niphon/iStock via Getty Images

I want to start this article by wishing everyone the best for 2023 and let’s hope that it will be a better investment year than 2022.

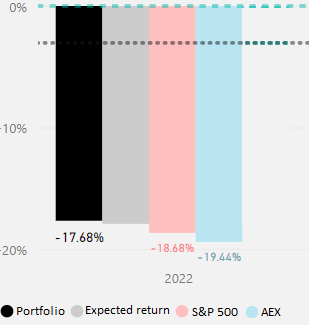

2022 has come to an end, a year that can be best described as a volatile year. The S&P 500’s total return was negative 18.1%, while the Nasdaq had a total return of negative 32.4%, making this the worst year since 2008, in which we had the great financial crisis. This was largely driven by the Fed’s rate hikes which totaled 425 basis points, compared to an expectation of 75 at the beginning of the year. My personal portfolio was also impacted a lot by the exchange rate between the Euro and the USD, which were trading at parity at a certain time. Nevertheless, I slightly outperformed the S&P 500 this year, with an approximate return of negative 17.7%. This marks my second year of outperformance since I started tracking it in 2019. A feat that I am proud of and I hope to do even better in the coming 4 years.

For the people that have not read my previous articles: I am a 25-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

December & end of year update

In December I did not change a lot to my portfolio. I added capital to 3 positions and had no sales. In 2023 I expect to keep my strategy largely the same for this portfolio, which means that my main focus will be on dividend-paying stocks and sectors that I am familiar with (mainly real estate). I will continue to keep a focus on the valuation of my stocks and only buy additional stocks when the valuation is right. The goal is to have at least $2,000 in dividends at the end of 2023.

In December I also consolidated one of my other portfolios. This portfolio I ran with a friend, but as we hadn’t touched it in a year, I decided to start working on its consolidation. I decided to sell all the positions that I did not own in this portfolio and added the other positions to the positions I already owned. This meant that I added 1 stock of Cboe (CBOE) and 2 stocks of Armada Hoffler (AHH) to my portfolio. To not ruin my cost basis, I added them at their fair value.

After consolidating I have 3 portfolios left, including this one. One is the portfolio that I, together with some teammates, run for the competition of the student association, the other one is a portfolio that is run by me, but uses a slightly different strategy. The strategy for the latter is to invest in merger-arbitrage, deep value and high insider-ownership stocks and the main focus is capital appreciation. There is a possibility that I will move my small-cap stocks to this portfolio, but I have not made a decision about this yet.

As for the competition, we are currently not doing that well. Our total returns are negative and our standard deviation is low, which has a negative impact on our risk-adjusted returns. This does not worry us yet as the low standard deviation allows us to take concentrated bets later in the competition. For now, our portfolio consists of 5 stocks, which were purchased based on their valuation or on a corporate event. I will try to keep you updated in the coming months.

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

||

|

Reconsider |

|

|

|

|

Sell |

|

Beginning of December

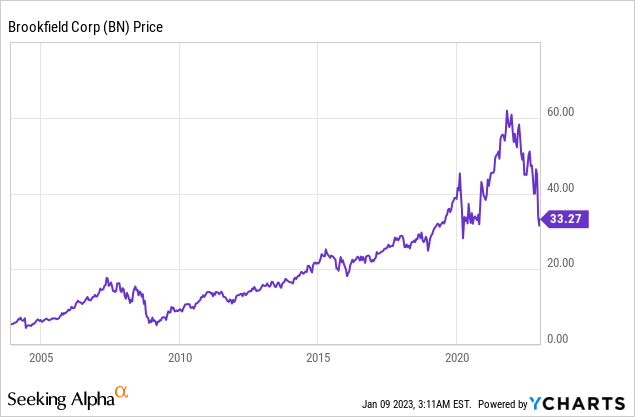

Brookfield Corporation (BN) – Bought 7.3 shares for $43.38 each & Brookfield Asset Management (BAM) – Received 11 shares from the spin-off: At the beginning of the month, I decided to add some additional shares to Brookfield (at the time trading as BAM). The company has been a great compounder for shareholders and as I mentioned last month its spin-offs have unlocked a lot of value. In the current environment, which is characterized by high inflation and rate hikes, I expect the company to be able to profit and buy long-term assets for a bargain price. One example of Brookfield doing this in 2022 is that it bought distressed real estate projects in the larger cities in China, which is experiencing a real estate crisis. They did a similar thing in 2008, when the US was experiencing a real estate crisis and the company bought General Growth Properties. They have since spin-off the company as Brookfield Property Partners and last year took the company private again. As for the latest spin-off, I am planning to hold onto it for now but might decide to sell one of the two positions later.

