DNY59

Previously we promised to “share extracts from our weekly reviews.” This article is part of that effort, and this is taken from analysis originally published for Wheel of Fortune’s subscribers on Nov. 15.

——————————————————————————–

Bad (Chinese) Economic News = Good Market News

Why are futures up nicely this morning?

Because some (particularly) bad economic data out of China is re-intensifying the calls/expectations for massive Chinese stimulus/support package/steps.

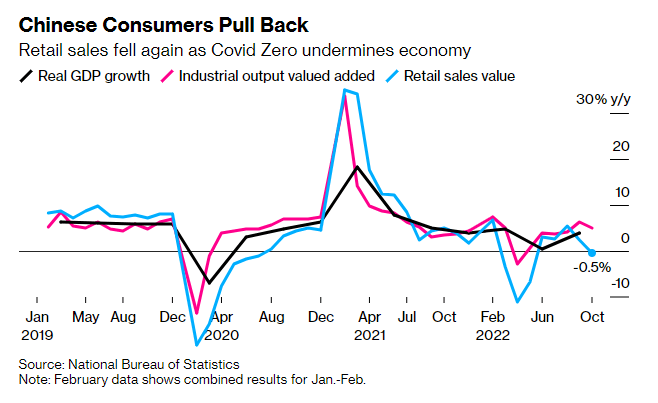

- October urban surveyed unemployment rate 5.5%[Est. 5.5%; Prev. 5.5%]

- Retail sales -0.5% Y/Y [Est.1.0%; Prev.2.5%]

- Industrial value-added +5.0% Y/Y [Est.+5.2%;Prev.+6.3%]

- Jan-Oct urban fixed assets investment +5.8% Y/Y [Est.+5.9%;Prev.+5.9%]

Bloomberg

Nonetheless, in this short post, we don’t want to discuss today’s futures, rather to focus on something really rare that has happened over the past few days: Investors shifting from an extreme bearish positioning into an extreme bullish positioning.

Where do we see this? In the option (aka PUTs and CALLs) market.

In the Blink of an Eye

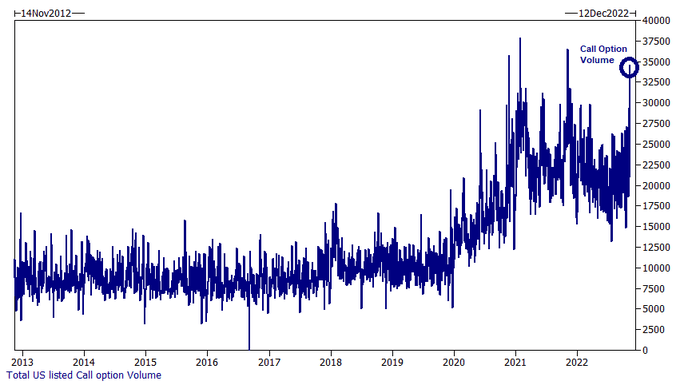

Last Friday, total call options volume hit the highest level of the year – and (one of) the highest levels since the January 2021 meme mania (which set a record for itself at the time).

CBOE

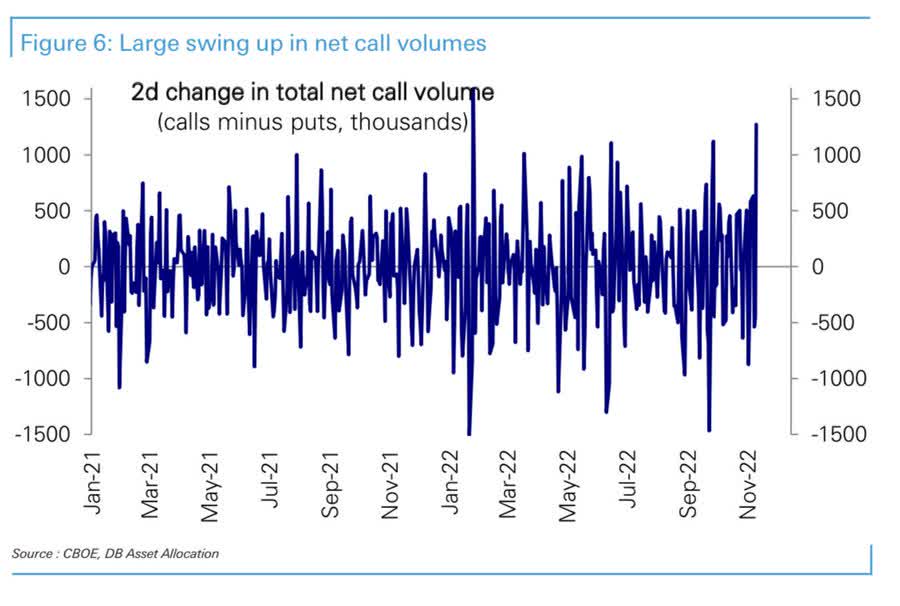

Nonetheless, more than the CALL option volume (for itself), it’s the rapid swing from record PUTs to near record CALLs in a matter of a few days.

