Michael Vi/iStock Editorial via Getty Images

Investment Thesis

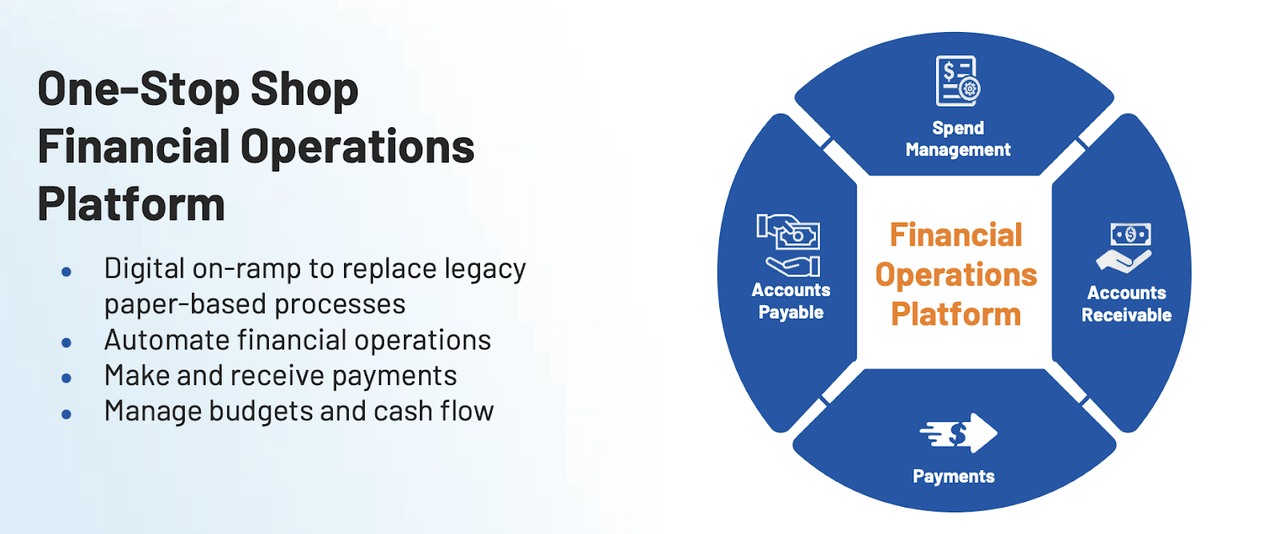

Bill.com Holdings Inc. (NYSE:BILL) offers SMBs an intelligent business payment platform to optimize their finances. Through a virtual card, ACH payment, paper check, or international wire, Bill.com makes it easy for SMBs to make payments and keep track of all their accounts from one platform.

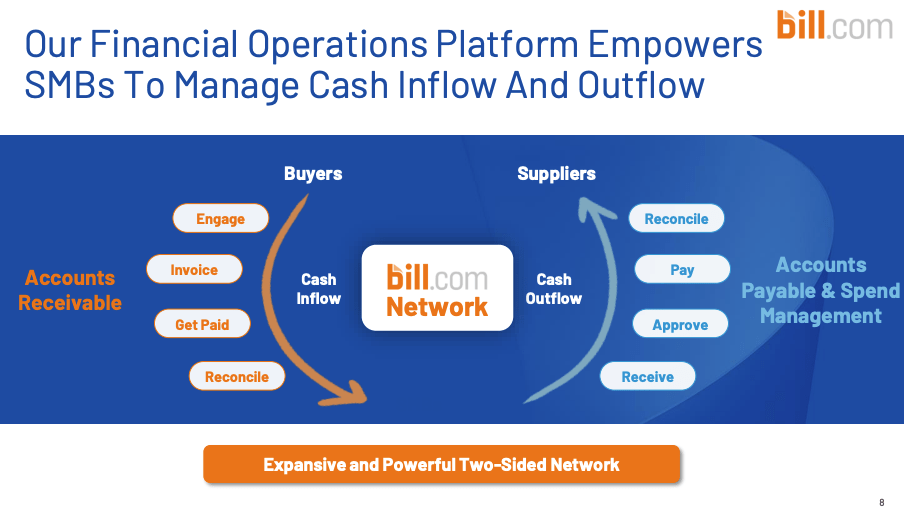

Our mission is to make it simple to connect and do business. We are champions of small and midsize businesses (SMBs). We are a leading provider of cloud-based software that simplifies, digitizes, and automates complex back-office financial operations for SMBs. By transforming how SMBs manage their cash inflows and outflows, we create efficiencies and free our customers to run their businesses.” – Bill.com’s Corporate Overview

Bill.com

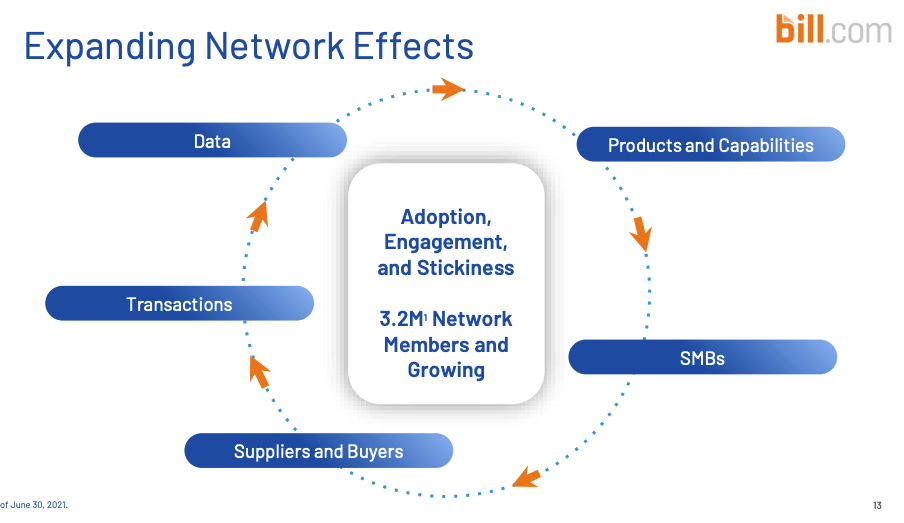

As Bill.com continues to build out its platform’s functionality, it strengthens its moat, and increases its value proposition because Bill.com automates more tasks making it easier for its customers to manage and reconcile their payments and finances. This results in strong network effects because of how simple it is for SMBs to manage these services, while Bill.com touches many components of its customers’ businesses, from suppliers and manufacturers to the end clients.

Bill.com trades at a premium, which is well deserved, but at its current valuation, $23B market cap on $600M in ARR and 50x PS, there is too much optimism priced into the shares. This makes the risk of investing in Bill.com today outweigh the potential returns.

