vgajic

Equitrans Midstream Corporation (NYSE:ETRN) is a midsized natural gas-focused midstream company that operates throughout the Appalachian region. This makes it somewhat unique among the midstream firms as it is one of the only ones that is exclusively focused on the Marcellus and Utica shale plays, which have been severely constrained in terms of midstream capacity for many years. The fact that the company is somewhat unique does not prevent it from enjoying many of the characteristics that we tend to appreciate in midstream companies, such as stable cash flows and high dividend yields. Indeed, Equitrans Midstream’s 8.94% current yield is high enough to catch anyone’s eye. The company also has a few other characteristics that actually make it much more appealing than many other companies in the sector, which we will of course discuss in this article. Overall, there are some very strong reasons for any investor to consider taking a position in the stock, but there are also some significant risks that should not be ignored.

About Equitrans Midstream

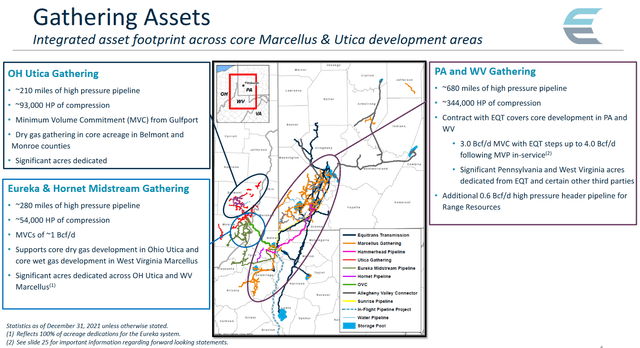

As stated in the introduction, Equitrans Midstream is a natural gas-focused midstream company that operates in the Marcellus and Utica shale plays of Ohio, Pennsylvania, and West Virginia:

One thing that we can see here is that Equitrans Midstream primarily operates gathering pipelines, which admittedly are not what most people picture when they think of a midstream company. These are not the giant pipelines that carry resources across long distances. Rather, the company’s pipelines grab the natural gas at the well, where it is pulled out of the ground and carry it a relatively short distance to the first step on its journey to the end-user. This first step is usually a processing plant or a much larger long-haul pipeline. Despite the company’s infrastructure being a bit different than what many other midstream companies possess, Equitrans has a very similar business model. Basically, Equitrans enters into long-term contracts with its customers under which the customer compensates Equitrans based on the volume of resources that the company handles, not their value. In addition to this, the contracts contain minimum volume commitments that specify a certain minimum volume of resources that the customer has to send through the company’s infrastructure or pay for anyway. This, overall, provides Equitrans Midstream with a great deal of insulation against changes in resource prices, which unfortunately limits the company’s ability to benefit when energy prices are high, like they are right now.

The usual contract length that a midstream firm will have with its customers is between five and ten years in length, which is typically long enough to outlast any macroeconomic problems or energy bear markets. Equitrans Midstream does much better than this though as its largest contract is a fifteen-year one with EQT Corporation (EQT), the largest producer of natural gas in Appalachia. This contract commenced in 2020 so we can expect it to last until 2035. The length of this contract gives Equitrans Midstream a bit of security beyond what other midstream companies possess but the fact that it guarantees growth for Equitrans Midstream makes it even more of a competitive advantage that the company has over its peers. This is because the contract calls for Equitrans Midstream to gather a minimum of 2.0 billion cubic feet of natural gas per day, however, the minimum volume commitment increases to 3.0 billion cubic feet of natural gas per day once the Mountain Valley Pipeline is complete and operational. This is expected to happen sometime in the second half of 2023 so we can expect to see the company’s cash flow increase significantly at that time and remain elevated until the contract concludes in 2035.