Armada Hoffler Corporation – Bought 23 shares for $11.71 each:

Armada Hoffler is a real estate owner and developer in the mid-Atlantic region. The company is one of the value picks in my portfolio. The company is trading at a low valuation for a few reasons. First of all, the company had to cut its dividend during the pandemic, secondly, the company’s net debt to EBITDA is on the higher side with a current value of 8.1, thirdly, it is a diversified REIT which tends to trade at lower valuations than specialized REITs and last but not least the higher interest rates lead to higher construction costs, further putting pressure on the stock price. Although I acknowledge that the company is riskier than some of its peers, the company is very experienced in its region, has strong ties with local government and its in-house development team lowers construction costs. For the aforementioned reasons, I think that a valuation of 9.5 NTM P/FFO is too low, and have decided to add to this position.

Mips AB (OTC:MPZAF) (OTCPK:MPZAY) – Bought 6 shares for 378.60 SEK each:

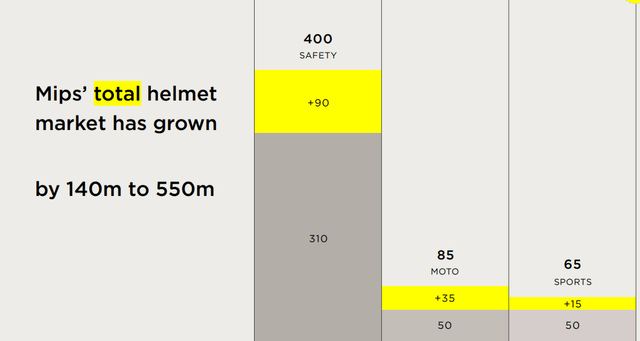

The last stock that I added capital to is MIPS AB. Most investors are relatively unaware of this company as it is a very small company out of Sweden. People that ride bicycles or like to ski or snowboard might be aware of helmets with a yellow sticker. These helmets are equipped with MIPS’ rotational motion protection strategy. The company is the market leader in this segment and is also starting to grow in the safety helmet market. The safety helmet market is a large category and includes both industrial and Law Enforcement and Armed Forces helmets. The safety helmet market is estimated at 400 million helmets annually, which is more than the sports and moto helmet markets combined. Thus if the company is able to grow in this vertical the stock price should do well.

Mips Helmet Market (Mips Capital Market Day presentation)

|

Company |

Shares |

Total price |

Effect on dividend (pre-tax) |

| Brookfield Corporation | 7.3 | $316.67 | $2.04 |

| Brookfield Asset Management | 11 | $0 | $14.08 |

| Armada Hoffler | 23 | $269.33 | $17.48 |

| MIPS AB | 6 | 2,271.6 SEK ($215.88) | 30 SEK ($2.85) |

Dividends

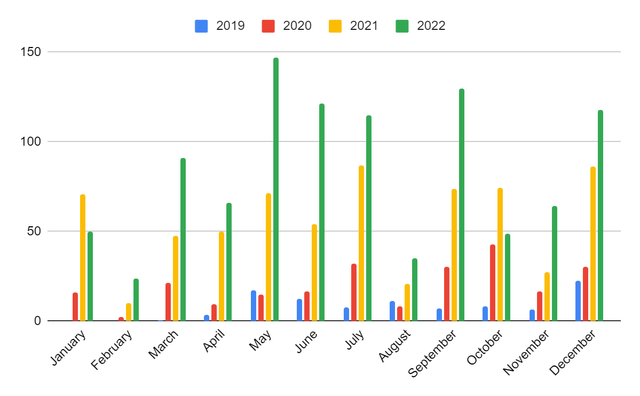

During December I received a total of $118.31 in dividends, mainly due to dividends by Enbridge (ENB) and Prudential Financial (PRU). This is $44.16 more than last year or an increase of more than 35%.

