mmac72/E+ via Getty Images

All values are in CAD unless noted otherwise. EIT has been used to refer to the Fund at various times in the article.

Canoe EIT Income Fund (OTCPK:ENDTF), a Canadian Closed End Fund with over $2 billion in assets, has a dual objective – maximize monthly distributions and capital appreciation. The Fund seeks to achieve this goal by investing in a diversified portfolio of high-quality securities. While there is a blend to a certain extent, we have generally found it hard to find quality companies that feel compelled to pay a high dividend. So we were naturally very curious as to how Canoe has performed on both fronts over the years.

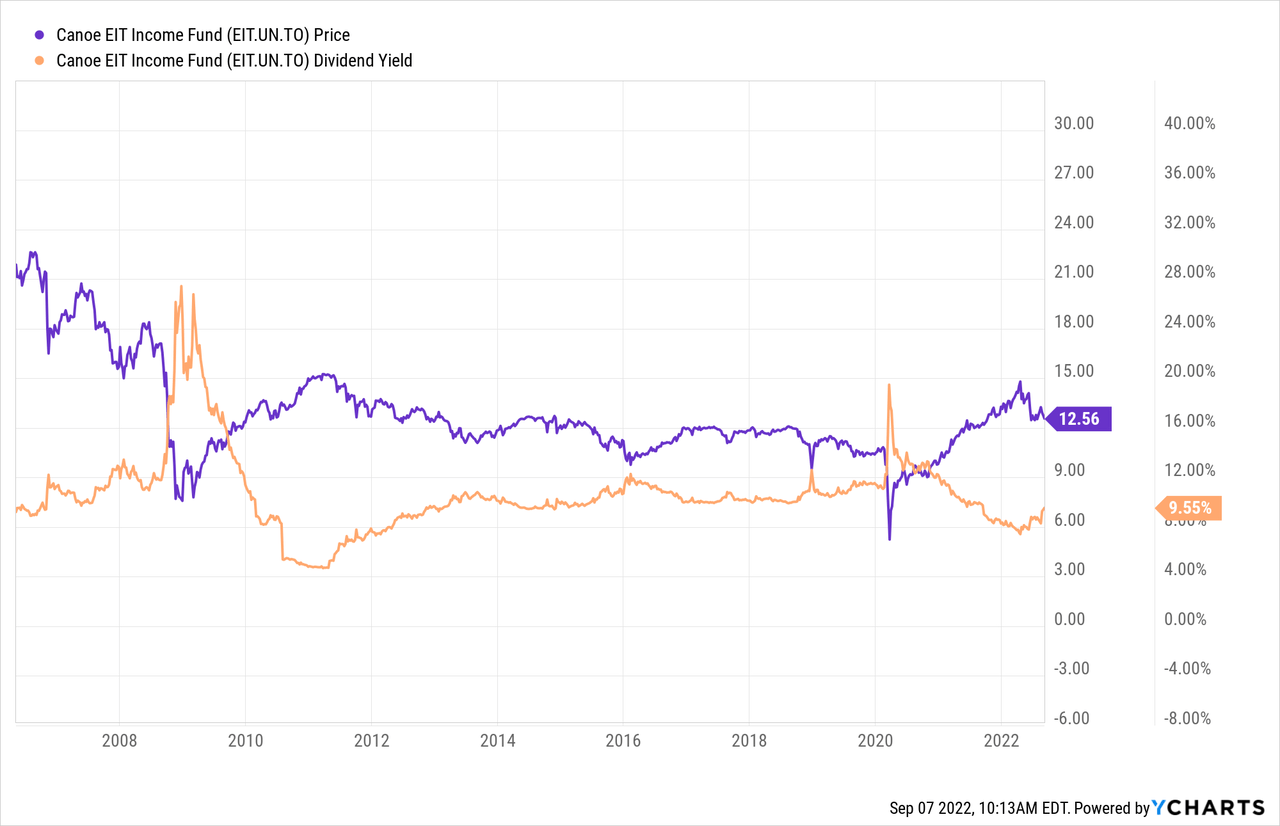

EIT came out of the 2008 financial crisis bruised and battered, but went on to maintain a monthly dividend of $0.10 since 2010. It has also traded in a fairly consistent price range since then and has not lost its investors’ major sleep or hair.

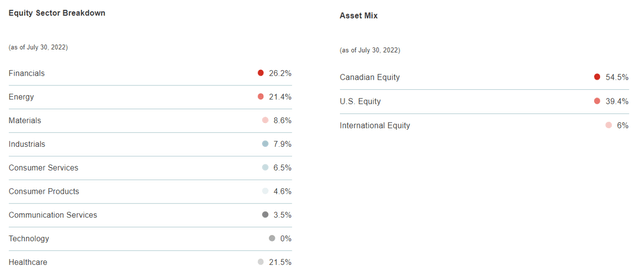

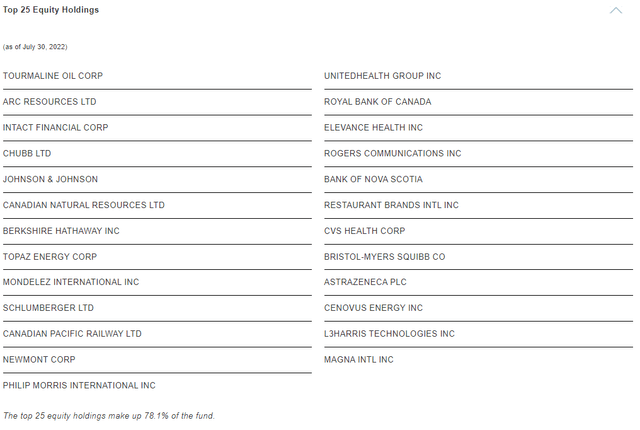

Financials, Energy and Healthcare make up the majority of its portfolio and most of the investments are from north of the border.

The remaining sectors each get a piece of the pie with Technology bringing up the rear with a sub 1% allocation. The Fund has a fairly concentrated portfolio with the Top 25 equity holdings making up 78% of the Fund.

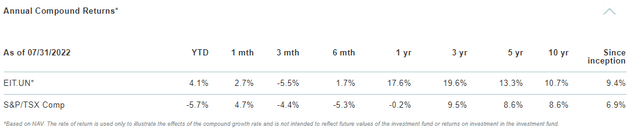

EIT has done well for itself over the years and shines in comparison to the S&P/TSP Composite Index. We can however see that it is hitting the brakes a bit this year.

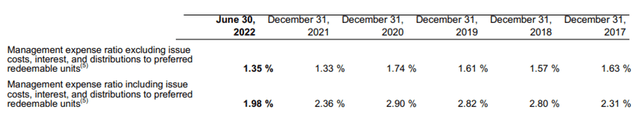

Any outperformance is even more impressive considering the Fund’s expense ratio versus nil for the index.

EIT has a default termination date of December 31, 2050 unless unitholders approve an extension. Finally, the Fund also allows for up to 10% of the outstanding units to be surrendered each calendar year at a price equal to 95% of the average net asset value, net of expenses.

Canoe EIT Income Fund RED PFD Ser B

Having got a feel for EIT, let’s look at one of its two preferred issues as that is where we are making our suggested trade. The Series B (TSX:EIT.PRB:CA) was issued in 2018 and has a 4.80% yield on par and a current price of $25. It can be redeemed after March 15, 2023, some information on which is provided below.

Prior to March 15, 2023, the Fund may not redeem any Series 2 Preferred Units. On or after March 15, 2023, the Fund may give notice in writing not less than 30 days nor more than 60 days prior to the applicable redemption date of its intention to redeem for cash the Series 2 Preferred Units in whole or in part, at the Fund’s option, at a price per Series 2 Preferred Unit equal to $25.75 if redeemed on or after March 15, 2023, but before March 15, 2024; $25.50 if redeemed on or after March 15, 2024, but before March 15, 2025; and $25.00 thereafter, together, in each case, with all accrued and unpaid distributions up to but excluding the date fixed for redemption and less any tax required by law to be deducted therefrom.

Source: SEDAR: Canoe EIT Income Fund Annual Information Form

The preferred unitholders do not have any voting rights except in case of the Fund being in arrears of their distribution payments or in case of matters such as termination of management fees agreement or the Fund.

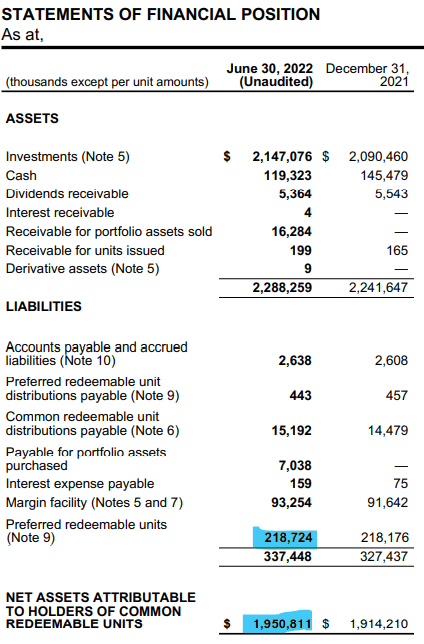

EIT has two classes of preferred, with features almost identical except for the redemption date. Both the classes combined make up around 11% of the net assets (common equity).

