golibtolibov

Thesis

ON Semiconductor Corporation (NASDAQ:ON) stock has staged a remarkable reversal from its July lows, surging more than 35% since we updated investors not to add yet (Hold rating) in our early July update. As a result, ON outperformed its broad semi peers and the market significantly, as buying momentum continued to build up markedly following a robust Q2 earnings release in early August.

We must highlight that we didn’t expect the recovery in ON to be so rapid over the past month, even as we are confident that semi stocks have likely staged their medium-term bottom in July. However, given the sharp momentum spike in ON Semi stock through August, we are increasingly confident that investors should use the recent rally to cut exposure and rotate. We postulate that its recent surge is unsustainable, and investors should expect a deeper pullback to follow subsequently.

Notwithstanding, we concur that ON Semi is still well-positioned to leverage the secular drivers underpinning the growth in automotive and industrial applications. However, its recent growth trajectory has been well above its medium-term growth guidance. Therefore, we posit that it seems reasonable to expect ON Semi’s growth to normalize moving forward, which could put further downward pressure on its stock.

Therefore, we revise our rating on ON from Hold to Sell. We urge investors to cut exposure and use the rally to rotate away their exposure over time.

Can ON Semi Sustain Its Tremendous Growth Cadence?

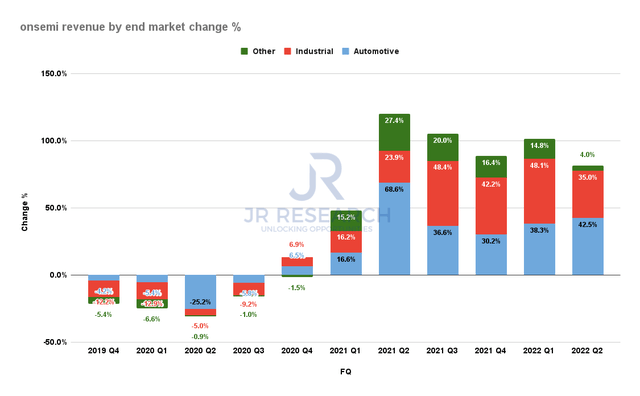

ON Semi revenue by end market change % (Company filings)

ON Semi reported another quarter of robust revenue growth in its automotive and industrial segment, which accounted for 66% of its Q2 revenue base. As seen above, the company posted revenue growth of 42.5% for automotive and 35% for industrial, building on its strength over the past five quarters.

As a result of its strategic revamp, focusing on the critical drivers in automotive and industrial, the company has also managed to mitigate the weakness in the consumer end market, which engulfed its peers with significant exposure.

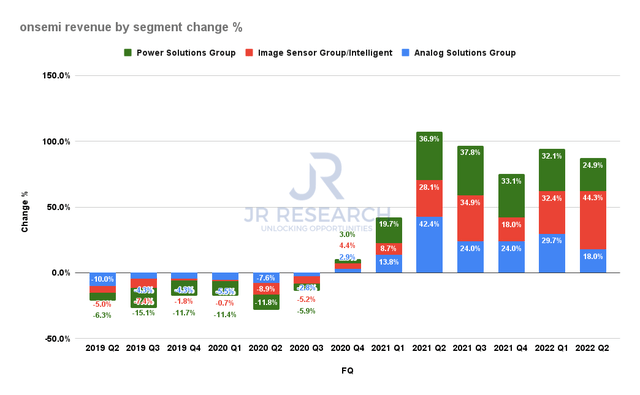

ON Semi revenue by segment change % (Company filings)

Moreover, its growth trajectory is diversified across its key segments, with the image sensor group posting another impressive 44.3% YoY increase, following Q1’s 32.4% growth.

DIGITIMES also highlighted in a recent commentary that the CMOS image sensor market (CIS) would continue to be supported by tailwinds from more autonomous driving applications, undergirding its structural growth prospects. DIGITIMES articulated:

As autonomous driving develops and high-end advanced driver assistance systems rapidly become popularized, it is expected that the scale of the automotive CMOS image sensor market will continue to expand. According to market analysts, the size of the global automotive CIS market will go from $1.91 billion in 2021 to $3.27 billion in 2025, with a compound annual growth rate of 15.4%. The current industry leader in automotive CIS, ON Semi, has a market share of 60%. – DIGITIMES

However, we would like to remind investors that the company’s long-term model through FY25 suggests the above-trend growth trajectory seen over the past year could normalize. The company’s FY25 model indicates a 7-9% revenue CAGR from FY20. Coupled with its gross margin guidance of 48-50% through FY25, we believe, arguably, ON Semi’s outsized growth could peak in FY22 before moderating.

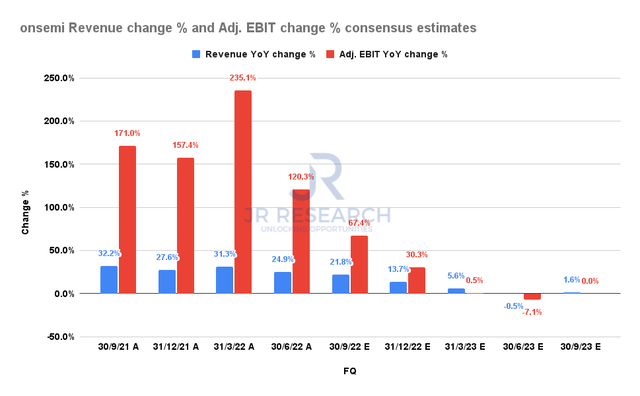

ON Semi revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that ON Semi’s quarterly growth could have peaked in Q1, and investors should expect further moderation through FY23.

Consequently, it’s also expected to impact its operating leverage gains as its adjusted EBIT growth cadence also normalizes. Therefore, investors need to be wary of expecting ON Semi to maintain its ability to continue its massive growth cadence.

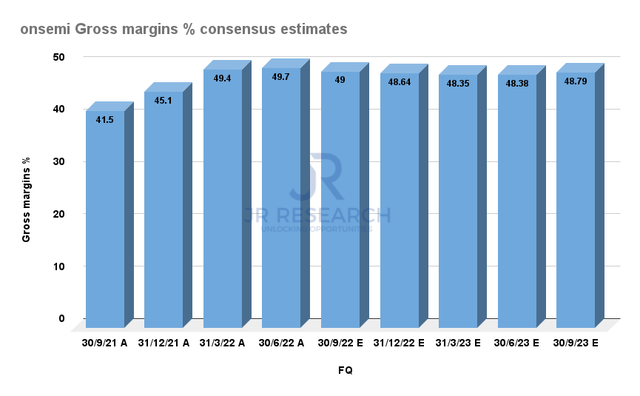

ON Semi adjusted gross margins % consensus estimates (S&P Cap IQ)

In addition, the company’s adjusted gross margins could also have peaked in Q2 as it ramps its silicon carbide fabs. As they remain subscale, the company expects near-term headwinds, even though it should be accretive over time to its corporate average.

Notwithstanding, ON Semi’s adjusted gross margins have reached the high end of its FY25 guidance range. Therefore, the company’s gross margins leverage should not be tailwinds in lifting its profitability profile moving forward.

ON’s Valuations Have Been De-rated

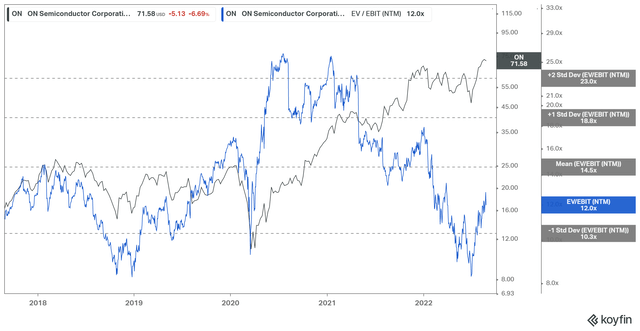

ON EV/NTM EBIT valuation trend (koyfin)

Our analysis suggests that ON’s valuations have been de-rated, even as it has likely bottomed out in July. In addition, we noted that the market has been unwilling to re-rate ON above its 5Y mean, even as its secular growth drivers led to outsized revenue growth. Therefore, we posit that the market could be adjusting its expectations for growth normalization moving ahead, in line with the consensus estimates.

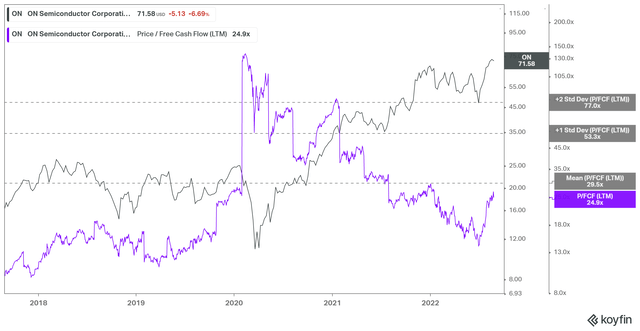

ON TTM FCF multiples valuation trend (koyfin)

Our analysis of its TTM FCF multiples also unveiled similar observations. We noted that ON has struggled to maintain its valuation above its 5Y mean, suggesting that the market has likely de-rated ON, even as it notched another high recently.

Is ON Stock A Buy, Sell, Or Hold?

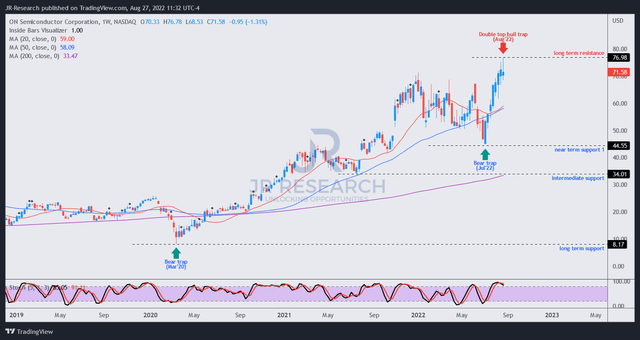

ON price chart (weekly) (TradingView)

We noted that ON staged a bear trap (indicating that the market denied further selling downside decisively) at its July lows. Therefore, it helped stanch further selling pressure in ON, leading to its remarkable recovery through August.

However, the price structure is also emblematic of a rapid flush-up, preceding a double top bull trap (indicating the market denied further buying upside decisively) at its recent August highs.

Consequently, we posit that the buyers have been lured into the recent momentum spike, likely setting up ON for a deeper pullback. It’s also consistent with our analysis of potentially slowing growth cadence moving ahead, coupled with its valuation de-rating.

Therefore, we urge investors to use the bull trap price action to cut exposure from the “mountain face,” as JPMorgan Asset Management (JPM) CEO George Gatch reminded in a recent June commentary. He articulated:

‘Speed is safety’… a mountaineering adage that I have come to live by. The longer you are on a mountain face, the more likely you will find trouble. But, if you have a bias toward speed- toward action-you reduce your exposure and increase the chances of getting down the mountain safely. I’ve seen this hold true personally and professionally. I always tell my team that I’ll gladly pay for your speeding ticket, but I won’t pay for your parking ticket. Maintain long-term focus, but be agile in the face of new challenges and opportunities. (George Gatch LinkedIn)

Accordingly, we revise our rating on ON from Hold to Sell.

Be the first to comment