2Ban

It’s been a while since my last update on the major credit card companies, Visa (V) and Mastercard (MA). While the rest of market has had a rough 2022, both stocks are approximately flat YTD. Both companies are high margin cash cows, but the valuations still look rich to me. I’m not looking for a 15x earnings multiple to start buying (which would be a slam dunk in my mind), but they aren’t cheap enough for a margin of safety. Both stocks remain on my watchlist due to their impressive business models, and shares have had an impressive run in the last couple months of more than 20%.

Investment Thesis

Visa and Mastercard are two high quality businesses that have earned their premium valuations for several reasons. Both companies have solid balance sheets with plenty of cash and impressive income statements that showcase the high margin nature of their businesses. Both can borrow at low interest rates and have consistently grown their dividends at double digit rates. They have also been consistently buying back stock for several years.

The main reason I don’t own either stock today is the rich valuations. Visa currently trades at 28.5x earnings which is slightly above their average multiple. Mastercard is even more expensive at 34.6x earnings. It’s not surprising as both have consistently grown the bottom line at double digit rates, but I don’t see a margin of safety in either stock today. The yield isn’t much either as both yield less than 1%. I will be looking for buying opportunities in Visa and Mastercard, and I wouldn’t recommend selling, but I’m not a buyer today either.

Visa’s 10-K

Visa recently reported its annual results showing that the business continues to hum along. I skimmed the 10-K and there is a lot to like about the financials. The top line showed impressive growth, from $24.1B in 2021 to $29.3B in 2022. They also maintained their net margins over 50%, an impressive feat. Visa has averaged double digit top and bottom-line growth for years, and that is projected to continue over the next couple years.

A quick peek at the balance sheet shows $20B in debt, which might seem like a lot, the debt breakout shows a lot to like. The maturities are well laddered, and most of the notes carry interest rates in the 2-3% range. Some are as little as 0.75% or as high as 4.3%, but the company’s AA- S&P credit rating means Visa should be able to continue to borrow at low interest rates. I don’t think the debt level is too high either, with $15.7B in cash and equivalents and $4.3B in restricted cash and investments to balance things out.

Mastercard’s 10-Q

Mastercard followed suit with another impressive quarter of its own. The top and bottom lines showed double digit growth for the first nine months of the year. Revenue grew from $13.7B in the first nine months of 2021 to $16.4B in 2022, with net income growing from $6.3B to $7.4B. Mastercard doesn’t quite have the margins that Visa does, but it is no slacker either, with 45% net margins for the first nine months of the year.

Mastercard also has plenty of cash, with $7.6B in cash and equivalents and another billion in restricted cash and investments. Mastercard had $14.5B in debt outstanding at the most recent report, most of which is also in the 2-3% interest rate range. They also have an impressive credit rating at A+, so they will likely be able to continue to get attractive terms on future notes. Due to their impressive business models and results, both Visa and Mastercard carry a well-deserved premium valuation.

Valuation

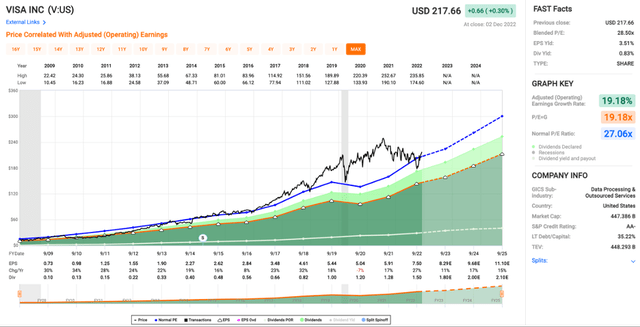

Visa is currently trading at 28.5x earnings, which is a little rich for my tastes. It is slightly above the average multiple of 27.1x. As you can see below, shares have spent most of their time above the average multiple in recent years, and any time shares touch the blue line in recent years has turned out to be a decent buying opportunity. Estimates for Visa are expecting continued double-digit growth in the bottom line, something that has been consistent for the company outside of the slight decline in 2020 that were likely caused by COVID lockdowns.

Price/Earnings (fastgraphs.com)

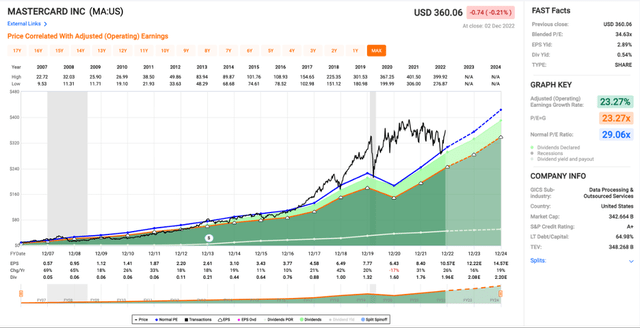

While Visa less expensive than Mastercard, I don’t think the current valuation for either company leaves much in the way of a margin of safety. Mastercard currently has an earnings multiple of 34.6x, which is also above the average multiple of 29.1x. Based on estimates, it looks like Mastercard will have slightly better earnings growth over the next couple years than Visa. Like Visa, it has also spent most of the time in recent years well above the average valuation multiple.

Price/Earnings (fastgraphs.com)

While the premium valuations make it hard for me to pull the trigger on either company, I can understand why both stocks are seldom cheap. They are proven long term compounders with impressive financials and huge margins. They also offer impressive dividend growth, even if the starting yields are small.

Dividend Growth

Neither of these companies will attract many investors looking for current income, but the dividend growth has been consistent and impressive. Visa currently yields 0.8% while Mastercard’s yield is 0.5%. They make up for that small yield with dividend growth. Visa recently announced a significant hike with its most recent quarterly dividend, from $0.38 to $0.45. Mastercard is due for a dividend hike in the next quarter if the pattern continues, and I’m expecting an increase in the ballpark of 10%. Both companies have low payout ratios that give them plenty of cushion for future increases. They also have been returning capital to investors in the form of buybacks.

Buybacks

Visa repurchased 56M shares in 2022 for a total of $11.6B. This was at an average price of $206.47. The current program had $5.2B remaining at year end, and they reloaded the buyback authorization in October with an additional $12B. Mastercard has also been buying back a large chunk of shares, with 18.3M shares repurchased in the first nine months of the year. They spent $6.3B for an average price just over $345. They have $5.6B remaining on the current authorization and I wouldn’t be surprised if they follow suit and authorize more buybacks in the next year.

Conclusion

Visa and Mastercard are two businesses that definitely fall in the high-quality bucket. It is so obvious to investors that they routinely carry earnings multiples above 30x, which is rare for companies of their size (approximately $450B and $350B market caps, respectively). Both companies have impressive balance sheets and very high margins. The problem is that neither stock offers much of a margin of safety, despite impressive growth track records and forward estimates.

While I like the dividends and buybacks, I would rather see larger dividend hikes and fewer buybacks due to the valuations of both stocks. This is certainly nitpicking, but I would be leaning towards larger dividend hikes over buybacks when both stocks are trading at 30x earnings (give or take). With yields of 0.8% and 0.5% and payout ratios below 20%, both have plenty of room for future dividend hikes, even if both companies continue to emphasize buybacks.

They will stay on my watchlist for now, but I will be looking for buying opportunities if we see broader market weakness in 2023. I might have missed the most recent chance as shares are up over 20% in the last couple months, but if they get cheaper in the next year, I will be looking to start a position. If I had to choose one to buy today, I would probably go with Visa, due to the lower valuation, better margins, and its slightly larger dividend.

Be the first to comment