Canoe EIT Income Fund Semi Annual Financial Statement

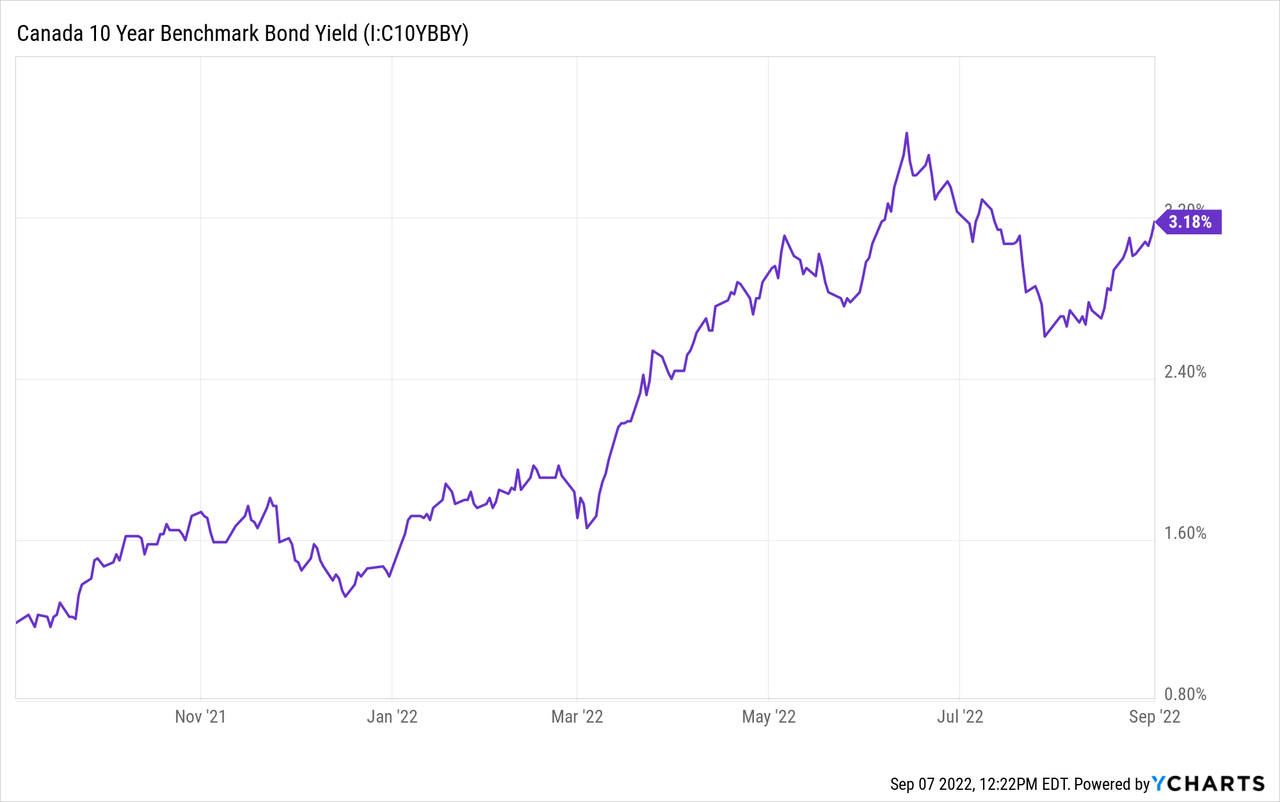

With such a comfortable coverage for the Preferreds, the risk to the 4.80% yield or the capital is very low. In fact, the risk to any preferred share issued by a fund is basically non-existent as they generally have massive asset coverage (total assets/liabilities) ratios. That said, for all of that you are getting a 4.8% yield and nothing more. In the current rising rate environment, the chances of EIT proactively redeeming them are about the same as your risk of loss, non-existent.

But is a spread of just 1.62% over the risk-free rate sufficient when we can get higher for Preferreds of quality companies at present? EIT Preferreds are super safe, however, there is another and with better returns.

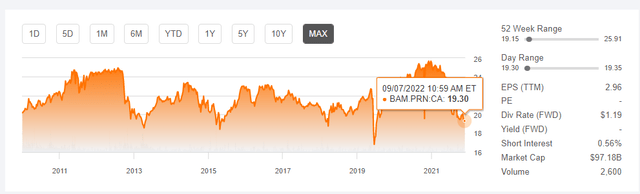

We are talking about one of the preferred shares of a company that needs no introduction, Brookfield Asset Management Inc. (BAM). The company is rated A- by Fitch and S&P and the issue we are talking about is Brookfield Asset Management Inc. 4.75% PFD 18 CL A (TSX:BAM.PRN:CA).

We chose these as they are a “fixed-rate” issue and that makes them directly comparable to Canoe’s preferred shares. As a side note, the vast majority of Canadian preferred shares are of the 5-year reset variety where their yields reset based on the Government of Canada bond yields. These Preferreds currently yield 6.15% as they are trading at over 22% discount to par. While it has been redeemable since June 30, 2012, the redemption while leading to a loss of further dividends, will yield an immediate capital gain as it is trading under par. BAM can convert them in common shares at their option, but that conversion will also result in a substantial capital gain and investors can then sell the BAM common shares.

BAM’s preferred shares consume less than 4% of the expected cash flow in 2022 and 2023. BAM also retains most of its earnings and pays a very tiny dividend to its common shareholders. That is a credit positive action for the preferred shares, especially in recessionary times.

Verdict

We get the love for Canoe EIT fund. It is rare to find a closed end fund with such an awesome record. The preferred shares, though, stink at the current price. 1 year back, EIT.PRB and BAM.PRN, both shares traded slightly above par near $26.00. Since then, this has happened.

We get that investors are obsessed with safety during turbulence, but this makes little sense. All things considered, we would buy the BAM Preferreds that are equally low risk and provide a higher return.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment