alvarez

A Quick Take On Vital Farms

Vital Farms (NASDAQ:VITL) went public in July 2020, raising $205 million in gross proceeds in an IPO that priced the shares at $22.00.

The firm sells pasture-raised eggs and related products.

Given how poorly the stock has performed against Cal-Maine (CALM), it is difficult to develop an interest in VITL in the current uncertain avian flu-affected supply environment.

I’m on Hold for VITL in the near term.

Vital Farms Overview

Austin, Texas-based Vital was founded to sell ethically-farmed, pasture-raised eggs. Pasture-raised eggs are from chickens that have spent at least some time in or have access to a pasture.

Management is headed by Chief Executive Officer Mr. Russell Diez-Canseco, who has been with the firm since January 2014 and was previously a consultant at McKinsey & Company.

The company was founded by Executive Chairman Matthew O’Hayer.

Vital sells its eggs through major supermarket chains, including:

-

Albertsons Companies (ACI)

-

The Kroger Co. (KR)

-

Publix Super Markets

-

Target (TGT)

-

Walmart (WMT)

-

Whole Foods

-

Others

Vital Farms’ Market & Competition

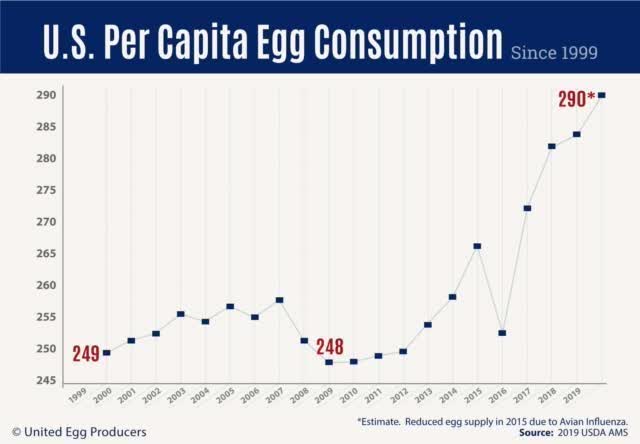

According to a 2020 market research report by United Egg Producers, the U.S. market for eggs continues to grow at a significant rate.

U.S. per capita egg consumption reached an all-time high in 2019, as the chart shows below:

U.S. Per Capita Egg Consumption (United Egg Producers)

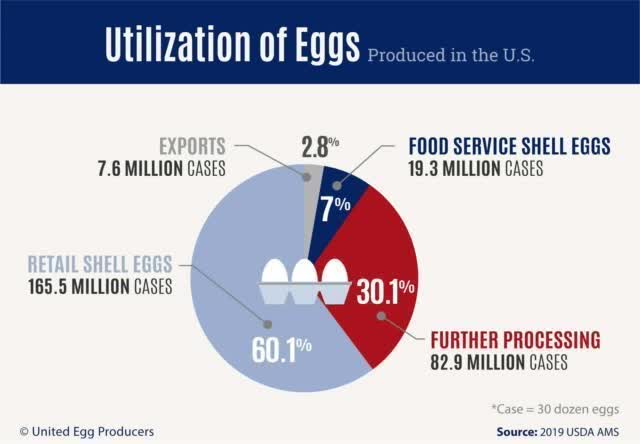

Most of the egg production is sold at retail, followed by eggs that were further processed into products for food service, manufacturing, retail, and export, shown in the chart below:

Utilization Of Eggs – US (United Egg Producers)

Major competitive or other industry participants include:

-

Cal-Maine

-

Ornua (Kerrygold)

