Photon-Photos

The Gold Juniors Index (GDXJ) didn’t have the Q2 Earnings Season that some investors had hoped for, and the Q3 outlook isn’t much better with a combination of only slightly better costs but weaker precious metals prices. However, one company is on track to buck this trend massively: EMX Royalty (NYSE:EMX). This is because the company’s flagship Gedikpete asset is finally ready to start paying, and EMX is also benefiting from an ~80% increase in its royalty at the Caserones Copper Mine in Chile.

The result of these two developments, combined with the start of royalty payments from Esan (Balya), should lead to a significant sequential increase in revenue & other income in Q3 and Q4 2022. So, while some companies in the sector are set to report year-over-year revenue declines, EMX will be a clear exception. Looking ahead to FY2023, EMX should see triple-digit revenue growth, allowing it to grow meaningfully despite a softer metal price environment. Given the unique position the company is in, I continue to see the stock as a Speculative Buy below US$1.80.

All figures are in Canadian Dollars unless otherwise noted.

Balya Core Sample (Company Website)

Q2 Results

EMX Royalty (“EMX”) released its Q2 results earlier this month, and while the headline revenue figure likely turned some heads, the net loss of C$4.1 million may have dampened some investors’ spirits. This is because this net loss was higher than in the year-ago period (C$3.58 million). However, after adjusting for non-cash items like mark-to-market adjustments on its investment portfolio of C$4.4 million, EMX didn’t post a net loss at all. Besides, the company should have an entirely different quarter in Q4 with two new assets contributing to its top line, one of which is a massive 10.0% NSR royalty on oxides in Turkey. Let’s take a closer look below:

It’s worth noting that EMX receives shares in companies as payments for vending out properties, being a prospect generator. So while a multi-million dollar loss due to mark-to-market adjustments might seem significant, this can be thought of as ‘bonus’ capital in an investment portfolio in addition to the royalties on these projects and cash payments. An example is its recent deal with Intrepid Metals, which paid 600,000 common shares, execution/staged payments of US$350,000 (plus milestone payments if reached of US$1.7 million), and a 2.0% NSR on the Mesa Well Property in Arizona.

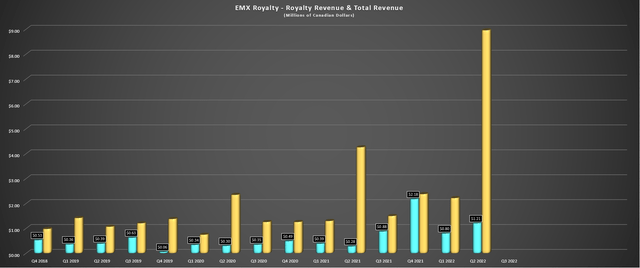

Looking at the chart below, we can see that EMX reported a massive increase in royalty revenue in Q2 2022, reporting C$1.21 million in royalty revenue, a 326% increase from C$0.28 million in the year-ago period. This was driven by a sharp increase in ounces sold from its Leeville royalty (C$0.92 million), with production increasing as it moved into different production areas, with 391 ounces of gold sourced from Four Corners, Monarch, West Leeville, and Carlin East. Meanwhile, from a revenue & other income bases, EMX saw a considerable boost from Caserones (where it recently increased its royalty rate further to ~0.734%), with Caserones generating C$3.1 million in income in the period.

EMX Royalty Revenue & Total Revenue (Company Filings, Author’s Chart)

On a total revenue & other income bases (excluding Caserones), EMX’s quarterly revenue came in at C$8.96 million, a more than 110% increase from the year-ago period. This was related to a sharp increase in royalty revenue (+326%), interest income (+415%), and option & other property income (+80%). The latter figure fluctuates wildly, which distorted the Q2 results given that this was one of the lumpier quarters for option & other property income. Still, if we look at revenue/income that is less noisy, revenue/income more than tripled (C$4.3 million vs. C$1.30 million) with the addition of the Caserones royalty and much higher production at its Leeville 1.0% gross smelter return [GSR] royalty.

Gediktepe Mine (Company Presentation)

While these Q2 results were quite solid and have led to a meaningful improvement in EMX’s price-to-sales ratio, even if one chooses to adjust out option & other property income, all eyes are on Balya, Gediktepe, and Timok. These three royalties are game-changers for the company, but Timok fell under a surprise dispute with Zijin Mining (OTCPK:ZIJMF), Balya was slightly behind schedule for initial production, and investors were waiting for Gedikpete to hit the 10,000-ounce (gold-equivalent) production mark. Fortunately, the latter was reached in August, a massive contributor to EMX’s production profile.

Post-quarter-end, EMX reported that Polimetal had met the 10,000 gold-equivalent ounce production milestone, triggering the start of royalty payments. Based solely on gold production at the Turkish asset and the mid-point of guidance, Gediktepe should contribute an average of US$7.0 million per annum at a US$1,750/oz gold price from 2023-2026, with an additional contribution from silver.

