Oxana Medvedeva/iStock via Getty Images

Investment Summary

Since our last publication on Embecta Corp. (NASDAQ:EMBC) in September, we’ve been consistently evaluating our stance to observe any change in market data. We’d note Embecta Corp. is set to report its Q4 FY22 earnings on December 20th, and leading into the report we’ve decided to evaluate where we stand. As a reminder, our previous examination of EMBC checked its first earnings since its spinoff from Becton, Dickinson (BDX). We uncovered the following key data points:

- At the time of its Q2 FY22 numbers, YTD revenue had slipped 110bps YoY to $855mm, and YoY OpEx was up 35% YoY to $105.8mm [$91.5mm removing the $14.3mm R&D investment].

- Net income slipped from $104mm to $62.4mm, a 40% YoY decrease at the bottom line, on EPS of $1.08. This was mainly due to costs associated with the spinoff, but could potentially skew the Q4 and FY22 EPS print to the upside as sequential growth would stem from such a low base.

- Strong quarterly return on invested capital (“ROIC”) of 8% [36.05% annualized], measured by c.$127mm in net operating profit after tax (“NOPAT”) for the quarter. This was ” well above the WACC hurdle of ~9% by 4 turns” at the time.

- Overhang of net transfers to be made to BDX still present and impacting bottom-line growth.

- Breadth in valuation outputs ranging from $35–$74, with consensus pricing the stock at just 6.5x forward earnings. This was below the peer median of 21x forward P/E at the time. We valued EMBC at $35.

- Internal forecasts of $1.12Bn at the top-line in FY22, pulling down to $4.84 in EPS for the year.

Noteworthy is the recent developments from EMBC with Intuity Medical (POGO) in selling its POGO device [discussed below]. However, we’d need more time to see how this benefits Embecta Corp.

Utilizing an additional combination of chart studies and market data, we’re back here today to reiterate our hold thesis on Embecta Corp. stock heading into its Q4 FY22 earnings print. As the date approaches, we will remain constructive on the stock, seeking out any upsides versus consensus when it does release its Q4 numbers. However, in the event the company fails to meet expectations, we have adequately controlled our risk, by estimation. We’d encourage investors to go along the same lines of thinking.

EMBC Recent developments

In early November the company signed a co-promotional agreement with Intuity Medical, Inc. that will see EMBC sales reps promote POGO’s “POGO Automatic Blood Glucose Monitoring System” in the U.S.

The POGO system consists of a handheld device that utilizes an algorithm to supposedly provide accurate readings with a single drop of blood. It is said to be compatible with any type of lancet and test strip.

To our understanding, it is the only FDA-cleared automated blood glucose monitor that completes the entire collection and testing process with the single press of a button, having received clearance in 2016.

Users can complete up to 10-readings with the internal cartridge before having to replace said cartridge through Intuity. Additionally, the monitor is compatible with any type of lancet and glucose test strip.

Exhibit 1. Example of POGO unit taken from the POGO website

Data: https://presspogo.com/

This is an advanced unit that has interesting economics tied into the mix, which is quite relevant to EMBC’s ability to move these at a profit.

The device sells over the counter and reportedly costs $68. The replacement cartridge is said to cost $32 for a package of 5 [50 tests total, ~1 months’ supply]. One can also purchase 150 tests for $96, 250 tests for ~$160, or pay roughly ~$60 for 150 tests if under private insurance.

The question really will be how POGO stands up to comparable, leading products in the market, such as Abbott Laboratories’ (ABT) FreeStyle Lite and FreeStyle Libre. For instance, the latter is a continuous blood glucose monitoring system that is worn continuously with a reading taken by hovering a smart phone over the unit. How POGO fares up to these will determine what viability of success EMBC realizes from the collaboration in our opinion.

Positioning for EMBC into Q3 earnings

We recognize that it’s still early days for EMBC as a standalone entity trading on the U.S exchanges. Nevertheless, we’ve been actively monitoring its price evolution to gauge how the market is positioning in the stock.

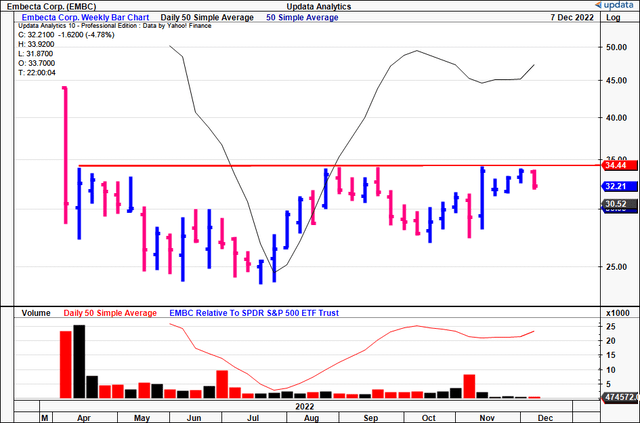

We’d note that the market appears bullish on EMBC stock, and this should absolutely be factored into positioning heading into Q4 earnings.

First, you can see the stock testing its line of resistance below, a mark it has failed to break 3-4x this year.

Meanwhile, weekly volume trends have been thin, and pale in comparison to the listing back in April. A break above this resistance line would add a bullish weight to the risk/reward symmetry in our opinion.

Exhibit 2. EMBC weekly price evolution since listing in April. Again testing clear resistance level, having failed 3-4x at this mark already in 2022.

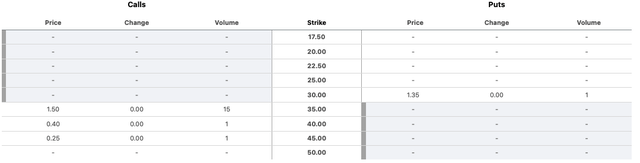

Looking at the EMBC option chain for January and February 2023 respectively [next expiry is December 16th, before EMBC’s earnings] we see investors are bullish in a price range of $20-$45. Strikes for calls expiring in both Jan and Feb are concentrated at the $35 and $40 mark respectively. Hence, investors are speculative on EMBC pushing to these levels. Whereas puts for the same tenor are stacked from $30–$35, as seen below.

Hence, the market is pricing in additional upside for the stock to these levels, which must be factored into the investment debate.

Exhibit 3. EMBC Jan-23′ option chain [ITM, calls and puts OI shown]

Data: Seeking Alpha, EMBC Options

Exhibit 4. EMBC Feb–23′ option chain [ITM, calls and puts OI shown]

Data: Seeking Alpha, EMBC Options

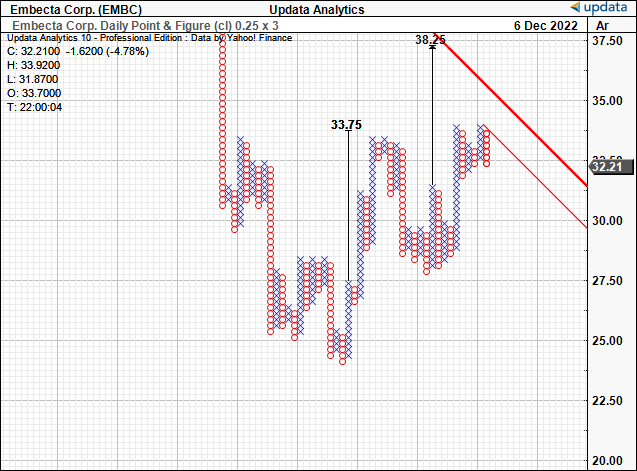

Further confirmation of the above is seen in our point and figure studies that suggest upside targets to $38, as seen below.

Exhibit 5. Upside targets to $38.25.

Data: Updata.

In short

Despite its recent developments and the available market data, we’ve seen no reason to change our position regarding EMBC prior to its Q4 FY22 earnings print. We look forward to scrutinizing the numbers once they’re available from December 20th. However, until then we’d prefer to control our risk and observe the post-earnings drift that may follow. Investors are notably bullish on Embecta Corp. stock, however, we’d also point out the price targets are still in the realms of our previous valuation of $35. Hence, we reaffirm our hold on Embecta Corp. until further data is available to suggest otherwise.

Be the first to comment