“Over the last two days, net call option volumes swung from extreme negative to positive, with the absolute change in the top percentile over the last 25 years” -DB

Deutsche Bank

Why do we share this?

- As you may well understand, this is an extremely rare swing. I dare say this is an unprecedented shift that suggests how confused/fragile the market is on one hand and how greedy/foolish so many investors still are.

- Is such a shift justified solely based on the lower (than expected) inflation figure coming out of a single month? Hell no!

- You know what comes next, after everybody is sitting on one side of the boat… Just as an extreme PUT (=bearish) positioning had led (eventually) to a rally (PUT/short squeeze?), an extreme CALL (=bullish) positioning can lead (sooner rather than later) to a pullback (CALL/long squeeze?)

We’re just putting this here, so you’re aware of how extreme/fragile things are. That, for itself (and regardless of the actual-eventual outcome) is a good reason to be more cautious (as we are).

At the end of the day it’s very simple: High risk + Greater fragility + Extreme market moves/positioning = Lower exposure.

Simple, yet so many investors ignore the obvious, basic, stuff.

JPMorgan’s Kolanovic Trims Bullish Stocks Call on Recession Risk

It feels as if Marko Kolanovic, co-head of global research at JPMorgan Chase & Co. and the most vocal bull on Wall Street, read the article we posted yesterday and then decided to say the exact same things in a Bloomberg report this morning.

The main difference between us: While we moved from (already) being under invested (cautious, for sure) to being even more under-invested (bearish, if you’d like), Kolanovic took another step in backing off the (previously uber-) bullish stocks call that he had maintained throughout much of the market’s rout this year (Note: He was bullish/overweight all the way when the SPX went from 4800 to 3500).

Two key points he mentioned (that sound extremely familiar…):

1) Last week’s rally has brought the SPX close to the 200-DMA, where he believes stocks will bump into a serious resistance.

Bloomberg

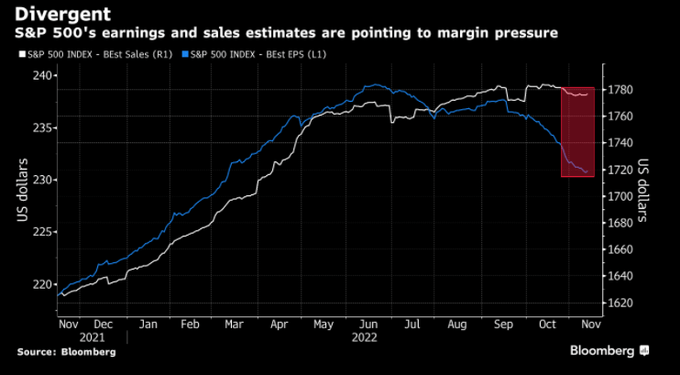

2) Corporate America is about to make a lot less money, or (using our words) an earning recession is upon us.

Bloomberg

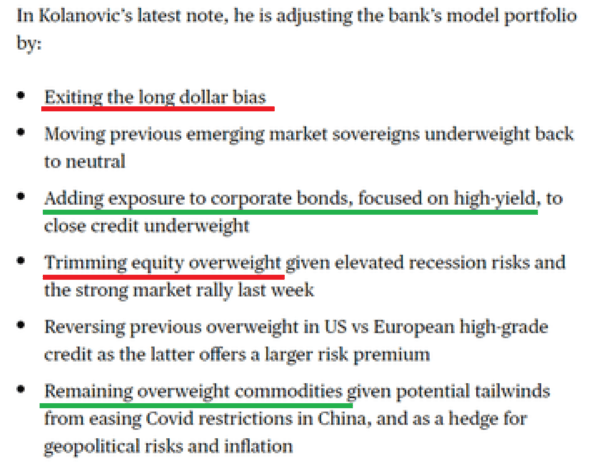

Kolanovic said that he was reducing his overweight equities position because recession risks remain high. To a large extent, his most recent tactical moves are very much echoing ours (but we were first to make those public to you!…)