Following the completion of oxide production, EMX will benefit from sulfide production at the asset with a lower 2.0% royalty but a much higher throughput rate (~2.4 million tonnes per annum). So, I would expect Q3 and Q4 to be strong quarters for EMX, while some royalty/streaming companies may have difficulty increasing revenue due to lower metals prices. This is especially true given that Balya should also begin contributing, where EMX holds a 4.0% NSR royalty on the zinc-lead-silver deposit. Within EMX’s prepared remarks, the company noted that the asset began commercial production in Q3.

Recent Developments & Medium-Term Outlook

Given that Balya and Gedikpete are now in commercial production, there is a much clearer path to revenue growth in H2 2022 and FY2023 – a positive development for investors. Meanwhile, EMX increased its Caserones royalty to ~0.734%, translating to nearly 800 tonnes of copper per annum, assuming a similar production rate to FY2021 levels. Even considering a more conservative copper price of US$8,000/tonne, this will be a huge contributor for EMX, and the company should benefit from a full year with at least four producing and paying assets (Balya, Gediktepe, Leeville, Caserones). There is the possibility that this figure could increase to five, assuming the company can agree on terms with Zijin Mining, which EMX appears confident in resolving by year-end.

Given this improved production profile and even with a backdrop of lower metals prices (US$8,000/tonne copper, US$1,750/oz gold), EMX is set to see a massive increase in royalty revenue and other income. Even if we assume just ~US$10 million from Gedikpete, ~US$7.5 million from Caserones, ~US$2.0 million from Leeville, and an additional contribution from Balya, EMX should report over US$22 million in royalty revenue/other income, a meaningful improvement from FY2021 levels (US$6.0 million). If Timok is resolved and previously owed royalty payments are made, this figure could come in north of US$25 million, translating to more than 300% growth in revenue & other income year-over-year. Let’s look at the valuation to see whether investors are paying a reasonable price today for this growth:

Valuation & Risks

Based on an estimated year-end share count of ~128 million fully diluted shares and a current share price of US$1.88, EMX trades at a market cap of US$241 million. Assuming the company generates a conservative US$23.5 million in revenue & other income in 2023, the company would be trading at a price-to-sales ratio of ~10.2. This figure is well below EMX’s peer group. I believe a discount is justified due to its lack of diversification and lower trading liquidity. However, the discount is starting to become significant, especially if it can beat these FY2023 revenue/other income figures. Notably, from a P/NAV basis, the discount is also substantial, with EMX trading at ~0.70x P/NAV.

I have adjusted my conservative revenue estimate higher for 2023 (June article: US$18 million) with the start of commercial production at Gediktepe, which has confirmed that EMX will receive meaningful royalty payments next year from the asset with the 10,000-ounce hurdle passed last month.

Some investors might argue that EMX is un-investable due to its significant concentration in just a few producing assets (Leeville, Caserones, Balya, Gedikpete, Timok) combined with the fact that some of its partners are private, making it more difficult to study these assets. Meanwhile, it doesn’t have any meaningful new contributors on the horizon to spread out this concentration risk, with over 90% of its assets being early exploration and even its advanced royalty assets (Diablillos, Yenzipar, Kaukua) still being years away from production.

I think these are fair criticisms, and while EMX has done a great job assembling a portfolio that is more diversified and growing revenue, the added revenue from Caserones may have boosted income, but it didn’t do much for diversification. However, I would not say that EMX is un-investable because of these risks. Instead, I believe investors must be very mindful of portfolio sizing due to the concentration of assets and the lack of exposure to Tier-1 ranked jurisdictions (Canada, Australia, United States, Finland) for producing royalties. For this reason, I continue to favor other names in the sector, like Osisko Gold Royalties (OR), which is much more diversified, even if EMX has a near-unrivaled growth profile at an inflection point.

Summary

EMX Royalty has had a tough past year with a delayed ramp-up at Balya, a dispute over its Timok royalty with Zijin Mining, and a write-down at Rawhide. However, on a positive note, a key royalty for the company has finally reached commercial production; the management team appears confident that they can resolve the Timok royalty this year, and one of its advanced royalties at Diablillos continues to enjoy exploration success. This doesn’t mean that Diablillos will be a mine one day, but the exploration success certainly doesn’t hurt its chances.

Given these developments, EMX is on a path to tripling its revenue and other income year-over-year, with the potential for up to US$24 million in FY2023, even at current metals prices. Equally important, EMX will benefit from increased diversification as new royalties come online. Based on what I believe to be a fair forward revenue/income multiple of 15 to account for concentration risk, I see a fair value for EMX of US$2.75 per share. Based on a requirement for a 35% discount to fair value to bake in an adequate margin of safety, I continue to see EMX as a Speculative Buy below US$1.80.

Be the first to comment