fatido/iStock via Getty Images

The Japanese yen (NYSEARCA:FXY) finally received a catalyst for ending its losses in the form of currency intervention. However, without backing up these moves with monetary policy, Japan’s monetary authorities may have flushed yen down the drain. I was optimistic that the Bank of Japan (BoJ) would implement a slight rate hike in last week’s policy decision as a way to back up the currency interventions. Instead, the BoJ proceeded with business as usual with no change in rates and a continuation of quantitative and qualitative easing [QQE] with yield curve control [YCC]. The market responded with a fresh wave of selling in the yen.

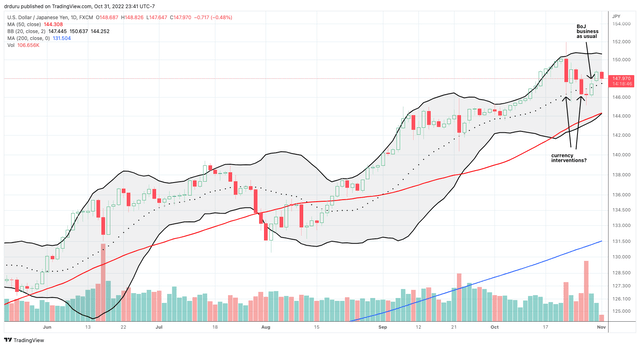

The relentless uptrend in the Invesco CurrencyShares Japanese Yen Trust (FXY) stalled out, but it looks ready to resume without fresh counter-catalysts. (TradingView.com)

The daily chart of USD/JPY suggests major interventions at least twice by Japan’s Ministry of Finance. The Ministry of Finance revealed the extent of its intervention over a month’s time. From September 29th to October 27th, 2022, the Ministry spent ¥6,349.B to defend the yen. So far, USD/JPY has not made a new high, but the BoJ forfeited its chance to control the fate of the yen. Now the baton goes to the U.S. Federal Reserve when it delivers its latest monetary policy on November 2nd. If the Fed’s decision weakens the U.S. dollar, currency flows will naturally flow into the yen as a bet on a final top for USD/JPY. If instead the response is a resurgent dollar, then the BoJ will need to round up more yen.

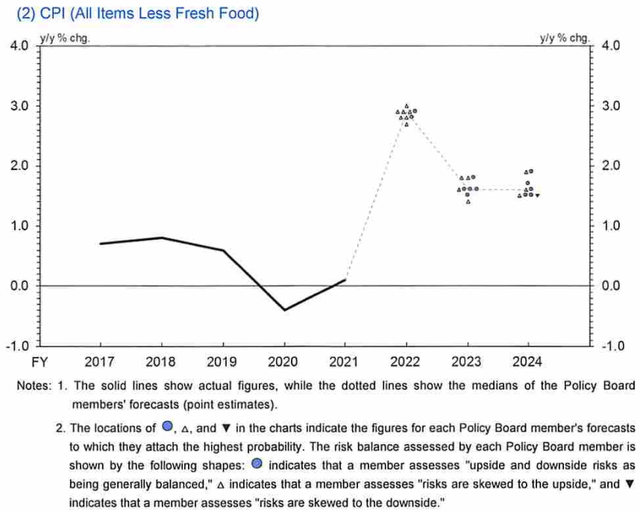

The Bank of Japan is able to maintain its easing posture because inflation expectations remain relatively low in Japan. In its latest Outlook for Economic Activity and Prices, the BoJ produced a benign outlook for inflation. The BoJ expects inflation to dip underneath its 2.0% target in 2023 and 2024 despite a commitment to keep rates extremely low for the foreseeable future.

The Bank of Japan expects core CPI to drop below its 2.0% target despite on-going monetary easing. (Bank of Japan)

The BoJ continues to ease policy despite claiming that risks to prices are skewed to the upside. Still, the mechanism toward higher prices sounds relatively benign compared to the higher prices raging through other advanced economies.

Formation of inflation expectations in Japan is largely adaptive, so an increase in actual inflation is expected to bring about a rise in households’ and firms’ price- and wage-setting behavior and in labor-management negotiations, leading to a sustained rise in prices accompanied by wage increases.

The BoJ fingered a rise in import prices as a main driver for a CPI print above expectations. Of course, the rapid weakening in the yen is in turn helping to drive import prices higher.

What keeps the gas on the monetary policy pedal is a parallel caution about downside risks to economic activity. Yet, the BoJ expects a growth rate that exceeds capacity in the economy. The economic projections are slightly lower because of a summer of COVID and slowing global growth.

Japan’s economy is projected to be under such downward pressure stemming from the slowdowns in overseas economies and the outflow of income, but is likely to recover because a self-sustaining increase in demand, including pent-up demand, is projected to continue with the impact of COVID-19 and supply-side constraints waning. Moreover, the government’s various measures are expected to mitigate the negative impact on income.

The BoJ spent the bulk of its Outlook giving equal discussion to the upside and downside potential in the outlook. There were no clues about the potential for future yen interventions or even conditions under which the BoJ would consider the currency to be excessively weak. For now, the BoJ can note that yen depreciation “has pushed up profits of large firms, mainly those in the manufacturing industry.”

The Trade

For now, I am sticking by the long yen thesis. I recently accumulated January call options in FXY and added shares for good measure. I am assuming the next 10+ weeks is enough time for yen strength to play out. If the strategy fails over this time frame, with Japan’s monetary authorities flushing even more yen down the drain to no avail, then I will reconsider the entire case for an end to yen weakness.

Be careful out there!

Be the first to comment