phototechno

Investment Thesis

Dynex Capital, Inc. (NYSE:DX) primarily invests in and manages agency and non-agency commercial and residential mortgage-backed securities (MBS) that pay sustainable dividend yields to its investor. I believe at the current valuation, it is a perfect opportunity to earn stable and fixed returns.

About Dynex Capital

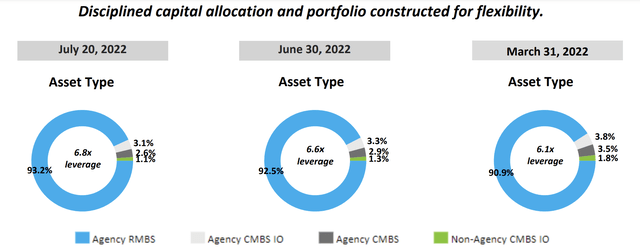

Dynex Capital is a mortgage real estate investment trust (mREIT) that primarily invests in and manages agency and non-agency commercial and residential mortgage-backed securities. Agency MBS is backed with a guaranty of principal payment of the USA government-sponsored entity (GSE). Non-agency MBS doesn’t provide any such guarantee about any payment. According to tax laws of the USA, the company is qualified as REIT because it distributes 90% of taxable income to its unitholder. It allocates more than 90% of the portfolio to the Agency RMBS. On March 31, 2022, 90.9% of the capital is allocated to agency RMBS, 3.8% of the capital is allocated to agency CMBS IO, 3.5% is allocated to agency CMBS, and 1.8% is allocated to non-agency CMBS IO. More than 90% allocation to agency RMBS is a big positive for the firm as it makes the investment safe by providing a guaranty about the principal payment.

Portfolio Structure (Dynex Investor Presentation)

Compared to its peers, the company’s competitive advantage is that it can quickly sell the portfolio, transfer funds between RMBS and CMBS as per market changes, and maintain solid performance during rising interest rates and volatile interest spread scenarios. I think in the current market environment, this advantage makes the company well positioned in the industry as the government’s fiscal and monetary policy will be a significant factor in driving incomes.

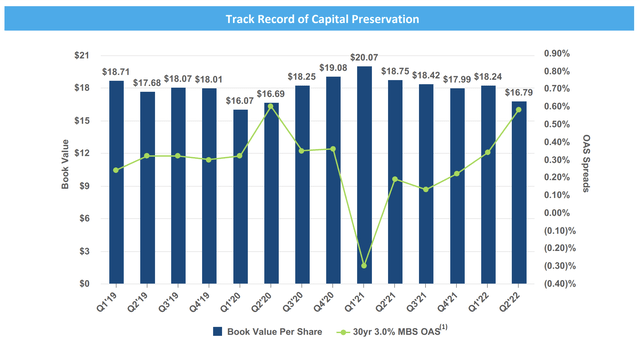

Book Value Per vs 30 Year MBS OAS (Dynex Investor Presentation)

It is currently paying a solid dividend yield of 9.54% as per its current share price. Compared to the current valuation, I believe this dividend yield is solid and can be a perfect opportunity to earn stable, safe, and fixed returns in the long term for retirees and risk-averse investors. Now let’s discuss the sustainability of the dividend payment in the next section.

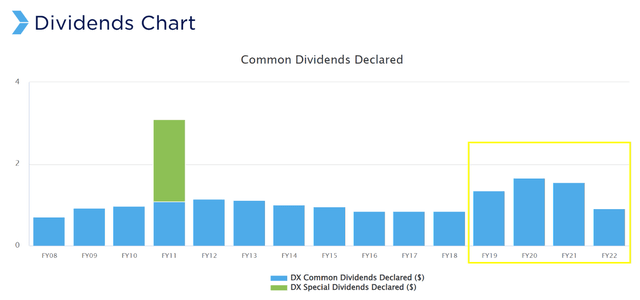

Solid Dividend Yield

Dividend Payment History (dynexcapital.com)

DX is currently paying the monthly dividend of $0.13 per share, which is an annual payment of $1.56 per share. With the current share price of $16.35, the annual dividend yield is 9.54% which is very stable, safe, and can be a source of fixed income in the current market scenario. Before the covid-19 outbreak, it was paying an annual dividend of $1.66, which is the yield of 10.15% at share price levels. I believe the dividend payment might increase once the uncertainty of the overall economy stabilizes. Let’s assume that the dividend payment remains the same for the coming period; still, the 9.54% stable dividend yield is very attractive for retirees and risk-averse investors. Now let’s discuss the sustainability of the dividend payment in the coming years.