-

Local and regional egg companies

Vital’s Recent Financial Performance

-

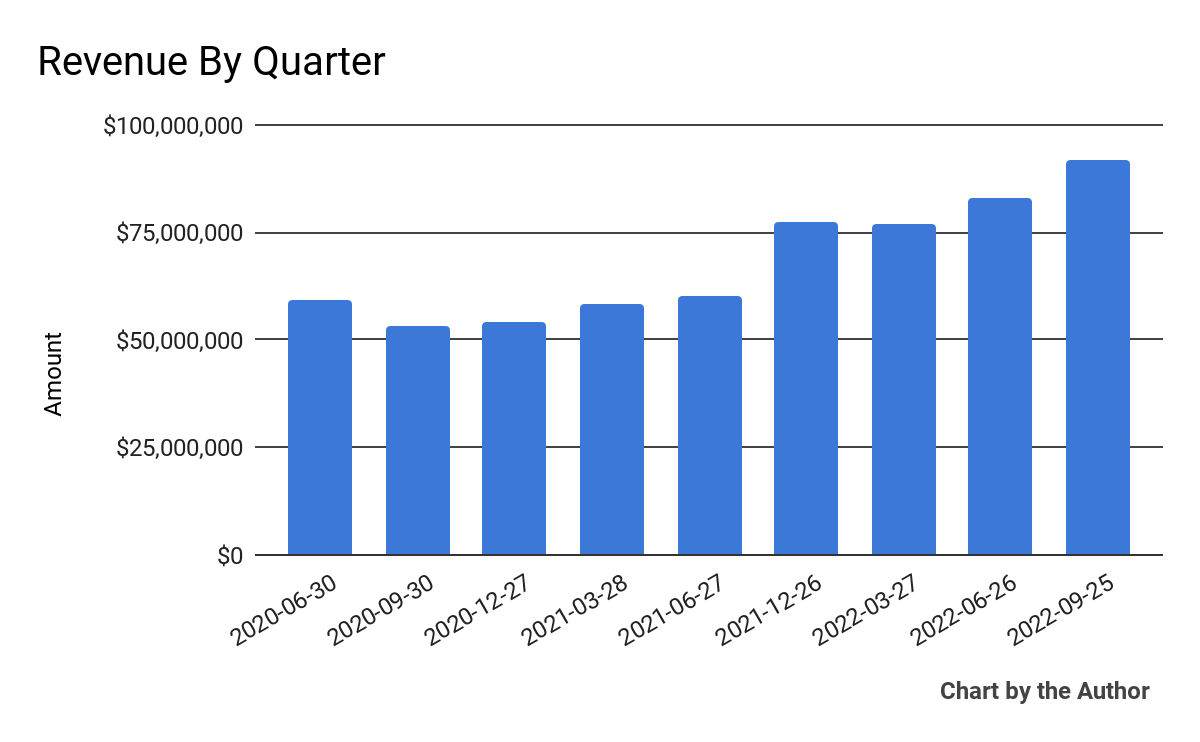

Total revenue by quarter has grown substantially in recent quarters:

