Dean Mouhtaropoulos

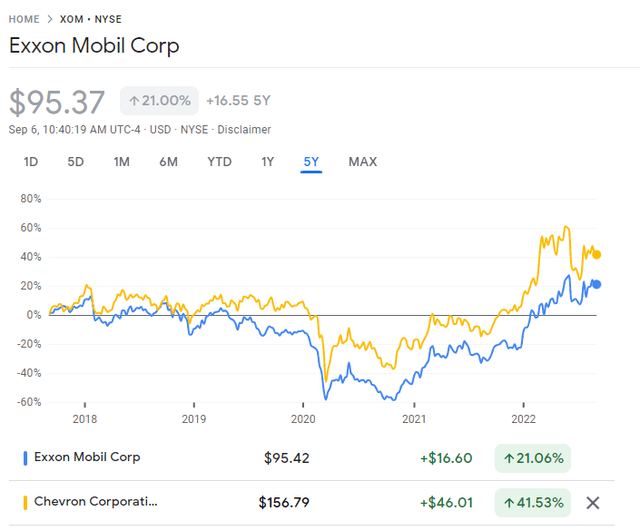

For many years I have looked to accumulate shares of Exxon Mobil (NYSE:XOM). While the business has had its struggles in recent years, failing to keep up with the performance of rival Chevron (CVX), I believe that management has righted the ship and the company is positioned for long-term success.

Commodity Prices / Macro

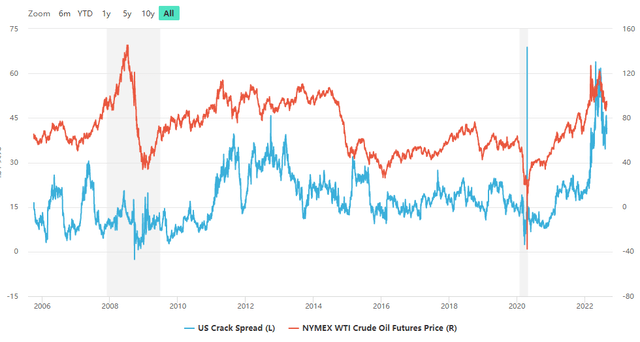

Unfortunately, for the last 10 years oil and natural gas markets have been troubled by an abundance of capital, high quality shale acreage and overproduction. Despite Exxon’s best efforts they struggled to perform over this time given (relatively) low energy prices, crack spreads and refined products prices.

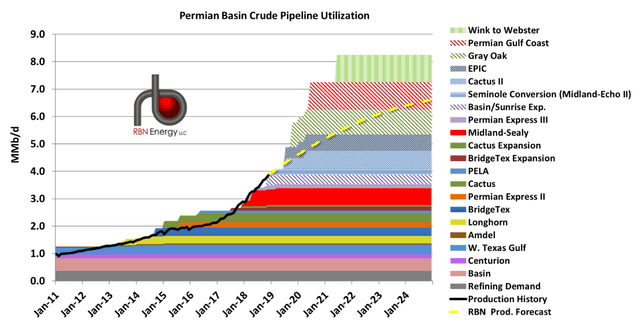

Long-haul takeaway capacity issues have abated recently as new pipelines have come online which has presented challenges for midstream operators in certain regions. Unfortunately Exxon’s Wink to Webster pipeline came online at the end of Permian takeaway buildout, however it has 100% of its contractible capacity secured and should still add value to Exxon’s gulf ecosystem which continues to ramp up and is on pace to increase refining capacity by 17% in Q1 2023 through expansion to the Beaumont refinery complex.

With any oil & gas investment it is important to consider the outlook on commodity prices and ignoring prices in favor of investing in “the best businesses” will yield subpar results over the long run (XLE is roughly flat since 2008).

XLE Performance (Google Finance)