Bloomberg

Chinese ETFs Weren’t Born Equal

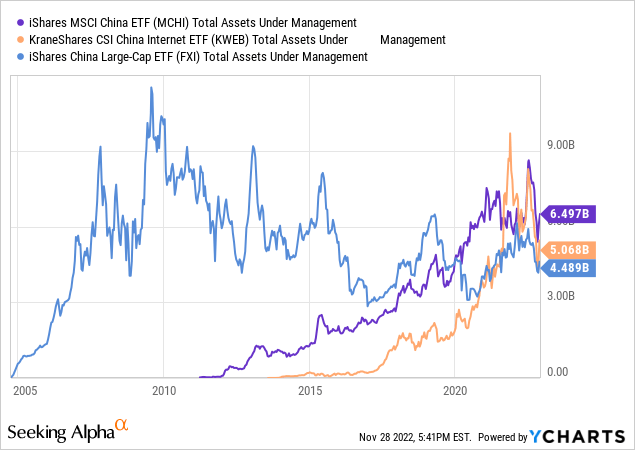

There are three leading Chinese ETFs.

- iShares MSCI China ETF (NASDAQ:MCHI), the largest one.

- KraneShares CSI China Internet ETF (NYSEARCA:KWEB), the youngest one.

- iShares China Large-Cap ETF (NYSEARCA:FXI), the oldest one.

As we keep saying over and over again – macro Trumps micro. This means that for most stocks general economic themes and/or overall market trends are more important (=having greater impact) than events and/or developments that impact a single/specific company/sector.

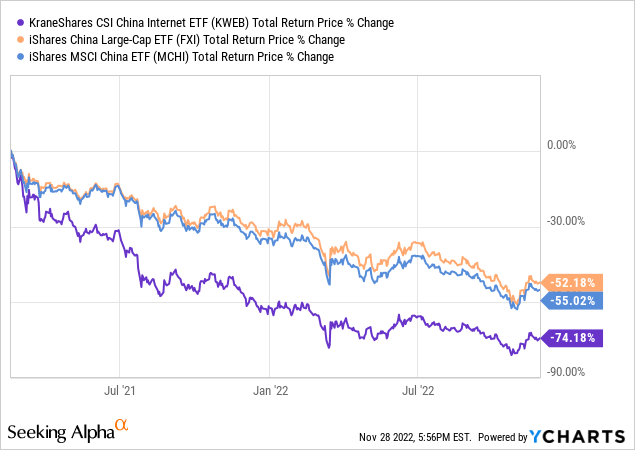

Chinese ETFs are a good example, with all three losing significant value in tandem (Below chart shows the total return since Feb. 18, 2021, where they all reached all-time/multi-year peak levels).

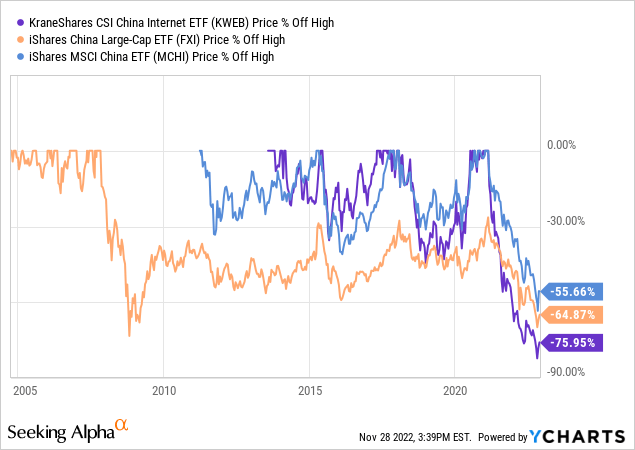

Both KWEB and MCHI traded not-too-long-ago with the largest drawdowns they’ve suffered since their inception date.

FXI, which has a significantly longer track record, has nearly hit the most extreme drawdown ever, but for now it managed to escape from replacing the GFC’s drawdown in the (negative) record books.

