Thinkhubstudio

Dear Friends & Partners,

Our investment returns are summarized in the table below:

|

Strategy |

Month |

YTD |

12 Months |

24 Months |

Inception |

|

LRT Economic Moat |

-12.5% |

-35.3% |

-35.3% |

-8.04% |

+19.02% |

| Results as of 12/31/2022. Periods longer than one year are annualized. All results are net of all fees and expenses. Past returns are no guarantee of future results. Please contact us if you would like to receive a full performance tearsheet. Please see the end of this letter for additional disclosures. |

December’s results capped the end of a weak year. Our longs declined somewhat more than the market, but these declines were only partially offset by our hedges. As of January 1st, 2023, our net exposure was approximately 58.81%, and our beta-adjusted exposure was 36.02%. We currently have 60 long positions with the top 10 accounting for approximately 35.7% of our total long exposure.

Goodbye 2022, you will not be missed

On December 31st, 2021, the value of our investment portfolio stood at an all-time high, and I was feeling pretty good about the result achieved in 2021. During the past year, 2022, the value of our portfolio tumbled by about one-third, and the emotion I now feel about the past year is quite different. This has been by far the worst year of my investment career. It is easy to look back, second guess one’s decision and be disappointed. But I have experienced drawdowns and setbacks in the past, and I climbed out of them each and every time. I am certain that over time the value of our investment strategy will once again climb to new highs, just like it has always been able to do in the past.

The lessons learned during 2022 and investment process improvements made as a result make it less likely what we will experience a drawdown like this in the future, something that I am hopeful for.

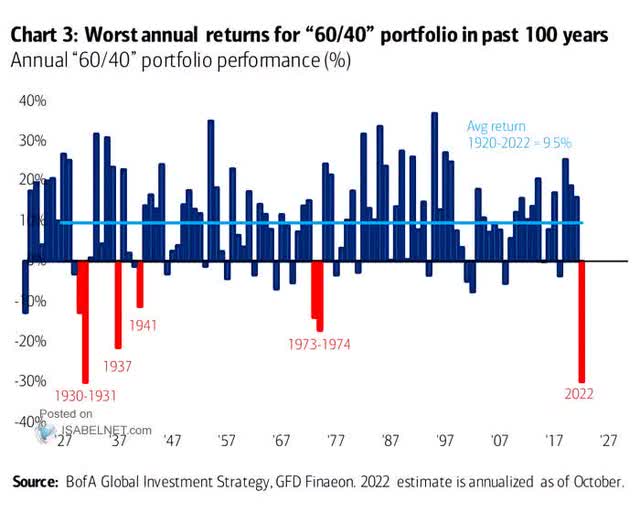

2022 was an extremely difficult investment year, with both stocks and bonds delivering poor returns. There are many ways to explain how bad the year was, but overall return of a “60/40” portfolio (as seen below) captures just how bad it was. Just about the only thing that delivered a positive return last year were energy stocks (which we rarely invest in). In investing, while bad years can occasionally occur, and even spectacularly bad ones can happen (like last year). However, I believe that stocks remain the best asset class for long term investors. Overall, 2022 has a challenging year for me, as it was for many investors. I expect the future to be much brighter.

In 2022, even Tom Brady, the greatest quarterback in the history of the NFL has had a bad year.[1] In the past year, his team, The Tampa Bay Buccaneers have been eliminated from the playoffs, his wife left him, and his reputation has been hurt by his endorsement of FTX, the bankrupt and fraudulent crypto exchange. Yet, Tom Brady will forever be amongst the best players in the history of the game. Even the best players in the game sometimes go through hard times.

I remain committed to continuing to invest for the long run and to running our investment strategy. I believe I will be able to recover from this drawdown and reach new all-time highs for our strategy in the months ahead. I am not in denial about the challenges of the past year, mistakes made, and steps needed to improve performance. Emotions can hurt long term investors more than short term market declines themselves.

Acting emotionally, in panic, and selling at market lows can often be the worst decision. As a result, I continue to look to the long-term business performance of the wonderful companies that we own and believe that this will soon be reflected in market prices and improved returns for our investment strategy.

I am cautiously optimistic for 2023. Our investment process has been improved, market valuations are much lower, and the bubble in unprofitable technology companies has clearly burst. I am as motivated as ever to generate good returns in the months ahead. Thank you for sticking with me during this difficult period. I believe your patience will be rewarded in the year ahead.

