baona/E+ via Getty Images

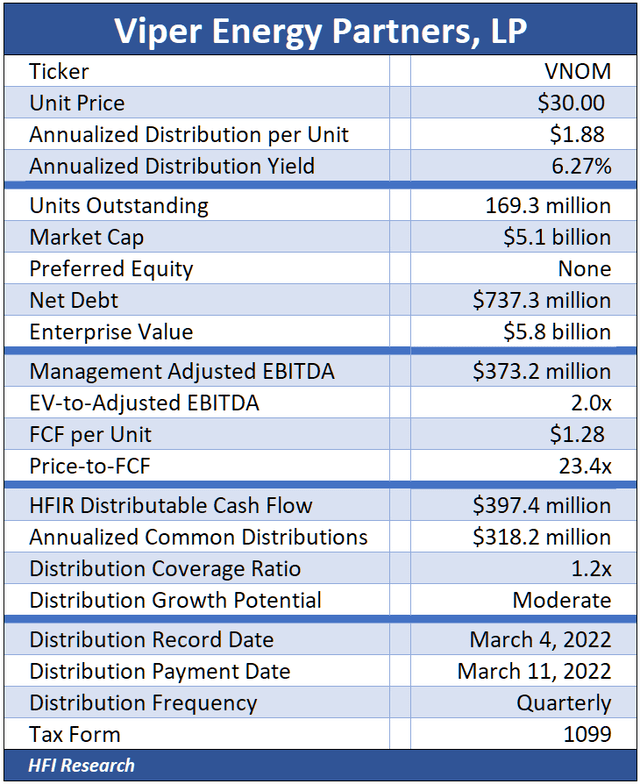

Viper Energy Partners LP (NASDAQ:VNOM) is a royalty and mineral interest owner in oil and gas properties. Viper is sponsored by Diamondback Energy (FANG), which owns 54% of Viper’s outstanding common units.

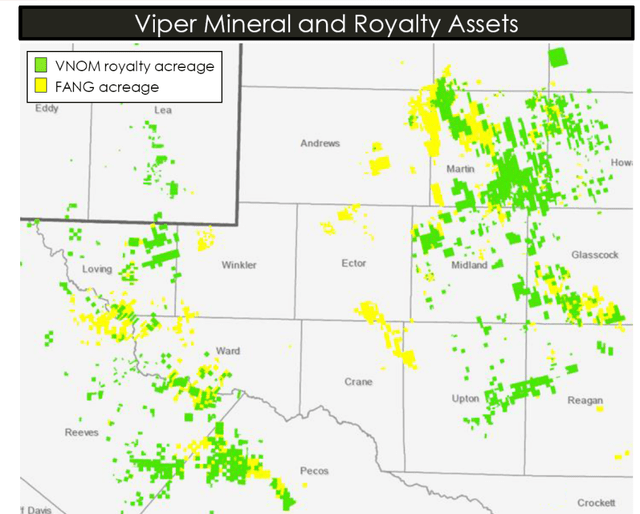

Diamondback operates 54% of Viper’s acreage, with the remaining 46% operated by third parties. A full 97.5% of Viper’s net royalty acreage lies in the Permian basin, with the remaining 2.5% located in the Eagle Ford. The following map shows Viper’s acreage overlap with Diamondback in the Permian.

Viper and Diamondback have a unique operating relationship, in which Diamondback acquires producing properties, keeps the revenue and working interests, then monetizes the properties by selling the mineral interests to Viper. Diamondback then retains a portion of the cash flow generated by those properties through Viper’s distributions.

Viper derives numerous advantages from having Diamondback as a sponsor that are not available to other public mineral interest entities. For instance, Viper has no employees and is managed entirely by Diamondback personnel. It, therefore, has visibility into Diamondback’s production plans. Having Diamondback as a sponsor also reduces frictional costs in the mineral interest business, such as legal fees, title disputes, payment issues. It also nearly eliminates Viper’s capital spending requirements on Diamondback-operated acreage.