In this note, I will illustrate that Bill.com is well-positioned to emerge as the industry standard payments solution for SMBs as businesses undergo a digital transformation. However, there are better opportunities to invest in this digital transformation of payments and get indirect exposure to Bill.com, as the evolution of the open banking paradigm enables new fintechs and services to arise.

Zero To One Strategy

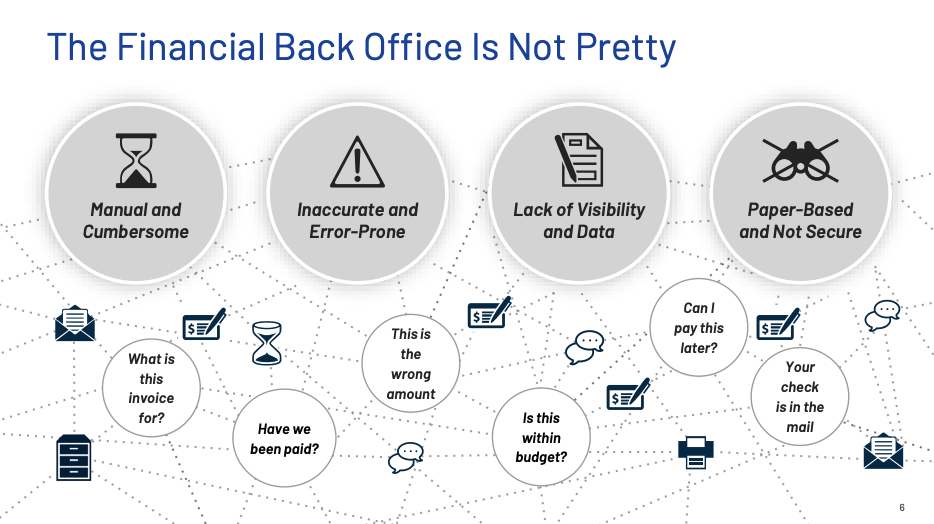

Bill.com automates the back office and financial operations for SMBs by making it easier for its customers to manage their accounts payable and accounts receivable. Bill.com supports an important component for any business because Bill.com enables its clients to focus on operating and maximizing their business for growth rather than worrying about payments, while Bill.com is uniquely positioned to use its insights from the payments it sees to offer embedded financial services.

Bill.com

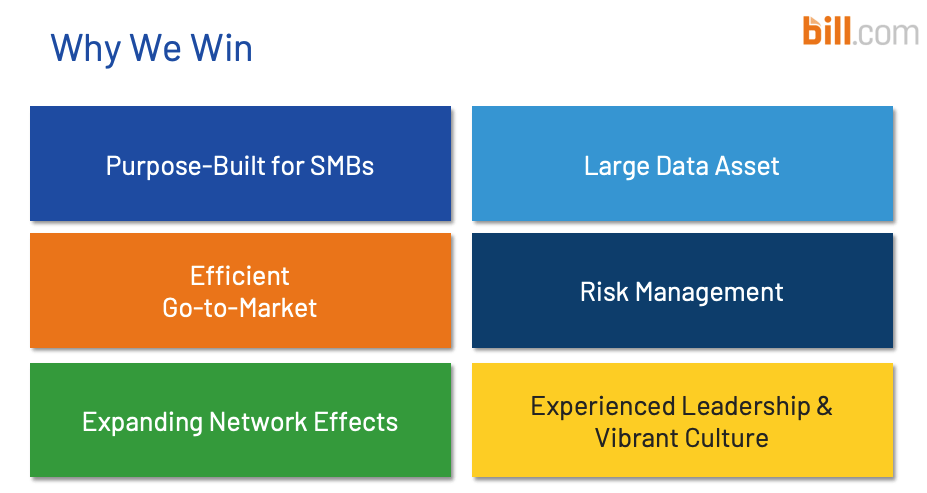

Competitive Differentiation

Bill.com

As depicted above, the back office has a lot of moving parts, and Bill.com simplifies the back office through integrations with more than 200 apps so that accounting databases can be in-sync and properly organized in real-time, eliminating the need for re-entry. Bill.com creates a secure environment for businesses to do their finances but they also speed up the reconciliation process and improve document management. Since Bill.com has deep insights into its customers’ accounts payable and receivables, which it tracks over time, Bill.com leverages these insights by offering card solutions or tailored financial products so that businesses can utilize their revenues or funds more efficiently.

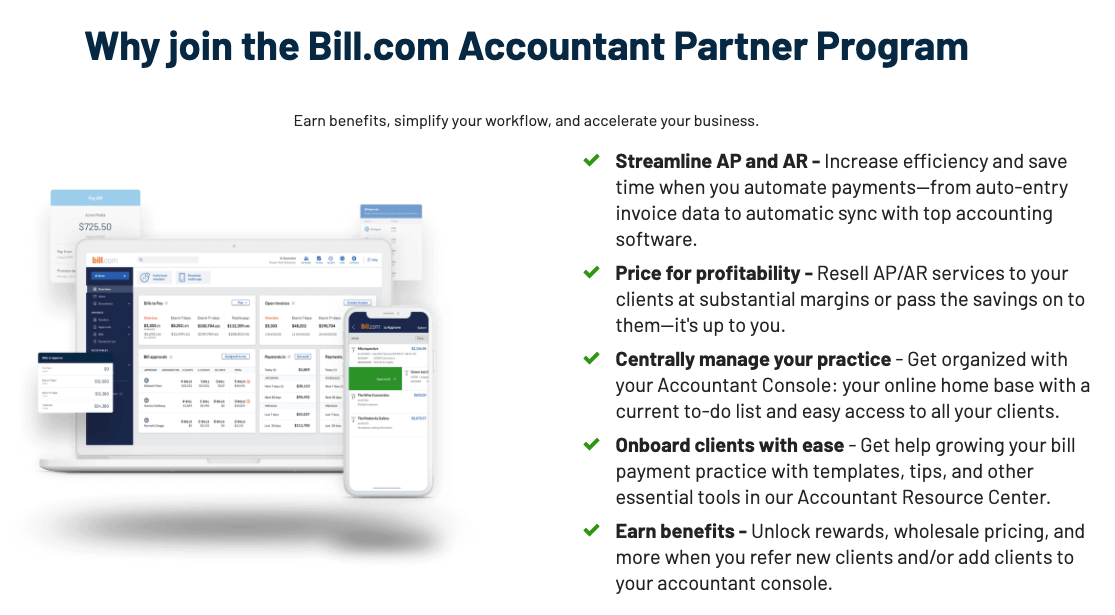

Bill.com’s strong network effects enable them to grow alongside its customers while also making it easy for accountants to add more clients.

Bill.com

Four Moats

Network Effects

Bill.com offers a sticky component for any type of business, and as more and more processes are being automated, Bill’s offering becomes increasingly valuable as it touches more parts of a company’s financial back end, whether through AR/AP services or a corporate card solution with Divvy. Bill.com uses its platform as a wedge to introduce more products to its clients which enables its customers to better manage and optimize their businesses for growth.

Bill.com

Embedded Moat

Bill.com is heavily embedded into its clients’ financial operations as it touches and processes many of the components that its clients use to manage cash inflows and outflows. As Bill.com’s clients integrate more solutions and platforms with Bill.com, they become further embedded and reliant on Bill.com’s software, while they introduce Bill.com to their network of suppliers and clients.

Bill.com

Scale Moat

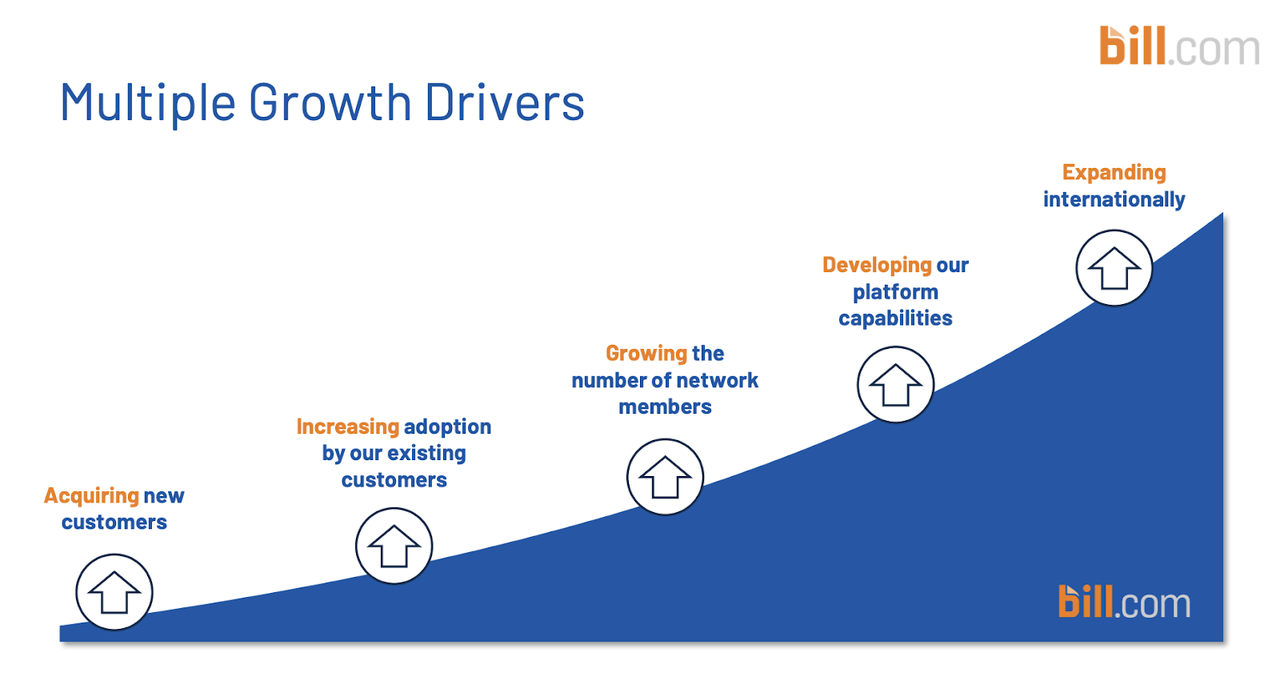

As Bill.com continues to grow its network of members and develop new platform capabilities, it will continue to automate more of the back end for its clients whether Bill.com helps clients manage spend controls across their employer base or optimize their inflows and outflows. Bill.com is cloud-based and enables its clients to grow on the platform whether through them adding new customers or enabling them to offer more services that could drive their business. Bill.com makes it easy for companies to manage their growth through one central platform while switching costs are typically high.

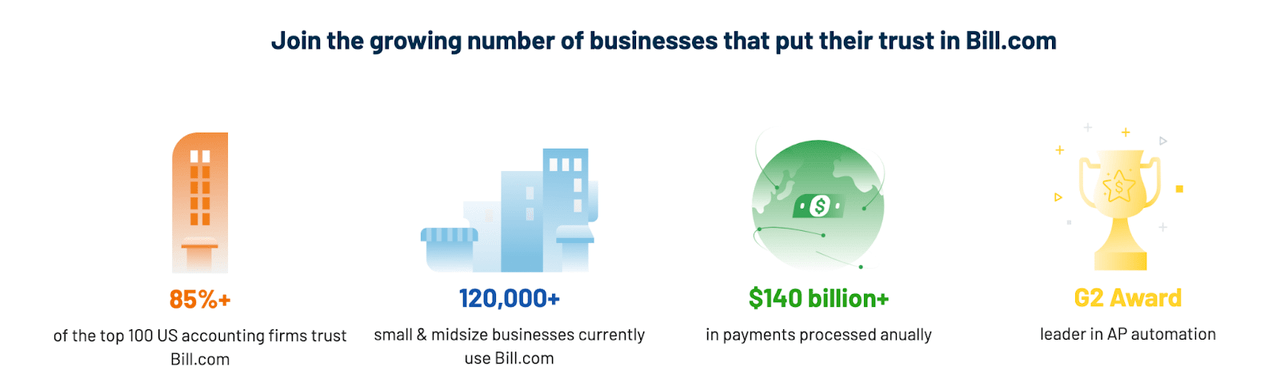

Brand Moat

Bill.com was founded in 2006, while Bill.com has become an industry standard that many accountants and SMBs depend on for operating their finances. Bill.com has over 200+ integrations and a partnership with QuickBooks (INTU) to leverage advanced Bill.com payments and workflow optimization. Bill.com has 135K customers and a network of 3.2M members consisting of suppliers and clients.

Bill.com

Bill.com already has a strong brand and this will continue to strengthen with the acquisition of Divvy, which is already a big hit at Bill.com, as highlighted below.

NPS / Customer Satisfaction

Bill.com had an 81 NPS, as of this summer, which is very strong and indicates that Bill’s customers are highly loyal. Bill.com also sports a 124% net dollar retention rate which is also strong and indicates the customers are increasingly spending more on Bill.com.

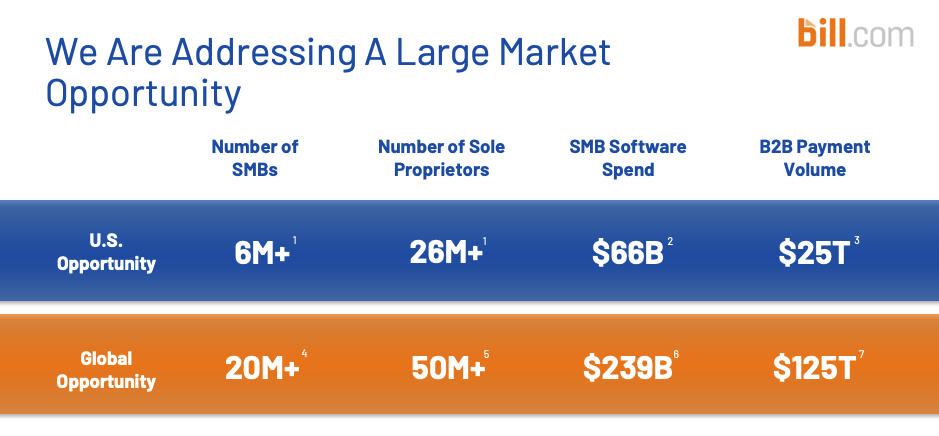

Total Addressable Market & Powerful Secular Growth Trend

Bill.com has a massive market opportunity as artificial-intelligence-enabled financial software automates the back-end finance operations to improve how businesses communicate from within, as well as externally through building connections between customers, suppliers, and clients. As open banking evolves the way in which companies leverage data at the transaction level, Bill.com is poised to leverage this data by offering more embedded financial services as it expands into its addressable market.

Bill.com

Mergers & Acquisitions

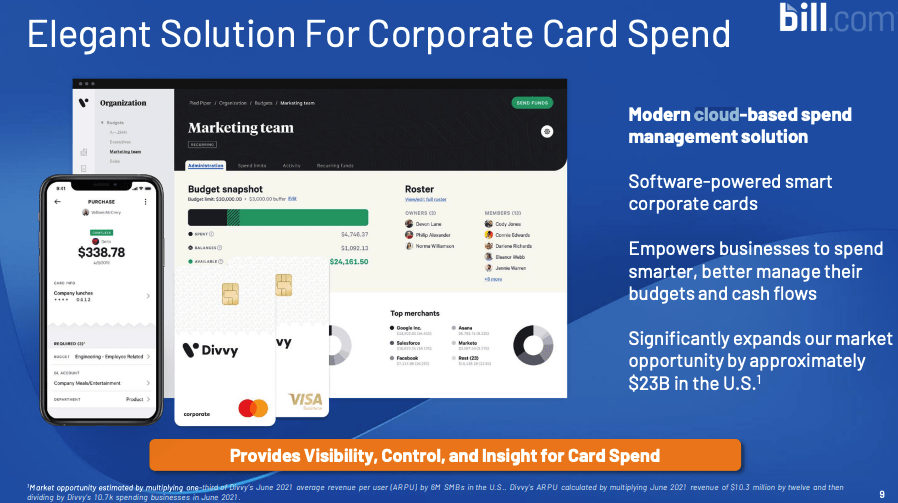

2021 was a significant year for Bill.com as it made two strategic acquisitions in Divvy and Invoice2go. Divvy is an expense management solution that makes it simple for companies to issue corporate cards to their employees where they have visibility into what’s being purchased. Divvy gives its customers spending control to manage how much can be spent on every card.

Bill.com

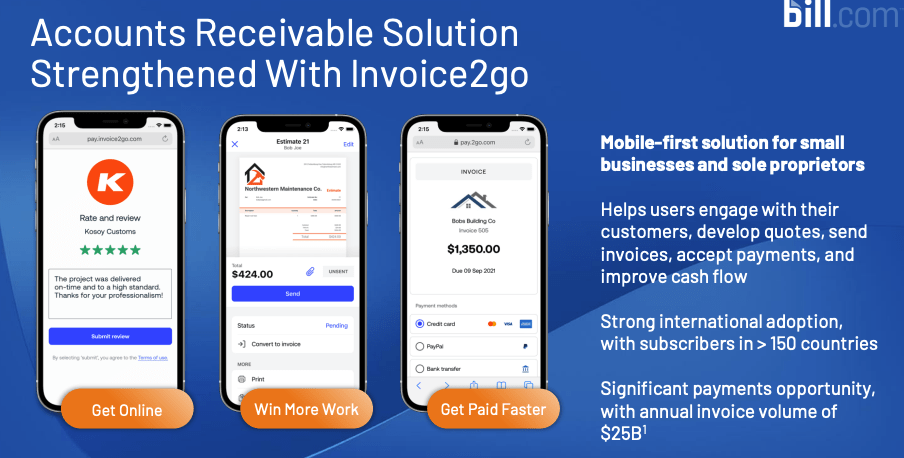

Invoice2go is a mobile-first accounts receivable software provider that helps business manage their invoices and expense tracking. When you combine Invoice2go’s expense tracking with Divvy’s corporate spend tools, and given that Bill.com’s already a leader in digital business payments, there’s a huge opportunity to cross-sell value-added services across Bill’s large network of customers.

Bill.com

Visionary Founder/CEO

René Lacerte is a fourth-generation entrepreneur, as he was raised in a family where both his parents and grandparents were entrepreneurs. They ran SMBs that were all financially oriented whether payroll processing, data processing, or taxes. Lacerte was introduced to business and accounting at a young age. Growing up, Lacerte was instilled with an incredibly strong work ethic inspired by his father, while Lacerte has prior experience as a founder as well before starting Bill.com. Lacerte thus grew up around SMBs and he was inspired by his parents’ and grandparents’ commitment to their business because of their passion to help other people.

In 1999, Lacerte started PayCycle, which was the first online payroll company and after 6 years of running it, he had the idea for Bill.com with the goal to take advantage of cloud-based computing to automate the financial operations of businesses. Lacerte’s experience as a founder and CEO of PayCycle would prove crucial for his success as a founder at Bill.com because he recognized mistakes and lack of continuity across the organization of his first startup, partially due to his leadership. This would prove crucial for Lacerte because he recognized that he had another idea in Bill.com and his lessons would prove pivotal in running his new company.

All of the investors in PayCycle were investors in Bill.com, which speaks to Lacerte’s persistence after he left PayCycle. Lacerte’s always had a passion for understanding businesses and the language of accounting. The night Lacerte was born, his mother was sorting punch cards and he’s been learning about businesses ever since. Now, Lacerte is automating the back end of businesses and solving the pain points for many SMBs.

René Lacerte was born for this.

The Time Is Now

The “Power of Pay” is a consistent trend that we are investing in at Beating The Market. The “Power of Pay” is the idea that as technology improves, payments become highly configurable and the cost of processing transactions decreases, all while enabling more data to be securely communicated. Bill.com is uniquely positioned to offer embedded financial services because it understands the inflows and outflows of its customers’ businesses and will leverage these insights to offer embedded financial services. As Bill.com automates more components of processing payments, Bill.com enables its customers to receive payments faster while using the data present in a transaction to drive future sales.

