blackdovfx

Written by George Spritzer, co-produced by Alpha Gen Capital

(Data below is sourced from the Virtus and BlackRock websites unless otherwise stated.)

Author’s note: An earlier version of this article was released to Yield Hunting members on Nov. 21, 2022. Please check latest data before investing.

At the end of each year, many investors look over their portfolios and seek to offset previous capital gains with losses, or generate new losses to carry over to future tax years. With closed-end funds, this tax loss selling effect causes strong selling pressure in specific sectors that were especially weak earlier in the year. This often results in wider discounts.

In 2022, there are many weak sectors in both fixed income and equities. But one of the weakest areas has been funds that are similar to the Cathie Wood ARK ETFs that specialize in “disruptive” technology.

In this article, I cover a technology-based closed-end fund that is trading at a relatively high discount. It should benefit from a tax loss selling bounce once the tax loss selling period is over.

At one time, this bounce from tax loss selling would occur early in the new year, but more recently it has been occurring earlier. Sometimes you see a nice bounce in late December as we approach the year-end.

Virtus Artificial Intelligence & Technology Opportunities Fund Ticker: (NYSE:AIO)

Inception Date: Oct. 31, 2019

Total Managed Assets: 803.9 Million

Total Common Assets: 673.9 Million

Baseline Expense Ratio= 1.53%

Leverage: 16.26%

Discount= -14.51%

Average 1 Year discount= -10.74%

Annual Distribution Rate (market price) = 10.61%

Current monthly distribution= $0.15

Annual Distribution= $1.80

Sub-Advisor: Voya

Investment Objective

AIO invests in a combination of securities issued by artificial intelligence companies and in other companies that stand to benefit from artificial intelligence and other technology opportunities.

The fund seeks to generate a stable income stream along with growth of capital using a multi-asset approach.

Investment Strategy

Differentiated Approach — AIO employs a differentiated, multi-asset approach which strives to create an attractive risk/reward profile through fundamental research and dynamically allocating across public and private investments in convertible securities and equities.

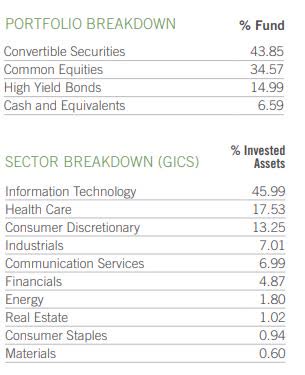

Portfolio Sector Breakdown (as of 09/30/2022)

AIO Sector Breakdown (Virtus web site)

AIO- Top 10 Holdings (as of 09/30/2022)

AIO Top 10 Holdings (Virtus web site)

Limited Term Feature

AIO was set up as a limited-term fund with a termination date of October 29, 2031. This will provide a tailwind as the current 14.5% discount should gradually dissipate as we approach the termination date in nine years.

The board has the option to extend the fund’s termination date for a total of 18 months. Note that the Fund is not a “target term” fund and will not seek to return the Fund’s initial public offering price per share.

AIO- Institutional Ownership

Institutional investors own about 15.7% of the shares outstanding. The top two institutional investors are Morgan Stanley who owned $15.7 million and Karpus Management who owned $11.2 million as of 09/30/2022. Many of the Morgan Stanley shares are likely held by financial advisors in managed accounts.

Aside from Karpus Management, I do not see any other CEF activist investors with large holdings. Karpus substantially added to its position in the third quarter of 2022, adding 421,038 shares bring its current total to 666,465 shares.

Source: nasdaq.com

AIO- Investment Performance: NAV Return as of 11/18/2022

YTD -20.42%

1-Year -21.97%

3-Year +10.98% annualized

NAV performance has been negative so far in 2022, but AIO has actually beaten its peers during this period. Morningstar ranks its performance #1 out of five funds in its Technology category.

Source: morningstar.com

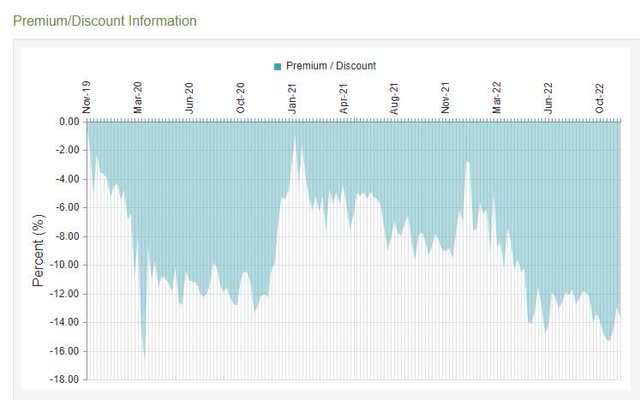

AIO- Three Year Discount History

AIO Discount History (cefconnect)

Effective Leverage has been running around 20% of managed assets. They primarily use reverse repo agreements or other derivative instruments with embedded leverage.

Z-Score Analysis

The discount to NAV as of November 23 is -14.51%.

Here are some of the current Discount Z-Scores:

Three months: -0.27 Six months: -0.49 One Year: -0.93

Source: cefconnect

Summary

There are several reasons I like AIO here:

- Year-end tax loss selling is occurring in many of their holdings. We could see a bounce as we approach year-end or in early 2023.

- Tailwind from the 14.5% discount and termination date in 2031.

- The underlying “AI disruptive” portfolio does not only own risky AI research stocks. The top two holdings are UNH and DE, which are solid blue chips that use AI technology.

I would try to buy AIO at a discount of 14% or higher. The fund is fairly liquid, with an average trading volume of over 125,000 shares a day.

Be the first to comment