gorodenkoff

Danaher Corporation (NYSE:DHR) designs, manufactures, and markets professional, medical, industrial, and commercial products and services is a buy for the total return investor. Danaher, a worldwide company in 60 countries, has steady growth and plenty of cash flow, which it uses to increase the dividend each year and buy bolt-on companies. Danaher is 1.7% of The Good Business Portfolio; my IRA portfolio of good business companies is balanced among all investing styles.

As I have said before in previous articles.

I use a set of guidelines that I codified over the last few years to review the companies in The Good Business Portfolio (my portfolio) and other companies that I am reviewing. For a complete set of guidelines, please see my article “The Good Business Portfolio: Update to Guidelines, March 2020”. These guidelines provide a balanced portfolio of income, defensive, total return, and growing companies that hopefully keep me ahead of the Dow average.

The Fundamentals

Danaher is not an income investment, but makes up for the low yield with strong growth as the global medical products and service business is expanded. Danaher has a good cash flow at $8.4 billion/year, and the company uses some of the cash to expand its business by buying bolt-on companies and increasing dividends each year, increasing the value for the shareholders. A quote from the 2nd quarter earning call by the CEO Rainer Blair sums up the good fundamentals for the past quarter and increased growth from the company’s buyouts.

We had a great quarter. In fact, our strong second-quarter results rounded out a terrific first half of the year. Broad-based strength across the portfolio drove better than expected revenue, earnings, and cash flow. And we were particularly pleased with the performance of our base business, which through high single digits, and believe we gain market share in many of our businesses. Our employees have done an incredible job leveraging the Danaher business system to help mitigate supply chain constraints, manage inflationary pressures, and improve our competitive positioning with impactful new innovations. Our second-quarter results also highlight the strength and resilience of the businesses that make up Danaher today. Our portfolio is comprised of leading franchises positioned in attractive end markets with strong, secular growth drivers, all united by a common set of durable business models. In fact, nearly 75% of our revenues today are recurring, the majority of which are consumables that are specified in highly regulated manufacturing processes or specific to the equipment that we supply. On top of that, our strong balance sheet and free cash flow generation position us well to further enhance our portfolio going forward. We believe this powerful combination of our talented team and the strength of our portfolio, all powered by the Danaher Business System, differentiates Danaher and reinforces our sustainable, long-term, competitive advantage. So with that, let’s turn to our second quarter results in a little more detail. Sales were $7.8 billion, and we delivered 9.5% core revenue growth, including 8% growth in our base business with strong contributions from all four of our operating platforms. COVID-19 testing contributed an additional 150 basis points to core revenue growth in the quarter. Geographically, core revenue in developed markets grew low double digits with broad-based strengths across North America and Western Europe.

This shows the feelings of the CEO and the fundamentals for the continued growth of the Danaher business and shareholder return. Danaher has good growth long-term and will continue as the world’s workforce returns after the COVID virus is controlled, growing the world economies. S&P CFRA recently decreased its one-year Danaher price target to $299, down from $310, giving you a possible gain of 7% in a year and making Danaher a good-long term buy at this time. The projected one-year PE is high at 28, which shows that Danaher is a bit overvalued now compared with the 22% CAGR projected growth, but good growing businesses do not come cheap.

One of the minor reasons to own Danaher is to have a steady quarterly income with good growth as the COVID virus uses more of DHR’s services and supplies and as workers get back to their jobs. Danaher’s revenue will increase in the rest of the world in the coming years as they buy more bolt-on companies. Danaher has a below-average dividend yield of 0.4% and has had increases for eleven years, making Danaher a fair choice for the dividend growth investor that wants consistent growing income. The dividend was last increased in February 2022, an increase from $0.21/Qtr to $0.25/Qtr or a 19% increase. The five-year average payout ratio is low at 15%, which allows cash to remain for increasing the business of the company by buying bolt-on companies and increasing the dividend that increases the earnings and stock price, bringing value to the stockholder.

The method I use to compare companies is to look first at the total return compared to the market. If a company cannot beat the market, why do you want to invest in that company? The great Danaher total return of 335.88% compared to the Dow base of 87.82% over my 80-month test period makes Danaher a fantastic investment for the total return investor. Looking back five years, $10,000 invested five years ago would now be worth over $37,100 today. This gain makes Danaher a great investment for the total return investor looking back, which has future growth with increased earnings as the COVID-19 virus is controlled worldwide. Overall, Danaher is a good business with an S&P CFRA 3-year CAGR of 22% projected growth as the United States and foreign economies grow going forward, with the increasing demand for Danaher’s products and services. Danaher right now is in the sweet spot as the demand for the company’s products continues to grow worldwide. The revenues YOY for the last quarter grew by 8% and should continue for at least a year as the rest of the world catches up on vaccinating their populations.

