Jae Young Ju/iStock via Getty Images

United Microelectronics Corporation (UMC) was in the limelight back in the March-April period last year during the worst of the semiconductor supply crunch, when it was able to get advance payments from its customers, composed mostly of auto manufacturers. This was something unheard of previously.

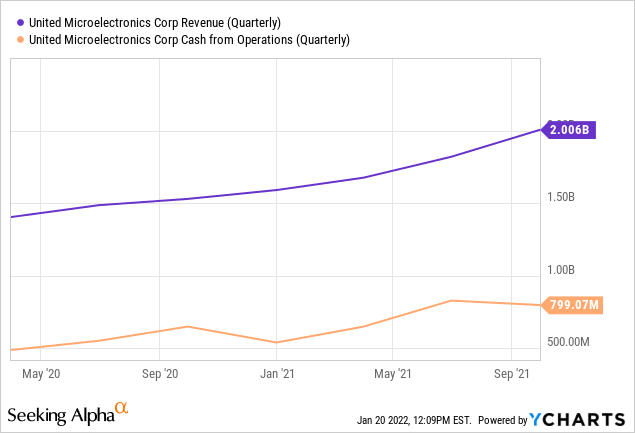

As a result, cash from operations surged to above $800 million at the end of the second quarter of 2021 as shown in the orange chart below, while revenues have risen more steeply in Q3 as the Taiwanese company sustained delivery of components to clients.

Now, in addition to automotive plays, the company has also experienced robust chip demand across the computing, consumer, and communication segments with higher 12-inch wafer shipments in the third quarter of 2021. It also benefited from an enhanced product mix which contributed to the lift in the average selling price or ASP. As a result, gross margins and operating income surged, culminating in an earnings beat.

Now, with the fourth-quarter earnings scheduled for January 25, my objective with this thesis is to provide some preliminary insights as to what to expect in terms of sales in an environment characterized by supply chain bottlenecks and inflation as UMC’s fabs are located throughout Asia.

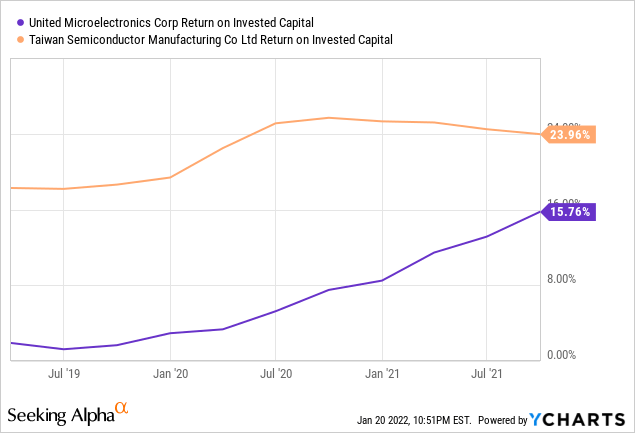

I first analyze the return on capital, an area where smaller foundries have been disadvantaged with respect to larger ones in the past.

The return on invested capital

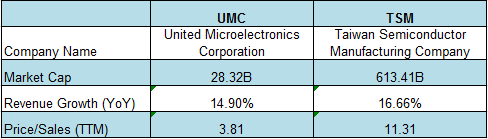

First, the way in which UMC was able to fund additional investments made for its 28 nm process production unit deserves further attention. While giant peer Taiwan Semiconductor Company (TSM) with a $613.4 billion market cap has to predominantly use its own funds, or get money from banks, and even rely on state-level subsidies for its U.S.-based fab, relatively tiny UMC (with a market cap of $28.3 billion) was able to obtain advance payment from car manufacturers, which also meant that it benefited not only from guaranteed orders but also better pricing.

At this stage, one key metric is the return on invested capital or ROIC. This is more of a profitability ratio, but with the added advantage that it also measures whether a company has a moat, signifying a strong competitive position. UMC’s ROIC, while being lower than TSMC’s, is growing rapidly as shown by the purple chart, meaning that it is getting more efficient at using capital.

On the other hand, it is a trickier picture for TSMC which after reaching a return of above 20% in mid-2020 seems to be having some difficulty in increasing the efficiency of capital invested. Thus, while it may be far behind TSMC or even Samsung Electronics (OTC:SSNLF) in terms of chip volumes produced, UMC provides evidence that it is possible to increase efficiency while operating at a smaller scale.

Moreover, this ability to deliver better returns on capital over time is important as the company invested $2.3 billion in CapEx for expansion of chip production in 2021 alone, or about 0.37 times of its total sales which amounted to $6.297 billion for 2020. This represents a large investment relative to sales, and I assess whether this has been a productive one by looking at revenues for 2021.

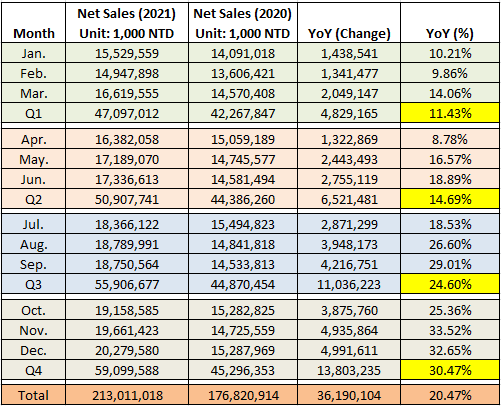

Dissecting sales figures for 2021

Looking at monthly sales revenue, which was published on the corporate website, it was NT$20.28 billion for December 2021, or a 32.65% increase over the same month last year. This increase was less than for November when a 33.52% increase was obtained, but sales still progressed on a quarterly basis as highlighted in yellow in the table below. Thus sales for Q4 were NT$59.1 as per my calculation.

Monthly, quarterly and yearly net sales

Compared with the industry, according to monthly data released by the Semiconductor Industry Association (SIA), global chips sales augmented by 23.5% on a Year-on-Year basis in November, which translates to a 1.5% Month-on-Month (from October to November) increase. This is less than UMC’s 33.5% Y-o-Y and 2.6% M-o-M respectively, signifying that the small Taiwanese foundry operator is growing at a faster pace than the industry.

Extending the comparison specifically with TSMC, while the latter’s October to November and November to December increases in chips sales at 10.2% and 4.8% respectively, were higher than UMC, the smaller Taiwanese play still managed to deliver better overall growth for 2021. Thus, its total sales for 2021 were better than 2020 by 20.47%, exceeding TSM’s 18.5%.

While this may not mean much in terms of absolute figures since TSM’s total sales for last year at NT$1.59 trillion is 7.45 times its smaller peer’s NT$213 billion, it does make sense for valuations purposes where revenue growth is a key metric.

Valuations and key takeaways

First, for clarification purposes, the annual revenue growth figures provided in the table below pertain to 2020 and at that time, UMC exhibited a lower growth rate. However, things have now reversed and for 2021, UMC has grown more rapidly, by nearly two percentage points.

Comparison of metrics with peer

Consequently, this means that UMC’s valuations at a trailing price to sales ratio of 3.81x also need to be adjusted. Thus, adjusting for a modest 5x in view of the market currently being volatile for tech stocks (in the context of the rotation from growth to value), I obtain an estimate of $14.5-15 based on the current share price of $10.88.

Target share price = 5/3.81 x 10.88 = $14.27.

Coming back to the return on capital invested, it should also continue on its uptrend as per the executives, wafer shipments together with ASP (in U.S. dollars) is expected to increase in 2022 while capacity utilization rate (usage of foundry production capability) is forecast to be at 100%. At the same time, demand is rising and the company was able to compensate for higher raw material (raw wafer) and labor cost through an improvement of production efficiency.

Adopting some caution, the company also experienced some shortages of components, but these have not impacted production. Also, the inventory level has reached $831.3 million or NT$23 billion as of the end of the third quarter, a record level. This should not be a problem as long as demand continues to be robust. For this purpose, UMC is diversified, with around 65% of its revenue coming from the Asia Pacific region in Q3, followed by 22% from North America, and the remaining 15% from Europe and Japan. I also found that inventory as a percentage of total assets was at 5.40%. This signifies that the company has a relatively low percentage of its assets tied up in inventory.

Finally, operating mostly in the shadow of TSMC in terms of revenue, UMC has now gained the upper hand in terms of growth while rapidly increasing the efficiency of capital use. This is not only synonymous with better profitability but is also a useful criterion used by financial organizations for allocating capital in sectors where CapEx tends to be very high. UMC also pays a higher dividend yield than its giant peer and its cash on hand was NT$113 billion (about $4 billion) at the end of Q3 after paying distributions to shareholders.

Be the first to comment