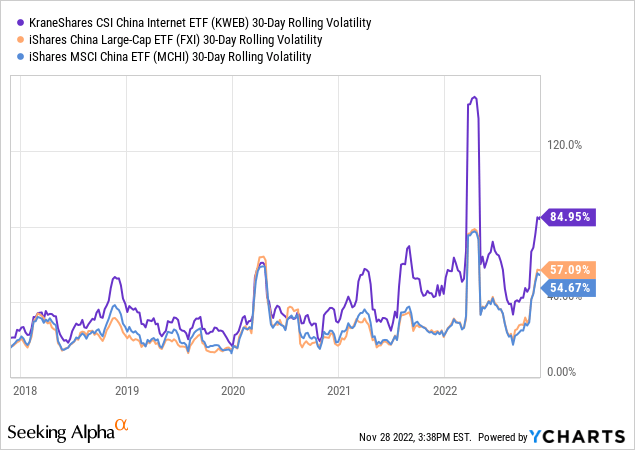

Where the three Chinese ETFs differ is volatility.

While FXI is slightly more volatile than MCHI, the technology-oriented KWEB is way more volatile than both.

Higher volatility should, in theory, translate into higher returns (over time), however over the past 21 months it’s the other way round.

Y-Charts

Now, let’s take a closer look at each of those, while trying to determine whether it’s an immediate or a pending BUY, and what are the levels to watch for.

iShares MSCI China ETF (MCHI)

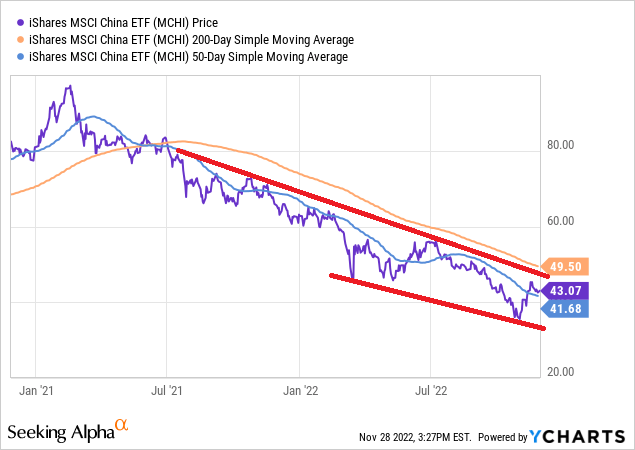

Although MCHI managed to move above the 50-DMA recently, the downtrend pattern (red lines) remain intact for now.

In order to become less bearish (or more bullish if you’d like), a move toward high 40s is a must, breaking above both the downtrend channel as well as the 200-DMA.

Y-Charts, Author

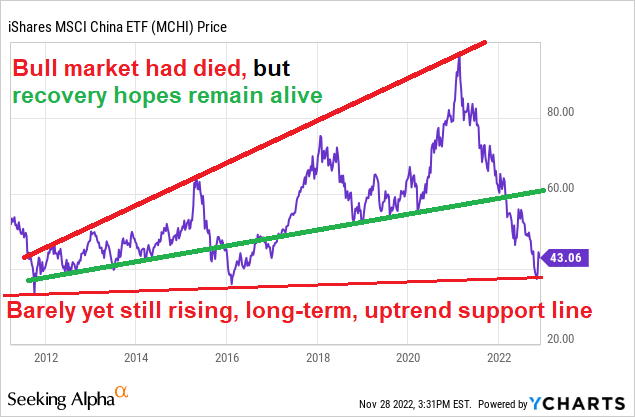

Looking at the long-term chart, it’s clear that the bullish trend is gone, but as a matter of fact – this is not a bearish chart.

Sure, it was/s very close to break below all support levels, but the recent recovery has somehow put the ETF back at a “potentially rising” long-term pattern, and we can see $60 being a target on a very bright (Chinese) day.

Y-Charts, Author

Verdict: We wish to see $50 to feel more comfortable about this one, but there’s hope here. If and when MCHI hit $50, $60 (+20% upside potential) would become our target.