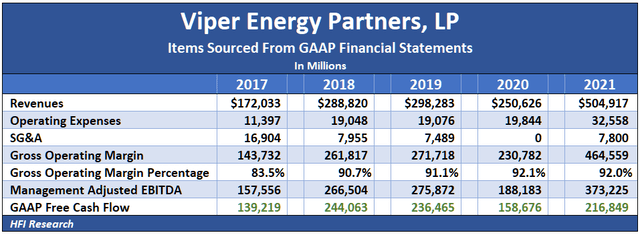

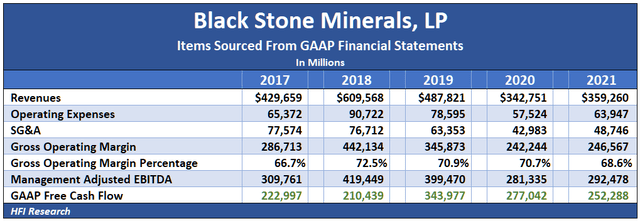

Viper’s relationship with Diamondback also keeps its operating and G&A costs minimal. Whereas other mineral interest owners such as Black Stone Minerals (BSM) have vast mineral holdings spread across the U.S. – each of which has to be maintained and monitored – Viper’s mineral interests are concentrated in a single region. Its low-cost structure reduces its exposure to cost inflation while also bolstering gross operating margins and cash flow generation.

The difference in financial profile between Viper and a more traditional public mineral interest owner like Black Stone Minerals is stark. Viper’s large gross margins mean that significantly more of its revenues convert to free cash flow, as shown in the comparison below.

Viper also benefits from the fact that its properties lie in the core of the Midland and Delaware Basins. As a result, activity levels are likely to remain high in all but the harshest operating and economic environments. Also, Viper’s production is 54% oil, a relatively high percentage for mineral interest owners. Ultimately, stable operators and a high oil cut translate into a strong and stable royalty stream for Viper.

While Viper enjoys advantages from being sponsored by Diamondback, there are some drawbacks. For instance, Viper’s concentration in the Permian constraints its third-party acquisition activities. If it begins to acquire mineral interests far from the basin, its costs are likely to creep up, as are the various risks that stem from operator and geographical diversification. Another drawback is that Viper is significantly impacted by Diamondback’s growth plans. At the moment, Diamondback is not planning to grow production in 2022.

Viper’s Financials

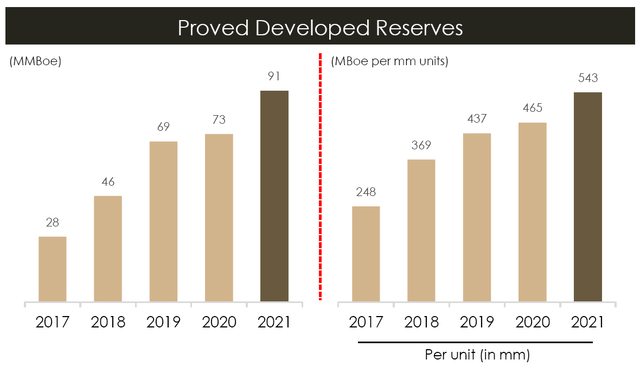

Diamondback management is among the best in the business, so not surprisingly, Viper has been well run by virtually any metric. For one, Viper has successfully grown its proven developed reserves year after year, as shown in the chart below.

Viper Energy Partners (Feb. 2022 Investor Presentation)

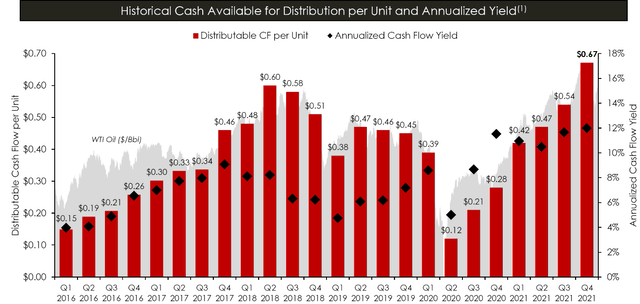

Despite the steady reserve growth, cash flow has fluctuated widely. This isn’t an indictment of Viper or its management but reflects financial reality among mineral interest owners.

Viper Energy Partners (Feb. 2022 Investor Presentation)

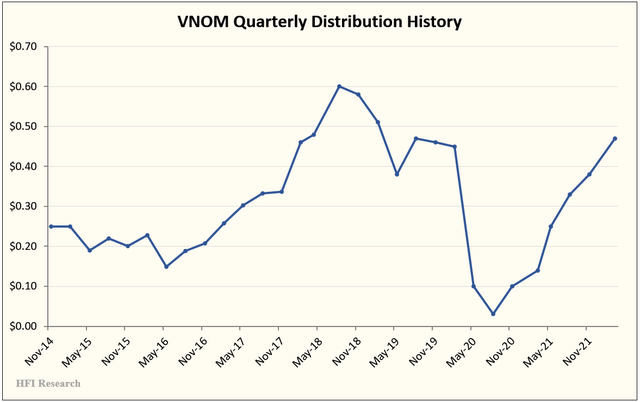

Viper’s distributions have similarly fluctuated widely over the years.

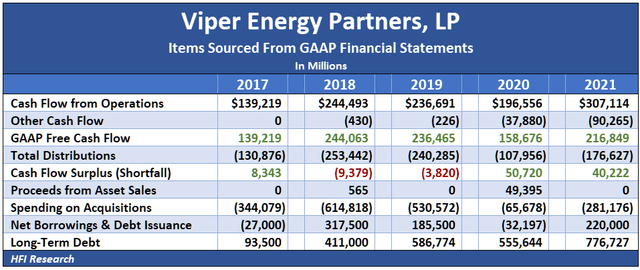

At the moment, Viper is generating record free cash flow from today’s high oil and gas prices. At $85 per barrel WTI, management expects Viper to generate $550 million of free cash flow in 2022. This excludes the cash flow impact of hedges, which are likely to reduce that amount somewhat. Even so, at today’s prices, free cash flow is more likely to come in closer to $600 million. This would be a vast improvement over previous years, as shown in the table below. Note that most of the “other” cash outflows in the table reflect cash payments to settle hedges.

Over the past five years, Viper plowed most of its free cash flow into acquisitions of new mineral interests, spending $1.8 billion over that time frame. Its last major drop-down acquisition from Diamondback was a $497 million of Midland and Delaware Basin properties, 95% of which was operated by Diamondback. Most recently, it spent approximately $530 million in October 2021 to acquire northern Midland Basin acreage, 62% operated by Diamondback.

Management has kept debt low. At the end of 2021, Viper’s leverage ratio stood just below 2 times. Management intends to pay down debt with free cash flow.

The market for mineral interests has heated up over the past few months. As a result, we expect Viper to abstain from potentially high-priced third-party acquisitions. It is more likely to source acquisitions from Diamondback. Viper has acquired its drop-down assets on good terms in the past and we don’t expect that to change. However, since mineral interest valuations are significantly higher today, even if Viper acquired properties from Diamondback, it would probably have to pay up, at least relative to prior years.

We expect management to adhere to its current policy of paying out 70% of free cash flow as common distributions. Viper also initiated a $150 million unit repurchase program in 2021. It repurchased $46 million, and as of its February 22 earnings conference call, management planned to continue unit repurchases in 2022.

Valuation

While Viper has good assets and quality management, while occupying a favorable position with Diamondback as its sponsor, its equity is fully priced. Assuming the company generates $550 million of operating cash flow as per management guidance at lower prices, its units are priced at fair value, which we estimate lies between $25 and $35 per unit.

Mineral interest businesses are simple but difficult to value. Their cash flows are dependent on the unknowable path of commodity prices and production activity. They are, therefore, prone to wide swings in value as operating conditions change, hence our wide valuation range for Viper units. Still, of all public mineral interest owners, Viper is probably the easiest to value because its cash flow prospects depend on Diamondback and other producers in the core of the Permian maintaining or growing production, which is as probable as it gets in shale.

Our EV/EBITDA valuation indicates an 11.7% total return upside in 2022, which increases to 49.7% in 2026. The valuation assumes EBITDA increases by 1.5% annually, and the unit count drops by 0.5% each year.

Our free cash flow valuation uses similar assumptions. It shows the units have a 15.4% total return potential in 2022, which increases to 60.2% in 2026.

Lastly, our discounted cash flow valuation assumes free cash flow remains flat at 2022 levels for ten years. It implies a 2% downside at the current market price of $30.00.

In our valuations, we don’t assume Viper makes any major accretive acquisitions, but we wouldn’t be surprised if it did. A large accretive drop-down acquisition from Diamondback would increase the potential upside for equity owners.

On the downside, however, our valuations assume Viper’s operating environment remains conducive to distribution increases, which of course is far from assured. If commodity prices took a tumble and stayed down, Viper would reduce its distributions, perhaps significantly.

Our valuations suggest repurchases are not a good capital allocation policy. Repurchases only add value for unitholders if made at a discount to intrinsic value. Viper is currently trading in the middle of our intrinsic value range, so distributions and debt paydown are better uses of capital than repurchases.

Conclusion

We prefer to purchase mineral interest owners like Viper when commodity prices are low and sentiment is in the dumps. Today, commodity prices are booming and sentiment is ebullient, so we’d rather avoid them. Viper’s units today hover around $30. We think they would have been a far more appetizing proposition back in 2020 when they averaged $11.75.

Still, Viper units are not overvalued. We recommend that current owners hold onto the units, mainly because Viper is so well managed. As for us, we’d rather wait for a major selloff before buying. Viper would be a top candidate if it fell below our valuation range. We’ll be sure to keep a close watch on this one.

Be the first to comment