| Company | Dividend 2021 | Dividend 2022 | Difference |

| Enbridge (ENB) | $30.31 | $35.13 | $4.82 |

| Intel Corporation (INTC) | $3.25 | $6.81 | $3.56 |

| Unilever (UN) | €5.98 ($6.76) | $0 | -$6.76 |

| TJX Companies (TJX) | $3.54 | $6.72 | $3.18 |

| L3Harris (LHX) | $5.20 | $8.24 | $3.04 |

| Visa (V) | $2.24 | $4.00 | $1.76 |

| Cboe Global | $4.78 | $7.20 | $2.42 |

| NETSTREIT (NTST) | $7.31 | $14.29 | $6.98 |

| Prudential Financial (PRU) | $10.56 | $23.88 | $13.32 |

| Interactive Brokers (IBKR) | $0.20 | $0.37 | $0.17 |

| Brookfield Asset Management (BAM) | $0 | $2.88 | $2.88 |

| Microsoft (MSFT) | $0 | $1.43 | $1.43 |

| Broadcom (AVGO) | $0 | $7.36 | $7.36 |

| Total | $74.15 | $118.31 | $44.16 |

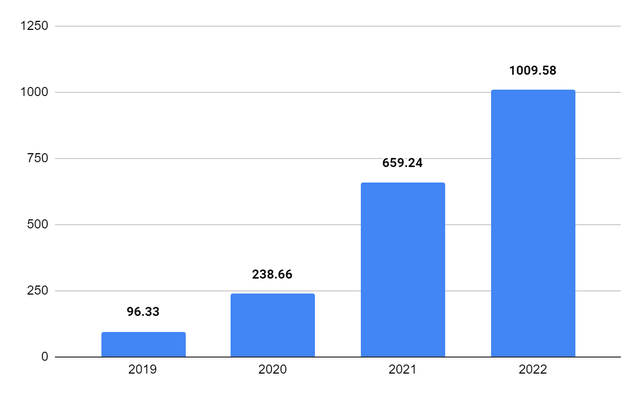

During the entire year of 2022, I received $1009.58 in dividends compared to $659.24 in 2021, an increase of more than 50%.

At the end of 2022, my forward dividend was €1,130.31 or $1,205.31. This means that I have reached my goal of $1,200 that I set during the year after reaching my goal of $1,000 early on. The main driver was the addition of new capital although the following dividend increases also helped:

| Company | Increase in dividend quarterly | Dividend per share pre-raise | Dividend per share post-raise |

| CVS (CVS) | $0.055 | $0.55 | $0.605 |

| Broadcom | $0.50 | $4.10 | $4.60 |

Sector overview

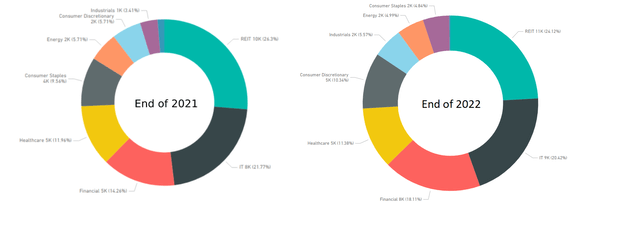

Compared to last year my positions in my top two sectors (REITs, IT) have declined significantly. This was mainly driven by their performance this year as both sectors were among the worst performing sectors this year. In that light, the increased allocation to financials makes sense as the sector outperformed the other two significantly. The decrease in consumer staples is due to the fact that I cut a significant amount of positions during the year, mostly in the beginning, which in hindsight wasn’t the greatest move. In the coming year, I do not expect much change in my allocation although I will mostly add to positions that I estimate to be relatively cheap.

Total return

As mentioned before, I outperformed the S&P500 this year, albeit by a small margin. I also outperformed the Dutch AEX, which is comprised of the largest companies listed on the Amsterdam stock exchange. The returns as shown below are in USD and the FX rate had a significant impact. As a result, I also added less new capital to US companies in 2022.

Total return (Author)

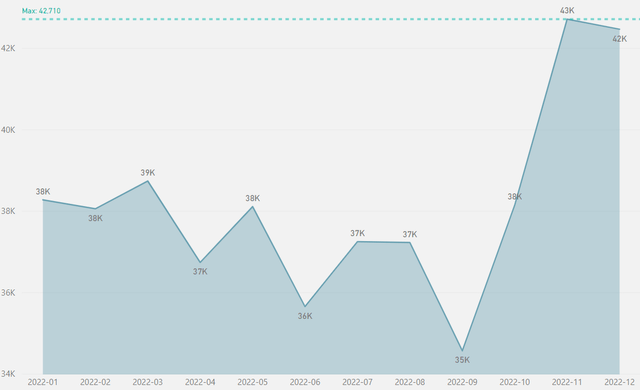

Below you can see my portfolio value over the months. You can see a huge improvement starting in October. This does not come as a surprise as inflation started to peak around this time and the USD started to depreciate against the Euro, increasing the value of my European positions (which account for approximately 30% of my portfolio).

