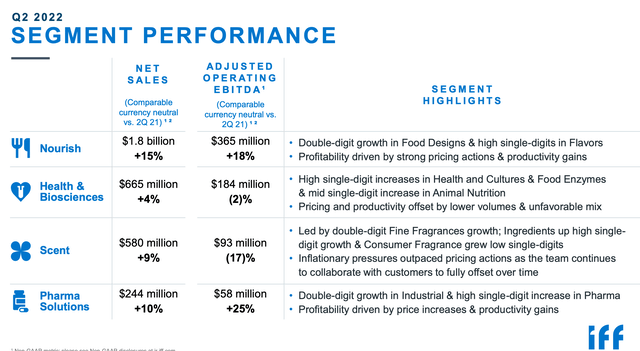

On a segment-by-segment basis, and the company reports in the segments of Nourish, Health/Biosciences, Scent, Pharma Solutions.

Sales were up in every segment, but profit was a very different story. Fragrances profits were down 17% because inflation completely outpaced any pricing action the company managed for the quarter and for this year. Aside from the Scent segment, the others were really fairly good, as far as I see it – and better than I would have expected from a company with these sorts of exposures.

The company still has a relatively high debt level on the back of recent sets of M&As and portfolio actions. It will take some time for the company to pay this down. Aside from this one factor, you need to swallow the dividend level – 2.77% currently – before investing in the business. The company does have a good BBB level in terms of credit rating.

It will take more time for synergies to be realized. The fact is that even the company’s own forecasts as of 2Q22 call for the company’s earnings to decline by double digits for the fiscal.

EBITDA is expected to be up slightly – but not EPS. The company is delivering on more “core” targets, such as maintaining sales momentum, managing inflation, capturing those synergies and selling additional assets.

All in all, few question marks remain for IFF. There are some questions as to why the company wasn’t able to grow in terms of volume, with most of the company’s peers having very volume-strong growth and IFF not showing exactly the same positives on a company-wide basis. Also some questions on productivity – but all of these boil down to detail-oriented questions that could perhaps bump results one or two percentage points in either direction. I focus on the high level here, and the high level looks good. I have no issues with the company’s recent results, and I expect the company to continue to deliver good in the long-term, even if 2022 looks like a flat or negative year in terms of earnings.

Let’s look at valuation.

International Flavors & Fragrances – Valuation

So, the main problem that people have with this company is that it typically trades at a premium. Given its overall market position, this should not be surprising, but the main argument against investing in IFF is the premium that it typically commands on the market.

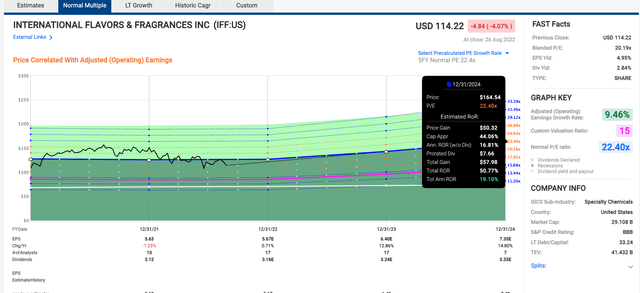

This premium is fairly well-established and on a 10-year basis, it’s close to 22x P/E. IFF has been both above and below this average at times, and it’s very fair to say that the last 10 years of investing in IFF haven’t exactly been exciting for shareholders, averaging around 3.9% annually. However, this is also a period marked by significant portfolio optimizations and changes, with IFF on a long-term 20-year basis delivering more than double that growth and actually being a relatively good investment. The question of course becomes if the company can deliver better results going forward, than the last 10 years, based on the current valuation.

I would say that “Yes”, this is entirely possible. IFF is now trading below its premium of 20-22x and currently is priced at a low range of 20.2x P/E, which would call for the company to deliver a potential upside of nearly 20% annually based on its 5-year valuation average when including the current EPS growth forecasts.

2022 isn’t forecasted to bring anything exciting to the table – but synergies in 2023-2024 should deliver growth in the double digits for the company, which should make it possible for IFF to give investors that 19% annual RoR, or over 50% in less than 3 years of investing.

IFF has a market cap of over $40B – and it doesn’t really miss estimates all that often – less than 15% with a 10% margin of error, which gives some confidence to these targets here. The yield isn’t the greatest in the business – there are an untold number of quality companies that yield more, and indeed have higher upsides than this company offers, but IFF is an interesting consumer staple that can’t be said to be “on sale” very often.

It might be a bit much to claim it being “on sale” now as well – 20x P/E is rich – but IFF is, as you can see, usually a bit higher than this.

Analysts give the company a target range between $101 to $178 – a wide range, with an average target of $141/share, which implies a 24% upside here. 13 out of 20 analysts come in at a “BUY” or “Outperform” rating, implying a high confidence in the generality of the “upside” or undervaluation in this company.

I concur with this, and I do consider the company at a decent valuation here. I now have a small stake in IFF. I prefer other investments with a higher upside and yield here, but this company is most assuredly attractive at a 20x P/E.

Consumer staples aren’t the cheapest stocks at this time. You’ll need to be prepared to pay a bit of a premium for some of these businesses.

But – IFF can deliver here. I consider it a “BUY” – but at a somewhat lower PT than analysts. I give the company a 19-20x 2023-2024E P/E, to around $135/share.

Those are my targets, and I go into IFF at a “BUY”.

Thesis

Here is my thesis for IFF:

- International Flavors and Fragrances is one of the world’s premiere flavor/fragrance companies. It has great fundamentals, a decent, well-covered yield, and a good upside of at least 10%, and likely up to 19% per year until 2024E.

- There are risks to the business, but these risks are mainly how long it will take for the company’s upsides to be realized, not insofar as the fundamentals or how the company operates.

- Based on this fairly straightforward situation, I begin my coverage of IFF by giving it a “BUY” rating and a $135 PT.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment