Ridwan Read/iStock via Getty Images

Viper Energy Partners (NASDAQ:VNOM) increased its oil production guidance for the full-year by approximately 4% as its royalty acreage has seen a strong amount of activity from both Diamondback and third-party operators.

The improved production outlook helps boost its value a bit compared to five months ago. I thought that Viper was fairly priced at the time for a long-term $70s WTI oil scenario. Viper appears to have a modest amount of upside now that it is trading a bit lower and has increased its production outlook.

I estimate Viper’s value (as a one-year target price) at $32 in a long-term $75 WTI oil scenario and $30 in a long-term $70 WTI oil scenario. Viper may also be able to put $3 per unit towards distributions and unit repurchases over the next year, so its total estimated value (over one year) is around $33 to $35 per unit.

2022 Outlook

Viper now expects to average approximately 33,625 BOEPD (59% oil) in production during the second half of 2022. Viper’s guidance midpoint indicates roughly flat production growth compared to Q2 2022.

This results in a projection of $405 million in revenues (after hedges) at current strip of $91 WTI oil for the second half of 2022.

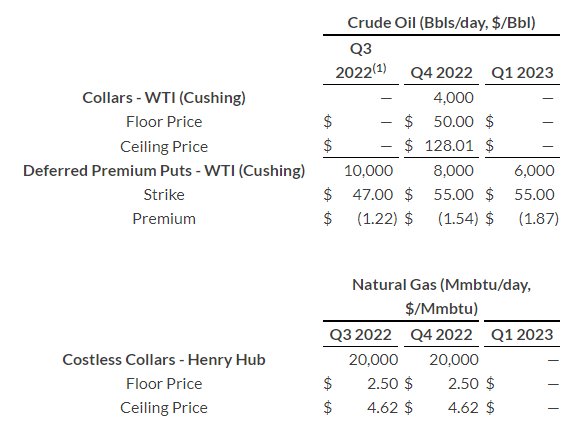

Viper’s Hedges (viperenergy.com)

Viper’s 2H 2022 hedges have an estimated value of negative $15 million. This is composed of negative $13 million in value from its natural gas collars and $2 million in premiums on its deferred premium puts.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

3,634,000 |

$89.00 |

$323 |

|

NGLs (Barrels) |

1,225,440 |

$34.00 |

$42 |

|

Natural Gas (MCF) |

7,965,360 |

$6.70 |

$53 |

|

Lease Bonus and Other Income |

$2 |

||

|

Hedge Value |

-$15 |

||

|

Total |

$405 |

This results in a projection that Viper will have around $341 million in positive cash flow in the second half of 2022.

|

$ Million |

|

|

Production and Ad Valorem Taxes |

$29 |

|

Cash G&A |

$4 |

|

Cash Interest |

$15 |

|

Cash Taxes |

$16 |

|

Total Expenses |

$64 |

Return Of Capital

Viper has now increased its annualized base distribution to $1.00 per unit. This translates into around $166 million per year, based on its total combined common and Class B units outstanding (as of late July 2022).

It has also increased its return of capital commitment to at least 75% of the cash available for distribution. If Viper puts 25% towards debt reduction, it would pay down its debt by $85 million in the second half of 2022. This would also allow it to put $173 million towards unit repurchases and variable distributions after the $83 million that goes towards its base distribution. Thus, the total distribution for the second half of 2022 could be as much as $1.54 per unit.

Viper repurchased 1.0 million common units for $28.9 million (average price of $28.38 per unit) in Q2 2022 and another 0.8 million common units for $20.1 million (average price of $26.51 per unit) in July 2022. It seems to be generally reducing its unit count by an annualized rate of around 3% to 4%.

Notes On Valuation

Viper’s increased production levels compared to early 2022 help boost its value a bit. I now estimate Viper’s value at approximately $32 per unit (as a one-year target price) at long-term $75 WTI oil and $4.00 NYMEX gas. Since Viper may also put around $3 per unit towards distributions and share repurchases over the next year (at a 75% return of capital rate), its total value is approximately $35 per unit.

This assumes that Viper can maintain or slightly increase production levels from the current 2H 2022 expectations for 33,625 BOEPD in average production.

A difference of $5 in long-term oil prices affects Viper’s estimated value by approximately $2 per unit. Thus, at long-term $70 WTI oil and $4.00 NYMEX gas, Viper’s one-year target price would be around $30 per unit instead, with the distributions increasing its total value to around $33 per unit.

Natural gas prices have less of an impact on Viper’s valuation. A $1 change in long-term natural gas prices would change Viper’s estimated value by approximately $1 per unit.

Conclusion

Viper increased its production expectations for 2022 due to strong activity on its royalty acreage. The increased production levels help support a value of around $30 to $32 per unit for Viper in a long-term $70 to $75 WTI oil scenario. In addition to the intrinsic value of the units, Viper also is expected to have around $3 per unit to put towards distributions and unit repurchases over the next year, so that should be factored into its total value calculations.

Be the first to comment