Product Roadmap/ Evolution

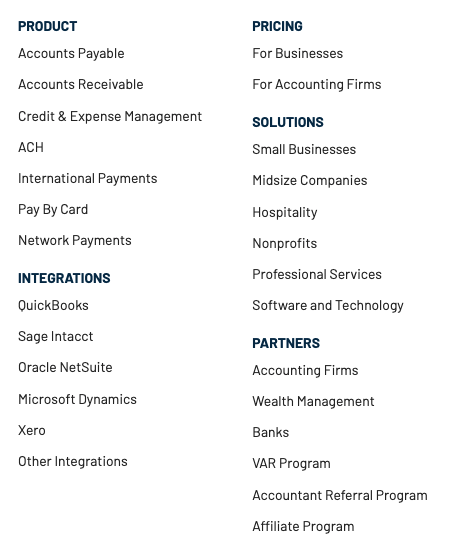

When Lacerte started Bill.com, he recognized that businesses needed to simplify their payments, so that they can focus on their actual business. Today, Bill.com offers a variety of products and numerous solutions for many types of businesses.

Bill.com

While Bill.com may have seemed like just a bookkeeper when it got its start, Bill.com is now a fintech company that’s well-positioned to capitalize on the trends of open banking and the availability of more and more alternative data points. Since Bill.com has strong ties to the bookkeeping and accounting of its customers, this gives them insights into how each and every customer operates their business and the ability to understand their cash flows. Bill.com will leverage the large amounts of data and information that it automates and will offer embedded financial services to its customers to enable them to access their funds instantly.

The acquisition of Divvy enables Bill.com to offer its customers a smarter way to spend and manage their budgets and cash flows, all from one central platform that is easy to use across a corporation. For example, Divvy Budgets makes it easy for businesses to manage spending controls across all of their employees while making it easy to reconcile their purchases on for audits. Bill.com will look to use Divvy’s expense management solutions as a wedge to introduce Divvy customers to Bill.com’s wide realm of products.

Bill.com

With Bill.com’s two recent acquisitions in Divvy and Invoice2go, Bill.com is uniquely positioned to control the entirety of its processing stack, while it will cross-sell Divvy’s spend management tools to its current customers. Bill.com will continue to integrate new payment solutions that will leverage the vast amount of data that Bill.com collects and uses to help their customers better run their businesses.

The goal is to be the de facto standard for SMBs when it comes to financial operations and operations to me are all about processes. It’s all around the steps you take – you go back to the pain point that got me started at PayCycle – was walking around the office, looking at filing cabinets, trying to find documents that were misplaced, executing payments, calling banks to follow up on the payment, find out if the check had cleared.

All of these things that businesses do are processes, and automating that is what I wanted to do with AP, but you can take that same mindset and look at the processes a business uses for AR, the processes a business uses for spend management, which is why we acquired Divvy, the processes a business uses to think about working capital and cash flow, acceleration of the invoice collection, processes around HR and payroll. These are all things that businesses have processes around and the cloud is a gamechanger… We, I think, are really the first platform that thought about the processes as the thing that the software was enabling… We are focused on the processes and using the software to get us to the data so we can make these decisions and make these offerings.” – René Lacerte

International Expansion

Bill.com supports payments in over 130 countries, while Invoice2go also has a strong international presence with subscribers in more than 150 countries. Bill.com offers competitive exchange rates for payments compared to the average fees for international outgoing wires, while Bill.com doesn’t charge a wire transfer fee when someone pays a vendor in their local currency. Bill.com makes it easy for its customers to reconcile international payments while keeping everything automatically synced.

Bill.com

As Bill.com strengthens its international offering, it is positioning its platform to grow with its customers if they choose to enter new international markets.

As we think about our global aspirations, we are very focused on delivering value for SMBs everywhere. And the way we’ve started that process with the core Bill product is through the international payments and the ability to do cross-border payments for those customers and those suppliers that are out there. And so when we think of the opportunity with respect to Invoice2go is to leverage all the experience that they have, simplicity in the product, simplicity in going to market, and to leverage that with the Bill.com payment rails and software capabilities that we have. So we’re excited about it and look forward to extending that reach as we continue to integrate the application.” – René Lacerte

Proprietary Technology

Bill.com makes it easy for SMBs to access their back office from any computer or mobile device, while the company has 10 patents. Bill.com’s technology is differentiated because it enables SMBs to stabilize cash flows, streamline activities, and eliminate redundancies while ensuring accounting systems are automatically synced.

Pcmag

Source: Bill.com Review

Quality of Board of Directors

René Lacerte sits on Bill.com’s board which is comprised of 11 people. The board has a range of industry veterans, specifically in the payments and technology industries, while some of the members have extensive experience in the venture capital industry. Bill.com is strategic as a steward of shareholder capital, as the recent acquisitions have proven quite beneficial, hence capital allocation is a strength of the board. Overall, the board of directors has a good deal of experience ranging from tech companies to large financial institutions.

Market Share

Bill.com serves ~1.75% of the global SMB market which is a $239B opportunity. Bill.com has 135,000 core customers, about 2% of U.S. employers, while Bill.com now estimates its potential market is 70M businesses. It will absorb more market share by providing more products or services, whether managing accounts receivable and accounts payables or helping businesses maximize their outflows through Divvy’s expense management solution. Bill.com only serves a small fraction of its market share and has a significant global opportunity, which is accelerated with Invoice2go’s AR solution. Bill.com will look to leverage its network of accountants and banks as it adds new solutions to its platform (expense management and spend management) to drive further adoption.