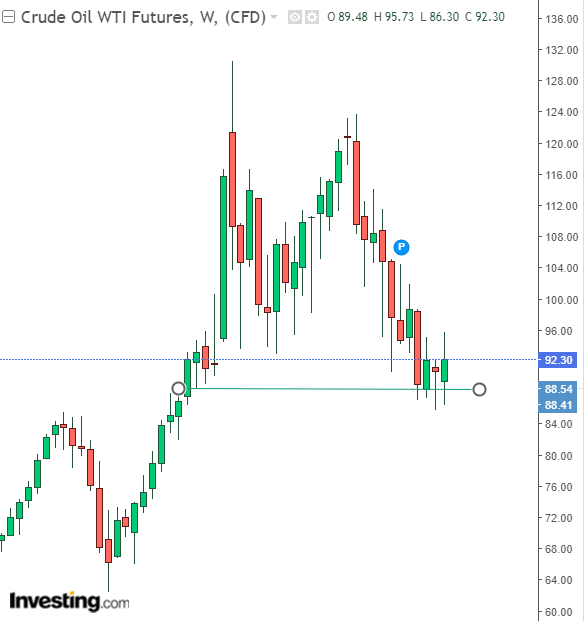

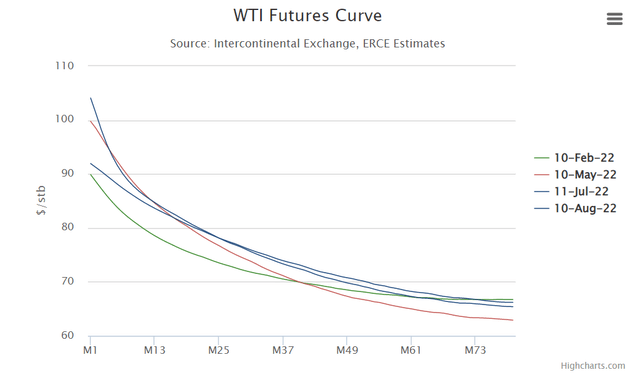

Zooming in on oil prices, WTI saw some relief following hawkish statements from OPEC as well as a small production cut announcement. I believe WTI was oversold at $86 after the broader short commodities trade became far overextended and has found support near that range with near term potential upside.

Investing.com

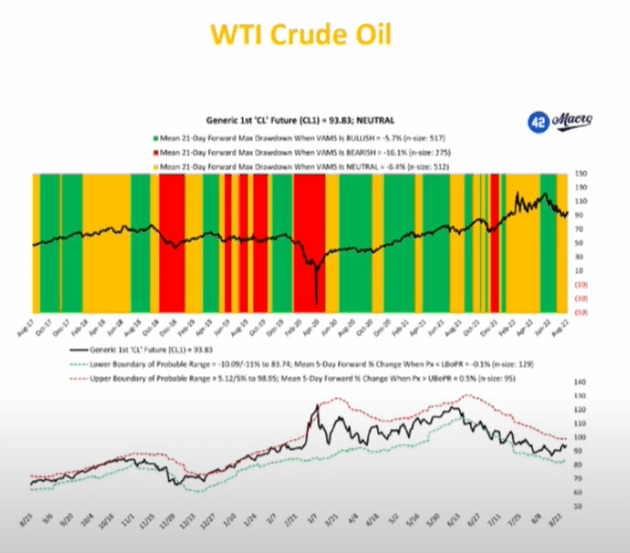

Volatility adjusted momentum signal range supports this theory with near-term support in the $80s.

42Macro

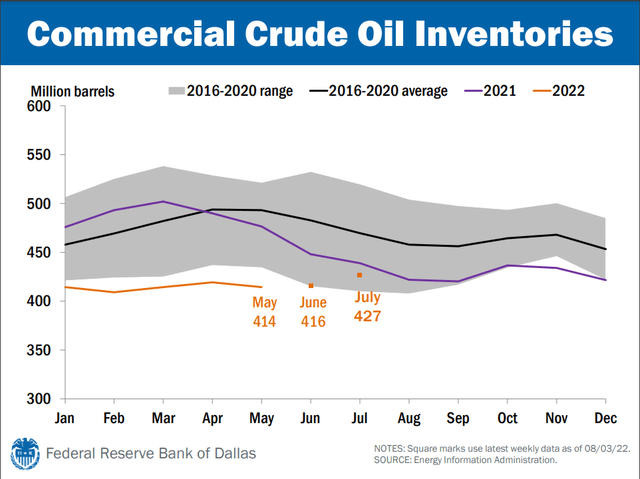

Finally, supply constraints remain with commercial crude inventories remaining below the 5-year range, which will continue to provide near term support for price.

With this in mind, I agree with the market’s repricing of the long-end of the oil curve upward and believe that undersupply will set a high floor on oil prices.

However, as I’ve written in the past (LINK), I believe that recession is likely outcome which will weigh on commodity prices. XOM performed poorly in the 2008 and 2020 recessions and trading this near-term opportunity will require tight stop discipline.

The Exxon Advantage

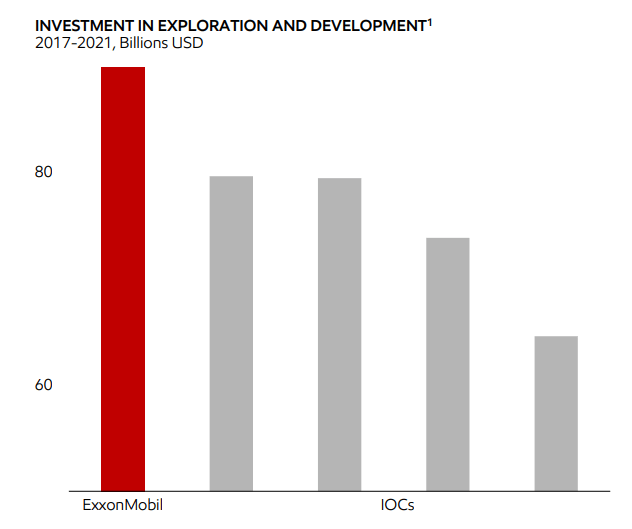

Exxon’s fully integrated business model allows unique competitive advantages that drive outperformance across cycles. These advantages will become particularly apparent as shale inventory downgrades and new discoveries are increasingly concentrated offshore. I believe that Exxon has proven its ability to execute in a wide variety of settings and geographies and will provide relative outperformance to shale concentrated producers over the long-term. The ~11B BOE Guyana discovery is a great example of this and the company is committed to maintaining capital investment in this play with continued ramp of Liza Phase 2. Two new discoveries were also announced in Q2, increasing the total number of discoveries in Guyana to more than 25. Exxon continues to prioritize exploration and development, outpacing all peers in investment from 2017-2021. This investment will reap long-term advantages as global supply will continue to be challenged due to broader underinvestment.

Exxon Mobil Investor Relations

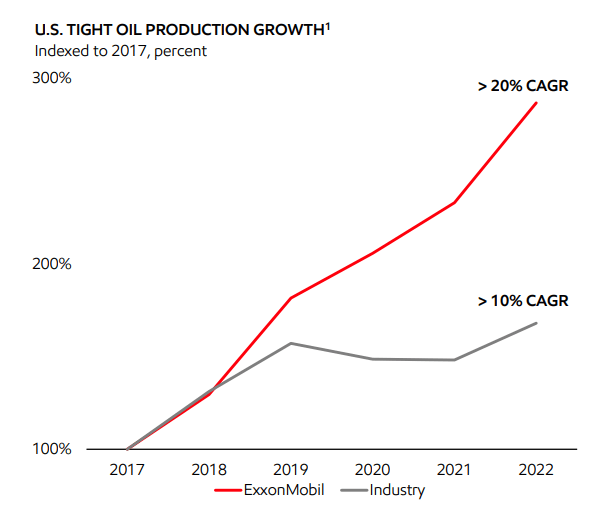

Exxon has also displayed a superior ability to ramp tight oil production (particularly in the Permian), utilizing scale advantages and a multi-well pad blowdown model to increase well output and efficiency. These scale advantages are a long-term advantage and cannot be matched by smaller independent peers.

Exxon Mobil Investor Relations

Long-term operational advantages can also be seen from Exxon’s rapidly improving refining margins – XOM’s $5.3B in energy products earnings in 2Q were more than the combined earnings for that division over the last eighteen quarters. While cracks have fallen recently, refining should continue to outperform alongside boosted oil prices. Boosts to refining and chemicals margins should provide substantial room for cash flow generation in 2022 provided that demand doesn’t contract too rapidly from any recessionary slowdown. Asia-Pacific chemical margins remain bottom of cycle but should improve as Chinese demand recovers.

Furthermore, XOM’s gas concentration provides a substantial long-term advantage. Given the volatility in gas prices recently, it is unclear where gas prices will stabilize however, it is likely that prices will remain elevated for the foreseeable future given capacity constraints and the European gas shortage. Exxon generated the second highest gas realizations of any major in the second quarter (behind Equinor) and is benefiting substantially from its Qatar heavy LNG portfolio. Exxon was awarded interest in Qatar’s North Field East joint venture to expand Qatar’s annual LNG capacity by >30 MTA by 2026 and remains Qatar’s partner of choice in LNG.

Valuation

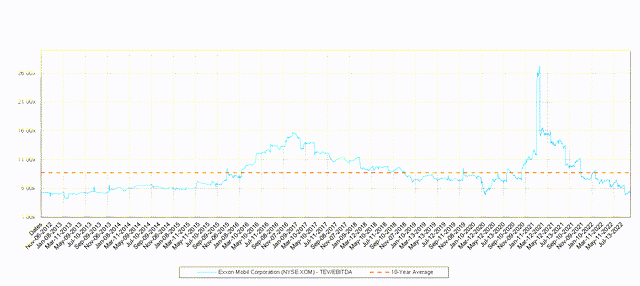

Despite the rapidly improving fundamental and macro backdrop, XOM still trades well below its 10-year average EV/EBITDA multiple as markets remain skeptical of the energy sector broadly, as well as Exxon’s operational improvements. While lower oil prices could present some additional downside to multiples, I believe that this is near the floor where the market will price XOM long-term and primary downside is related to compressed margins and falling global oil demand.

Conclusion

Overall, given the strength in oil prices (combined with what appears to be a floor in the $80s), the competitive advantages of Exxon and the boost to profitability in 2021, I believe that Exxon could represent a tactical buy in the near term. As mentioned earlier, there exists substantial downside risk with recessionary concerns and I would caution any investor to use tight stop-losses to limit downside exposure. Given the bearish impulse of the market (which I’ve also discussed in other articles), I would consider pairing an XOM trade with a broad market put or volatility call to hedge beta exposure and further limit downside risk.

Be the first to comment