KanawatTH/iStock via Getty Images

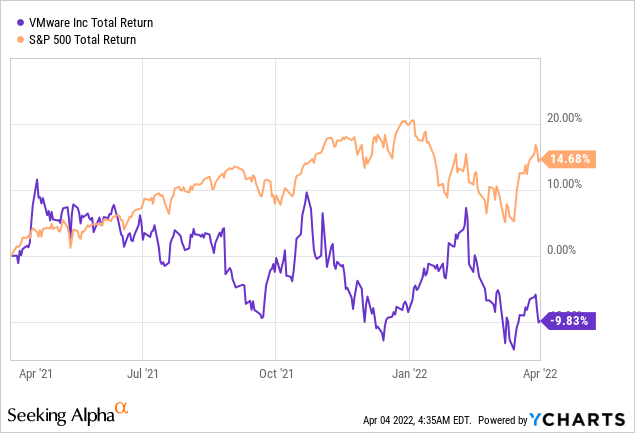

Last year was hardly a successful one for VMware (NYSE:VMW) shareholders, with the company’s total return standing at a negative 10% over the last twelve-month period, at a time when the broader market delivered roughly 15%.

In spite of the special cash dividend of $11.5bn following the spin-off from Dell (DELL), VMware shareholders still underperformed both the market and other major peers in the cloud and software space. While operational performance over the past was not spectacular, the spin-off transaction has also likely contributed to the higher selling pressure.

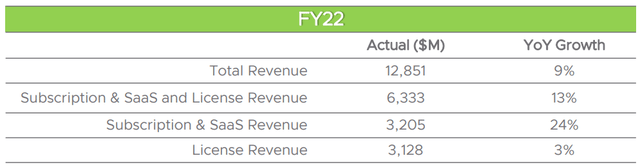

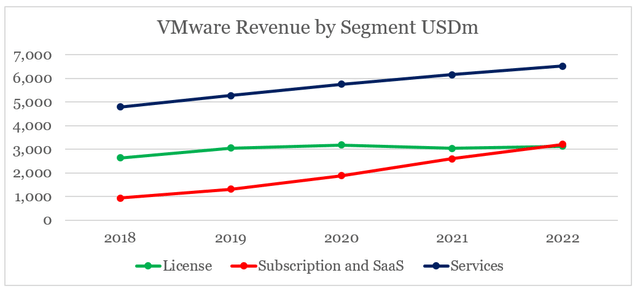

Nonetheless, performance for fiscal year 2022 was largely in-line with short-term expectations. As I showed in my previous analysis, expected revenue growth was roughly 10% a year ago. The actual reported numbers showed an overall topline figure at 9%, with subscription and SaaS revenue growing as high as 24% while legacy license sales also noting a 3% increase.

Source: VMware Q4 FY 2022 Earnings Presentation

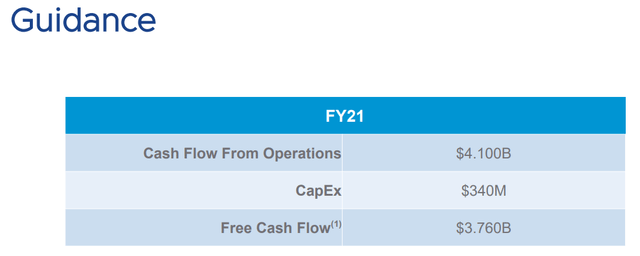

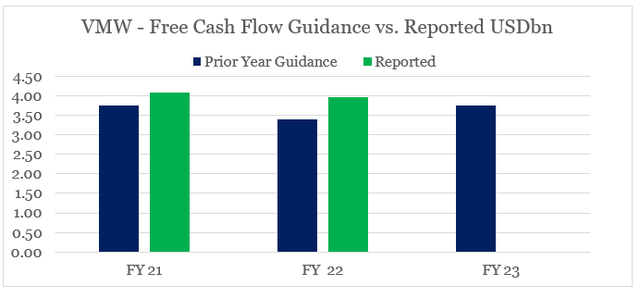

Free cash flow performance, however, was disappointing. Going back to end of fiscal year 2020, the guidance for next year’s free cash flow was around $3.76bn (see below).

VMware Q4 FY 2020 Earnings Presentation

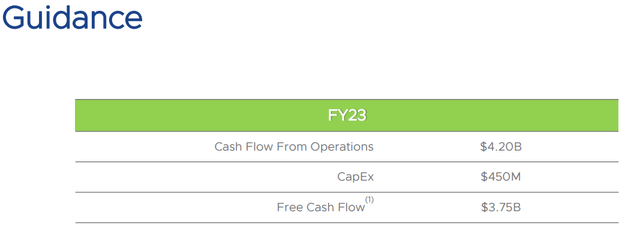

Fast forward two years, and guidance for fiscal year 2023 is now expected to be roughly the same at $3.75bn.

VMware Q4 FY 2022 Earnings Presentation

Having said that, actual reported free cash flow over the last few years came in higher than the previous year’s guidance for both fiscal years 2021 and 2022.

Prepared by the author, using data from VMware investor presentations

Therefore, it is not unreasonable to expect that VMware’s management continues to underpromise and overdeliver in the next year as well. More importantly, however, VMware’s financial position remains strong, while the company is now priced at significantly more attractive levels.

Where does VMware stand financially?

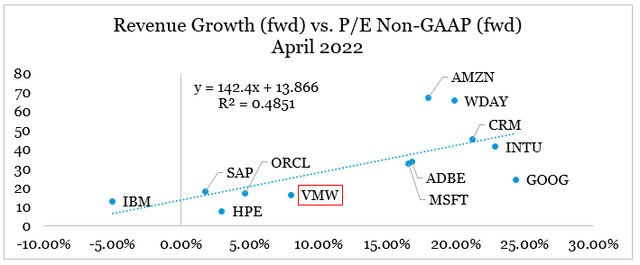

As I showed in my sector analysis, revenue growth is still the key driver of valuations in the cloud space with profitability taking the backseat for the time being.

In terms of expected revenue growth, VMware is still positioned among the companies considered to be the “underperformers” with low growth rates and low earnings multiples. However, at the moment VMware appears too cheaply priced even for its 8% forward revenue growth rate (below the trend line in the graph below).

Prepared by the author, using data from Seeking Alpha

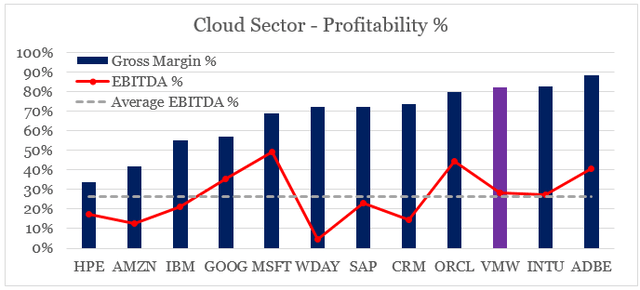

In the meantime, VMware has one of the most profitable business models across its broader peer set laid out above. On a gross margin basis, only Intuit (INTU) and Adobe (ADBE) achieve slightly higher profitability, while on an EBITDA basis VMware is surpassed only by Adobe, Oracle (ORCL), Microsoft (MSFT) and Google (GOOG).

Prepared by the author, using data from Seeking Alpha

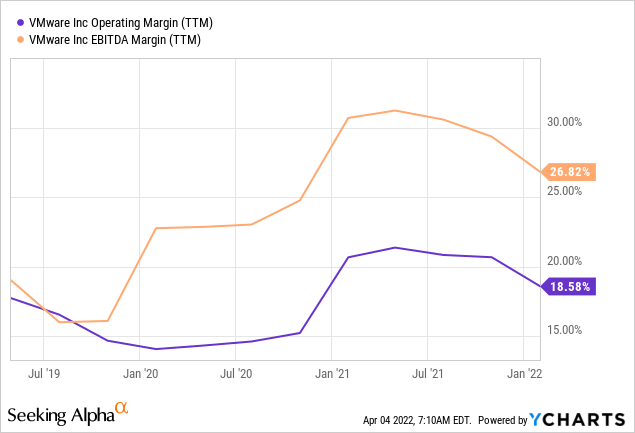

Moreover, this superior positioning is standing strong in the face of increased competition in the hybrid cloud and the slight fall in margins over the past one year is unlikely to be the start of a new trend.

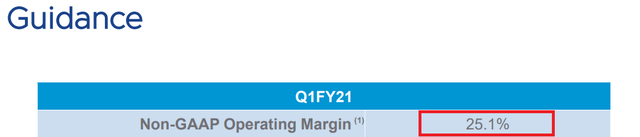

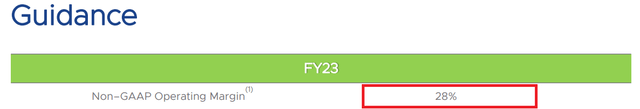

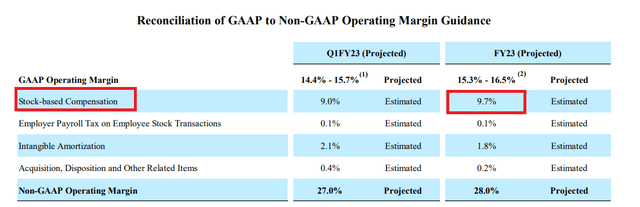

Looking ahead, VMware’s Non-GAAP operating margin guidance for fiscal year 2023 is now significantly higher than the one provided for the year 2021.

VMware Q4 FY 2020 Earnings Presentation VMware Q4 FY 2020 Earnings Presentation

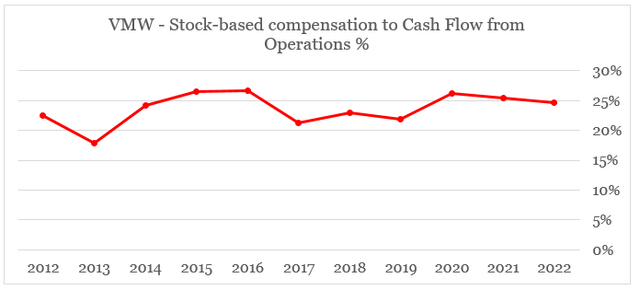

The major adjustment for Non-GAAP margin is the company’s stock-based compensation, which is expected to trim off roughly 10% of GAAP operating margins.

This might sound like a lot, but the company’s stock based compensation expense as a share of cash flow from operations has not changed much over the past decade or so (see below). What is more, it is still relatively low when compared to other software names, such as Intuit and Salesforce (CRM). You can read more on these two names here and here.

Prepared by the author, using data from VMware 10-K SEC Filings

Well-positioned Strategically

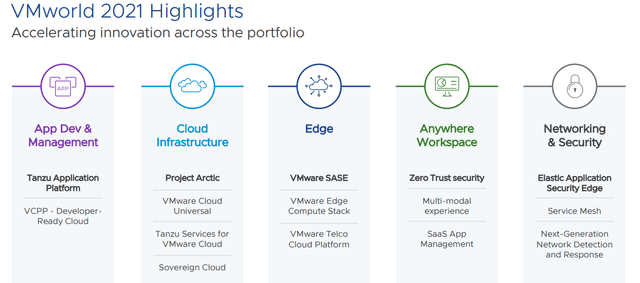

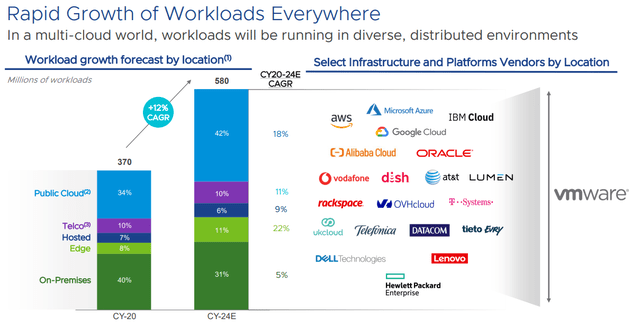

In addition to the nearly double-digit revenue growth, highly profitable business model and low valuation, VMware is also uniquely positioned to succeed in the hybrid cloud by enabling customers to benefit from a multi-cloud approach.

I go into further detail on VMware’s service offering in my last analysis of the company, but to put it briefly, the three pillars of VMware’s strategy are based around Tanzu & cloud management, tools allowing migration across all hyperscalers and delivery of work from anywhere through networking, security & unified endpoint management tools.

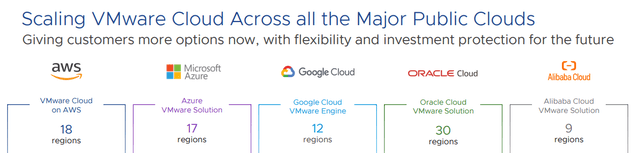

As a leader in multi-cloud and applications platform provider, VMware has secured partnerships with all major hyperscalers, which gives the company a significant competitive advantage in the hybrid cloud.

That is why VMW will benefit from increased workload across the whole ecosystem as more businesses embrace a more diversified approach.

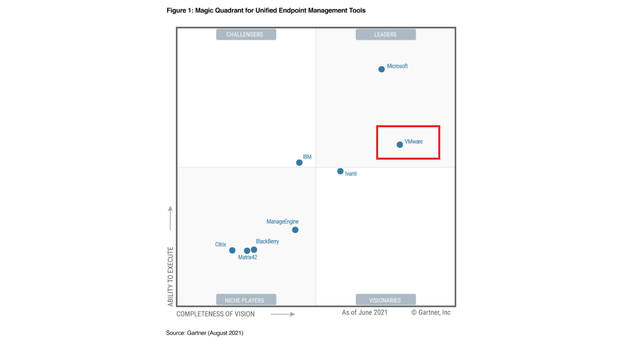

In terms of providing secure distributed workforce solutions, VMware is ranked second to Microsoft on unified endpoint management tools, which are essential part of today’s hybrid or remote work environment.

In addition to the unique strategic positioning of VMware, the company is also well-positioned operationally to migrate its service offerings to the cloud as SaaS.

During fiscal year ’23, we expect to achieve our goal of making all of our major products available as subscription or SaaS offerings. Specifically, all of our SDDC offerings will become available as cloud-delivered software, joining our Tanzu, cloud management, security and end-user SaaS offerings and will help further accelerate our business model transformation.

Raghu Raghuram – Chief Executive Officer

Source: VMware Q4 2022 Earnings Transcript

Having said that, it is worth mentioning that during the last fiscal year, the company’s subscription and SaaS revenue for the first time surpassed the legacy license revenue stream.

Prepared by the author, using data from 10-K SEC Filings

Conclusion

Although it doesn’t get much attention by the media, VMware is one of the best-positioned businesses to benefit from more workload migrating to the cloud, whether it’s public, private, edge, telco or a hybrid approach. At the same time, the high topline growth rate and high margins are coupled with a relatively conservative valuation which creates an attractive risk-reward opportunity.

Be the first to comment