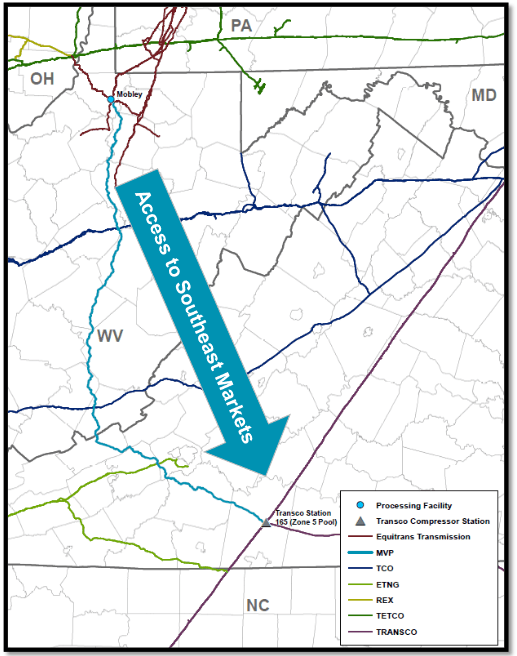

As might be expected, the Mountain Valley Pipeline is the most significant growth project that Equitrans Midstream is working on. This is a 303-mile long natural gas pipeline stretching from northwestern West Virginia to southern Virginia:

Equitrans Midstream

The primary purpose of this pipeline is to supply natural gas to the increasingly thirsty markets of the southern United States. These markets are seeing rapidly growing demand for natural gas from the utility sector as well as from the increasing number of liquefied natural gas plants that are being constructed along the coastline. The Mountain Valley Pipeline will certainly go a long way towards satisfying this demand as it is capable of carrying approximately 2.0 billion cubic feet of natural gas per day. As is always the case with midstream projects too, Equitrans has already secured contracts for its customers for the use of this pipeline. As such, we can be quite certain that the company is not spending a great deal of money to construct a pipeline that nobody wants to use. In addition, the company knows just how profitable the project will be so it knows that it will earn a sufficient return to justify the investment. In this case, the Mountain Valley Pipeline can be expected to generate $220 million per year in adjusted EBITDA. When we consider that the pipeline is costing Equitrans Midstream approximately $3.4 billion to construct, the pipeline will pay for itself in just over fifteen years. This is admittedly not a very impressive return as companies like Kinder Morgan (KMI) regularly undertake projects that pay for themselves in four to six years. However, that $220 million figure does not include the fact that Equitrans will see its gathered volumes under the EQT contract increase once the pipeline is complete. The increased cash flow that Equitrans will get from these higher volumes could more than offset the somewhat weak returns from the pipeline itself.

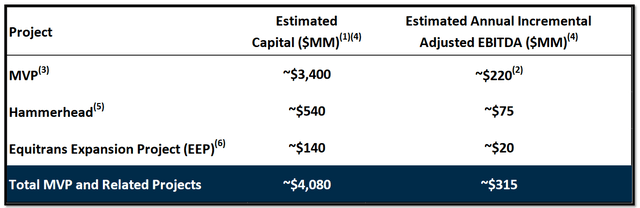

Although the Mountain Valley Pipeline is by far Equitrans Midstream’s largest growth project, it is not the only one that the company is currently working on. In fact, the company has $4.080 billion worth of growth projects at various stages of development:

The largest of these projects aside from the Mountain Valley Pipeline is the Hammerhead Gathering Pipeline. This pipeline is a 64-mile one running from southwestern Pennsylvania to northern West Virginia and is intended to aggregate the gas collected by the company’s gathering pipeline infrastructure throughout the region. Earlier in this article, I stated that one place that a gathering pipeline might carry resources to is a larger long-haul pipeline. The Hammerhead Gathering Pipeline will serve as that larger pipeline in this case as it will be capable of carrying approximately 1.6 billion cubic feet of natural gas per day. Equitrans has already obtained a contract for 1.2 billion cubic feet per day of this capacity from EQT so we know that it will begin generating cash flow once it begins operation, which is expected to be in the second half of 2023 alongside the commencement of operations of the Mountain Valley Pipeline. This pipeline can be expected to increase Equitrans Midstream’s annual adjusted EBITDA by about $75 million, which means that this project will pay for itself in about seven years. That is certainly much better than the payback period of the Mountain Valley Pipeline but it is still admittedly not as good as I want to see. However, any growth potential is still better than many other companies in the industry have so we can still appreciate it.

