piranka

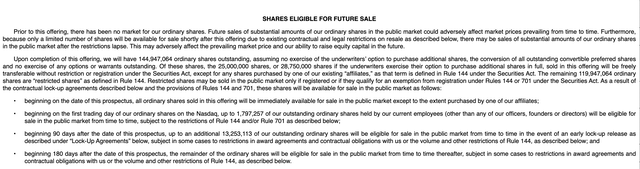

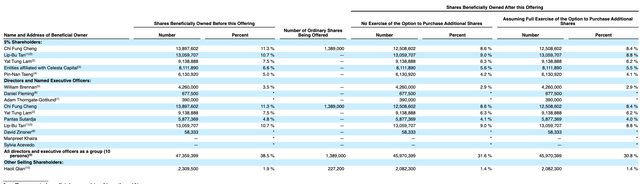

When the lockup period ends for Credo Technology (NASDAQ:CRDO) on July 26, 2022 pre-IPO shareholders and company insiders will have the opportunity to sell more than one hundred million outstanding shares, which the six-month lockup period prevents. This will significantly increase the number of shares available for sale in the open market. The IPO sold 20 million shares, although the company originally sought to sell 25 million. The potential for a sudden increase in stock flooding into the secondary market may negatively impact the share price of Credo Technology.

Currently, Credo trades in the $11 to $11.50 range, a return from IPO of more than 10%.

Warning About Shorting Stock

Investors interested in shorting shares of CRDO should be aware of the risks of shorting stock, especially in shorting shares of a recent IPO like CRDO. Shorting stock puts you at risk of losing assets in excess of your initial investment. CRDO shares have had a volatile trading history and concerns about liquidity and depth could impact investor’s ability to cover short positions. Changes in analyst rating could also have a positive, short-term impact on share price.

We highly recommend that any investor that takes this recommendation be very risk tolerant.

Business Overview: Provider of High-Speed Connectivity Solutions

Credo offers high-speed connectivity solutions that target electrical and optical Ethernet applications in the 100 gigabits to 800 gigabits markets. Their products use Digital Signal Processor (DSP) and Serializer/Deserializer (SerDes) technologies. The product portfolio includes SerDes Chiplets, Active Electrical Cables, and integrated circuits. The company believes that its proprietary technology enables it to disrupt existing markets and facilitates entry into emerging markets.

Credo operates in a multi-billion dollar industry focused on data infrastructure, which is driven by 5G infrastructure, high performance computing (HPC), and hyperscale data centers. Players in this industry compete against each other to provide better power and cost efficiency, increased bandwidth, and greater security in a rapidly growing market.

Credo targets the wired connectivity segment of this industry, which is expected to grow from $12 billion to $17 billion in 2025. The company has global teams focused on marketing, sales, and business development, which target HPC customers, 5G wireless enterprise networking, cloud infrastructure providers, and hyperscalers. Their customer base includes 5 of the top 7 hyperscalers, more than 10 optical module manufacturers, more than 20 blue chip companies, and over 10 OEMs.

The company generated $58.7 million in revenue in 2021 coming from product engineering services, product sales, and IP license engineering services. Its largest geographical markets are North America and Asia.

For the 6 months ended October 31, 2021, revenue increased although the company sustained a loss of $17 million from $37 million in revenue. This is in contrast to the same period the prior year of a loss of $19 million from $25 million in revenue.

Credo was founded in 2008 and is based in the Bay Area in California. It’s registered mailing address is located in Cayman Island.

Financial Highlights

Credo Technology Group Holding Ltd. reported fourth-quarter financial highlights for the period ending April 30, 2022:

- Revenue totaled $37.5 million, an increase of 90.0% year on year

- GAAP operating expenses totaled $30.1 million with non-GAAP operating expenses reaching $21.6 million

- GAAP Gross margin was 63.3% with non-GAAP gross margin being 63.7%

- GAAP net loss totaled $5.4 million with non-GAAP net income reaching $2.8 million

- GAAP net loss per share was $0.04 with non-GAAP diluted net income per share of $0.02

- Ending cash balance was $259.3 million

Management

CEO Bill Brennan has been in his position and served on the board of directors since September 2014. His previous experience includes senior positions at Vital Connect, Marvell, and Texas Instruments. He earned a B.S. in Computer Science and Electrical Engineering at the University of Colorado.

CFO Dan Fleming has served in his position since 2015. His previous experience comes from financial positions at Siva Power, SunPower Corporation, Marvell, Xilinx, AT&T, and Prism Solutions. He earned an MBA in finance from Indiana University and a B.S. in electrical engineering at Pennsylvania State University.

Competition: Allegro MicroSystems, Silicon Laboratories, and More

Credo operates in the “semiconductors and related devices” industry. Within this sector, its top competitors include Alphawave, Cadence Design Systems , Synopsys , Marvell Technology, Broadcom, Allegro Microsystems, Cirrus Logic, Amkor Technology, Power Integrations, Silicon Laboratories, Tower Semiconductor, CMC Materials, IPG Photonics, Synaptics, and Daqo New Energy.

Early Market Performance

The underwriters priced the IPO at $10 per share. The stock closed on its first day of trading at $11.65. The share price rose to $16.90 on February 28, but then began a lengthy decline to reach $8.80 on May 11. It rose again to reach $13.65 on June 7. Currently, the stock trades between $11 and $11.50.

Factors we look at for Lockup Picks

We look to several factors for when selecting an LU trade. Some of the factors that we believe that could cause more volatility with CRDO’s lockup expiration include that they (1) are in a high-tech industry which leads to increased volatility, (2) were taken public by well-known underwriters so investors are tuned in to IPO related events like quiet periods and lockup expirations (3), CRDO has a short interest greater than 5%, and the stock is trading above its IPO pricing point (making it attractive for large shareholders to cash in).

Conclusion: Short CRDO ahead of LU expiration

When the CRDO IPO lockup expires, pre-IPO shareholders and insiders will be able to sell more than one hundred million currently restricted shares. This group includes a large number of 5% stakeholders.

Significant sales of currently restricted stock could result in a sharp, short-term decrease in share price. While there are some early release provisions for the LU, the portion of these shares is small relative to the total, and the 90-day provision doesn’t appear to have been utilized by major shareholders.

We recommend that investors short shares of CRDO ahead of the July 26th lockup expiration and cover positions during the July 27th and 28th trading sessions.

Be the first to comment