As always, I look forward to hearing from you and answering any questions you might have. Thank you for your continued interest and support.

Lukasz Tomicki, Portfolio Manager, LRT Capital

Appendix I: Attributions and Holdings as of 12/1/2022

|

Top Holdings (%) |

Sector Allocations (Long Exposure) |

|

|

Northrop Grumman Corporation (NOC) |

6.29 |

|

|

Domino’s Pizza, Inc. (DPZ) |

4.76 |

|

|

Marriott International, Inc. (MAR) |

4.74 |

|

|

Murphy USA Inc. (MUSA) |

4.66 |

|

|

Asbury Automotive Group, Inc. (ABG) |

4.02 |

|

|

Texas Pacific Land Trust (TPL) |

3.90 |

|

|

Aspen Technology, Inc. (AZPN) |

3.32 |

|

|

Progressive Corp. (PGR) |

3.17 |

|

|

AO Smith Corp. (AOS) |

3.02 |

|

|

Novo Nordisk A/S (NVO) |

3.01 |

|

|

Top Holdings Total |

40.89 |

|

|

Sector |

Portfolio |

S&P 500 |

Delta |

|

Consumer Cyclical |

26.47 |

10.59 |

15.88 |

|

Industrials |

24.21 |

8.69 |

15.52 |

|

Healthcare |

10.24 |

15.42 |

(5.18) |

|

Technology |

9.82 |

23.60 |

(13.78) |

|

Financial Services |

7.36 |

13.61 |

(6.25) |

|

Real Estate |

5.35 |

2.74 |

2.61 |

|

Basic Materials |

4.61 |

2.27 |

2.34 |

|

Communication Services |

4.31 |

7.36 |

(3.05) |

|

Energy |

3.92 |

5.37 |

(1.45) |

|

Consumer Defensive |

3.71 |

7.38 |

(3.67) |

|

Utilities |

– |

2.97 |

(2.97) |

|

Hedges (%) |

|

|

Vanguard Mid-Cap ETF (VO) |

-12.51 |

|

Vanguard Small-Cap ETF (VB) |

-11.53 |

|

iShares Core S&P Mid-Cap (IJH) |

-11.36 |

|

SPDR S&P MidCap 400 ETF (MDY) |

-11.36 |

|

iShares Russell 2000 (IWM) |

-10.93 |

|

iShares Core S&P Small-Cap (IJR) |

-10.87 |

|

Market Cap Allocations (%) |

|||

|

Large |

38.22 |

||

|

Mid |

49.36 |

||

|

Small |

12.42 |

||

|

Return Attribution (%) |

|

|

Long Equity |

-7.61 |

|

Hedges |

2.64 |

|

Unlevered Gross Return |

-4.97 |

|

Leveraged Gross Return |

-12.42 |

|

Net Return |

-12.50 |

|

Country Allocations (%) |

|||

|

United States |

93.50 |

||

|

Canada |

3.49 |

||

|

Denmark |

3.01 |

||

|

Source: Morningstar, Sentieo. Numbers may not add up due to rounding. Net returns are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account results may vary due to the timing of investments and fee structure. Please consult your statements for exact results. Please see the end of this letter for additional disclosures. |

Appendix II: Investment Philosophy

Over the past five years, we saw a large increase in the number of LRT Capital partners (the term we use to describe our clients). With so many newcomers, it is important that we write about our investment philosophy again.

Here are the key points:

- Exceptional stock returns come from exceptional business returns on a per-share basis.

- We seek to invest in high-quality companies, i.e., those possessing sustainable competitive advantages (moats), the ability to grow and reinvest capital over time, and management that excels at capital allocation.

- We only purchase companies whose shares trade at a discount to our assessment of their intrinsic value.

- It is futile to predict short-term market movements. We seek to hold our investments for as long as possible.

- The financial markets are dominated by short-term traders who see stocks as casino chips. This occasionally allows us to purchase shares in great companies at large discounts to their true worth.

- If we are right about the trajectory of the businesses we invest in, over time, we will be right on the trajectory of their stock prices.

We view stock market volatility as a source of opportunity. Volatility allows us to profit by acquiring shares in superb businesses at attractive prices. The more that markets (the “other” participants) are irrational, the more likely we are to reach our ambitious performance objectives.

In the long run, stocks are the best investment asset class, but our experience has taught us that our investment process will not generate linear returns. In some years, our portfolio will outperform, and in others, it will generate a below average return. This is a certainty that we must accept. We are long-term investors and we do not try to dance in and out of the market.

In summary, our investment strategy can be summed up in three steps:

- Only seek out high-quality companies.

- Do not overpay.

- Do nothing – patience and discipline are the keystones to success.

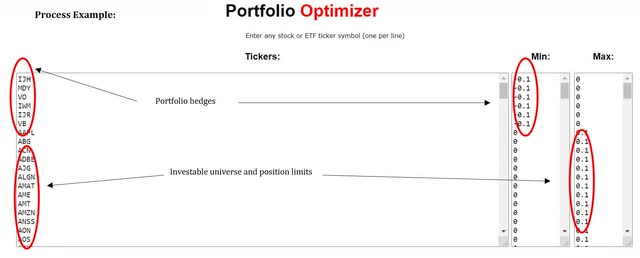

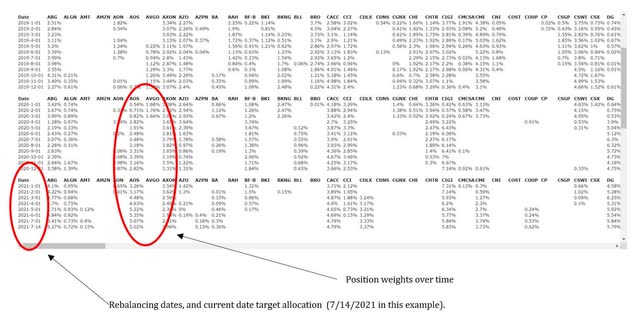

Appendix III: Portfolio Construction Software Overview

LRT separates the discretionary and qualitative process of selecting the equity holdings from the portfolio construction process which is systematic and quantitative.

Our quantitative process considers each position’s contribution to portfolio volatility, contribution of idiosyncratic vs. systematic risk and portfolio factor (size, value, quality, momentum, vol, etc.) exposures.

The system outputs target portfolio weighs for each position. We trade mechanically to rebalance the portfolio each month to the targeted exposures. This eliminates emotions, human biases, and overconfidence risk.

Example system output:

Disclaimer and Contact InformationLRT Capital Management, LLC is an Exempt Reporting Adviser with the Texas State Securities Board, CRD #290260. Past returns are no guarantee of future results. Results are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account returns may vary based on the timing of investments and individual fee structure. This memorandum and the information included herein is confidential and is intended solely for the information and exclusive use of the person to whom it has been provided. It is not to be reproduced or transmitted, in whole or in part, to any other person. Each recipient of this memorandum agrees to treat the memorandum and the information included herein as confidential and further agrees not to transmit, reproduce, or make available to anyone, in whole or in part, any of the information included herein. Each person who receives a copy of this memorandum is deemed to have agreed to return this memorandum to the General Partner upon request. Investment in the Fund involves significant risks, including but not limited to the risks that the indices within the Fund perform unfavorably, there are disruption of the orderly markets of the securities traded in the Fund, trading errors occur, and the computer software and hardware on which the General Partner relies experiences technical issues. All investing involves risk of loss, including the possible loss of all amounts invested. Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly herein will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing herein should be construed as guaranteeing any investment performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. For a more detailed explanation of risks relating to an investment, please review the Fund’s Private Placement Memorandum, Limited Partnership Agreement, and Subscription Documents (Offering Documents). This report is for informational purposes only and does not constitute an offer to sell, solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Any offer to sell is done exclusively through the Fund’s Private Placement Memorandum. All persons interested in subscribing to the Fund should first review the Fund’s Offering Documents, copies of which are available upon request. The information contained herein has been prepared by the General Partner and is current as of the date of transmission. Such information is subject to change. Any statements or facts contained herein derived from third-party sources are believed to be reliable but are not guaranteed as to their accuracy or completeness. Investment in the Fund is permitted only by “accredited investors” as defined in the Securities Act of 1933, as amended. These requirements are set forth in detail in the Offering Documents. |

Footnotes

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment