Nastassia Samal/iStock via Getty Images

For many years, I’ve had a tagline at the bottom of my email: “In volatility there is opportunity!” The tagline is a reminder that when things look darkest in the financial markets, this is often an area of maximum opportunity.

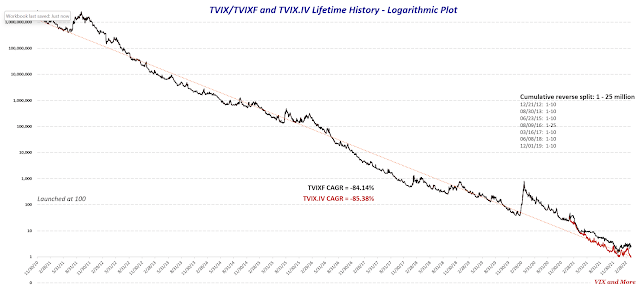

On the other hand, the VIX ETPs have quite a few quirks and as a result of these quirks and their high volatility, there are considerable risks for both longs and shorts. How much risk? Quite a lot. Consider that on a split-adjusted basis, the +2x long TVIX launched at 2.66 billion (not a typo!) and trades anywhere from less than a dollar (the TVIX.IV indicative value) to 2.45 TVIXF (on the pink sheets), depending upon how you wish to measure the magnitude of the bloodbath. On the other side of the coin, the -1x short XIV fell 93% on one day back in the February 2018 volatility spike now known as Volmageddon that resulted in an acceleration event (triggered when the price of XIV fell by more than 80% on a single day) and the closing of XIV.

From the 30,000-foot perspective, the big risk in being short volatility is that a big one-day VIX spike can theoretically destroy the value of your entire position. On the other hand, the big risk in being long volatility is that you die a death by a thousand cuts and suffer the same 85% per year compound annual decline experienced by a product like TVIX.

There are many individual risk factors that are responsible for the total risk of an individual VIX ETP. I have spelled out a number of these in the past, spending considerable time on contango and negative roll yield. Way back in May 2009, I summarized some of my thinking in the likes of VXX Calculations, VIX Futures and Time Decay and elaborated on some of those themes in October 2009 in Why VXX Is Not a Good Short-Term or Long-Term Play. I also addressed the subject of how reverse splits are the only thing keeping some of these products from falling to zero in Will TVIX Go to Zero? in February 2012. In that post, I highlighted this gem from the TVIX prospectus:

“The long-term expected value of your ETNs is zero. If you hold your ETNs as a long-term investment, it is likely that you will lose all or a substantial portion of your investment.”

One of my better summaries of the factors putting downward pressure on the price of TVIX came in Four Key Drivers of the Price of TVIX in 2012. Here is the meat of that post:

1. Volatility – this seems obvious, but in the short term, the movements of the front month and second month VIX futures explain almost all of the change in the price of TVIX. For day traders, TVIX becomes essentially a substitute for trading the VIX futures and with the exception of leverage, the other factors below are inconsequential.

2. Leverage – another obvious factor, the 2x leverage in TVIX means that on average it moves about as quickly up and down in percentage terms as the VIX does and twice as quickly as a basket of front month and second month VIX futures. In the short term, leverage means mostly that the moves in the underlying are exaggerated; in the long term, leverage enhances volatility compounding and has a negative impact on price.

3. Contango – thanks to the emergence of VIX ETPs as the cornerstone of volatility as an asset class, issues related to the VIX futures term structure in general and contango and negative roll yield in particular have become among the most frequently discussed issues in this space. Simply stated, the front month and second months of VIX futures are in contango more than 75% of the time, with the result being a monthly drag on TVIX’s price that exceeds the current annual yield on the 30-Year U.S. Treasury bond.

4. Volatility compounding – the more volatility a leveraged security exhibits, the more that volatility will have a negative impact on performance over an extended period. The issue is the same as someone who owns a dress shop and marks the dress down 50% and then up 50% or reverses the chronology and marks the dress up 50% and then down 50%. Either way, the value of that dress declines by 25%. The same is true for leveraged ETPs and the degree of the price decay is a direct function of volatility.

While the number of VIX ETNs is dwindling, ETNs have their own set of issues, as these are debt securities – essentially a promise to pay the value of the underlying index – rather than a portfolio of VIX futures, as is the case with VIX ETFs. We have seen issues related to VIX ETNs come to the fore with TVIX in 2012 when Credit Suisse suspended new creation units in TVIX only to resume new creation units a little more than a month later – roiling the supply and demand dynamics as well as the TVIX market price in both directions. Last month something similar happened with Barclays and VXX when Barclays suspended new creation units in this product. There are issues related to ETNs that are unique to these types of securities and include credit risk, counterparty risk, price risk relative to indicative value, etc. The SEC summarizes some of these ETN-specific risks in this investor bulletin.

If you want to better understand some of the risk factors involved in these products, I highly recommend you review the prospectuses of some of the following ETNs and ETFs:

I am often asked if these products were designed to go to zero. No, they were not designed to go to zero. The original intent was that these products would be short-term hedging or speculative instruments for institutions. They do, however, have structural flaws that begin to appear as soon as these products are held for more than one day. Over time, these structural flaws compound and will dominate the price action.

For all the reasons state above, I urge anyone considering trading VIX ETPs to review all relevant prospectuses and make a concerted effort to educate yourself on the products, their price histories and the reasons behind those price movements. For those who insist on trading these products, it is always safest to consider defined risk trades so that the maximum loss is known in advance. This may be a long position, a long or short position with an options hedge, or an options position such as a vertical spread that is a defined risk trade.

In the graphic below, I show the lifetime history of TVIX/TVIXF in black and TVIX.IV in red (it was the same as TVIX until it was delisted in July 2020). Note that the Y-axis is on a log scale so that the data captures the relatively constant percentage declines, rather than the precipitous drop in price. For fun, try to pick out any major spike in volatility on this chart other than the pandemic.

Yahoo, VIX and More

Disclosure(s): net short VXX and UVXY, long SVIX at time of writing

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment