Sundry Photography/iStock via Getty Images

Background

Our summary bullet points are similar to the first note we published on Vistra Corp. (NYSE:VST) approximately 18 months ago (link to article). Winter storm Uri effectively delayed realization of our original thesis. While VST shares performed well given their circumstances, they did not outperform the broader market as we expected. We believe management has performed well in overcoming Winter storm Uri and we also believe that Vistra is once again well positioned to outperform over the next 12-18 months.

Investment Thesis

The broader market faces substantial head winds while VST has a number of positive catalysts. Consider the broader market headwinds: (1) US economy is likely to slow as households received stimulus checks a year ago and those will not be coming in 2022 creating a negative y/y income comparison and therefore a negative PCE comparison (2) High inflation in basics such as food and fuel not to mention housing translates into less spending power elsewhere (3) Fed raising interest rates with the market pricing in 7 rate hikes (4) Fed allowing US government securities to mature without repurchasing, aka, quantitative tightening (5) War between Ukraine and Russia has contributed to commodities prices surging contributing which in turn contributes to greater drag on economic growth (6) New eruptions/hot spots of Covid19 cases. The main tailwinds are lifting of Covid19 mandates and the fact that geopolitical risks make it more likely for the Fed to raise interest rates at a gradual cadence rather than the 50bp hikes in the future.

Compared to the broad market headwinds, there are a number of tailwinds for Vistra Corp.:

- Debt reduction: Vistra reduced its debt by $625mm during 4Q21 and says it is on track to reduce debt by $1.5B by the end of 2022.

- Credit rating upgrade potential: Based on forecast EBITDA and debt, Vistra is on track to reach investment grade status by no later than 2024.

- Dividend growth: The Board approved a DPS increase of 13%, to $0.17/Q/share and expects to return $300mm to shareholders via dividends in 2022

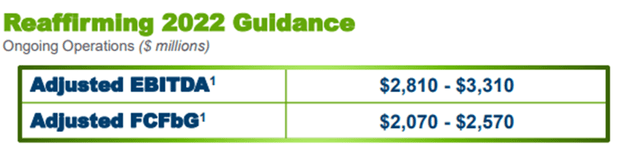

- Free cash flow: With 2022 midpoint Adjusted EBITDA guidance of $3.06B Vistra is expected to generate FCF before growth cap ex of $2.07-$2.57B. With cap ex forecast of $600mm, there is ample fire power for share repurchases.

- Share Repurchase Program: The issuance of $2B in preferred last year not only enabled Vistra to reduce debt, but also enabled it to execute $764mm in share repurchases through February 22. $1.236B remains under the share repurchase program and the company have the ability to issue an additional $500mm in preferred stock under the term of the existing preferred stock outstanding (which we assume they do to get close to achieving management debt reduction goals).

Source: Vistra 4Q21 results presentation

We believe that Vistra Corp shares offer investors one of the more attractive opportunities, not only within the broader market, but within the utility sector. Given the broader market headwinds, the utility sector offers stability as well as a non-discretionary service for consumers. Vistra adds to the sector in that it is well positioned for a potential credit upgrade as it expects to achieve investment grade credit grade metrics by the end of 2023. As such, we would expect VST to be able to achieve an investment grade credit profile by mid-2024 at the latest.

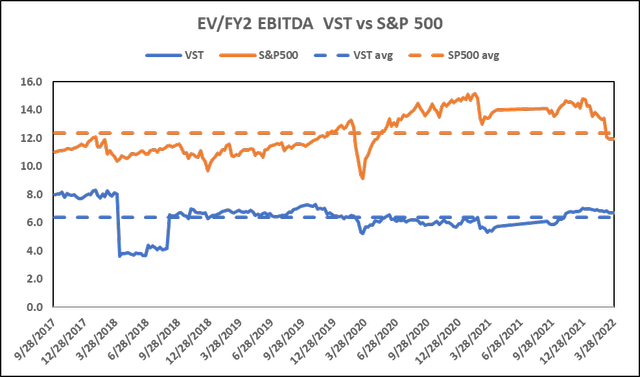

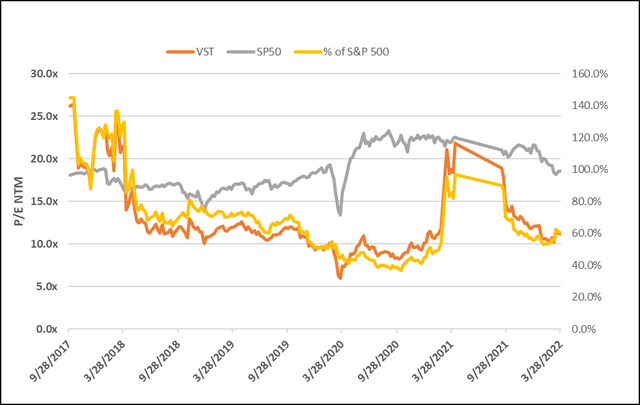

VST trades at a steep discount to the utility sector and the market owing to be primarily a merchant generator. Currently it trades at approximately 6x EV/FY 2 EBITDA as well as a forward P/E in the low double digits.

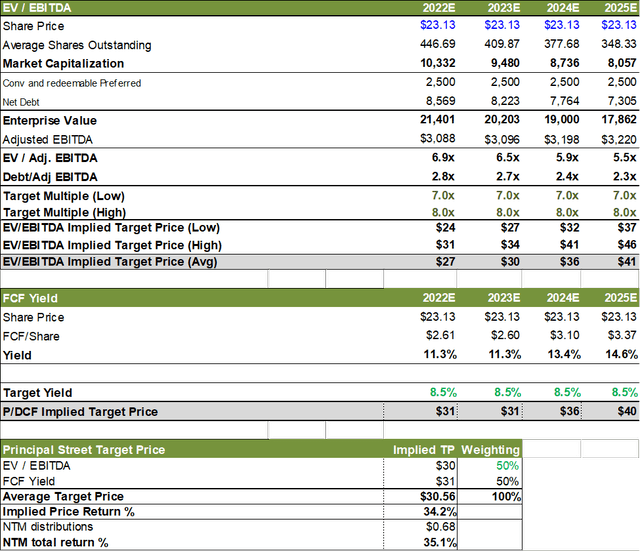

A significant catalyst is that VST generates over $2B/year in FCF which amounts to approximately 20% of its current market value. This kind of cash flow means that VST can drive debt lower such that it should achieve investment grade credit metrics by the end of 2023 and drop well below the debt levels for investment grade credit by mid to late 2024. FCF yield is forecast to reach low double digits this year and next and achieve mid-teens yield by 2025. Upon reaching investment grade credit we believe that the valuation multiple should re-rate higher, and we suggest that the shares should reach at least $27/share by 2023 and by 2023 should reach the low to mid $30s or roughly 50% higher than where shares are currently trading. The $1.236B on VST’s share repurchase program should also assist in driving the VST share price higher.

Source: FactSet, Principal Street estimates

As far as risks, we discussed in (our earlier article) the issues surrounding the Texas power market and the reserve margin outlook

Conclusion

VST shares trade at a low multiple of earnings as well and EV/EBITDA. VST is likely to generate ~$2B/year in free cash flow and reach investment grade credit metrics by 2024 at the latest. The large free cash flow relative to the company’s market cap suggests that VST itself could be the largest source of incremental share purchases and on its own drive shares higher. Considering these factors, we believe that VST shares offer a compelling opportunity for investors.

Be the first to comment