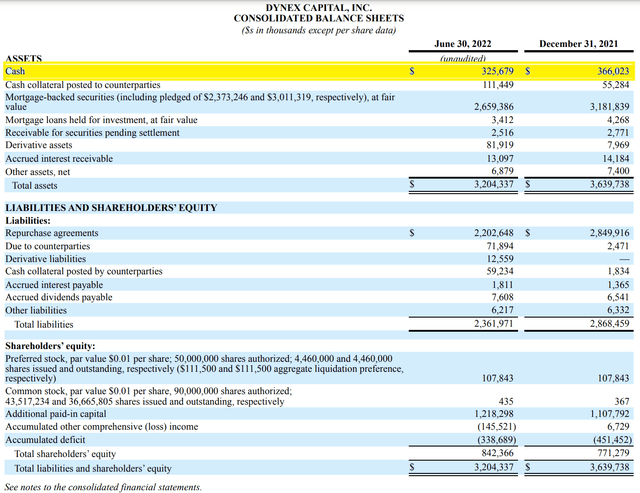

Balance Sheet of Dynex (2Q22 Result)

A strong cash position on the balance sheet is essential for sustainable dividend payments. DX currently has $325.7 million cash or 45% of the current market capitalization on its balance sheet, which is a significant cash position to sustain the dividend payment in the long term. The risk-reward scenario favors the company as the demand for a residential and commercial mortgage is high compared to historical levels. Currently, the mortgage rate has again fallen below 5%, and 30-year mortgages are stagnant near 2.77%, which is positive for the demand for mortgages. However, there is still uncertainty about the interest rates in the overall economy. After considering all these factors, I believe the dividend payment is sustainable in a conservative scenario, as even in the past, the company has managed to earn a stable income. In the best-case scenario of stable interest rates, we can expect a rise in dividend payments.

What is the Main Risk Faced by DX

Fluctuating Interest Rates

The company may see a decline in profitability during rising rates, especially hikes in the targeted U.S. Federal Funds Rate, since borrowing costs may rise more quickly than the coupons on its investments reset or investments reach maturity. Bond yields are expected to rise right away once the Federal Reserve declares a higher targeted range for the Fed Funds Rate or if the markets believe that it is likely that it will do so, which will have a negative effect on net interest earned, dividends, and book value per common share. The market value of securities may be adversely impacted by changes in interest rates, which could lead to decreases in comprehensive income, book value per common share, and cash flow. Since a large portion of its investment portfolio consists of fixed rate instruments, rising interest rates will lower the fair value of MBS because the market will demand a higher return for these kinds of securities. Margin calls from the MBS’s lenders frequently follow fair value drops, affecting the firm’s liquidity.

Prepayments could rise due to falling interest rates, raising amortization costs for any premiums paid to buy investments, and lower interest income. Additionally, when market players consider the possibility of faster prepayment rates in the future, falling interest rates may also lead to a decline in the market value of RMBS. Unexpected and uncertain global political and economic events, such as the COVID-19 pandemic, the Russia-Ukraine war, international and domestic trade issues, or sanctions, might be difficult to foresee in terms of how they will affect interest rates.

Technical Analysis and Fundamental Valuation

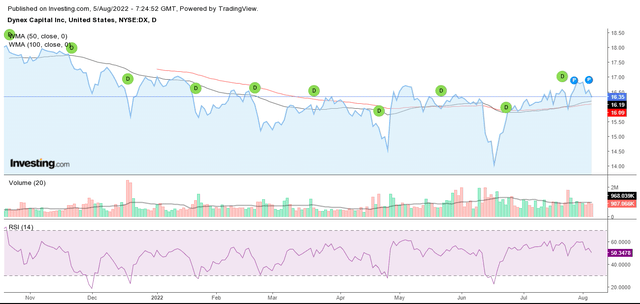

Technical Chart (Investing.com)

DX has positive technical indicators suggesting a buying opportunity from current price levels. The stock is trading above its 50-day and 100-day weighted moving average (WMA). This reflects a strong uptrend in the stock price. The 50-day WMA has recently crossed the 100-day WMA, which could translate into a fresh momentum in the stock price. DX has a strong support zone at $16 price levels. I believe there is limited downside risk from current levels, and the stock price can see a solid upside move. There is no significant divergence on the RSI indicator, but the stock is consolidating in the 50-60 RSI band range. This range is generally considered as a buying zone. The stock can soon test the 70 RSI band range, and that could result in an increased stock price.

DX is currently trading at a share price/book value ratio of 0.98x as against the market median of 1.22x. DX is trading at a discount to the book value at current price levels. I believe in the coming quarters; the stock can trade near the sector median price/book value. Let us now look at the P/E multiple of the stock. The stock is trading at a P/E multiple of 9.05x against the sectoral median of 10.26x. The stock is undervalued on the P/E parameter, and I believe the stock can trade at a significantly higher P/E multiple of 12x in the near future. With the P/E multiple of 12x and FY2022 EPS estimates of $1.57, we get a target price of $18.84. This represents a 15% upside from the current share price of $16.35.

Conclusion

DX has a solid dividend yield of 9.54%, and the company has a track record of consistent dividend payments. DX is trading at a discount to its book value and is also undervalued on the P/E parameter. I believe the stock is a great investment opportunity for investors seeking stable dividend income with limited risk exposure. I assign a buy recommendation for DX on the basis of a strong dividend yield at an attractive valuation.

Be the first to comment