9 Quarter Total Revenue (Financial Modeling Prep)

-

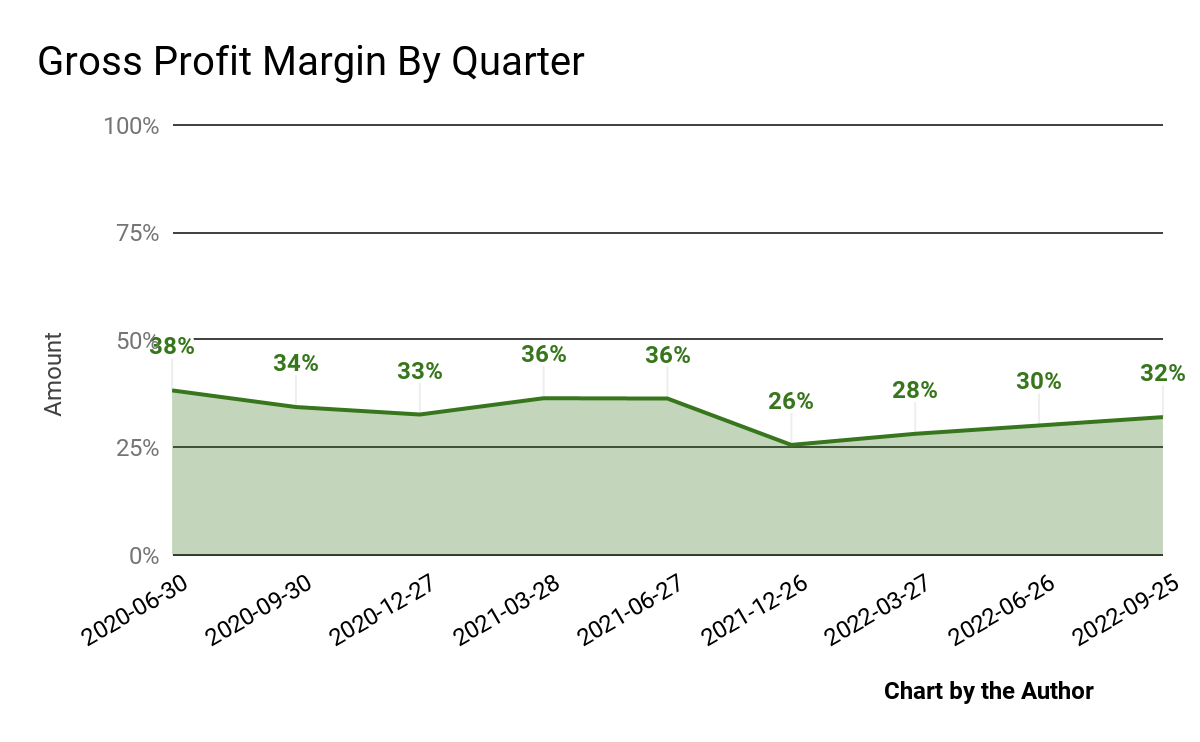

Gross profit margin by quarter has trended lower more recently:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

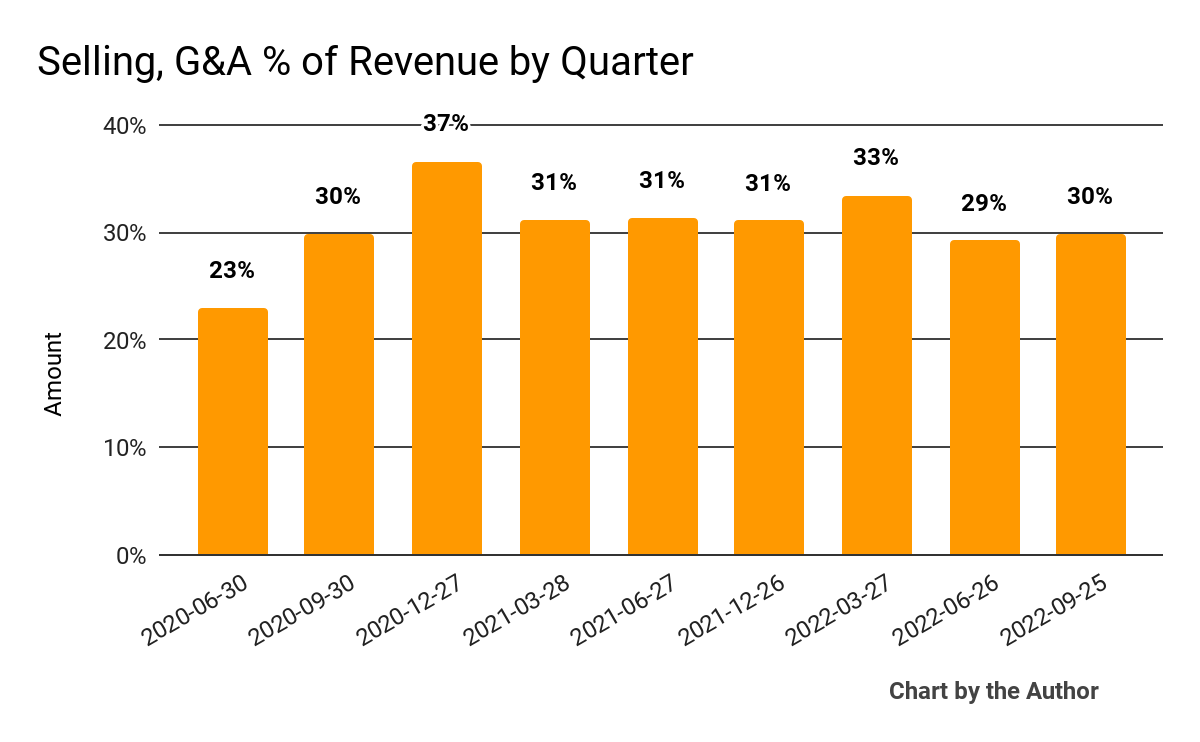

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a narrow range in recent reporting periods:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

