John Pennell

Earnings of Northrim BanCorp, Inc. (NASDAQ:NRIM) will most probably dip this year due to higher provisioning for loan losses and lower mortgage banking income. On the plus side, both the loan portfolio size and the net interest margin are likely to trend upwards in the last nine months of 2022. Overall, I’m expecting Northrim BanCorp to report earnings of $4.63 per share for 2022, down 23% year-over-year. Compared to my last report on Northrim, I have barely changed my earnings estimate, as my downward revision of the loan growth estimate cancels out the downward revision in operating expenses. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Northrim BanCorp.

Loan Growth to Pivot on Alaskan Oil Prices

Northrim BanCorp’s loan portfolio declined by 2.6% during the first quarter of 2022, which was the fourth straight quarter of declines. The prolonged loan declining trend is likely to reverse soon because most of the Paycheck Protection Program (“PPP”) forgiveness was over by the end of March 2022. As mentioned in the 10-Q Filing, approximately 99% of PPP round one and 74% of PPP round two loans had been forgiven by the end of March 2022. PPP loans outstanding totaled $64.3 million at the end of March, representing 5% of total loans.

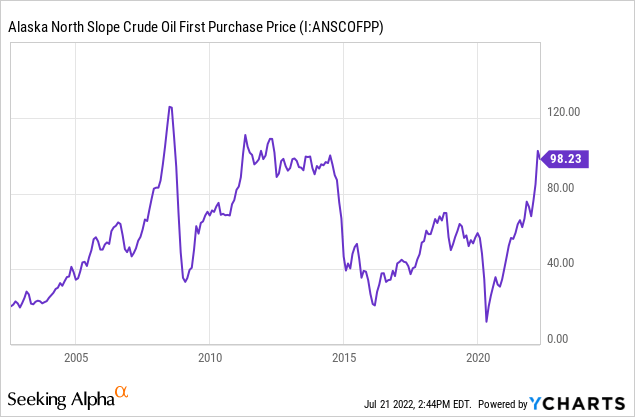

Moreover, the persistently high oil prices over the last year bode well for credit demand going forward. As shown below, Alaska North Slope Crude is near its multi-year highs.

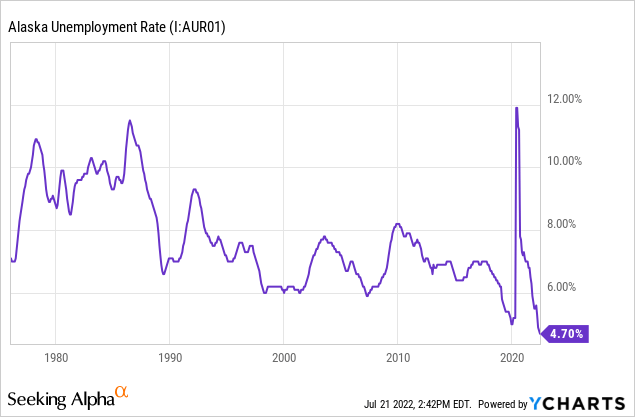

The high oil price is one of the reasons why Alaska’s job market has reached the strongest level in decades. As shown below, the unemployment rate now stands at 4.7%, which is higher than the national average but still at a multi-decade low.

Further, Northrim BanCorp is continuously striving to expand its presence in Alaska. As mentioned in the earnings release, the company opened a new loan production office in Nome, Alaska during the first quarter of 2022. Nome is a small city of only 3,869 residents representing just 0.5% of Alaska’s population. In comparison, Anchorage, the city where Northrim is headquartered, has a population of 280,437.

Considering these factors, I’m expecting the loan portfolio to grow by 3% in the last nine months of 2022. Combined with the first quarter’s decline, I’m expecting the loan book to grow by just 0.4% this year. In my last report on Northrim BanCorp, I estimated loan growth of 2%. I have now reduced my loan growth estimate mostly because of the first quarter’s poor performance.

Meanwhile, other balance sheet items will likely grow in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 933 | 965 | 1,024 | 1,423 | 1,402 | 1,407 |

| Growth of Net Loans | (2.3)% | 3.4% | 6.2% | 38.9% | (1.5)% | 0.4% |

| Other Earning Assets | 353 | 365 | 429 | 506 | 1,157 | 1,105 |

| Deposits | 1,258 | 1,228 | 1,372 | 1,825 | 2,422 | 2,414 |

| Borrowings and Sub-Debt | 45 | 52 | 19 | 25 | 36 | 36 |

| Common equity | 193 | 206 | 207 | 222 | 238 | 239 |

| Book Value Per Share ($) | 27.6 | 29.5 | 30.4 | 35.0 | 38.5 | 39.9 |

| Tang. Book Value Per Share ($) | 25.3 | 27.2 | 28.1 | 32.5 | 35.9 | 37.2 |

|

Source: SEC Filings, Author’s Estimates (In USD million, unless otherwise specified) |

Highly Rate-Sensitive Loan Portfolio to Lift the Margin

The asset side of Northrim BanCorp’s balance sheet is quite sensitive to interest rate hikes. This is because 73% of core portfolio loans are based on adjustable rates, as mentioned in the earnings release. These adjustable-rate loans are subject to rate increases in line with changes in prime rate and other indices.