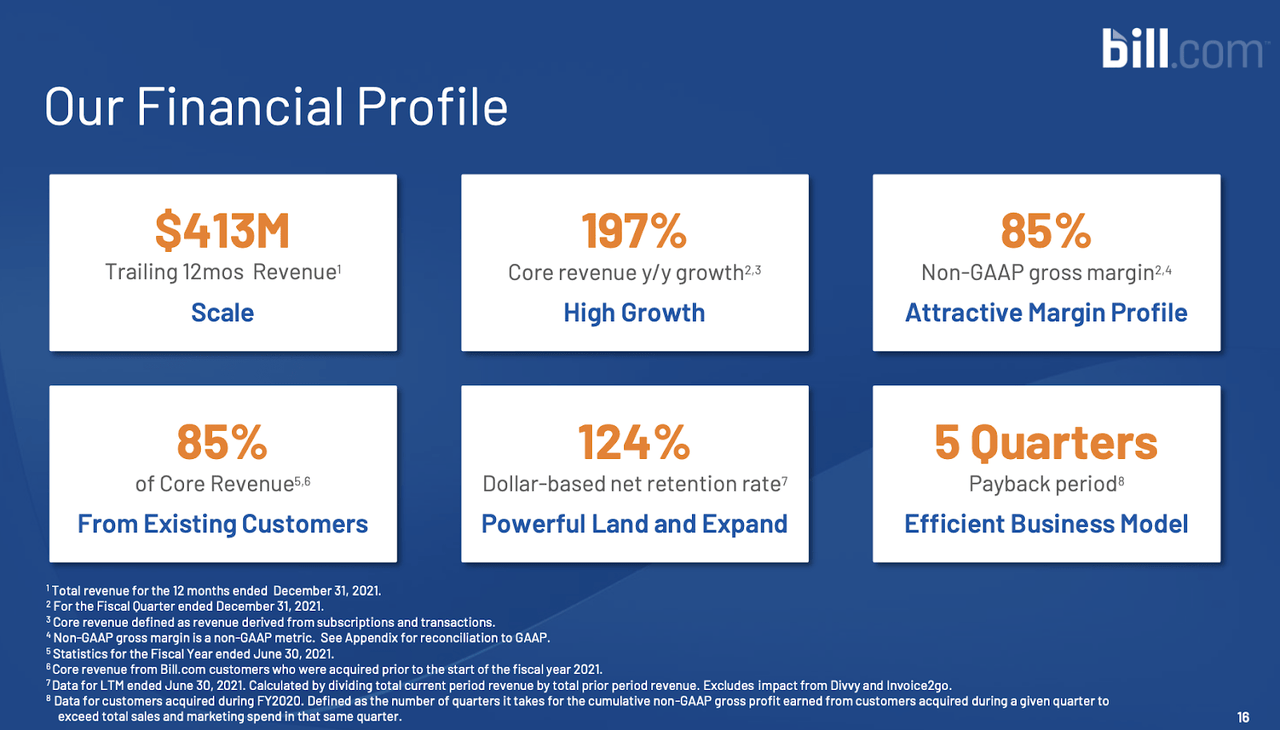

Sound Financials

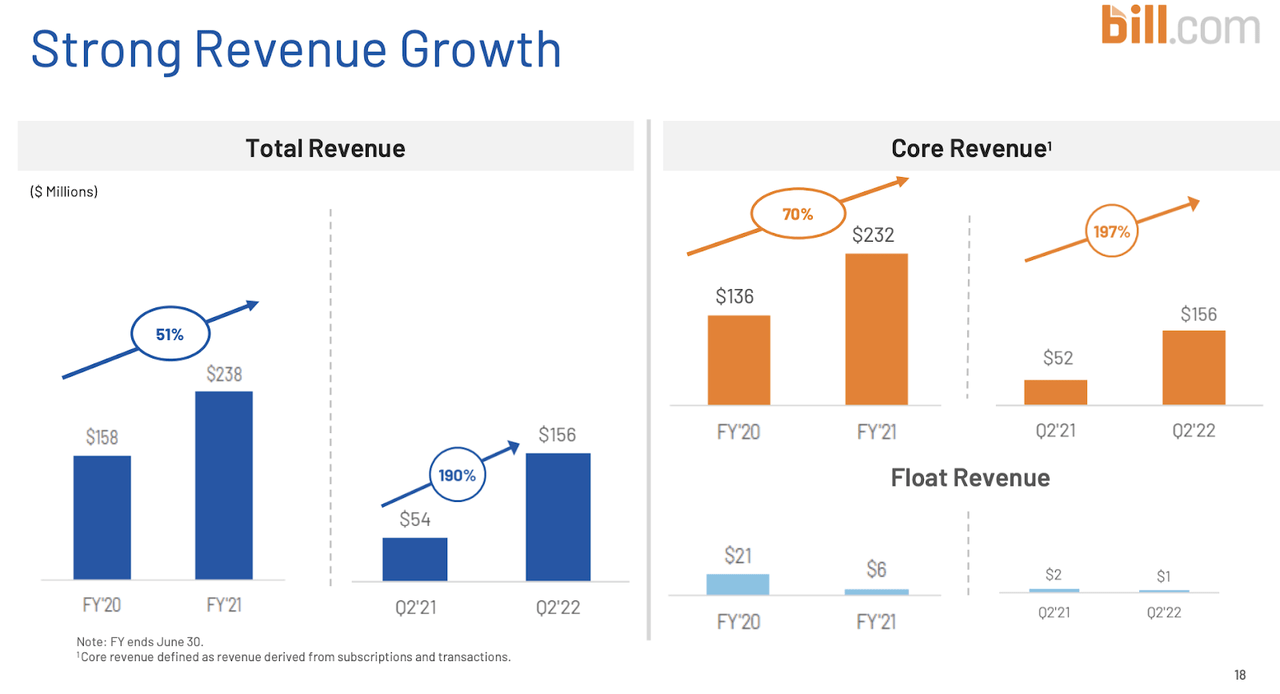

- 85% year-over-year core organic revenue growth last quarter (not including revenue from Divvy or Invoice2go), up 77% the prior quarter

- 190% top-line revenue growth last quarter, including the two recent acquisitions, up 152% the prior quarter

- $600M revenue run rate business with an annual growth rate of greater than 100% today

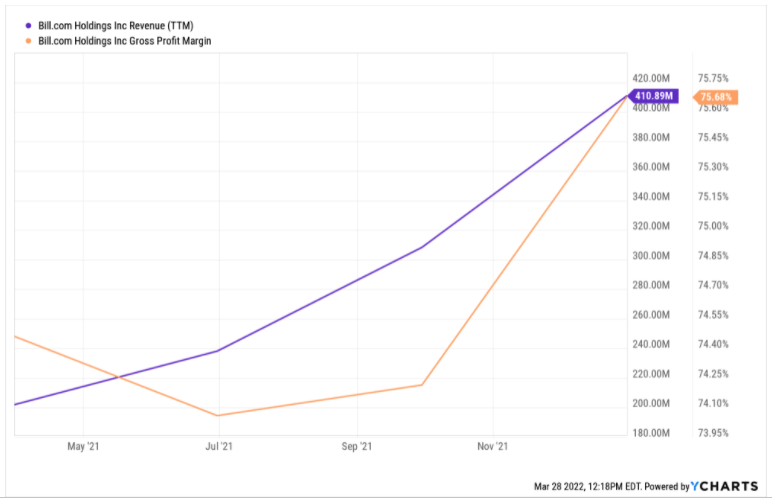

Bill.com Ycharts

-

Strong gross profit margin at 85% (non-GAAP)

