Ariel Skelley/DigitalVision via Getty Images

Introduction

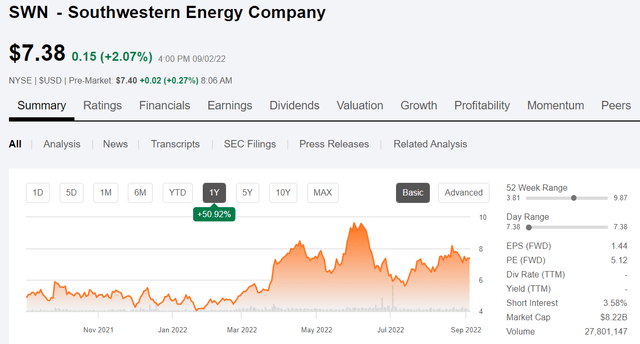

Southwestern Energy Company (NYSE:SWN), a Marcellus and Haynesville natural gas and NGL producer, is a company we have meant to cover previously, but just never got around to doing. As you can see from the price chart, we are a little late to the game. Oops!

SWN Price chart (Seeking Alpha)

The company rallied hard from lows in March to attain nearly $10 per share in early June. Almost 2.5X! Darn! It is my practice and custom to look ahead rather than backward, and in this article we will see if the company now is at an attractive price point, based on future prospects. The $7’s are not a bad place to begin a new position if the company’s story remains intact! The current softening price environment might present patient investors a still better entry point in the $6’s.

The nineteen or so analysts who cover the stock are all over the map, with an overweight rating, and price targets that range from $7 to $20. The average is $10.93, implying a respectable amount of growth from current prices. Or nearly a triple if that $20 outlier estimate bears fruit.

Let’s look a little deeper.

The thesis for SWN

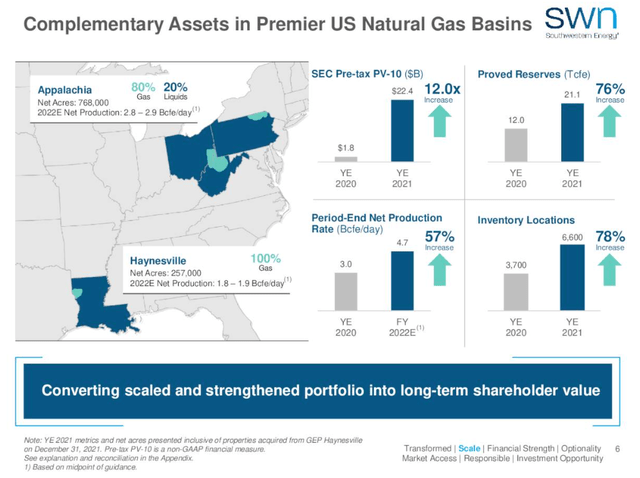

The company is mid-size producer – nearly 5 BCFe/D of mostly gas and gas liquids from the two key basins known for favoring those commodities, the Marcellus, and the Haynesville. Currently they are focusing on areas known for dry gas and NGLs.

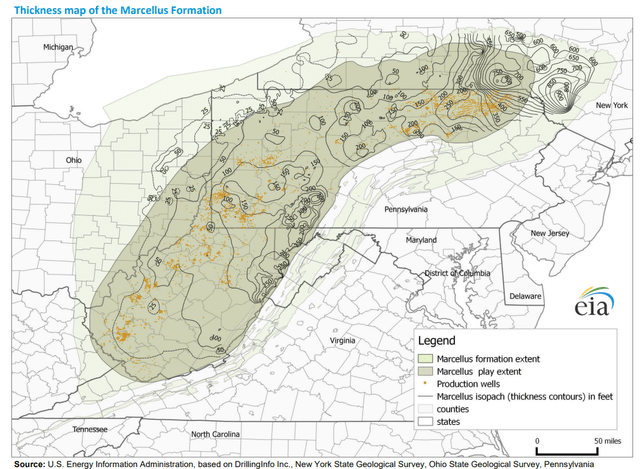

You all know me as a “rock-guy.” That’s where I look immediately when a company gives me information such as you see in the acreage footprint slide below.

A look at the EIA thickness map of the Marcellus shows that a nice chunk of the SWN acreage is in the premium part of the play, with thicknesses in the 300-500′ range. That said, the bulk of their 768K acre position is in the western portion of the play where thicknesses run more like 50′. Still pretty good, as the contours thin out rapidly the farther west you go. SWN notes they have 4,900 economic locations at $2.75 gas.

EIA Marcellus Counter map (EIA)

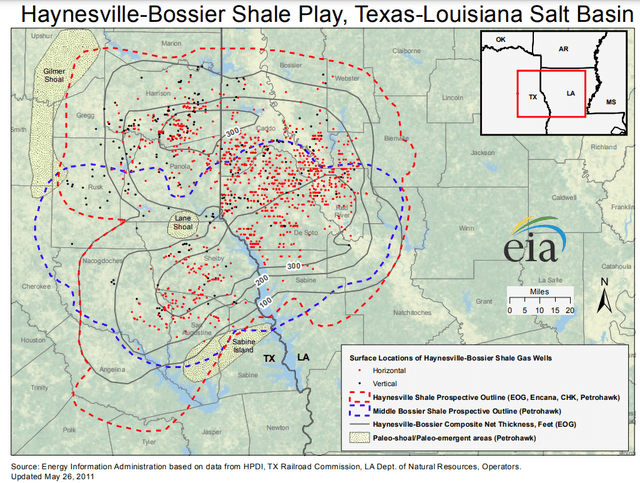

Looking at the Haynesville, the best stuff seems to be on the Louisiana side, and that’s just where SWN’s footprint seems to be. They show 1,700 economic locations at $2.75 gas, which should mean they have many more at $9.00 gas.

EIA Contour map-Haynesville (EIA)

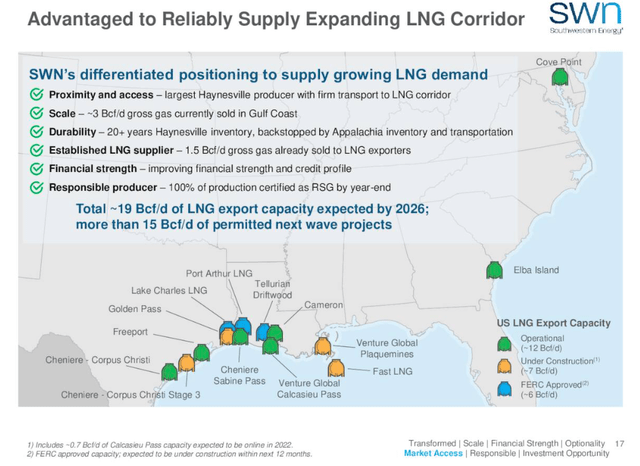

So SWN passes the rock test. Looking below, you can clearly what they view as their target market. They have established relationship in the LNG market that drives 1.5 BCF/Day to export. This base is due to nearly double in the coming years as more liquefaction comes online.

SWN Access to markets (SWN filings)

Bill Way, CEO of SWN, commented in regard to their view of the export market opportunity for gas:

As a key differentiator for SWN is our proximity and firm transportation to the long-term demand growth along the Gulf Coast. As the largest producer in Haynesville with complementary firm transportation from Appalachia, 65% of our total production reaches this market. Approximately 12 Bcf per day of liquefaction is currently in service, which could more than double with FERC approved projects, including approximately 7 Bcf per day that is already under construction.

Today, Southwestern Energy is one of the largest suppliers of natural gas to existing LNG exporters at 1.5 billion cubic feet per day. As natural gas transitions from a regional to a global price-linked commodity, we believe we will differentially benefit as the Haynesville and Gulf Coast garner premium pricing relative to other basins.

In summary, SWN has years’ worth of quality assets and solid export contracts. So why are they selling in the $7’s?

Hedging is one reason

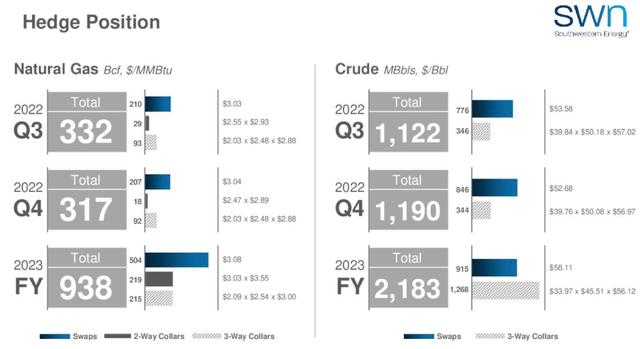

Hedging is problematic for SWN. They produce about 1.5 BCF/d of gas and have about 62% of that hedged at what I would call extremely low pricing. The upside here is that there is a plan to dial this back, starting next year, adding additional volumes to be exposed to market pricing.