Unfortunately, the liability side is also quick to re-price. This is because interest-bearing demand, savings, and money market accounts made up a hefty 57.8% of total deposits at the end of March 2022. However, there is excess liquidity in the banking industry, which has given banks greater than usual power to price deposits. As a result, the deposit beta (i.e., the sensitivity of deposit cost to interest rate hikes) may remain low this year.

Meanwhile, the tapering off of the accelerated booking of PPP fees will also hurt the net interest margin. Overall, I’m expecting the margin to increase by 30 basis points in the last nine months of 2022 from 3.2% in the first quarter of the year. Compared to last year, the margin will likely be around 30 basis points lower this year.

High Interest Rates to Keep Provisioning Elevated

Northrim BanCorp’s nonperforming loans made up 0.70% of total loans at the end of March 2022. In comparison, allowances made up 0.82% of total loans. The allowance coverage of nonperforming loans seems a bit tight especially as the interest rate spike in the coming months is likely to hurt the debt servicing ability of those borrowers that are paying adjustable rates. Further, the threats of a recession will encourage the management to build up its reserves immediately.

Overall, I’m expecting the provision expense to be slightly above normal for the last nine months of 2022. However, combined with the first quarter’s large provision reversal, the net provision expense for the full year will likely remain below normal. I’m expecting the net provision expense to make up 0.03% of total loans in 2022. In comparison, the provision expense averaged 0.06% of total loans from 2017 to 2019.

Expecting Earnings to Dip by 23%

The above normal provisioning in the last nine months of 2022 will likely be one of the biggest reasons for an earnings decline this year relative to last year. Further, lower mortgage banking revenues will drag earnings. Meanwhile, the net interest income will likely remain almost unchanged from last year. Overall, I’m expecting Northrim to report earnings of $4.63 per share for 2022, down 23% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Income Statement | ||||||

| Net interest income | 58 | 61 | 64 | 71 | 81 | 81 |

| Provision for loan losses | 3 | (1) | (1) | 2 | (4) | 0 |

| Non-interest income | 40 | 32 | 37 | 63 | 52 | 40 |

| Non-interest expense | 71 | 70 | 77 | 89 | 89 | 86 |

| Net income – Common Sh. | 13 | 20 | 21 | 33 | 38 | 28 |

| EPS – Diluted ($) | 1.88 | 2.87 | 3.04 | 5.11 | 6.00 | 4.63 |

|

Source: SEC Filings, Author’s Estimates (In USD million, unless otherwise specified) |

In my last report on Northrim Bancorp, I estimated earnings of $4.64 per share for 2022. My earnings estimate has barely changed as the downward revision in loan growth estimate cancels out the commensurate drop in operating expenses estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation. The new Omicron subvariant also bears monitoring.

NRIM Trading at a Significant Discount to its Target Price

Northrim BanCorp is offering a dividend yield of 4.0% at the current quarterly dividend rate of $0.41 per share. The earnings and dividend estimates suggest a payout ratio of 35% for 2022, which is the same as the five-year average. Therefore, the anticipated earnings dip presents no threat to the level of dividend payout.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Northrim BanCorp. The stock has traded at an average P/TB ratio of 1.19 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 25.3 | 27.2 | 28.1 | 32.5 | 35.9 | ||

| Average Market Price ($) | 31.3 | 37.8 | 36.5 | 28.5 | 41.9 | ||

| Historical P/TB | 1.24x | 1.39x | 1.30x | 0.88x | 1.17x | 1.19x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $37.2 gives a target price of $44.4 for the end of 2022. This price target implies a 7.7% upside from the July 20 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.09x | 1.14x | 1.19x | 1.24x | 1.29x |

| TBVPS – Dec 2022 ($) | 37.2 | 37.2 | 37.2 | 37.2 | 37.2 |

| Target Price ($) | 40.7 | 42.6 | 44.4 | 46.3 | 48.2 |

| Market Price ($) | 41.3 | 41.3 | 41.3 | 41.3 | 41.3 |

| Upside/(Downside) | (1.3)% | 3.2% | 7.7% | 12.2% | 16.7% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.9x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.88 | 2.87 | 3.04 | 5.11 | 6.00 | ||

| Average Market Price ($) | 31.3 | 37.8 | 36.5 | 28.5 | 41.9 | ||

| Historical P/E | 16.6x | 13.2x | 12.0x | 5.6x | 7.0x | 10.9x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.63 gives a target price of $50.4 for the end of 2022. This price target implies a 22.2% upside from the July 20 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.9x | 9.9x | 10.9x | 11.9x | 12.9x |

| EPS 2022 ($) | 4.63 | 4.63 | 4.63 | 4.63 | 4.63 |

| Target Price ($) | 41.1 | 45.8 | 50.4 | 55.0 | 59.7 |

| Market Price ($) | 41.3 | 41.3 | 41.3 | 41.3 | 41.3 |

| Upside/(Downside) | (0.3)% | 10.9% | 22.2% | 33.4% | 44.6% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $47.4, which implies a 14.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 18.9%. Hence, I’m adopting a buy rating on Northrim BanCorp.

Be the first to comment