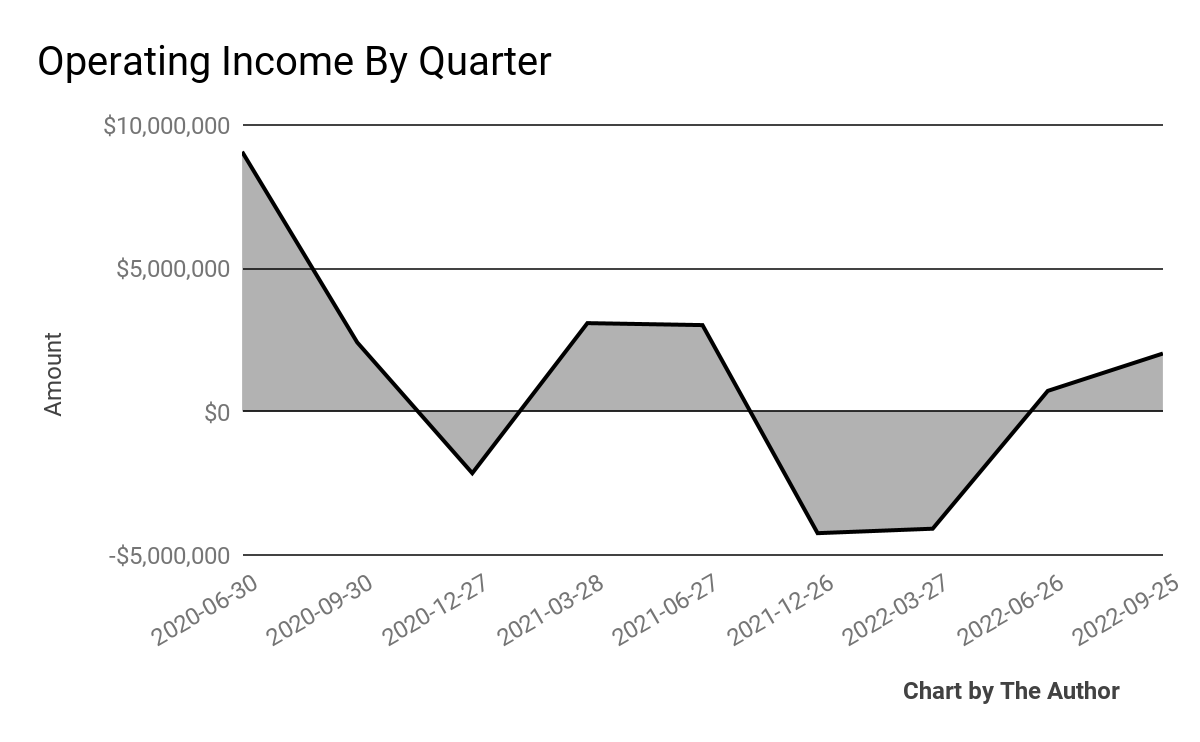

Operating income by quarter has fluctuated between positive and negative results, but has been trending in a negative direction:

9 Quarter Operating Income (Financial Modeling Prep)

-

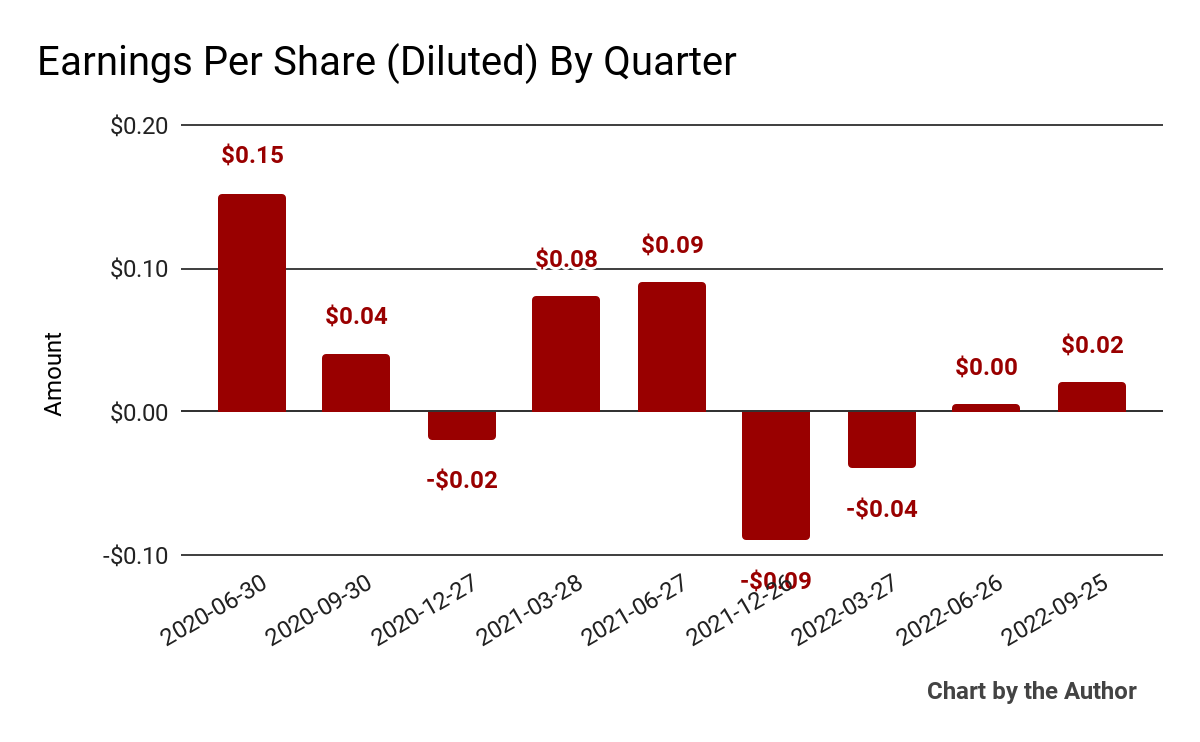

Earnings per share (Diluted) have recently turned positive:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

Valuation And Other Metrics For Vital Farms

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.8 |

|

Enterprise Value / EBITDA |

580.9 |

|

Revenue Growth Rate |

45.6% |

|

Net Income Margin |

-1.3% |

|

GAAP EBITDA % |

0.3% |

|

Market Capitalization |

$618,717,568 |

|

Enterprise Value |

$601,779,263 |

|

Operating Cash Flow |

$689,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.11 |

(Source – Financial Modeling Prep)

As a reference, a relevant partial public comparable would be Cal-Maine Foods; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Cal-Maine |

Vital Farms, Inc. |

Variance |

|

Enterprise Value / Sales |

0.9 |

1.8 |

100.8% |

|

Enterprise Value / EBITDA |

3.4 |

580.9 |

16884.4% |

|

Revenue Growth Rate |

78.8% |

45.6% |

-42.1% |

|

Net Income Margin |

18.7% |

-1.3% |

-106.9% |

|

Operating Cash Flow |

$486,490,000 |

$689,000 |

-99.9% |

(Source – Seeking Alpha and Financial Modeling Prep)