Bill Way’s comment in regard to an analyst question on hedging:

With our improved financial position, however, and the supportive fundamental outlook for natural gas prices, expect our future hedging levels to migrate lower within our approved ranges and with preference for using collars. As our hedges settle, our reinvestment rate will more clearly reflect the inherent cash generation capability of our asset base. The resulting prospective rate of change in our free cash flow profile differentiates SWN as an investment opportunity.

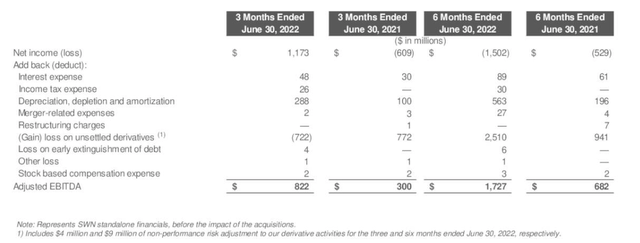

Yep, can’t argue with that. Pay less for hedging as shown below, and do other things with that money. In Q-2 alone, settlement costs ran to $722 mm in the quarter and $2.5 bn for the first half. Somebody needs to talk to Mr. Way about that. I get covering your bases if pricing goes pear-shaped, but c’mon fellas…$3 per mmbtu????? A lot could be done with that money, like pay down some their $5.0 bn in long term debt!

SWN hedging costs (SWN Filings)

Q-2, 2022

This quarter beat expectations, on revenues of $4,140 bn on which SWN generated approximately $1.5 bn of EBITDA and $170 million of free cash flow. A working capital draw caused by the sharp rise in natural gas prices between April and June, and settlement of hedges, cut into their OCF for the quarter.

Looking forward, due to strong operational performance, and given the current commodity price outlook, free cash flow should approximate $1 billion in 2022 and, as their hedges settle, $2 billion per year starting in 2023. The company plans to prioritize allocation of this free cash flow to debt retirement in the near term before shifting more heavily towards share repurchases.

At the current strip, they are targeting $3.5 billion top end of the target debt range by the end of next year, while also completing the share repurchase authorization. This capital allocation strategy is consistent with their strategic objective of returning to investment grade. As noted previously SWN holds $5.0 bn of long term debt. The company rescheduled its RBL of $3.5 bn to 2027 last April. Other debt maturities are staggered 2024,25, 27, 28, 29 in varying amounts ($400-600 mm), with $1.2 bn due in 2030, and $1,150 bn in 2032. In my view, SWN doesn’t present a risk of default with commodity prices in the present range.

The company also has a $1.0 bn share repurchase authorization. This would retire about 15% of common stock at present prices.

Just a quick word on the debt

SWN went on a spending spree in 2020/21, doubling long term debt with the purchase/merger of Mustang Acquisition Corp, Indigo Resources and GEP Haynesville. This was done for sound business purposes, primarily to consolidate acreage in the Haynesville-Bossier shale plays, that form the basis for much of their future EBITDA.

Risk

I think SWN is de-risked at present prices in the current gas price regime. Any change to that story would affect this comment.

Your takeaway

SWN should be a cash cow. Hedges have derailed that story for 2022. They are on track to generate ~$6.0 bn of OCF in 2023, and forecast free cash of $2.0 bn for 2023. With an EV of $13 bn, that would have them trading at a 6X multiple at present prices. Not excessive, although we still wish we could turn the clock back a few weeks. It may be possible to do that thanks to softening gas prices.

The price per flowing boe is not excessive either, coming in at $15k per barrel.

I am giving SWN a buy rating. They’ve got a sound business and are on track to improve cash flow. That said, I might be patient. Gas prices have softened significantly due to surging production- we put 61 BCF into storage last week, and the ongoing outage at Freeport LNG, putting 2-BCF back on the market.

Better prices may present themselves in this one before the chilly winds of winter begin to blow. If SWN was to revisit the low to mid $6s, I might be tempted.

Be the first to comment