Danaher is a large-cap company with a capitalization of $213 billion, well above my guideline target of at least $10 billion and up from my last report. Danaher’s 2022 projected cash flow at $8.4 billion is excellent, allowing the company to have the means for company growth and increased dividends. Danaher’s S&P CFRA rating is three stars or hold with a one-year target price of $299, passing the guideline. Danaher is below the target price at present by 7% and has a high PE of 28, making Danaher a fair long-term buy at this entry point when you consider the solid growing cash flow that drives the stock price up by buying bolt-on companies.

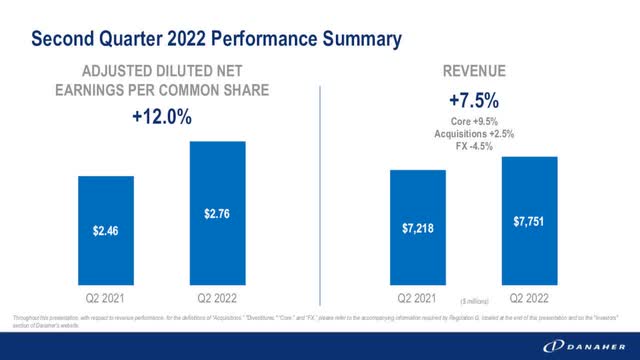

I look for the earnings of my positions to consistently beat their quarterly estimates. For the last quarter, on July 21, 2022, Danaher reported earnings that beat expectations at $2.76 by $0.40, compared to last year at $2.46. Total revenue was higher at $7.75 billion more than a year ago by 7.3% year over year and beat expected total revenue by $460 million. This was a great report with the bottom-line beating expected, the top line increasing, and the bottom-line beating compared to last year. The next earnings report, Q3, will be out in October 2022 and is expected to be $2.31 compared to the previous year at $2.39, a slight decrease. By Q1 2023, the COVID virus should be well under control in the United States, with the workforce back to normal, but the rest of the world will still be fighting COVID to keep revenues and earnings of DHR above normal. The graphic below shows a summary of Q2 adjusted earnings and revenues.

YOY earnings comparison (2nd quarter earnings call slides)

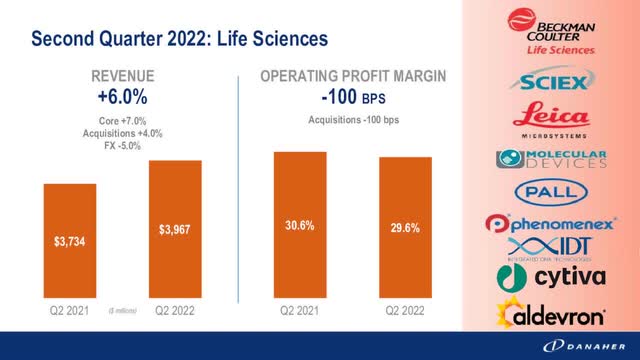

The Good Business Portfolio likes to embrace all kinds of investment styles but concentrates on buying companies that can be understood, makes a fair profit, invests profits back into the business, and also generate a good income stream. Most of all, what makes Danaher interesting is the good future growth rate of 22% for its business, and its products and services will be in demand because of the COVID virus in the rest of the world. The graphic below shows the Q2 growth in the Life Sciences business, which should continue over the next couple of years.

Life sciences (2nd quarter earnings call slides)

Risks And Negatives Of The Business

The obvious risk for Danaher’s short term is that an easy-to-manufacture pill or vaccine will be developed to stop the COVID virus; let us hope that happens. Danaher has great world services, and they keep adding companies to their sales, but you have the risk of integrating the new companies short term. It is expected that soon, the COVID virus will be controlled in the United States with new vaccines for the BA.5 strain of the virus, reducing revenue, but the rest of the world will take years to control the COVID virus, so Danaher’s Revenue will continue to grow. There is also always the risk of government regulation and exchange rates compared to the dollar, which could hurt Danaher’s earnings.

Conclusions

Danaher is a great investment choice for the total return growth investor with its well-above-average total return. The Good Business Portfolio has a small position of 1.7% of the portfolio, and I intend to add to the position when cash is available. If you want steady growth and good total return in a growing medical services and products business, Danaher is the right investment for you, and it’s highly priced with a possible 7% gain over the next year.

The Good Business Portfolio’s total return is behind of the Dow average from 1/1/2022 to August 26 by 0.6%, which is a loss below the market loss of 10.16% for a total portfolio loss of 10.76%. Each quarter after the earnings season is over, I write an article giving a complete portfolio list and performance. The latest article is titled “ The Good Business Portfolio: 2022 First Quarter Portfolio Review“. We still have four months in the year and the mid-term elections to make the portfolio profitable. The second quarter report is being worked on and should go out next week.

Be the first to comment