Paul Zimmerman

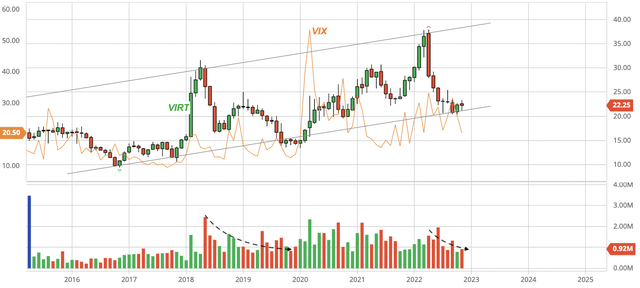

As a fellow Seeking Alpha author pointed out, Virtu Financial, Inc. (NASDAQ:VIRT), a leading high-frequency trading firm that specializes in providing market making and execution services, and the stock may be used as a hedge against market volatilities thanks to its tendency to thrive in volatile environments.

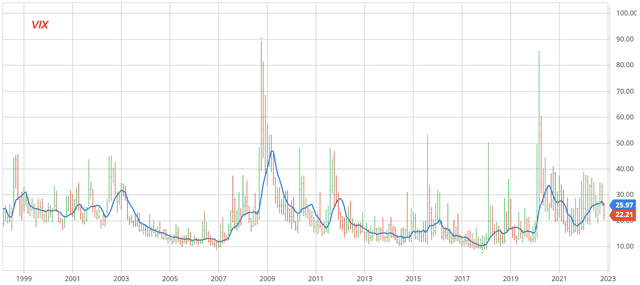

Market volatility is highly unpredictable (Fig. 1) and, naturally, certainty-loving investors are averse to it. Such an aversion may drive some potential investors away from the stock.

Fig. 1. CBOE volatility index (or VIX) shown with its 7-month moving average (modified from Barchart and Seeking Alpha)

However, rational thinkers are supposed to see through superficially unpleasant things to identify great underlying businesses, as Peter Lynch showed in his book ‘One Up On Wall Street‘ using Waste Management (WM) as an example.

In that vein, let’s examine Virtu Financial below, in hope of adding to and updating the investment thesis presented in the previously mentioned Seeking Alpha article.

Volatile but resilient business

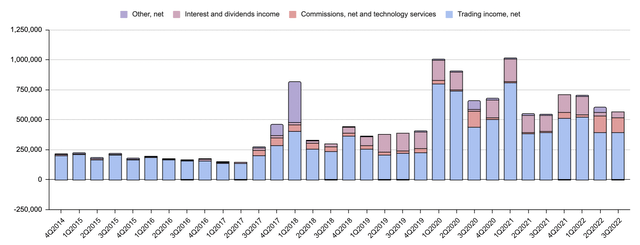

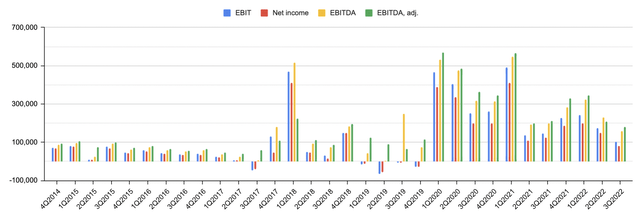

As a result of Virtu thriving when the general market is in turmoil, the financial performance of Virtu ends up being highly volatile, as can be seen in its quarterly revenue, net income, and EBITDA (Fig. 2; Fig. 3).

Fig. 2. Quarterly revenue of Virtu from various business segments (compiled by Laurentian Research based on company financial reports and Seeking Alpha)

Fig. 3. Quarterly EBIT, net income, EBITDA and adjusted EBITDA of Virtu (compiled by Laurentian Research based on company financial reports and Seeking Alpha)

In spite of the high variability that makes security analysis difficult, the following implications can still be drawn:

- Decline in revenue and profit in the last few quarters indicates neither a collapse in Virtu’s ability to pull in revenue nor its earnings power. Accordingly, such a volatility may not justify the recent share price weakness. It may only take a spike in market volatility for the company to report explosive expansion in revenue and profit.

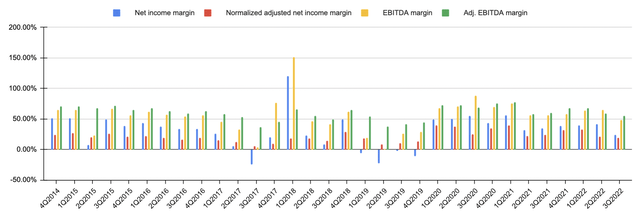

- Even in quarters when volatility was relatively low, e.g., in 2017-2019 and recently (Fig. 1), the company was still making good money. Its normalized adjusted net income margin and adjusted EBITDA margin average 21.6 +/- 9.0% and 60.5 +/- 10.9%, respectively (Fig. 4). High profitability, in spite of its variability from quarter to quarter, enabled the company to pay a steady quarterly dividend of $0.24 per share since the 3Q2015. From then to 3Q2022, Virtu generated a total of $18.13 in normalized adjusted EPS but only paid out $6.96 per share in dividends, for a relatively low cumulative payout of 38.4%.

