Thaweesak Saengngoen

For quite some time now, Americans have been desperately seeking additional sources of income. This is largely in response to the pervasive inflation that has been devastating our income. As this inflation has been focused in the critical areas of food and energy, maintaining the purchasing power of our incomes is very important. This has forced many people to take on second jobs or perform other activities in order to obtain the extra money that they need to feed themselves and their families. Fortunately, as investors, we have other possibilities available. One of the best of these options is to purchase shares of a closed-end fund that focuses on income. These funds can provide investors with easy access to a diversified portfolio of income-producing assets that can utilize various strategies in order to produce a yield that is significantly higher than that of any of the underlying assets. In this article, we will discuss the Lazard Global Total Return & Income Fund (NYSE:LGI), which is one fund that can be used for this purpose. The fund boasts a very impressive 10.02% yield at the current price, which is certain to turn heads and provide investors with a sufficient increase in their purchasing power to achieve our goals. The fact that the fund is trading at a reasonable price is an added bonus so read on and determine if this fund could be a worthy addition to your portfolio.

About The Fund

According to the fund’s webpage, the Lazard Global Total Return & Income Fund has the stated objective of providing its investors with a high level of total return consisting of capital appreciation and income. This is hardly unusual for a closed-end fund, especially one that focuses on investing in equities. After all, as investors, we typically buy stocks in order to generate a total return since these investments are designed to deliver a return both through capital appreciation and through dividends paid by the issuing company. As the name of the fund implies, management will invest the fund’s assets into a portfolio of both American and foreign stocks. However, the somewhat unique thing comes from the fact that the fund will also include things such as forward contracts on emerging market currency and may also include emerging market debt. This could be an interesting way to boost the fund’s income since emerging markets often have considerably higher interest rates than developed markets. Their currencies are also frequently perceived to be somewhat riskier than those of developed markets so that is something that could concern more conservative investors that desire the preservation of capital. However, these forward contracts and emerging market debt securities will normally constitute such a small percentage of the portfolio that it should not really be a concern.

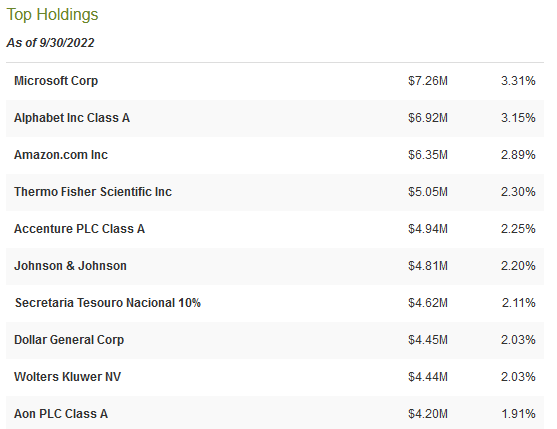

Although the fund invests in both American and foreign stocks, the largest positions in the fund are largely comprised of the same major American companies that occupy the largest holdings in most other closed-end funds. However, there are certainly some significant differences:

CEF Connect

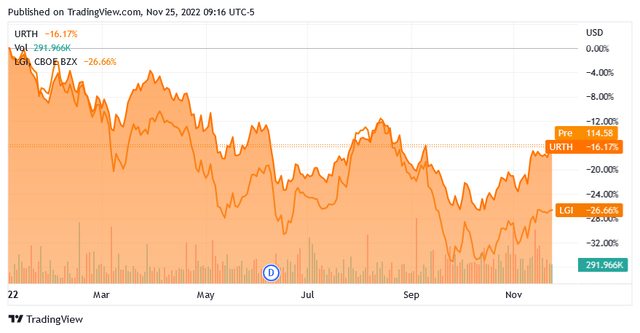

We see here three of the mega-cap technology funds occupying the largest positions in the fund. This is very similar to what we see in many other funds. However, as I have pointed out in many recent articles, their presence also does not make very much sense for an income-focused fund. This is because out of all of the ones here, only Microsoft (MSFT) pays a dividend and its yield is so low that it does not really matter. In addition, Microsoft, Alphabet (GOOGL), and Amazon (AMZN) have all significantly underperformed the market year-to-date. There is also little reason to believe that any of them will recover in the near term. Fortunately, though, their weightings are significantly lower than they are in the portfolios of many peer funds (such as the Eaton Vance funds) so they will hopefully not have a huge impact on the fund’s performance. With that said, the fund has still underperformed the MSCI World Index (URTH) year-to-date:

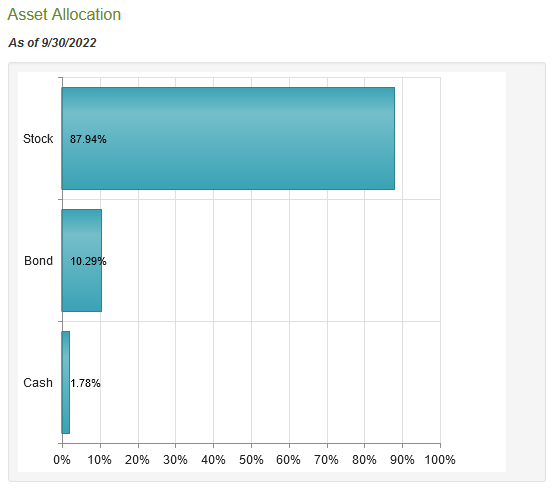

The fact that the Lazard fund has a substantially higher yield does help to close the performance gap but the index has still performed a bit better overall. With that said, the MSCI World Index is not a perfect benchmark for the Lazard Global Total Return & Income Fund. This is because the Lazard fund invests in emerging market currencies and bonds, while the MSCI World Index is a common equity index. As of the time of writing, 10.29% of the fund is invested in bonds and another 1.78% of the fund is in cash:

CEF Connect

Over the past ten months or so, we have seen central banks all over the world raise their national interest rates in an effort to combat the rampant inflation that we have been suffering from. This had the effect of pushing down bond prices and driving up yields. While the rising rates have also reduced economic growth expectations and driven down stock prices, the fact that the fund has this not-insignificant bond position certainly has an effect on its performance. This is especially evident when we consider that the J.P. Morgan Emerging Bond Index (EMB) is down 21.22% year-to-date, which is quite a bit more than the major stock indices.

With that said, the fund does not appear to be particularly overweighted to any individual asset. As my regular readers on the topic of closed-end funds are undoubtedly well aware, I do not generally like to see any individual asset account for more than 5% of a fund. This is because that is approximately the level at which the asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the fund, this risk will not be completely diversified away. Thus, the concern is that some event will occur that causes the price of a given asset to decline when the market does not, and if that asset accounts for too much of the fund’s portfolio, then it may end up dragging the entire fund down with it. As we can see above though, there is no individual asset that accounts for such a large weighting in the portfolio so we do not really need to worry about that here. This is a nice improvement from Eaton Vance’s various funds that have an outsized weighting to the large American technology companies.

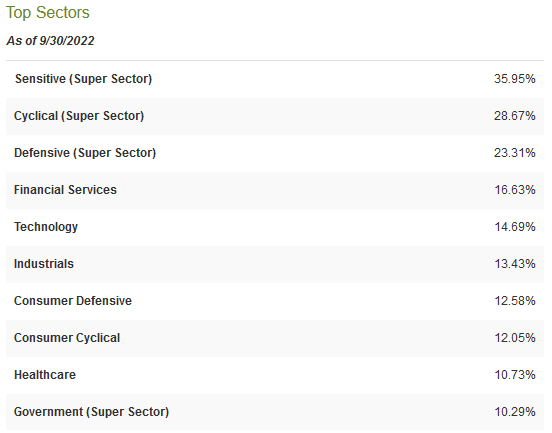

The fund appears to be generally well-diversified across sectors. As we can see, the major sectors in the fund all account for relatively similar weights:

CEF Connect

This could be very nice as the global economy continues to look as if it will shortly enter a recession if it has not already. This is because some sectors like healthcare, consumer defensive, and government will normally hold up much better than cyclical sectors in such an environment. The fact that the fund includes quite a bit of exposure to these sectors should help reduce its losses compared to a fund that is heavily weighted toward a cyclical sector.

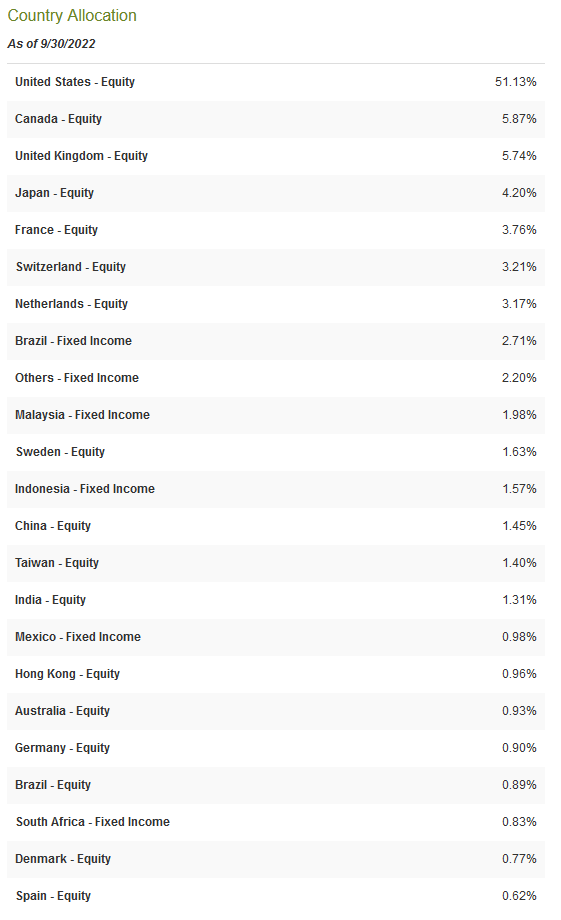

Finally, as the name of the fund states, the Lazard Global Total Return & Income Fund invests in securities from both American and foreign issuers. Here is how the portfolio currently breaks down by country:

CEF Connect

As we can see, only 51.13% of the fund is invested in American issuers. This is quite a bit less than the 60% to 70% weighting that most global funds have to this country. However, the United States only accounts for a bit less than 25% of the global gross domestic product so it is still overweighted in the fund relative to its actual representation in the global economy. We do still see a great deal of diversification here though, which is nice because it provides us with some protection against regime risk. Regime risk is the risk that some government or other authority will take an action that has an adverse effect on a company that we are invested in. The only realistic way to protect ourselves against this risk is by ensuring that only a relatively small proportion of our assets are exposed to any individual country. This fund is certainly doing that better than most funds but it is still necessary to have an ex-U.S. fund alongside it in order to ensure proper international diversification across your portfolio.

Distribution Analysis

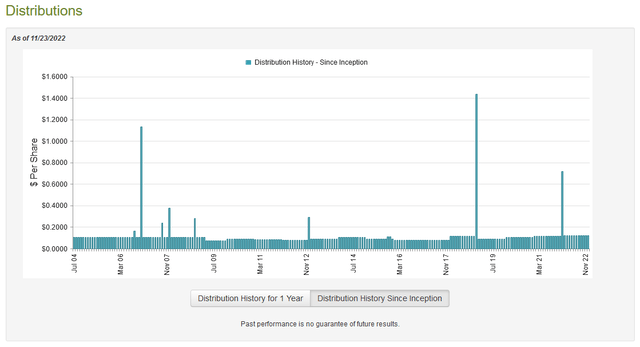

As stated earlier in the article, the primary objective of the Lazard Global Total Return & Income Fund is to provide its investors with a high level of total return that consists at least partly of current income. In addition, the fund invests in forward currency contracts and emerging market bonds in an effort to boost its income so we can expect that it has a fairly high yield. This is indeed the case as the fund pays a monthly distribution of $0.1247 per share ($1.4964 per share annually), which gives it a 10.02% yield at the current price. The fund’s distribution has varied quite a bit over its history but it has been growing it over the past several years:

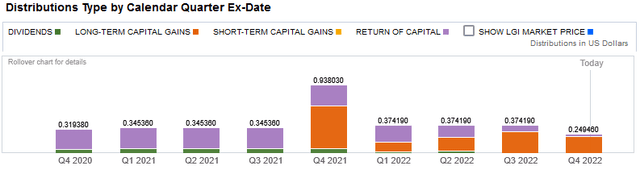

The fact that the fund’s distribution has bounced around quite a bit over time is something that will likely be a bit of a turn-off to many investors that are looking for a safe and secure source of income with which to pay their bills and otherwise support their lifestyles. However, it should be comforting that most of the fund’s distributions over the past year are considered to be capital gains or dividend income. The fund has distributed a significant amount of return of capital in the past, though:

The reason why the return of capital distributions could be concerning is that they can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that could cause a distribution to be classified as a return of capital, such as the distribution of unrealized capital gains. As such, we should investigate exactly how the fund is financing its distributions in order to determine how sustainable these distributions are likely to be.

Fortunately, we do have a relatively recent report that can provide us with the information that we need for this task. The Lazard Global Total Return & Income Fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it should be able to provide us with a great deal of insight into how the fund performed during the first half of the year, which is when much of the market turbulence that characterized this year took place. During the six-month period, the fund received a total of $1,922,253 in dividends and another $840,107 in interest from the assets in its portfolio. This gives it an income of $2,762,360 during the period. The fund paid its expenses out of this amount, leaving it with $729,144 available for investors. This was obviously nowhere close to enough to cover the $9,736,170 that the fund actually paid out in distributions during the period. This is obviously going to be fairly concerning at first glance.

The fund does have other ways through which it can obtain the money that it needs to cover its distributions, however. The most important of these is capital gains but as we might expect from the market’s choppy performance over the past year, the fund did not perform particularly well here. During the six-month period, it did achieve net realized gains of $13,546,968 but this was offset by $73,412,567 net unrealized losses. With that said, the fund’s net realized gains and net investment income was enough to cover the distributions even though its assets declined by $68,872,625 over the period. For the time being, this distribution appears reasonably secure but if the fund keeps losing money through unrealized gains, then it will become harder and harder for it to generate the returns that are needed to maintain the distribution. Thus, we still want to keep an eye on things.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. The usual way that we value a closed-end fund is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. This is indeed the case with this fund today. As of November 23, 2022 (the most recent date for which data is currently available), the Lazard Global Total Return & Income had a net asset value of $16.40 per share. However, the fund only trades for $15.02 per share, which gives it an 8.41% discount to the net asset value. This is a reasonable discount that is much better than the 5.99% discount that the fund has had on average over the past thirty days. Thus, the price certainly seems reasonable here.

Conclusion

In conclusion, the Lazard Global Total Return & Income Fund appears to be a reasonable investment for an income-seeking investor today. The fund has a very high yield that is supported by a well-diversified portfolio and sufficient capital returns to maintain it. It is admittedly possible that the fund will have to cut its distribution depending on its performance in the second half of 2022 as the market weakness appears unlikely to change any time soon but this is something that would likely affect just about any fund in the market. The price is certainly right today so this fund may be worth considering.

Be the first to comment