Fundamentals Of Natural Gas Midstream

As Equitrans Midstream is one of the only midstream firms that focuses exclusively on the transportation of natural gas, it may be prudent to take a look at the fundamentals of this commodity as part of our analysis. Fortunately, the fundamentals are quite strong. In fact, they are much stronger than the fundamentals of any other fossil fuel, which points to the likelihood that Equitrans Midstream will see its transported volumes increase over the long term. This is, perhaps surprisingly, being driven by global warming concerns. Earlier in this article, I mentioned that utilities in the United States are increasing their consumption of natural gas. I discussed this in detail in a previous article. This is in fact a global phenomenon that is being driven by utilities retiring their old coal-fired power plants and replacing them with renewable ones. However, renewables are not reliable enough to support a modern electric grid on their own. After all, wind power does not work when the air is still and solar power does not work at night. The common solution to this problem is to supplement renewables with natural gas turbines as natural gas can produce electricity reliably enough to ensure that the grid remains functional in any weather conditions and burns much cleaner than any other fossil fuel. This is why natural gas is sometimes called a “transitional fuel” as it provides a way to ensure the reliability that we expect from a modern electric grid and still reduce carbon emissions while we wait until renewable technologies have advanced sufficiently to be able to perform this task on their own.

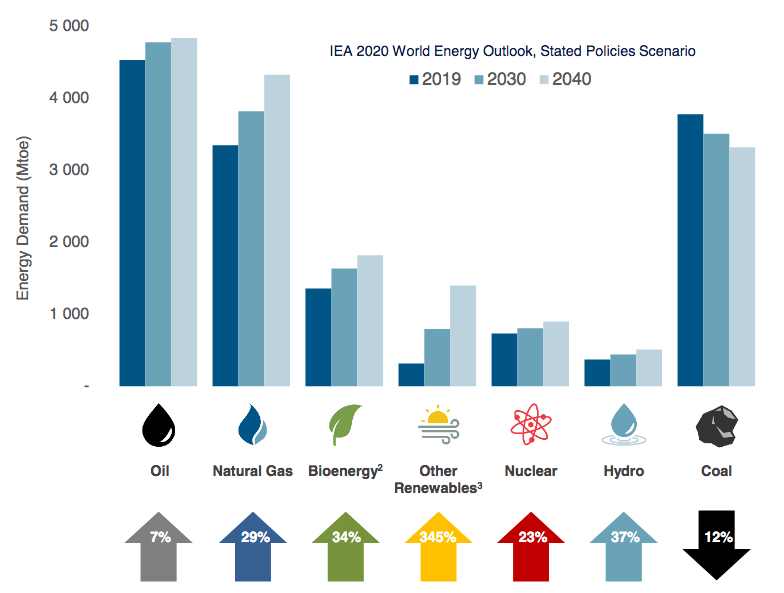

According to the International Energy Agency, the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The United States is one of the only countries in the world that has the ability to increase its production sufficiently in order to meet this demand because of the wealth of areas like the Marcellus Shale. It is uncertain whether or not the producers in the region will actually do that but it seems logical that some production increase is likely should natural gas prices remain high. Equitrans Midstream would likely benefit if this happens because production growth in Appalachia will result in the company having higher volumes. After all, somebody needs to transport the newly produced resources from the wells to the market where they can be sold. As Equitrans Midstream’s cash flows are directly correlated with the volume of resources handled, this should result in growing cash flows for the company going forward. This will obviously benefit investors in the company.

Financial Considerations

It is always important that we analyze the way that a company finances itself before making an investment in the business. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by the company issuing new debt to replace the existing debt, which may cause its interest costs to increase depending on the conditions in the market. In addition to this, the company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flow could push the company into financial distress. Although midstream companies like Equitrans Midstream tend to have remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector so this is still a risk.

The usual way to judge the debt load of a company like Equitrans Midstream is by looking at a metric known as the leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to this task. As of March 31, 2022, Equitrans Midstream had a net debt of $6.8441 billion. In the first quarter of 2022, the company had an adjusted EBITDA of $276.985 million, which works out to $1.10774 billion annualized. This gives the company a leverage ratio of 6.18x, which is a bit on the high side. Analysts generally consider anything under 5.0x to be reasonable and as we can clearly see, Equitrans Midstream is substantially above that. This is a problem that the company needs to address as this high debt load poses a risk for investors.

Dividend Analysis

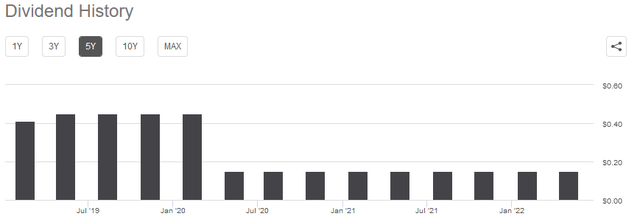

One of the biggest reasons why investors purchase shares of midstream companies is because they tend to have a higher dividend yield than most other things in the market. Equitrans Midstream certainly does not disappoint here as the company’s 8.94% current yield is substantially higher than the 1.55% yield of the S&P 500 index (SPY). Unfortunately, Equitrans Midstream does not exactly have the most promising dividend history. The company slashed its dividend substantially in response to the events of 2020 and has kept it at that low level ever since:

This alone should not necessarily turn someone off from this investment, though. After all, many midstream companies cut their payouts in 2020 so Equitrans Midstream is in good company here. In addition, someone buying the shares today will receive the current dividend and yield so they do not have to worry or care about what happened in the past. The important thing for us today is to determine if the company can actually afford to maintain the dividend at its current level since we do not want to be the victims of another dividend cut. That scenario would both reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we analyze a company’s ability to maintain its dividend is by looking at its free cash flow. The free cash flow is the money that was generated by the company’s ordinary operations that are left over after the firm pays all its bills and makes all necessary capital expenditures. This is the money that is available to do tasks such as paying down debt, buying back stock, or paying a dividend. In the trailing twelve-month period, Equitrans Midstream had a levered free cash flow of $228.1 million but it paid out $318.0 million in dividends. This is concerning as it is a sign that the company is relying on external financing to cover its capital expenditures and dividend. Its operating cash flow of $1.1252 billion over the period was more than enough to cover the dividend, but I will admit that I am more nervous about a midstream company levering itself up to cover the dividend than a utility because of the market’s somewhat fickle attitude towards these companies. Equitrans Midstream can probably cover its dividend in the short-term, particularly since its cash flows will increase in a year when the Mountain Valley Pipeline comes online and the EQT contract’s minimum volume commitment increases but we should be cautious here and keep an eye on the company’s cash flows.

Conclusion

In conclusion, Equitrans Midstream has a great deal to like about it. The company’s focus on Appalachian natural gas has provided it with many growth opportunities, which are reinforced by a very attractive contract with EQT Corporation. The company’s major growth project, the Mountain Valley Pipeline, should serve as a very strong growth driver between now and the end of 2023 and the growing global demand for natural gas may present it with further opportunities beyond that project. Unfortunately, the company’s balance sheet leaves a lot to be desired as it has an enormous debt load that it will ultimately need to get under control at some point. While I think that the dividend will probably be okay, I am concerned about the company paying out more than its free cash flow and levering itself up in the process. Overall, I want to recommend this company but be sure that you are willing to take on the risks before buying the shares.

Be the first to comment