Fig. 4. Net income, normalized adjusted net income, EBITDA and adjusted EBITDA margins of Virtu by quarter (compiled by Laurentian Research based on company financial reports and Seeking Alpha)

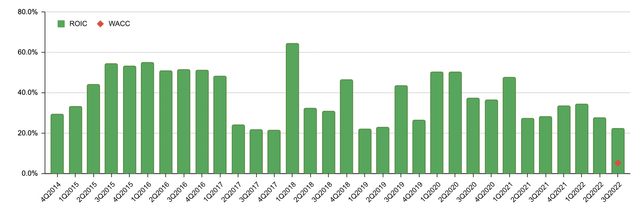

ROIC versus WACC

At The Natural Resources Hub, we require a non-natural resource business to possess sustainable competitive advantage to be considered for investment. The key criterion we use to identify a durable economic moat is to examine whether the business has a ROIC that is substantially higher than the WACC. In ROIC calculation, we follow Michael J. Mauboussin and Dan Callahan, while in computing WACC we reference Aswath Damodaran.

For Virtu, the ROIC averages 38.1 +/- 12.4% from 4Q2014 through 3Q2022. In the 3Q2022, the ROIC was at 22.2%, as compared with a WACC of 5.2%. Virtu has been able to earn a return of 17.0% in excess of the cost of invested capital, which suggests Virtu is a moated business.

Fig. 5. ROIC vs. WACC of Virtu Financial (compiled by Laurentian Research based on company financial report and Seeking Alpha)

Valuation

Let’s consider three scenarios for Virtu:

- In the worst case, shareholders will continue to receive a well-covered but constant quarterly dividend at $0.24 per share but they will not get any share price appreciation.

- In the best case, Virtu will grow at the maximum rate supported by after-dividend cash flow: ROIC X (1 – Payout ratio). Virtu’s maximum self-funded growth comes to 13.71%, including organic growth and/or M&A. In 2017, Virtu acquired Knight Capital Group, and sold its fixed income trading venue, BondPoint, to Intercontinental Exchange (ICE) for $400 million; and in 2019, it bought Investment Technology Group.

- In the base case, I assume Virtu will grow at one-half of the maximum self-funded growth rate, or 6.85%.

In the worst case, Virtu is worth $18.35 per share, as determinable from an annual dividend payment of $0.96 per share and a WACC of 5.23%. The downside risk is thus 20%, from $22.11, the share price as of November 29, 2022.

In the base case, Virtu is worth $33.08 per share, pointing to an upside of 50%. It can also be deduced that, by year 10, Virtu is supposed to reach $76 assuming the median P/E at 26.50, which implies a total return of 17.5% per year (4.31% dividend yield inclusive).

In the best case, Virtu is estimated to be worth $58.84 per share, implying an upside of 166%.

Virtu is currently valued at a P/E of 7.27X on a trailing-12-month basis, as compared with an industry average multiple at 11.46X. Virtu is significantly undervalued relative to industry peers including Flow Traders (OTCPK:FLTDF), BGC Partners (BGCP), Compagnie Financière Tradition (OTC:CFNCF), Tradeweb Markets (TW), MarketAxess (MKTX), and Intercontinental Exchange, whose P/Es range from 9.63-45.08X according to Seeking Alpha data.

Risks

The above upside comes with a number of hidden risks. Regulators may tighten regulations concerning high-frequency trading, which will have a negative impact on all high-frequency traders, including Virtu. Competition may erode the competitive advantage. As a market maker, Virtu profits by pocketing the spread on the bid and ask prices, and earn commissions by providing liquidity to client firms. Virtu may incur trading losses. However, its exposure to an outsized position is well diversified across numerous positions. Virtu also does not take any directional risk.

Investor takeaways

Despite quarter-to-quarter volatility in financial performance, this analysis suggests, Virtu is a moated, consistently profitable business with extraordinary resilience in market turmoil. Investors may consider using Virtu as a hedge against general market volatility while being paid 4.31%-yielding dividends.

Virtu is undervalued at this time, relative to industry peers as well as its intrinsic value, in part thanks to the recent selloff (Fig. 6). With a downside risk of 20% and an upside potential of more than 50%, I believe Virtu offers discerning investors an attractive entry opportunity.

Fig. 6. Stock chart of Virtu, dividend back-adjusted, as compared with CBOR volatility index (or VIX) (modified after Barchart and Seeking Alpha)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment