gorodenkoff/iStock via Getty Images

Investment Thesis

Vishay Precision Group, Inc. (NYSE:VPG) is a global company involved in precision measurement sensing technologies with its headquarters in Malvern, United States. In this thesis, I will mainly analyze the company’s Q3 2022 results and its future growth prospects. I will also be analyzing the company’s valuation at current price levels and its growth potential. I believe VPG is one of the best stocks in the sensor and measurement technology space, and I advise investors to buy it at the current price levels.

About VPG

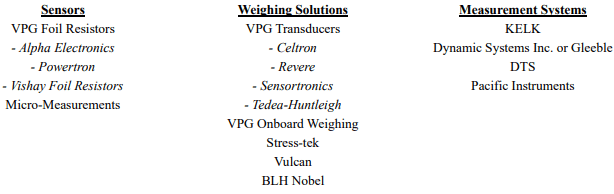

VPG produces and sells specialized sensors and measurement systems, and solutions. The company’s business can be categorized into three segments; the sensors segment, the weighing solutions segment, and the measurement systems segment. The sensors segment contributes the majority of the revenue at 42%, followed by the weighing solutions segment at 35% and the measurement systems segment at 23%. The company has a diversified product portfolio which includes products like material testing and simulation systems, data acquisition systems, on-board weighing systems, strain gages, and precision resistors. The company markets its products under multiple brand names globally. As we can see in the image below, the company has different brands within each segment.

Investor Relation APG

Q3 2022 Results

VPG recently reported the third quarter 2022 results beating the market EPS estimates by a significant 9.5%. The revenue was in line with the market estimates. The company experienced a substantial improvement in the gross and net profit margins while maintaining a healthy revenue growth rate. As per my analysis, the sensors segment proved to be an outperformer with expanding gross profit margins and strong demand experienced by the advanced sensor products.

VPG reported Q3 2022 revenue at $90 million, a 9.8% increase compared to $82 million in the corresponding quarter last year. I believe the primary revenue driver was the increase in the sales of precision resistors and advanced sensory products. If we break down the revenue with respect to the three segments, we realize that the sensors segment witnessed a significant improvement, with the revenue from the segment increasing 23% to $38 million compared to $30.7 million in the same quarter last year. The gross profit margins for the segment also experienced a significant improvement from 31.1% in Q3 2021 to 40.5% in Q3 2022. The weighing solutions segment revenue grew 2.4% to $31.4 million compared to $30.7 million in the corresponding quarter last year. As per my analysis, the higher volume of products sold coupled with higher sales prices was the main reason for this increase. However, the foreign currency exchange rates had a significant impact on the company’s performance. If we exclude the impact of foreign exchange rates, the weighing solutions segment revenue grew 10.3% y-o-y. The measurement systems segment revenue remained flat at $20.8 million, but the gross profit margin improved from 52.8% to 55.5% y-o-y. The operating income for Q3 2022 stood at $11.9 million, up a significant 65% compared to $7.2 million in the same quarter last year. The company managed to keep the operating expenses in control despite the inflationary headwinds, which I believe is a big positive for the company. The diluted EPS stood at $0.74, up a significant 90% compared to $0.39 in the same quarter last year.

Overall, the company’s performance in Q3 2022 was quite impressive, showing improvement on multiple parameters. VPG witnessed profit margin expansion while maintaining a significant growth rate. The company has provided an optimistic revenue outlook for Q4 2022, with estimated revenue in the range of $88-$98 million. I believe VPG will manage to achieve this target and even exceed it given the company’s growth trajectory and improved performance from the sensors segment

Key Risk Factor

Foreign currency exchange rate fluctuations: VPG has a significant operation outside the United States, mainly in the European countries and Asia Pacific. The foreign currency exchange rate had a material impact on the company’s performance in the recent quarter. The revenue from each business segment suffered the effect of the foreign currency exchange rate fluctuation. The company doesn’t indulge in any hedging activity to mitigate the impact of the foreign currency fluctuation, and a higher fluctuation in the foreign currency rates could have a material impact even in the future.

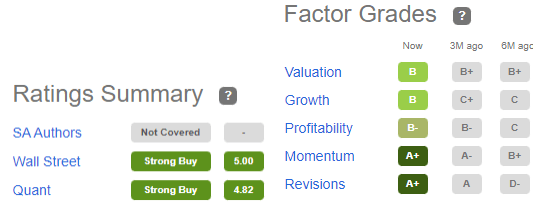

Quant Ratings and Valuation

Seeking Alpha

VPG has a Quant rating of strong buy, reflecting the company’s upside potential. The company has a B grade in the valuation and growth segment, which I believe could see a substantial improvement in the coming quarters with the consistent revenue growth rate and profit margin expansion. The company has improved grades in most of the segments compared to three months ago period, which reflects the company’s improved financial and fundamental position in the market. The strong buy rating by Wall Street further strengthens my thesis and represents the optimistic outlook of the analysts for VPG. The Wall Street analysts have an average price target of $59 for VPG, representing a solid 50% upside from current price levels.

VPG is currently trading at a share price of $39, a YTD increase of 7%. The company has a market cap of $550 million. I believe VPG is highly undervalued on multiple parameters compared to its competitors. It is trading at a forward P/E multiple of 15x compared to the industry average of 23x. Even if we look at the PEG ratio for VPG, which generally is considered a better evaluation method for growth companies, we realize that it is trading at a forward PEG multiple of 0.80x against the industry standard of 1.5x. A PEG multiple below 1x is considered good for growth companies, and it reflects that the company is undervalued. I believe VPG has significant upside potential with respect to current price levels.

Conclusion

VPG reported an impressive quarterly result, maintaining a solid growth rate and simultaneously expanding the profit margins. The company has provided strong future revenue guidance representing the management’s confidence in the company’s growth. VPG is highly undervalued at the current price levels, with a forward P/E multiple of 15x and a forward PEG ratio of 0.80x. I believe VPG is a great investment opportunity for the investors looking for a growth company at a cheap valuation. I assign a buy rating for VPG after considering all the growth and risk factors.

Be the first to comment