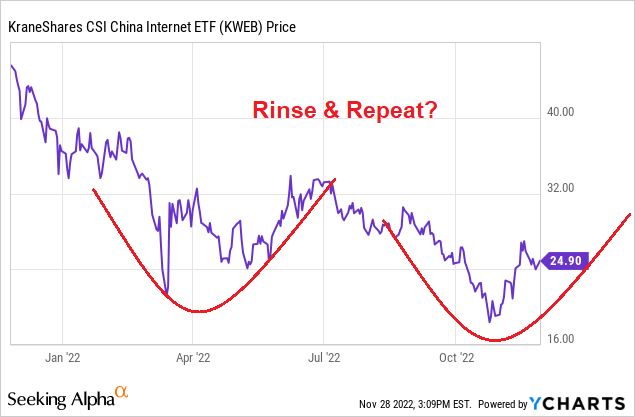

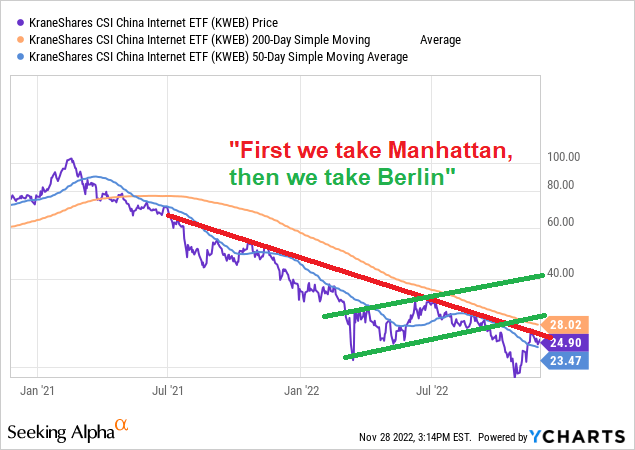

KraneShares CSI China Internet ETF (KWEB)

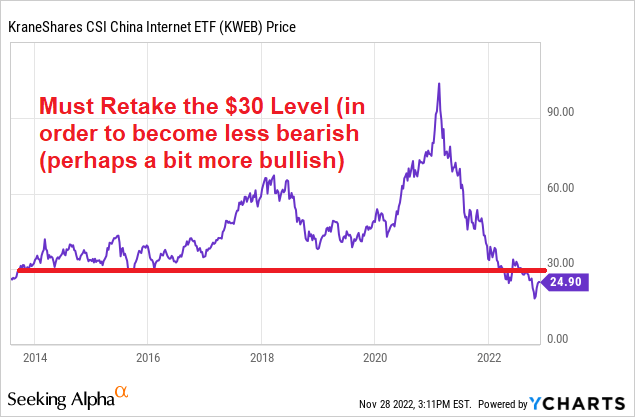

Bearish as bearish can be.

Once KWEB broke below the $30 level – twice! – there was no support (level) left for it.

The failed attempt in mid 2022 to retake that level only strengthened the bearish case, which KWEB is still very much buried in.

Y-Charts, Author

Moreover, until proven wrong, we can’t rule out that we’re witnessing another fake recovery that may end with lower highs and lower lows.

Y-Charts, Author

We need to think small here, without setting too high/ambitious targets.

First, break the downtrend resistance line. This should be a fairly easy task.

Then, make it back to the 200-DMA. This requires KWEB to move up ~12.5%; not easy but doable.

Then, and only then, we can set the ultimate goal – a move into the uptrend channel (green lines), to start a new bullish trend.

Y-Charts, Author

Verdict: Dead for now, but soft targets may bring it back to life sooner than it deserves to.

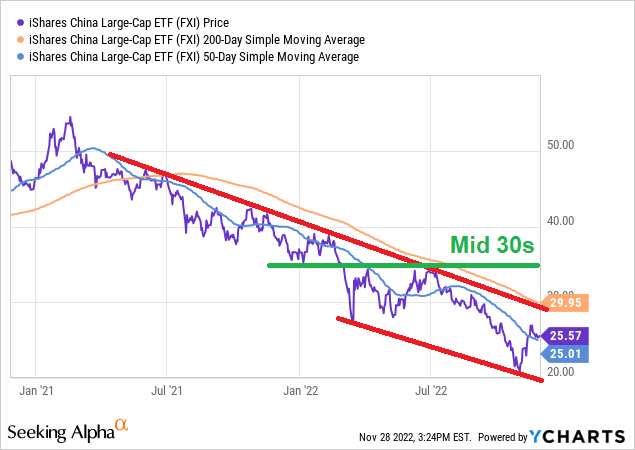

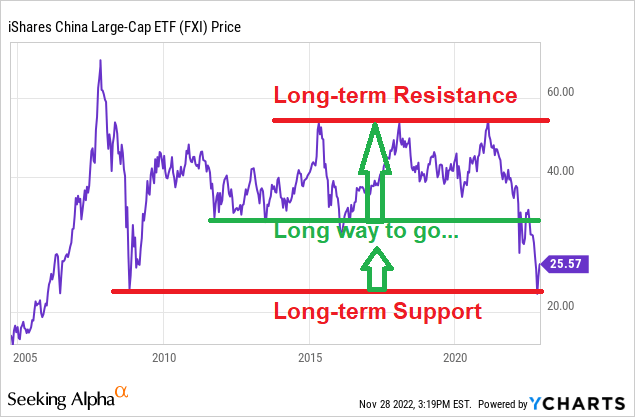

iShares China Large-Cap ETF (FXI)

This is a very similar case to MCHI: The 50-DMA is behind us, but we’re still stuck in the middle of the downtrend channel (red lines).