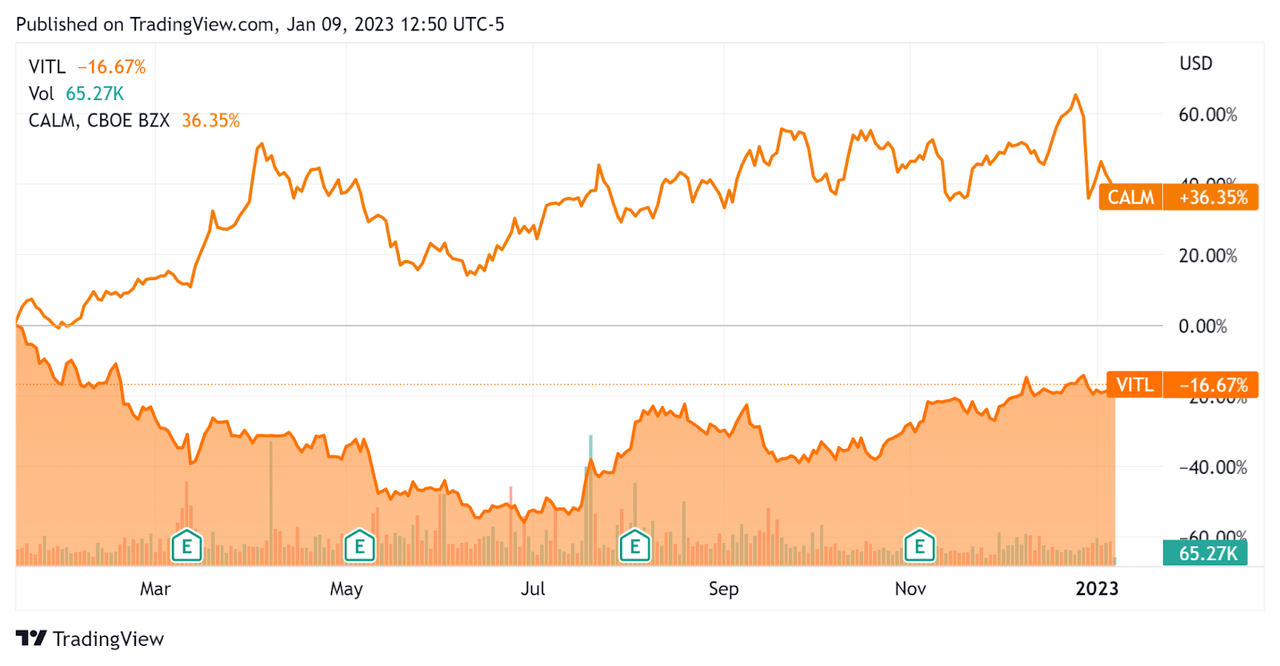

In the past 12 months, VITL’s stock price has performed poorly compared to that of Cal-Maine Foods, as the chart shows here:

52-Week Stock Price Comparison (Seeking Alpha)

Commentary On Vital Farms

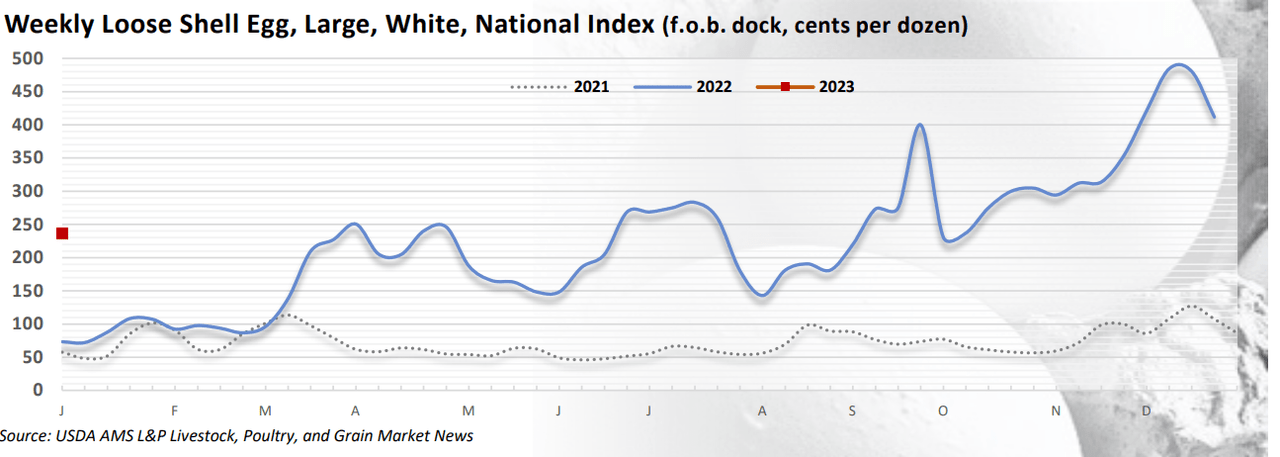

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the growth in shell egg prices during 2022 as well as another planned price increase in January 2023.

Notably, the company has chosen to increase payments to its network of egg suppliers and has also seen the impact of inflation on its operations.

A significant chicken death rate has been underway due to an outbreak of bird flu in the United States, with over 50 million birds dying in 2022 through the end of November.

As to its financial results, total revenue rose 42.4% year-over-year, reaching a record revenue result for the company.

Adjusted EBITDA was 5.7% of net revenue compared to 0.3% in the same period in 2021.

Earnings per share turned positive during the quarter for the first time since Q2 2021’s positive result.

For the balance sheet, the firm finished the quarter with $86.9 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash used was $9.7 million, of which capital expenditures accounted for $9.4 million. The company paid $5.7 million in stock-based compensation.

Looking ahead, management reaffirmed revenue growth guidance for the full-year 2022 of 30% and adjusted EBITDA of $13 million. Note that adjusted EBITDA typically excludes stock-based compensation.

Regarding valuation, the market has amply rewarded egg producer Cal-Maine while disdaining VITL by comparison.

Commodity egg prices appear to be coming off their recent highs, as the loose shell egg chart from the USDA shows below:

USDA

The primary risk to the company’s outlook is the prospect of a further drop in egg prices if the worst of the avian flu outbreak is over, which may spill over into pricing for the firm’s focus on high-quality egg products.

Given how poorly the stock has performed against Cal-Maine, it is difficult to develop an interest in VITL in the current uncertain egg supply environment.

I’m on Hold for VITL in the near term.

Be the first to comment