-

124% dollar-based net retention rate is above the industry average

Bill.com

-

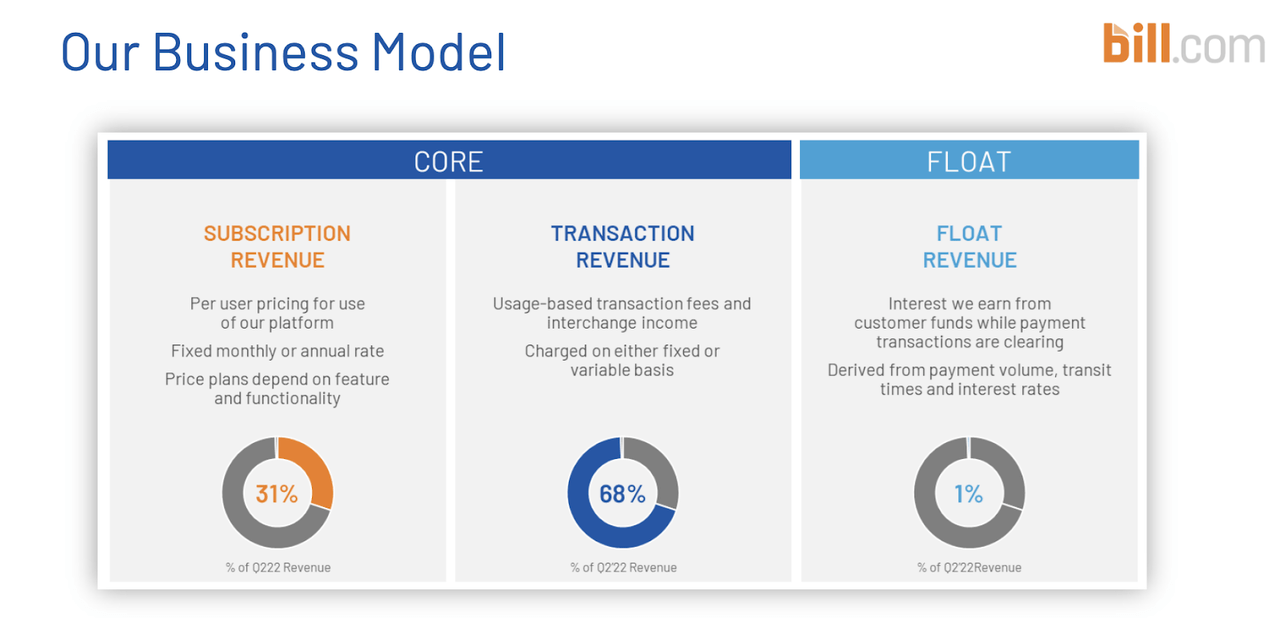

Bill.com primarily earns its revenues through a subscription model or usage-based fees and interchange on the transactions it processes. As a result, Bill.com generates revenue through a traditional SaaS offering through recurring monthly revenue, while 68% of revenue was driven by transaction revenue. This is positive for Bill.com because it stands to benefit from its customers’ growth, when they process more transactions leveraging Bill.com’s platform.

Bill.com

As Bill.com adds new functionalities and capabilities that enable its customers to quickly access or process funds, it will incentivize customers to process more volume through Bill.com because it simplifies their financial operations. By simplifying these operations, Bill.com makes it easy for SMBs to access their funds and manage their outflows at scale, which is beneficial for Bill.com as it stands to process more volume.

Liquidity of Bankruptcy Risk

-

$2.789B in cash and short-term investments, $1.672B in cash and equivalents

-

$1.134B in current debt

-

$1.77B in long term debt

-

Free cash flow was negative last quarter, $16M, down from $25M the prior quarter

Shareholder Dilution Risk

Bill.com’s balance sheet is relatively strong with ~$2.8B in cash and short-term equivalents, which would enable them to operate its business over the next 8 quarters even if Bill.com were to continue operating at its current run rate. Bill.com has plenty of short-term assets to cover its current debt, but we will factor in 15% dilution into our valuation model, to consider potential dilution to shareholders, which could be used for capital to either pay off current debts, or future acquisitions to launch new value-added services.

Risk Factor Mitigation

-

No customers exceeded 10% of the company’s total revenue during 2021, hence no concentration risk.

-

Bill.com made two significant acquisitions in 2021 and it will be crucial that Bill.com smoothly integrates with Invoice2go and Divvy to maximize the synergies between their services and the current Bill.com platform. It will be a challenge to integrate the teams, but important for driving sustained growth and cross-selling the new acquisitions across Bill.com’s network of 3.2M members.

-

Bill.com spends significantly on Sales and Marketing to drive customer acquisition. Bill.com invests significantly in this area as its platform is sticky and tough for customers to switch from since Bill.com is exposed to important components of its customers’ businesses, their accounts payable or accounts receivable. Since Bill.com is usually difficult for customers to switch from and since they learn a lot about their customers’ businesses, Bill.com can capitalize on new capabilities like instant payments to improve the back-end for its customers. Bill.com’s strong margins and multiple revenue streams enable Bill.com to capitalize on this investment by offering new innovative financial services.