Just like MCHI, a 16%-17% move up towards the 200-DMA is required in order for the bearish stance to finally end.

If FXI can do that, we see a fairly clear path towards mid 30s.

Y-Charts, Author

The long-term chart is very clear, providing strong support and resistance levels, with the low-mid 30s being the near-future target.

It would require a lot from FXI to move above the green line, but let’s not be too greedy. A move from here to mid-30s (say $33-$35) implies an upside potential of 33%-37%.

Y-Charts, Author

Verdict: On one hand, we like it better than the other two right now. On the other hand, it’s only trading 2% above the 50-DMA so a slip back below is certainly possible, taking us back to square one.

Time to buy China?

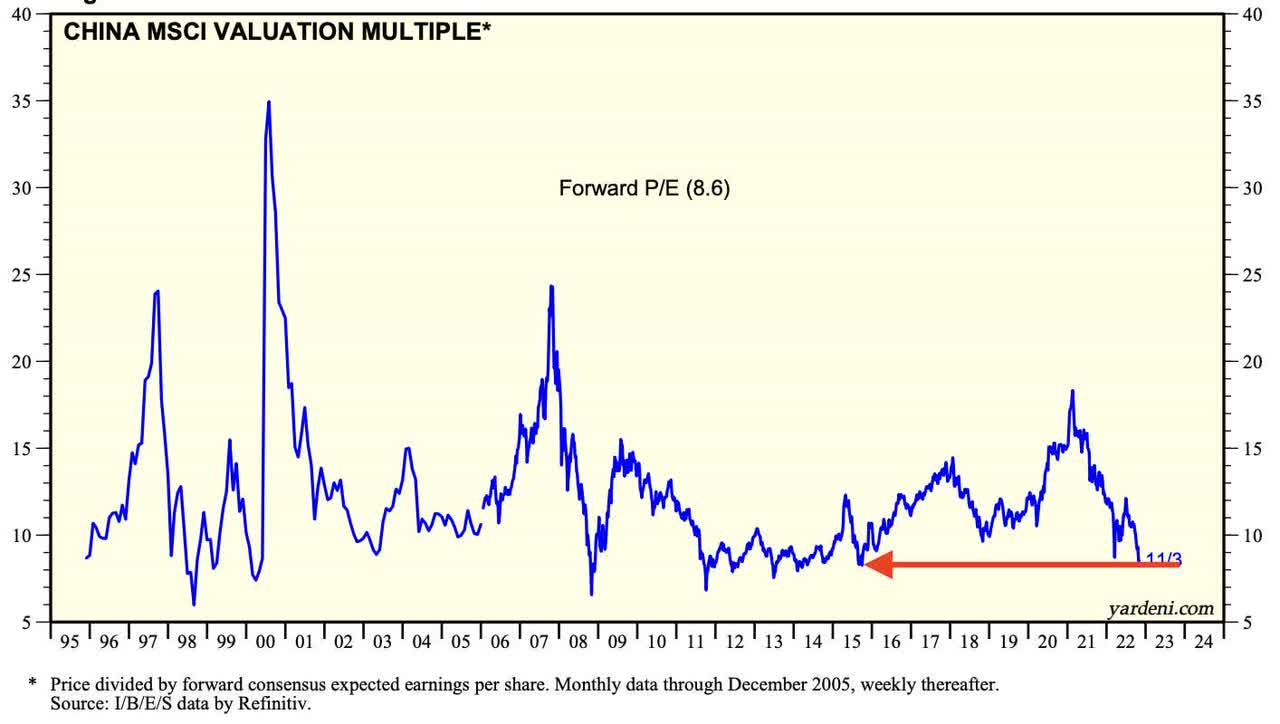

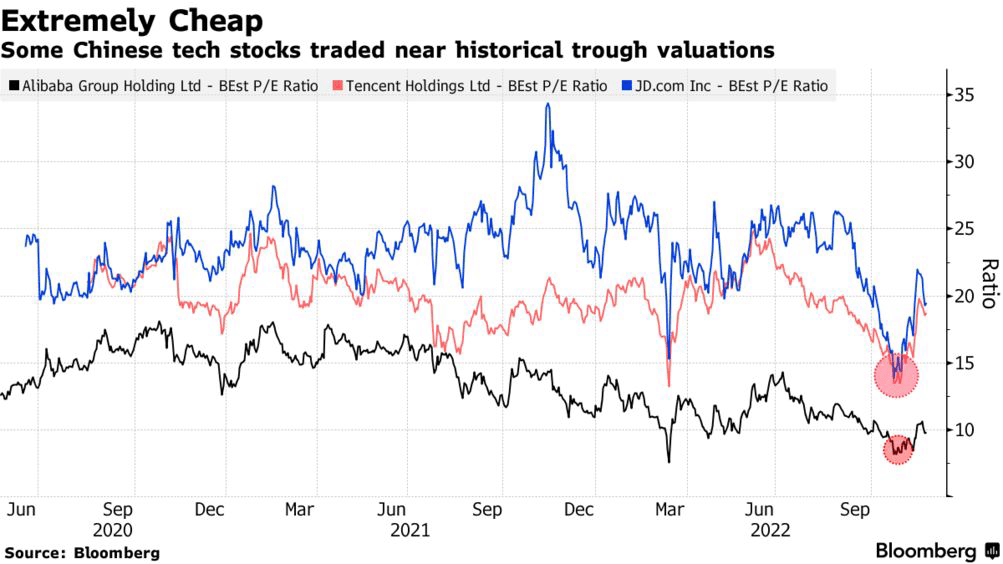

On one hand, valuations of Chinese stocks are as low as they’ve been in a long-long time, making for a very bullish case (as is) at present, surely in the near future under the assumption that the Chinese authorities will ease their zero-COVID policy sometime in 2023, leading to the (much anticipated) grand economic reopening.

Yardeni

Bloomberg

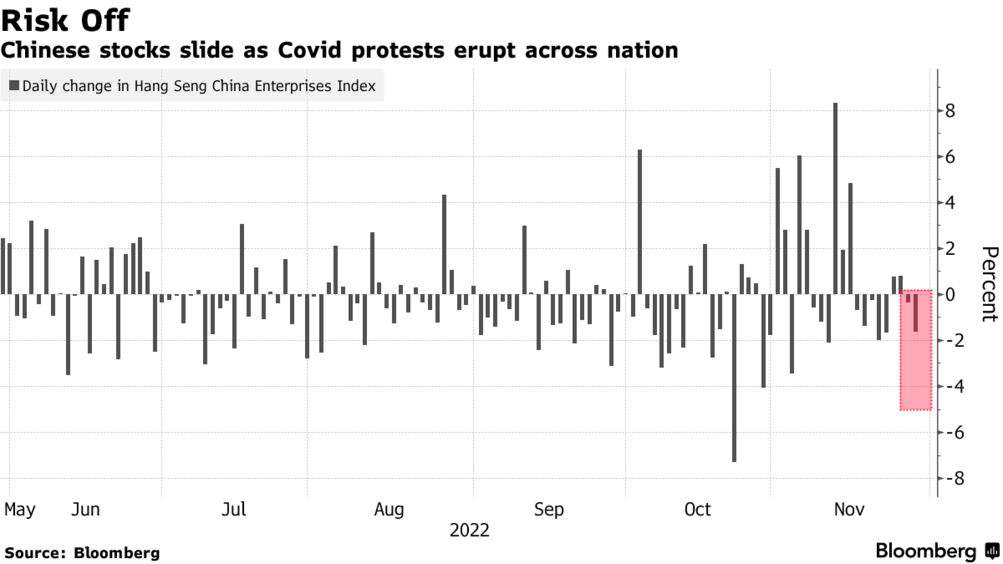

On the other hand, soaring COVID cases (leading to more lockdowns) and street demonstrations (leading to more COVID cases, aside from instability) are good enough reasons to stay away from what’s currently an investment opportunity with a high degree of uncertainty.

