Editor’s note: Seeking Alpha is proud to welcome Anthony Mcneila as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

alvarez/E+ via Getty Images

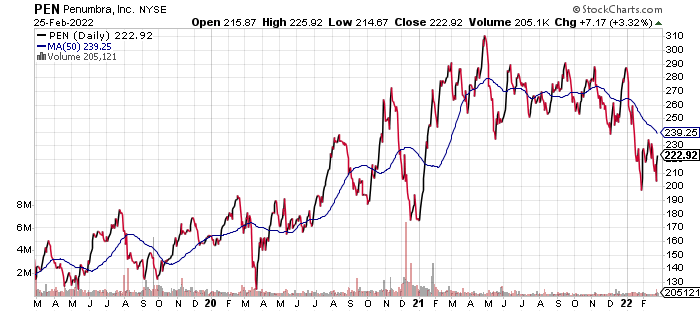

Penumbra, Inc. (NYSE:PEN) is a healthcare company that develops innovative medical devices and therapies for the vascular device market. Currently, the majority of Penumbra’s revenue comes from the United States, but an expansion into international markets is on the company’s horizon, catalyzing future growth for the company and subsequently for investors. By managing to balance growth with profitability, building a strong balance sheet in the face of regulatory setbacks, and developing its reputation as an industry leader in vascular devices, Penumbra is set for growth.

With 33% year-over-year revenue gains and double-digit percent growth in international market revenues alone, all of the facts point to Penumbra being a company heading for significant appreciation in the next several quarters. In my opinion, the recent downturn in Penumbra’s price provides the optimal opportunity for investors looking to expand their portfolio into medical devices to acquire a position in one of the most promising companies in the sector.

stockcharts.com

Industry Analysis

As a company based in the United States, the global leader in medical innovation, Penumbra has access to a large pool of investment capital and guidance from some of the world’s top biomedical investors and companies. BlackRock Inc. (NYSE:BLK) owns around 9% of the company, while Capital Research Global Investors owns around 8%. Institutional investors are bullish on the direction of the medical devices industry, which, in 2020, was valued at nearly half a trillion USD. The compound annual growth rate (CAGR) of the market was around 3.5%, but due to a surge in lifestyle-related diseases, it is expected to grow at a higher rate of 7.7% in the near future. Penumbra is positioned to leverage the increased demand for medical therapeutics by developing cost-effective devices to treat thromboses, aneurysms, and strokes – three of the most common causes of death in the developed world.

The industry is inherently dependent on regulatory approval. Some markets have stricter clearance requirements than others. In the United States, the Food and Drug Administration (FDA) has a history of being liberal with its premarket approval of medical devices based on literature review and predicates alone. This has both positive and negative effects on Penumbra. Aligning with liberal regulations is relatively quick and cheap, as companies are not compelled to conduct clinical trials. However, the lack of stringent oversight heightens the risk of defective products hitting the market.

The Financial Picture

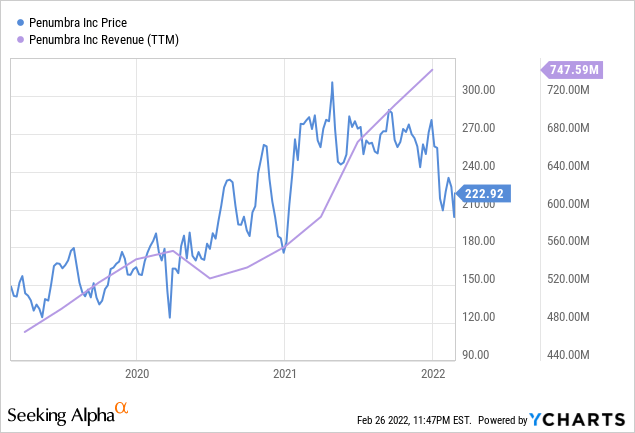

ycharts.com

Penumbra boasts strong revenue growth and profit. In FY21, the company achieved almost $750 million in revenue, a 33% increase y-o-y. While most revenue was from vascular products and U.S. hospitals, the primary driver of growth was international expansion. In FY21, international revenue from cardio and neuro products increased by 53% and 33% respectively. This is significant considering that domestic income from neuro products grew by a mere 3% in comparison. The growth in international revenue reflects the company’s strategy to dilute and distribute its regulatory and reputational risks across the globe while meeting the surging demand for cost-effective vascular products and capturing untapped markets.

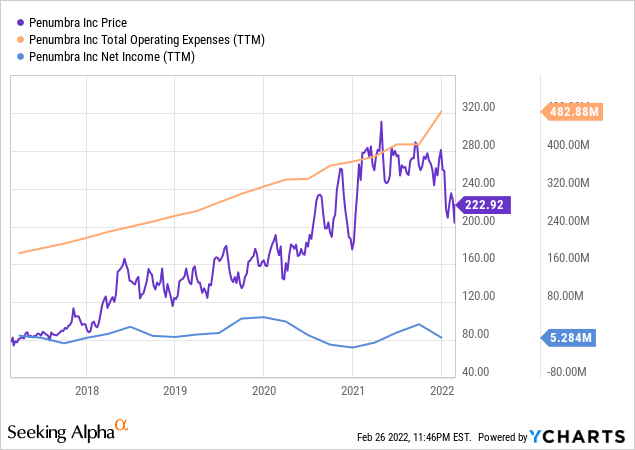

ycharts.com

In FY21, operating expenses jumped to $483 million, a 22% y-o-y increase. There are two reasons for the extra spending: Firstly, Penumbra invested $15 million in R&D for “Thunderbolt”, banking on the product’s future profitability. Secondly, Penumbra spent $25 million on the acquisition of Sixense Enterprises in a bid to break into the nascent medical-VR market on the ground floor. Despite high expenses eating into the company’s profits, Penumbra recorded a positive net income of $2.6 million. This is compared to a net loss of $19.3 million in FY20, caused mainly by the “Jet 7” recall and the launch of the “Lightning” product. “Lightning” proved to be a successful product and contributed to the higher gross profit in FY21, up 29% y-o-y at $475 million.

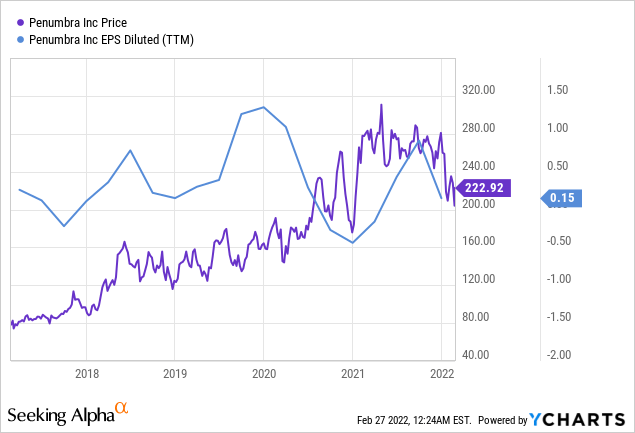

ycharts.com

In the third financial quarter of FY21 (Q3-21), the company missed Earnings Per Share (EPS) expectations by 14%. In Q4-21, Penumbra’s EPS was about 40% below expectations. The negative earnings call drastically affected the company’s market valuation. As of February 24, 2022, the stock is down 28% year-to-date (YTD). By contrast, the S&P 500 has declined by around 9% YTD. However, future indicators of growth are positive. The high EPS expectation from analysts suggests an overall bullish sentiment toward Penumbra.

Risks

Regulatory Risks

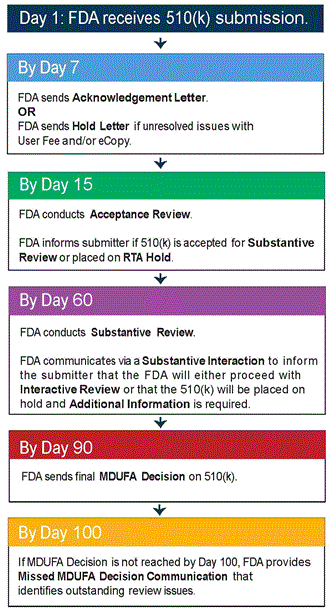

Penumbra must receive FDA clearance through the 510(K) process for access to U.S. markets. Several of the company’s products went to market with serious defects over the years, leading to costly product recalls and reputational hits. Most recently, in December 2020, Penumbra’s specialized catheter device, “Jet 7”, was voluntarily recalled after it led to 14 deaths and over 200 complications. This is a significant risk, as lawsuits and loss of public trust could harm the company’s prospects. However, the product recall was by no means uncommon in the industry – in the same year, Abbott Vascular (NYSE:ABT) and LeMaitre Vascular Inc. (NASDAQ:LMAT) recalled their defective catheter products. Following the recall, Penumbra’s net profits for the Fiscal Year 2020 (FY20) took an $18.4 million hit.

fda.gov

The “Jet 7” recall sparked an industry-wide push for regulatory reform in the U.S., as part of a larger trend toward strict, potentially stifling regulations. Stricter regulations in the medical device industry could be a good thing. The extra oversight would mitigate the risk of costly product recalls, reestablish trust in the industry, and thin out the competition. The downside is that getting products to market will be lengthy and costly, but Penumbra is reducing its exposure to regulatory hurdles by expanding its operations overseas, where the premarket approval process is faster and cheaper. To that end, in FY21, almost 30% of the company’s revenue was from international markets, increasing by $60 million, or 30%, year-on-year (y-o-y).

Competitor Risks

Penumbra’s customers are primarily hospitals and private practitioners. Several competing companies, such as Stryker (NYSE:SYK), have more extensive portfolios and similar products. Another competitor, Boston Scientific (NYSE:BSX), has an alternate system (called AngioJet) to Penumbra’s Indigo Aspiration System Lightning 12 for the treatment of pulmonary embolism. Initially, there was the possibility of concern when Penumbra got approval for their Indigo Aspiration System Lightning 12 that it would be difficult for them to gain market share as Boston Scientific’s competing system had already gotten approval 5 years earlier. Despite the competition, Penumbra is a market leader in its niche.

While this market dominance is encouraging, it is important to note that the neurosurgery device market is especially high-risk. About 25% of Americans will experience a stroke in their lifetimes. Treatment is highly delicate and has a relatively low survival rate. The slightest trauma could lead to devastating neurological damage or death. Penumbra’s market appeal is that its devices are designed to be minimally invasive, highly accurate, and nontraumatic. The company’s “3D Revascularization Device”, in conjunction with its “Jet” catheters, boast a higher-than-average survival outcome for neuro-surgery patients.

Covid-19 Impact

There has been a surge in heart attacks and blood clots during the Covid-19 pandemic. According to the Global Alliance for Vaccines and Immunization (GAVI), Covid-19 infection increases the risk of heart failure by 72%. For at least half a billion people worldwide, the virus is predicted to deal delayed damage in the form of heart attacks. Also, due to the lockdowns, people have been relegated to sedentary lifestyles and discouraged from seeking health screenings, which has led to higher rates of heart disease, cancer, and aneurysms. New York alone saw a 139% increase in deaths due to heart disease and a 164% increase in hypertensive disease. While unfortunate, the surge in health complications has created a higher demand for therapeutic medical devices. This is reflected by the optimistic industry forecast, confident institutional investors, and bullish market sentiment during and after the pandemic.

Valuation and Future Growth

When looking at companies in the healthcare or biotech industries, valuation is always a tough subject to approach. Due to the nature of the industry, these companies require massive expenditure to release products and pass approval that is simply unseen in other sectors. On paper, Penumbra’s valuation metrics with regard to its competitors in the sector are concerning. The company is currently trading at an 11x multiple of its sales, with its price to sales ratio being nearly two times worse than the rest of the sector. Similarly, Penumbra (TTM) price to book ratio of 8.78 is in stark contrast to the 2.51 representing the sector average; not only that, the forward ratio is nearly 20% worse, at 11.17.

With that said, everything about this company exclaims growth. As shown earlier, the revenue has spiked over the last few quarters. This is expected to continue, with a projected forward growth of 21%. Such an expectation lies on two fundamental assumptions. Firstly, it assumes that the aging American population will cause a continued increase in the aforementioned predicted vascular issues such as heart failure and stroke. Secondly, it assumes that Penumbra’s lightning thrombectomy system remains relevant in the market and continues to capture a larger portion of the device market for the procedure. In tandem with this revenue growth, the earnings are also expected to drastically increase with a forward EBITDA growth of over 90%, dwarfing the industry average of just 11%.

Given such growth potential, the question becomes, “what is a reasonable target and why”. I structured this as a recovery play due to my view on the forward earnings increases and how price may respond to that. A year ago, Penumbra was trading at roughly $280, or at a 26% premium. If we see this as a recovery target a year from now with a projected forward EBITDA growth rate of even a conservative 80% from the 90% figure mentioned earlier, this comes out to a price/earnings improvement of 70% (1.26/1.8). This would return Penumbra to a reasonable valuation – based on this, investors may want to look into riding the recovery to the high seen between February and April 2021.

Outlook and Final Thoughts

With bullish institutional investors, cutting-edge cross-industry products, international expansion, and strategic investments, Penumbra Inc. is on its way to achieving steep and steady growth in the medium to long terms. Going into 2025, as people suffer vascular conditions at unprecedented rates, the demand for the company’s products will increase by more than double the rate of previous years. To stay ahead of regulations, avoid future medical catastrophes, and bolster its reputation and trustworthiness, the company is impelled to spend more on clinical testing its products. As long as Penumbra continues on its current profit-focused innovation and expansion path, the company is a promising buy-and-hold opportunity, especially now as the stock price has dipped.

Be the first to comment