Jose Luis Pelaez Inc/DigitalVision via Getty Images

In April, VNET Group (NASDAQ:VNET) received a buyout offer from a consortium led by Chinese PE firm Hina Group for $8/ADS. Management promptly acknowledged the bid but did not form a special committee. However, management is still clearly interested in the offer. In VNET’s latest Q2 results (about 4 months after the offer announcement), management gave a brief M&A update saying it had hired Citigroup to assist in evaluating Hina Group’s proposal and any other strategic option that the company may pursue.

About 2 weeks later, on the 13th of September, the company received a non-binding offer from founder and CEO Mr. Josh Sheng Chen (who owns 29% of voting power and 9% of economic interest) to acquire the company for $8.2/ADS. Excluding the expected $0.05/ADS fee, the upside stands at just over 40%. A special committee was immediately formed to consider the offer and the founder invited other parties to join his consortium (including Hina Group). Aside from Hina Group, it seems that there might be other parties interested in the consortium – in July, Bloomberg reported that South Korea’s MBK Partners (an Asian-focused PE firm) was also considering a bid. However, there have been no significant updates ever since.

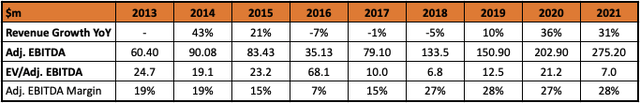

Interest in VNET is not surprising given the booming interest from PE firms for data center companies. The growth is related to the ever-increasing need for and consumption of data. Buyers have also seen strong returns and the long-term growth of the industry. The interest for VNET comes at an opportunistic time when shares are hovering at all-time lows. The founder’s offer values the company at 6.8x TTM adj. EBITDA and 7.6x E2022 Adj. EBITDA versus a historical multiple fluctuating in the double digits.

Historical Financials (Company’s Filings)

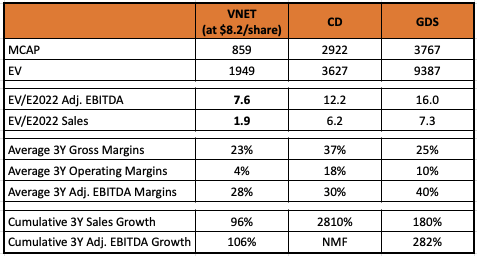

The offer also comes at a discount to other Chinese US-listed data center peers. Note that CD has IPOd just 2 years ago and their impressive growth is largely driven by high demand from one customer ByteDance which accounts for over 80% of their revenue.

Peer Comparison (Company’s Filings)

However, it’s worth noting that peers are multiple times larger, have higher margins, and have been growing faster in recent years.

Hardly comparable, but PE firm acquisitions of US/EU data center firms are averaging at a significantly higher 26x EBITDA multiple.

Overall, the offer price really seems to favor the buyers here, and it can be expected that the founder’s intentions are serious. Once a definitive agreement is reached, the spread should narrow down significantly.

Previous takeover attempt

The main issue here is that the founder already tried to take over VNET in 2015, but later on withdrew the offer. The market fears this might happen again.

In June 2015, the founder teamed up with Tsinghua Unigroup International and announced a non-binding offer at $23/ADS – 20x TTM adj. EBITDA multiple. A special committee was formed. The offer hovered around for a year until it was dropped in June 2016 with no explanation apart from “certain circumstances”. During this 1-year period, VNET’s share price plunged by around 50% and its financials were starting to deteriorate (revenue decline and compression in margins). It is likely that the buyers saw what was happening and decided to pull the plug. An interesting nuance is that a party related to Tsinghua Unigroup made a share subscription at $16.274/ADS (30% lower prices than the original offer) just 1 month before the founder folded.

What’s different this time

However, there is a chance that this time it will be different as not only the price is multiple times lower and comes at historical lows, despite VNET posing higher revenue and higher Adj. EBITDA margins than it did in under the previous offer. The proposal comes at a time of the booming M&A transactions in the industry and VNET has already attracted 2 other interests (one of them only rumored). The fact that the founder is inviting other parties to join the consortium is also very positive.

Shareholder support

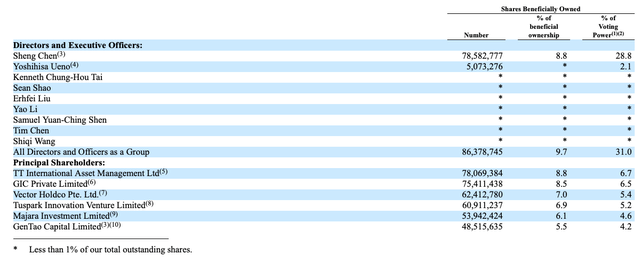

A binding offer will require approval from 2/3rds of shareholder votes cast. Given the founder’s control of 29% of the voting power, the support seems likely. Nearly 33% of voting power is held through various funds (mostly from Hong Kong and Singapore), which have the option of joining in on the founders’ consortium.

Major Shareholder (Company’s Filings)

Worth mentioning that the Blackstone Tactical Opportunities fund currently holds about 7% of the company’s shares outstanding. It also holds $250m of convertible notes (5-year maturity at 2% annual interest rate) that have a strike price of $11/ADS. It seems a conversion of their notes would lift the ownership to around 20%. Blackstone likely bought these debt instruments for the sake of conversion as the 2% yield looks very low for such corporate debt. It previously invested another $150m in VNET via a private placement of convertible preferred shares (these were converted into equity in 2021).

About the company

The company is a carrier-neutral data center services provider in China. VNET began its operations in 1999 and now counts more than 50 data centers in more than 30 cities across China. It offers solutions in three key verticals: Managed Hosting Services (IDC), Cloud Services, and VPN Services. It is unlikely that VNET is yet another Chinese-US listed fraud as it is Microsoft’s (MSFT) operating partner in China, operating several Azure regions in the country. As mentioned above, VNET is also backed by Blackstone (BX). The founder states VNET can better focus on its transformation into Web 3.0 being a private entity (as being a private company would alleviate it from the short-term earnings-driven cycle, possibly suggesting the transformation would bring even more volatility in VNET’s share price)

About Hina Group

Hina Group has some experience in the hosting and related services industry and has a relationship with VNET. Hina Group has previously invested in JD.com’s (JD) property subsidiary (manages data centers). Hina’s MD of Private Equity was previously president of the overseas business department in VNET. The PE firm also holds a small position in VNET’s convertible notes (aggregate value only $17m), a fraction of which it converted two years ago (at a share price of $12/ADS).

Conclusion

VNET’s situation is interesting but comes with the major risk of the offer getting rejected. However, there seem to be indications that this time the founder is more likely to proceed with his bid and may sweeten it. The situation offers a decent risk-to-reward ratio (40% upside versus 20% downside to pre-announcement prices). A much safer play, however, is to wait until a definitive agreement is signed.

Be the first to comment