Total value per month (Author)

Current holdings

| Company | Qty Held | Portfolio % | Days Since Latest Buy |

| AbbVie (ABBV) | 16 | 5.86% | 409 |

| VICI Properties (VICI) | 73 | 5.37% | 329 |

| Enbridge | 55 | 4.99% | 422 |

| Prudential Financial | 21 | 4.86% | 160 |

| Ahold (OTCQX:ADRNY) | 72 | 4.84% | 135 |

| Visa | 10 | 4.71% | 120 |

| CTPNV | 164 | 4.63% | 92 |

| Broadcom | 4 | 4.63% | 94 |

| TJ Maxx | 25 | 4.62% | 266 |

| Cboe | 16 | 4.45% | 338 |

| L3harris | 9 | 4.40% | 36 |

| Vonovia (OTCPK:VONOY) | 72 | 4.30% | 76 |

| Prosus (OTCPK:PROSY) | 23 | 4.06% | 234 |

| Morgan Stanley (MS) | 20 | 4.05% | 157 |

| Inditex (OTCPK:IDEXY)(OTCPK:IDEXF) | 62 | 3.94% | 157 |

| Aroundtown (OTCPK:AANNF) | 608 | 3.68% | 65 |

| Brookfield Corporation | 45 | 3.39% | 29 |

| NETSTREIT | 73 | 3.19% | 162 |

| Armada Hoffler | 109 | 2.96% | 30 |

| CVS Health | 13 | 2.81% | 344 |

| Fresenius SE & Co. KGaA (OTCPK:FSNUF) | 40 | 2.71% | 279 |

| CoreCard (CCRD) | 29 | 1.86% | 279 |

| Mips AB | 19 | 1.79% | 13 |

| Intel Corporation | 20 | 1.29% | 343 |

| TISG | 83 | 1.17% | 122 |

| Microsoft | 2 | 1.10% | 65 |

| StoneCo (STNE) | 53 | 1.06% | 174 |

| Bragg Gaming (BRAG)(BRAG:CA) | 103 | 0.96% | 37 |

| NeoGames (NGMS) | 30 | 0.92% | 37 |

| Brookfield Asset Management | 11 | 0.75% | 27 |

| Interactive Brokers (IBKR) | 4 | 0.60% | 233 |

| Tezos (XTZ-USD) | 50 | 0.09% | 679 |

| Hedera Hashgraph (HBAR-USD) | 680 | 0.06% | 651 |

| Bitcoin (BTC-USD) | 0 | 0.06% | 651 |

| Binance (BNB-USD) | 0 | 0.02% | 679 |

Going forward

In 2023 I am planning to add approximately $800 a month to my portfolio. This is slightly less than I did during 2022, but I want to add a bit more capital to my other portfolio. For January I am looking at the following stocks:

Brookfield Asset Management

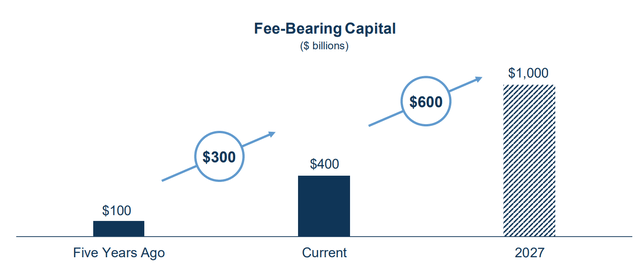

After the split Brookfield Asset Management is purely an asset manager. This makes it easier to understand and value the company. To get a general idea of the performance of the new BAM you should look at the company’s fee-bearing assets. Fee-bearing assets tend to be sticky and the performance of the company will be easier to predict going forward. The company is planning to pay out 90% of cash flow, which leads to a higher dividend. For the coming year, management expects to pay a dividend of $1.28 per share, which is expected to grow at a higher rate than the dividend of the old BAM. In terms of valuation, it is trading at a lower valuation than other alternative asset managers such as KKR (KKR) and Blackstone (BX), which I expect to grow at a lower rate in the coming years.