Bloomberg

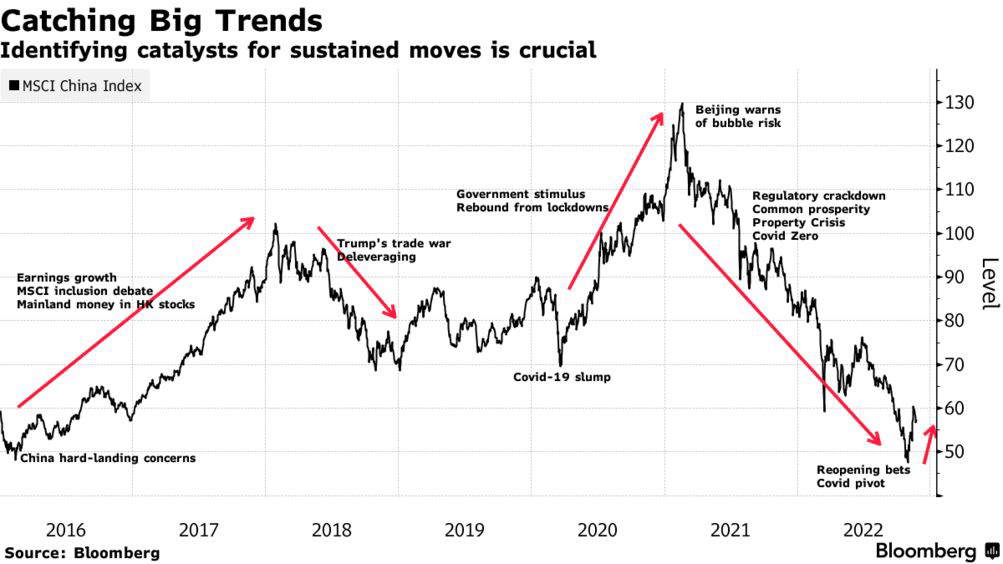

Identifying the game-changing catalyst, at the right time, is important for any investment, but it’s crucial when it comes to highly volatile Chinese stocks.

Picking the wrong time may end with most of the invested-capital vanishing over a relatively short time, just as those who pushed money into Chinese stocks saw 3/4 of their investment losing money in a matter of 18 months.

Bloomberg

We believe that China is a global force that investors mustn’t ignore, subject to two preliminary conditions/requirements:

- Long-term investment horizon. China is only suitable for those who are willing to adopt a “buy and forget” investment strategy. This is an investment that is likely to run over a course of (at least) 5-10 years, if not more than that, and it requires durability and patience.

- Low level of risk aversion. If you can’t handle/afford extreme volatility, and/or if you lose sleep over large drawdowns – China isn’t for you. This is an investment for those with a strong stomach and self-restraint.

If you have what it takes to deal with the extreme volatility that Chinese stocks are likely to go through over the next few (not just a couple!) years – we believe that allocating money to China makes sense.

Bottom Line

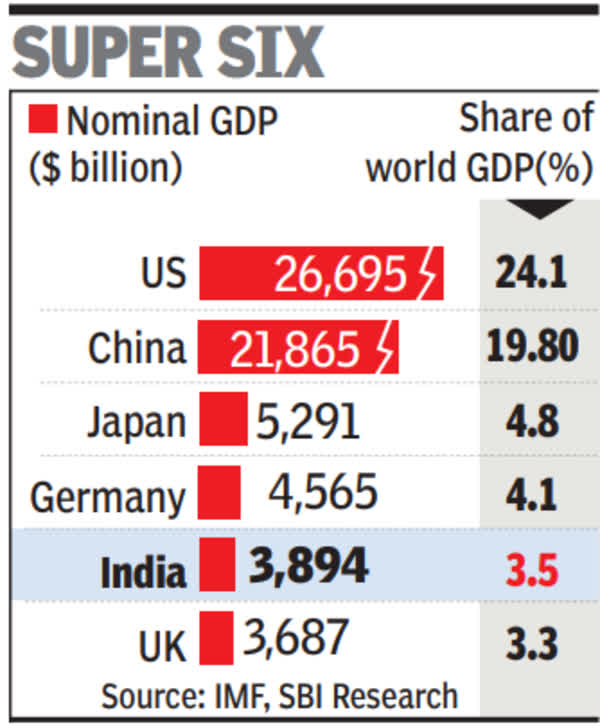

Only time will tell whether (and how quickly) China can become the world’s largest economy. Recent years, dominated by the pandemic and its implications, have delayed the Chinese galloping into world’s dominance.

Delayed, but not destroyed.

Can investors afford ignoring the world’s second largest economy that might be back on the right (economic) track as early as in 2023, possibly/likely before the US will?

Times of India

When it comes to China, and to the endless debate between fear and greed, we choose both.

“Greed” = We have a strategic allocation to China. As of now, this is a losing position, however we employ the required durability and patience.

“Fear” = We keep building this position, and we haven’t yet reached the allocation we deem appropriate for the “game-changing catalyst,” when the time comes.

Over time, we intend to give Dr. Xi Greed more room at the expense of Mr. Fear Jinping. We respect them both, but we have to admit that when we think about China we like the former better.

Be the first to comment