mysticenergy

Viper Energy Partners (NASDAQ:VNOM) is expecting solid production growth in 2023 from Diamondback activity. It expects roughly 10% Diamondback growth on its royalty acreage compared to 2022 and since Diamondback accounts for around 60% of Viper’s production, this should result in high-single digits overall growth.

While the production growth increases Viper’s estimated value a bit, it doesn’t appear to have quite as much upside as it did a few months ago due to Viper’s increased unit price since then. Viper’s unit price appears fair for a long-term $75 WTI oil price scenario currently, but it should also be able to generate around an 11% distributable cash flow yield at current strip for 2023.

Diamondback Growth

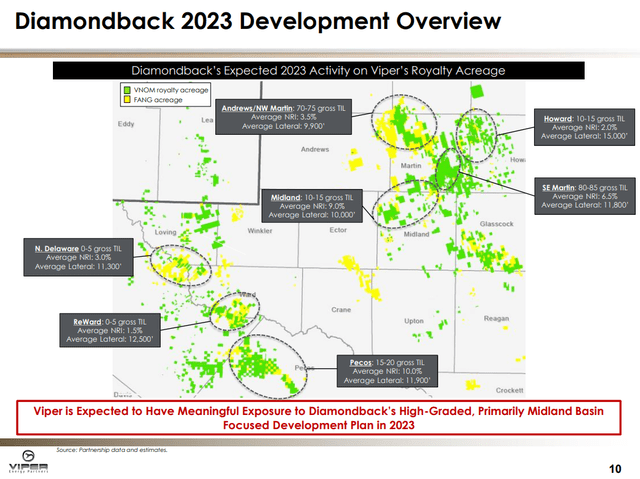

Viper has insight into Diamondback’s expected 2023 development plans and believes that will result in 10% production growth (on Diamondback volumes). These plans are focused on the Midland Basin, where Diamondback plans to turn in-line 170 to 190 gross wells on Viper’s acreage in 2023. Most of these wells are in Martin County. Diamondback also plans to turn in-line 15 to 30 gross wells in the Delaware Basin, primarily in Pecos County.

Diamondback Development On Viper Acreage (viperenergy.com)

The SE Martin area accounts for close to half of the net locations (based on Viper’s NRI) involved in Diamondback’s 2023 development plans.

2023 Outlook

If we assume that non-Diamondback production growth is around 5% next year, that would result in 8% overall production growth for Viper. This would result in Viper averaging around 36,200 BOEPD in production in 2023, including around 20,900 barrels per day in oil production (a 58% oil cut).

At current strip for 2023 (including approximately $77 WTI oil), Viper would thus be projected to generate $745 million in revenues before hedges. Viper has basis hedges for 2023, but other than that it only has puts covering 8,000 barrels per day of oil production per day in Q1 2023. These puts have a premium of $1.90 per barrel and a strike price of $54.25 per barrel, and seem unlikely to be in the money.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

7,628,500 |

$75.00 |

$572 |

|

NGLs (Barrels) |

2,764,328 |

$32.00 |

$88 |

|

Natural Gas (MCF) |

16,921,035 |

$4.60 |

$78 |

|

Lease Bonus and Other Income |

$7 |

||

|

Hedge Value |

-$1 |

||

|

Total |

$744 |

As a royalty company, Viper is not affected by the cost increases (both for operating expenses and D&C capex) that are cutting into the margins for upstream companies. Unhedged margins (including maintenance capex) may be slightly lower for producers in 2023 compared to 2021 based on current strip prices. However, Viper’s margins per BOE should be higher since it doesn’t bear development and operating costs.

|

$ Million |

|

|

Production and Ad Valorem Taxes |

$52 |

|

Cash G&A |

$8 |

|

Cash Interest |

$30 |

|

Cash Taxes |

$65 |

|

Total Expenses |

$155 |

Viper is projected to generate $589 million in distributable cash flow in 2023, including amounts attributable to non-controlling interests. This is approximately $3.57 per unit.

Viper currently is returning at least 75% of its cash available for distribution in the form of base and variable distributions as well as unit repurchases. This would leave $147 million for debt paydown, which may put its credit facility debt around $50 million by the end of 2023 if it doesn’t spend on acquisitions.

Notes On Valuation

The expectation for solid continuing production growth increases Viper’s value to around $33 per unit (as a one year target price) in a long-term $75 WTI oil scenario. As well, Viper is expected to generate around $3.57 per unit in distributable cash flow in 2023, so its total value becomes over $36 per unit over a one year horizon. Viper thus has some modest total value upside in that long-term $75 oil scenario, although I’d the upside appears mostly limited to the distributable cash flow that it can generate over the next year.

Conclusion

Viper Energy Partners appears set for a solid amount (high-single digits) of production growth in 2023, driven by Diamondback’s Midland Basin development plans. This increases Viper’s value as well as allows it to generate a projected $3.57 per unit in distributable cash flow in 2023 at current strip.

Viper appears to be roughly fairly priced for a long-term $75 WTI oil environment at the moment with its increased production levels, although it would also generate around a 11% distributable cash flow yield during 2023, which adds to its overall value.

Be the first to comment