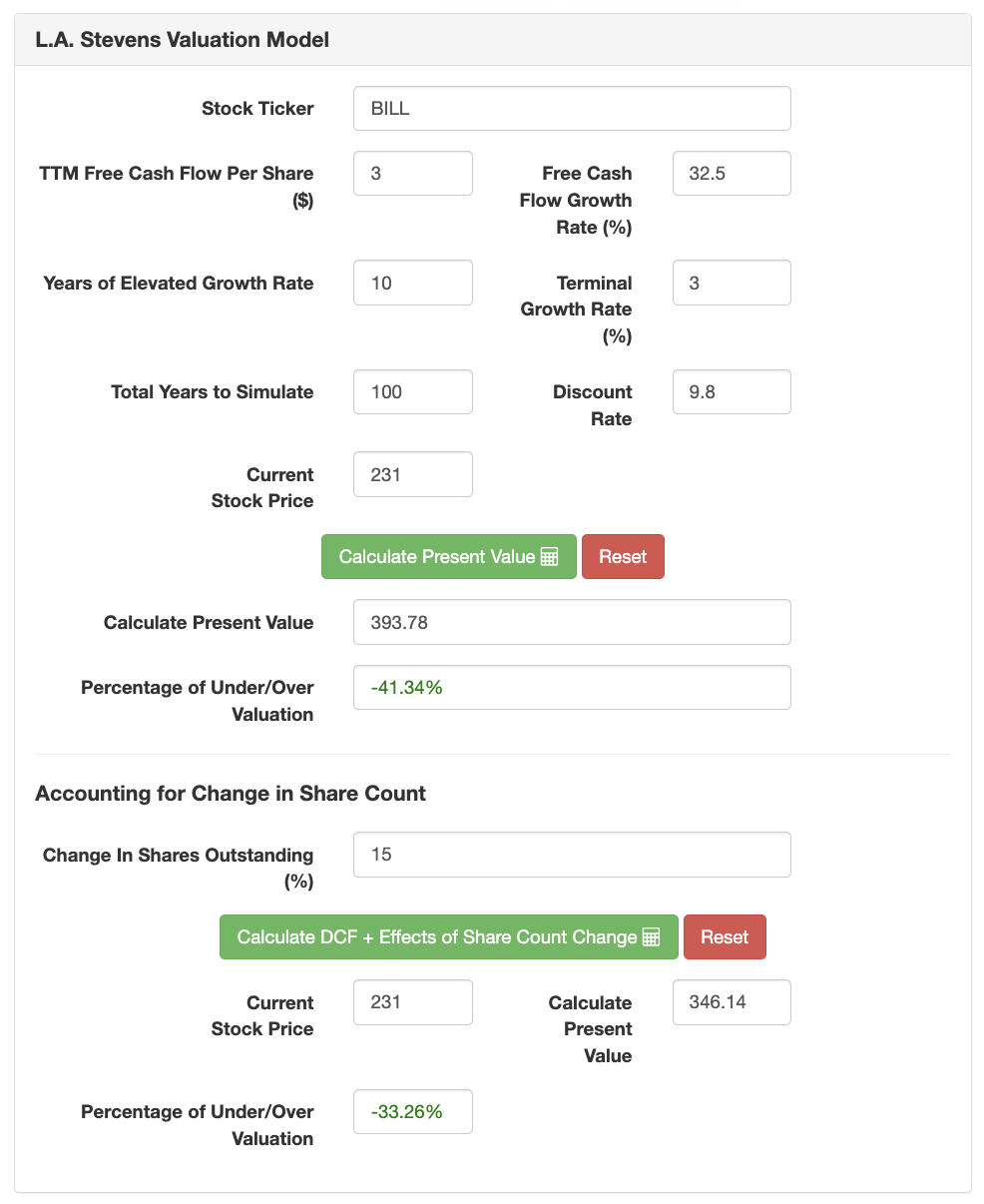

Valuation Level

To determine BILL’s fair value, we will employ our proprietary valuation model. Here’s what it entails:

-

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

-

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

-

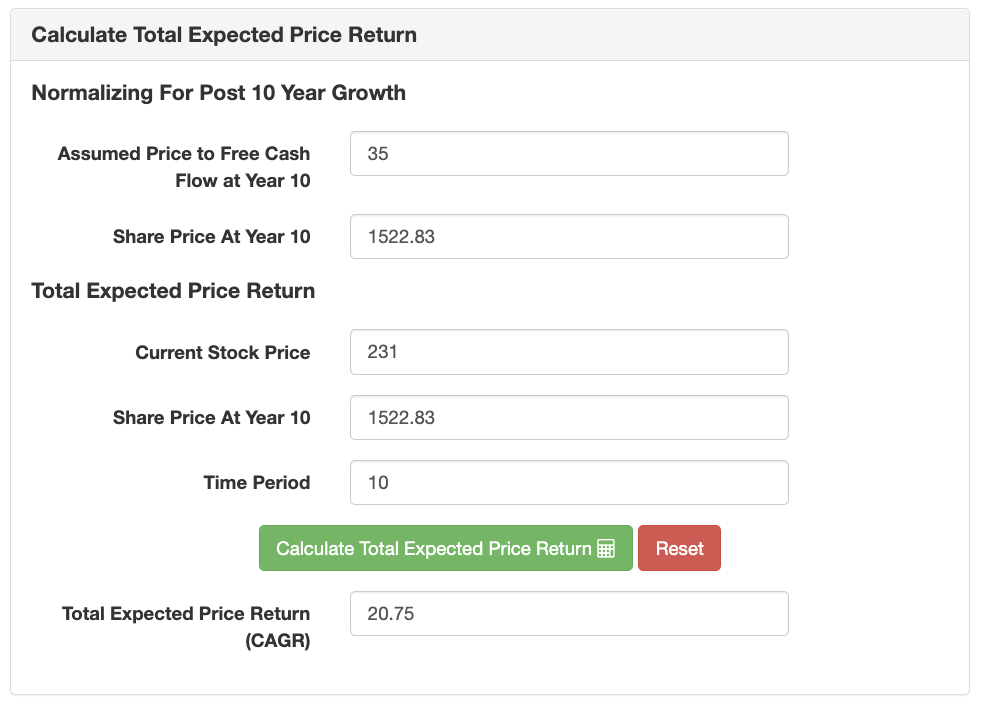

In step 3, we normalize valuation for future growth prospects at the end of the ten years. Then, using today’s share price and the projected share price at the end of ten years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Assumptions:

|

Forward 12-Month revenue [A] (conservative estimate) |

$900 Million |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average fully-diluted shares outstanding [C] |

~105 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$3.00 |

|

Free cash flow per share growth rate (currently growing greater than 100%; 32.5% = avg. of 10 yr. annualized growth rate) |

32.5% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

L.A. Stevens Valuation Model

Results:

L.A. Stevens Valuation Model

Based on the L.A. Stevens Valuation Model, Bill.com is worth ~$346 today, however, Bill still trades at a premium and a high valuation compared to other fintechs or similar SaaS companies. Bill.com trades at 50X PS and ~27X price to forward 12 months of sales, which is still expensive and for a company that’s still not free cash flow positive and with some debt on its balance sheet, there are better opportunities to deploy capital today. Trading at or below 20x price to forward 12-month revenue, ~$18B in market cap today, is where Bill.com would become attractive and we’ll revisit the stock if it were to fall.

Conclusion

Bill.com is one of the more intriguing fintech and SaaS companies because it understands and processes the financial operations of its customers’ SMBs, and this gives Bill.com a unique understanding and position as an enabler for SMBs to automate and simplify their finances. As a result, Bill.com is building a massive network of customers and their partners as Bill.com supports many components of a company’s finances ranging from corporate cards or managing accounts payable to accounts receivable. Bill.com is developing a massive network while its customers depend on Bill.com to move money from one party to another, which gives Bill.com a massive market opportunity as it expands its platform’s services.

Trading at a premium today, I label Bill.com a hold with a buy rating initiated at $175. Bill.com’s valuation today limits the potential upside for investors, while there are better opportunities to invest in fintech and open banking. Marqeta (MQ) is a modern card issuer who supports money movement for many large financial institutions and fintech disruptors. Marqeta has supported Divvy’s spend management solutions and card since late 2020, while Bill.com announced a partnership with Marqeta in October of 2021. Marqeta trades at an attractive valuation, at less than 7x EV to sales and less than 4.5x EV to forward 12-month sales. While Marqeta doesn’t sport the 80%+ gross margins, Marqeta benefits from the growth and S&M of its customers as Marqeta doesn’t spend much on S&M expenses, as Marqeta grows alongside its customers through the payment volume it processes.

Through our investment in Marqeta, we, at Beating The Market, have exposure to Bill.com. For more on Marqeta and its partnership with Bill.com and Divvy, check out my latest updates:

Thanks for reading, and happy fintech investing!

Be the first to comment