Bet_Noire

A few months ago, I wrote a bullish article on Virtu Financial, Inc. (NASDAQ:VIRT), arguing that the company was a good hedge against market volatility, as market making is one of the few businesses that can benefit from increased volatility.

With the Fed’s ‘pivot’ in reducing the pace of interest rate hikes, market volatility, as measured by the VIX Index, has decreased dramatically, from a late September / early October peak of ~35 on the VIX to recent lows of 17 (Figure 1).

Figure 1 – VIX index has collapsed since October (stockcharts.com)

As I warned in my prior article, “the biggest risk to Virtu is actually a calm market, where there is little opportunity for market makers like Virtu to make money.” Unfortunately, that risk turned into reality in Q4.

Q3/Q4 In Review

Virtu’s Q3/2022 results were actually decent, as the quarter saw the S&P 500 Index rally to over 4,300 before plunging to 3,600. The VIX index spiked to a peak of ~35 as mentioned above, translating into $181 million in adj. EBITDA and non-GAAP EPS of $0.61 for Virtu, beating analyst estimates by $0.07.

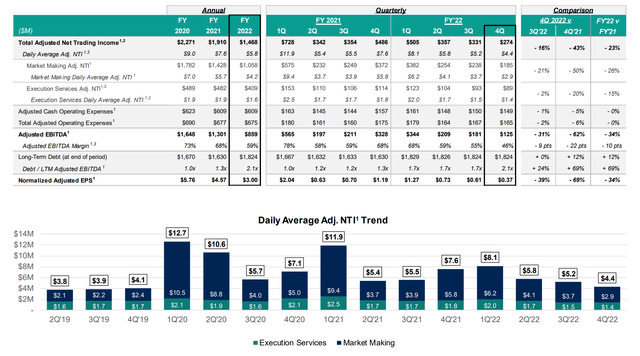

Unfortunately, the lower market volatility took a toll on the company’s results in Q4, with net trading income declining 16% QoQ and 43% YoY to $274 million, and adj. EBITDA declining 31% QoQ and 62% YoY to only $125 million. Non-GAAP EPS was $0.37, a decline of 39% QoQ and 69% YoY (Figure 2)

Figure 2 – VIRT Q4/2022 operating results (VIRT Q4/2022 earnings presentation)

For the full year, net trading income (“NTI”) declined 23% YoY to $1.47 billion or $5.8 million / day, leading to adjusted EBITDA of $859 million and normalized EPS of $3.00.

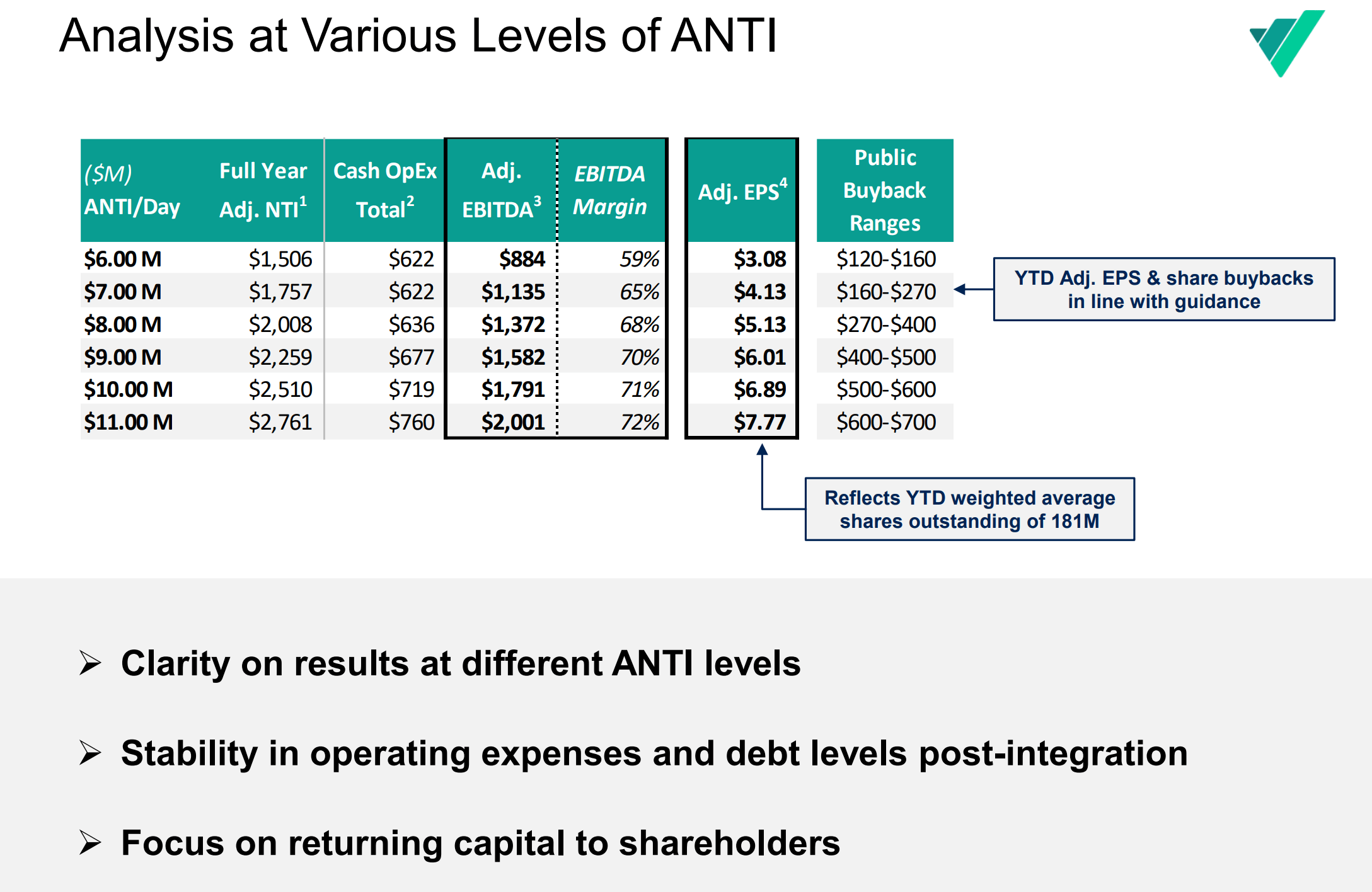

Unfortunately, if we look at the company’s presentation from Q2, VIRT was guiding to NTI of ~$7 million per day or ~$4 in EPS after a stellar H1/2022, so Virtu’s actual operating performance in the third and fourth quarter was quite disappointing relative to guidance and expectations (Figure 3).

Figure 3 – VIRT NTI sensitivity (VIRT Q2/2022 earnings presentation)

However, if there is one silver lining to Virtu’s 2022 results, it is that the company has a firm handle on its cost structure, so even though revenues disappointed at just $5.8 million NTI per day, Virtu was still able to achieve $859 million in EBITDA and $3.00 in EPS, essentially in line with the $6 million NTI / day forecast in figure 3.

Spread Compression A Fluke Or Something Else?

According to Virtu’s CEO in his prepared remarks on the earnings call, A big cause of the weak Q4 earnings was due to “decreased opportunity as the overall spread opportunity and retail participation ebbed and the quality of the flow we receive from our retail customers was significantly less desirable.” Although the CEO also mentioned that this is normal ebb and flow of the market making business, his answers to questions on the Q4 earnings call suggest something else may be afoot.

For example, when asked to describe the retail flow in more detail, he said that normally, the “opportunity set” is “correlated very linearly with volatility. So the higher the volatility, higher spread some was in the retail customer flow that you received.” However, the historical relationship “has broken down over the last quarter, quarter and half,” particularly in the fourth quarter.

Moreover, in a follow-up response, he said that “in the retail business”, the orders are small and “are typically not correlated with the wider market.” However, in the fourth quarter, “maybe more institutional investors were sliding into retail brokers”. Virtu saw “more flow that tended to be more correlated with the larger marketplace, and that makes it more of a challenge for a market maker.” Since Virtu, as a market maker, must “take all the flow that comes” their way, the result is “negative selection and a negative P&L with regard to that stock for a day, a week, a month, whatever it is.”

What the CEO seems to be describing is a change in customers’ behaviour, from historically market uncorrelated trades that can be internalized and matched off to market correlated trades that are one-sided and hard to offset as a market maker.

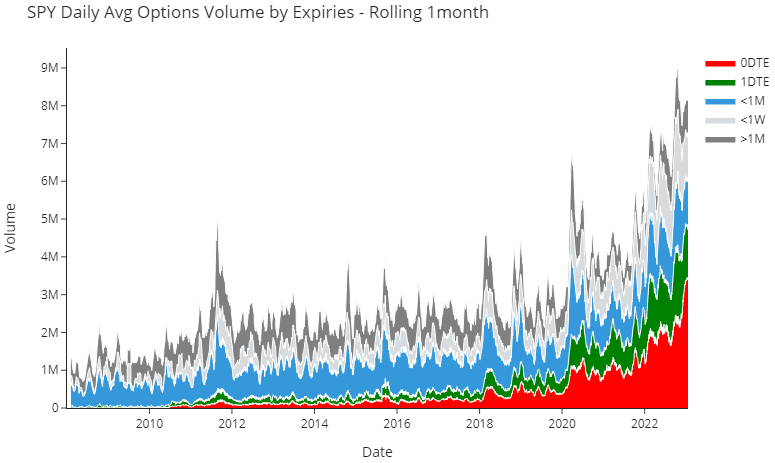

When I look out across the market, one phenomenon seems to fit the bill to what Virtu’s CEO is describing. Over the course of 2022, we have seen a dramatic rise in the popularity of ‘0DTE’ option trades. 0DTE refers to the time to maturity of options, with the ‘zero’ referring to the fact that these options typically expire within 24 hours of trading. Figure 4 below shows the increase in 0DTE option volumes on the SPDR S&P 500 ETF Trust (SPY), as noted by WSJ reporter Eric Wallerstein.

Figure 4 – Rise of 0DTE options (WSJ)

This passage from a recent MarketWatch article describes what could be happening:

Retail traders once dominated trading in this corner of the options market, but that has changed in recent weeks as institutional traders have picked up the slack as retail traders have retreated, McElligott said.

Instead of recklessly gambling like Robinhood-using amateurs, these professional volatility traders are buying these options as part of a calculated strategy to force large dealers to move markets in their favor, as McElligott explains.

McElligott even has a name for this type of trading: “weaponized gamma” which is a reference to the hedging strategies that dealers employ to lay off risk from their clients’ options trades.

The strategy has allowed these traders to generate profits in a volatile trading environment while minimizing their risk. Traders often close out the trades “mere hours” after opening them.

In that respect, these professionals are behaving like “full-tilt day traders, using the certainty of Dealer hedging flows that their orders create to then amplify and ‘juice’ the intended directional market move,” McElligott said.

Option market makers lose small amounts of money when they have to delta-hedge their exposure. Ultimately, market makers profit when the implied volatility (“IV”) of the options they sold is greater than the realized volatility (“RV”) of the underlying stock. While market makers may lose on some individual securities, overall, if they price their IV well, they will make money on the whole. However, the rise of 0DTE appear to be changing the calculus.

Sophisticated traders appear to be using cheap 0DTE options (most pronounced on meme stocks and market indices like the S&P 500) to force market makers to hedge in the direction of their bets, amplifying market volatility and transferring market makers’ profits into their pockets. Incidentally, my good friend, rtgamma, have developed tools to help retail traders track the 0DTE gamma levels of S&P 500 Index options. Interested readers may want to have a look at his twitter feed.

At this time, it is difficult to determine how worried Virtu investors should be regarding this new 0DTE phenomenon. Recall, when the meme stock mania hit initially in early 2021, market makers were caught offsides and likely suffered losses as they had to hedge the wild moves in stocks like GameStop and AMC. However, over time, market makers learned to adapt by raising the IV of the options they sold, giving themselves a higher profit cushion and making it more difficult for traders to ‘gamma squeeze’ those securities. In fact, Citadel, one of the largest market makers in the world, have seen 12 consecutive quarters of net trading revenue in excess of $1 billion, suggesting profitability has not been diminished.

Furthermore, although sophisticated traders seem to be ‘weaponizing’ gamma on the indices, the return of meme stocks in early January, as represented by the 34% YTD rally in the Roundhill MEME ETF (MEME), suggest a return of unsophisticated retail traders, which could boost profitability for market makers (Figure 5).

Figure 5 – Return of meme stocks in early 2023 (Seeking Alpha)

At the end of the day, Virtu investors should watch the 0DTE space closely to see if/how the market makers respond and whether the 0DTE phenomenon will be a long-lasting one.

Payment For Order Flow Rule Change Neutral For Now

Another big question on investors’ minds in the past few quarters is the potential impact of new proposed SEC regulations on payment for order flow (“PFOF”). For those not familiar, retail brokerage commissions have been reduced to nil in the last few years as retail brokers like Robinhood have sold the order flow of their clients to large market makers like Virtu and Citadel.

In an ideal world, PFOF is a win/win/win for everyone involved. It offers retail investors commission free trading and better prices than national best bid and offer (“NBBO”). For retail brokers, it gives them another source of revenue. For market makers, they get access to order flow that they can internalize (match in their own order books), without having to compete explicitly with other market makers.

However, the practice of PFOF came under intense criticism in 2021 as an SEC report on the retail meme stock mania suggested retail brokerages were encouraging their customers to trade in order to profit from PFOF. Importantly, Robinhood was fined $65 million by the SEC for failing to disclose PFOF payments it received for trades that did not result in best execution for its customers.

Although the SEC has ruled out a direct ban of PFOF, they have recently introduced proposed rules that would promote increased competition on an order-by-order basis by sending the trades to an auction process. Commenting on the proposed rules, Virtu’s CEO believes they will likely not be implemented in their current form and would most likely be neutral for Virtu (author highlighted):

In addition to a less transparent and less fair landscape for the average retail investor on top of increased cost and worse execution quality, the SEC’s proposals would also harm liquidity and increased costs for institutional investors and issuers. Further and importantly, the half Harrison [ph] rulemaking, lack of any real engagement with stakeholders an abbreviated comment period has resulted in a proposal that is internally inconsistent, theoretical analysis that ignores empirical evidence and an experimental approach that disregards the likely cost everyday investors.

It is extremely unlikely to withstand any degree of scrutiny in the upcoming process, which could take several years. Sadly [ph] as we have noted before, we believe the proposal is a politically motivated solution in search of a problem.

Lastly, as I have mentioned several times, these proposed rules, while they would be terrible for the average retail investor would not necessarily be terrible for scaled wholesalers like Virtu. Remember, today’s wholesalers like Virtu are service providers that compete for business by immediately filling all orders we accept and by providing price improvement as part of our commitment to our retail broker customers.

Under the SEC proposal to mandate options, we would be able to and in fact, we will be required to send flow, we do not internalize to an exchange retail auction. Today, we incurred significant fees, including payment for order flow, price improvement and exchange, SEC and other transaction fees on orders we do not internalize. These costs would be dramatically reduced under the proposal.

We also internalized tens of thousands of orders daily in small and mid-cap listed companies as part of the overall wholesale service we offer to our clients, which we could now simply route to exchanges at a substantial savings to ourselves, but this savings would come at the expense of retail investors.

So the preliminary analysis of the trade-off suggests that the exchanges in wholesalers may stand to benefit under key aspects of this plan. And at worst, we will be in a neutral position. I’m sure we will discuss these issues further in the Q&A to follow.

For now, I think investors should put the PFOF issue on the backburner until the SEC rules are finalized and implemented.

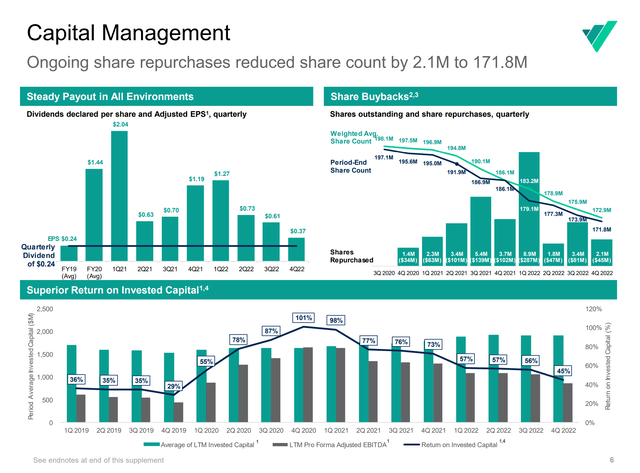

Share BuyBacks Above Guidance

Despite weaker than expected trading revenues, Virtu continued to return capital to shareholders, maintaining its $0.24 quarterly dividend and buying back $45 million in shares in Q4 (Figure 6).

Figure 6 – VIRT continues to return capital to investors (VIRT Q4/2022 earnings presentation)

For the full year 2022, Virtu bought back $461 million in shares, above the company’s guidance of $120-160 million at $6 million NTI.

Cheap Gets Cheaper

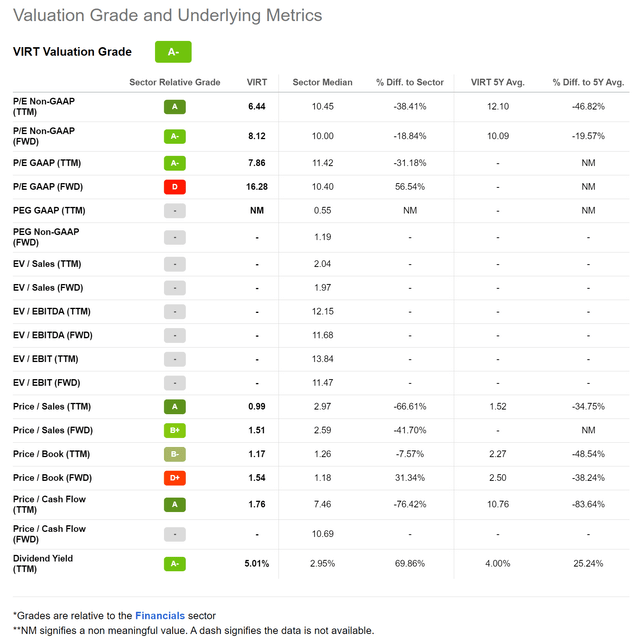

In terms of valuation, Virtu is a case of cheap assets getting even cheaper. In my prior article, Virtu screened attractive at a 4.1% dividend yield. However, with the recent decline in the shares, Virtu now sports a 5.0% dividend yield. Furthermore, the company is trading at a discounted 8.1x Non-GAAP Fwd P/E multiple vs. the sector median 10.0x (Figure 7).

Figure 7 – VIRT trading at discounted valuations (Seeking Alpha)

Setting Up For Beat And Raise?

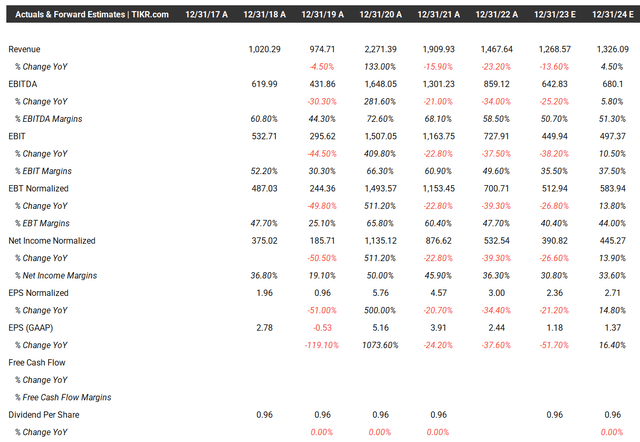

Interestingly, Wall Street analysts appear to have taken recent trends and projected them into the future, as they are expecting a steep 13.6% YoY decline in revenues to $1.27 billion in 2023, or $317 million / qtr (Figure 8).

Figure 8 – Wall Street estimates are low (tikr.com)

From figure 2 above, we can see that $317 million / qtr in revenues would be in between Q3 and Q4/2022 levels, and would be one of the worst quarterly revenue figures in the past few years. So the bar has been set very low for Virtu, potentially setting up for several ‘beat and raise’ quarters.

Risk To Virtu

For now, I believe Virtu deserves the benefit of the doubt that the decline in Q4 trading profitability is due to normal ebb and flow of the business. However, we should bear in mind that the rise of 0DTE option trading could fundamentally change the profitability of market making. If Virtu and other market makers cannot come up with a solution, for example, by raising the IV of 0DTE options to improve profitability, then future trading margins could be compromised.

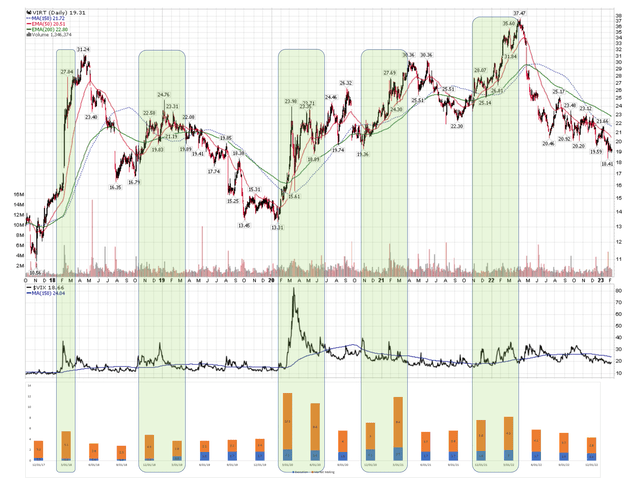

Another risk for Virtu is that a new bull market has begun, in which case market volatility may be depressed for an extended period. From figure 9, we can see that Virtu’s trading performance and stock price tends to outperform in periods where market volatility is elevated. Depressed market volatilty could be a headwind for Virtu’s financial results.

Figure 9 – VIRT tends to perform well in periods of market volatility (Author created with data from company reports and price chart form stockcharts.com)

Conclusion

In conclusion, I continue to view Virtu as a counter-cyclical holding that could outperform if markets do not go up in a straight line. However, the rise of 0DTE option trading may be fundamentally changing the profitability of option market making, and investors should keep an eye out for that. To compensate investors for the increased risk, Virtu is currently paying an attractive 5% dividend that appears well supported by earnings.

Be the first to comment