Fee-bearing capital growth expectation (Brookfield)

Microsoft

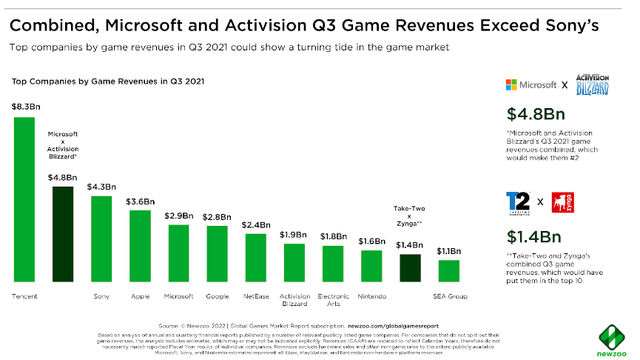

Microsoft is another company that I would love to add additional capital to. The company’s share price was down approximately 30% in 2022 and has entered buy territory several times in the past few months. The company is active in almost all parts of daily life and the pending acquisition of Activision, as well as the potential addition of ChatGPT to its Bing search engine can be some real game changers. The acquisition of Activision will make Microsoft the second largest company in video games by revenue, only trailing Tencent (OTCPK:TCEHY). The video game sector is expected to grow at a CAGR of 12.9% by 2030. While the addition of ChatGPT could make Bing the number one search engine, taking over the number one spot from Alphabet’s (GOOGL) Google. At the same time, the company’s other businesses continue to grow. Thus, if the company continues to trade below my fair value estimate of $231.79, I will add to it.

Revenue of Microsoft + ATVI higher than Sony (Newzoo)

Vonovia

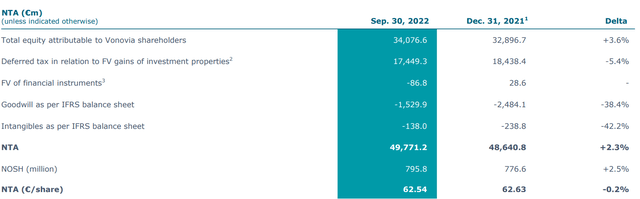

Vonovia is currently my favorite real estate stock. The company is the largest listed real estate company in Europe and owns apartments in countries that have a significant shortage in living spaces. In the short- to mid-term the shortage will most likely persist as Germany was flooded with refugees from Ukraine at the beginning of the war, while the country also gets many refugees from other countries. Construction, on the other hand, has slowed down significantly as the input prices and interest rates have increased. Less construction is a positive thing for the valuation of the company’s real estate, also considering that inflation continues to increase the rents. Unfortunately, in Germany, most rents are tied to the Mietspiegel, which tracks the rent for similar apartments in the area, and that means that it takes a while before rent increases catch up. Nevertheless, at the current price, the company is trading at approximately 1/3rd of its net asset value, which makes it a great bargain.

Net tangible asset Vonovia (Vonovia Q3)

L3Harris

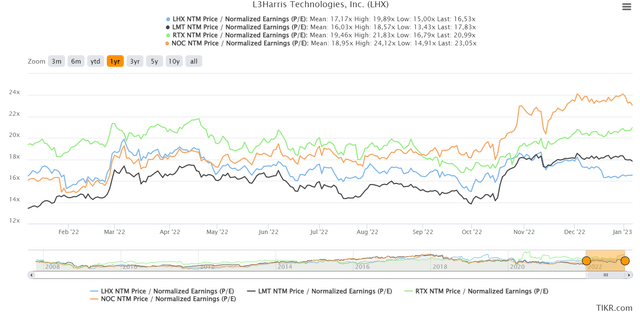

The last stock that I am keeping an eye on for the coming month is L3Harris. I have mentioned the name a few times over the past few months as it has come down significantly from its 52-week high. This is driven by, among other things, higher input costs for manufacturing its product. I personally view this as a short-term issue and expect that the increased tensions in the world will lead to higher demand for defense products. As mentioned in previous updates, multiple countries have already increased their defense spending as a percentage of GDP and I expect most countries to keep it at this level for the foreseeable future, or at least until the war between Russia and Ukraine is over. As for the pending acquisition of Aerojet Rocketdyne (AJRD), I expect the company to have a larger chance of acquiring it than Lockheed Martin (LMT) did as the company is considerably smaller and is not active in that vertical yet. In terms of valuation, the company is currently trading at the lowest PE compared to peers, giving it ample room for multiple expansions.

L3Harris valuation vs peers (Tikr)

Conclusion

All in all 2022 was a year to forget about for most investors. Even though I outperformed the S&P500 this year, my returns were still significantly below what I am aiming for. I do think that receiving dividends helps an investor to not sell all their stocks at the lowest point. In the coming year, I will keep my current strategy, which mainly focuses on dividend growth and quality.

In total, I received approximately $1,010 in dividends, over 50% more than I received in 2021. The goal for the coming year is to have a forward dividend of $2,000, which equals a lower growth rate than over the past few years. The lower growth rate is a result of the additional portfolios that I run, to which I am planning to add slightly more capital.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment