Teka77

When FedEx (NYSE:FDX) reports a disastrous quarter, the market always has to ask whether this was an internal issue or an economic problem. The package delivery company has a bad history of missing targets including the 4 quarters prior to COVID lockdowns. My investment thesis is Bullish on the stock due to the market panicking, but the history of internal issues and questions on whether the new CEO has a handle on the business are major concerns.

Estimates Slashed

After the close on Thursday, FedEx slashed FQ1’23 numbers due to global volume softness that accelerated in the final weeks of the quarter. The company cut revenue estimates, but the package delivery business is still forecasting revenue growth for the quarter.

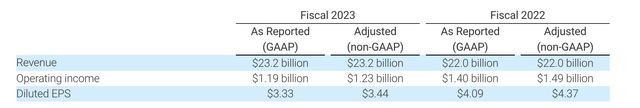

Source: FedEx FQ1’23 preliminary release

The biggest issue is the lack of pricing power and cost pressures despite the revenue growth. Sure, FedEx built the business during the quarter for revenues to reach $2x billion, but the package delivery company cut guidance for the quarter to $23.2 billion in a reduction to expectations by only $0.3 billion.

The EPS number is the major problem were the FQ1’22 EPS dip from $4.37 last year to only $3.44 now. The consensus estimates were for FedEx to hit $5.14 for the quarter while the company managed to turn a $1.2 billion boost in revenues to a nearly $1 hit to earnings per share, or the equivalent of a nearly $500 million hit to net income expectations on a limited revenue miss.

FQ2’23 appears to face the same issue with a new EPS target of $2.75 on revenues reaching $23.5 billion to $24.0 billion. Last year, FedEx earned $4.83 per share on revenues of $23.5 billion.

Again, the package delivery company is pointing more towards internal issues with revenues topping the prior FY levels. The company has a long history of not correctly managing the business including integration issues with the TNT business in Europe where a lot of the current problems exist.

FedEx has a history of missing targets including the 4 quarters prior to the COVID lockdowns. CEO Raj Subramaniam took over the position on June 1 due in part to this history of missing expectations.

The dramatic part of the preliminary FQ1 announcement, outside of the EPS cut, were the comments by the CEO regarding a global recession. Mr. Subramaniam immediately appeared on MadMoney with Jim Cramer and made this dire statement about the business:

We’re seeing that volume decline in every segment around the world, and so you know, we’ve just started our second quarter. The weekly numbers are not looking so good, so we just assume at this point that the economic conditions are not really good.

The company has a huge disconnect with the dramatic language of the CEO and the dire press release by FedEx while the company still guided to a potential $500 million in revenue growth YoY for FQ2’23. Sure, analysts had the company growing revenues by up to $1.3 billion in the current quarter, but a company missing growth targets is far different than a company reporting a massive revenue decline.

The dramatic warning deviates from the announcement by United Parcel Services (UPS) just a week ago on the plans to hire 100,000+ extra workers for the holiday season. The leading package delivery firm has plans to hire a similar amount of seasonal workers as the prior two years to handle the surging package volumes for the holiday season starting in October and running into January.

Clearly, UPS provided no hints of a dramatic slowdown in global package demand, or the company wouldn’t hire so many seasonal workers. The discrepancy in these views hints at a potential large execution issue at FedEx.

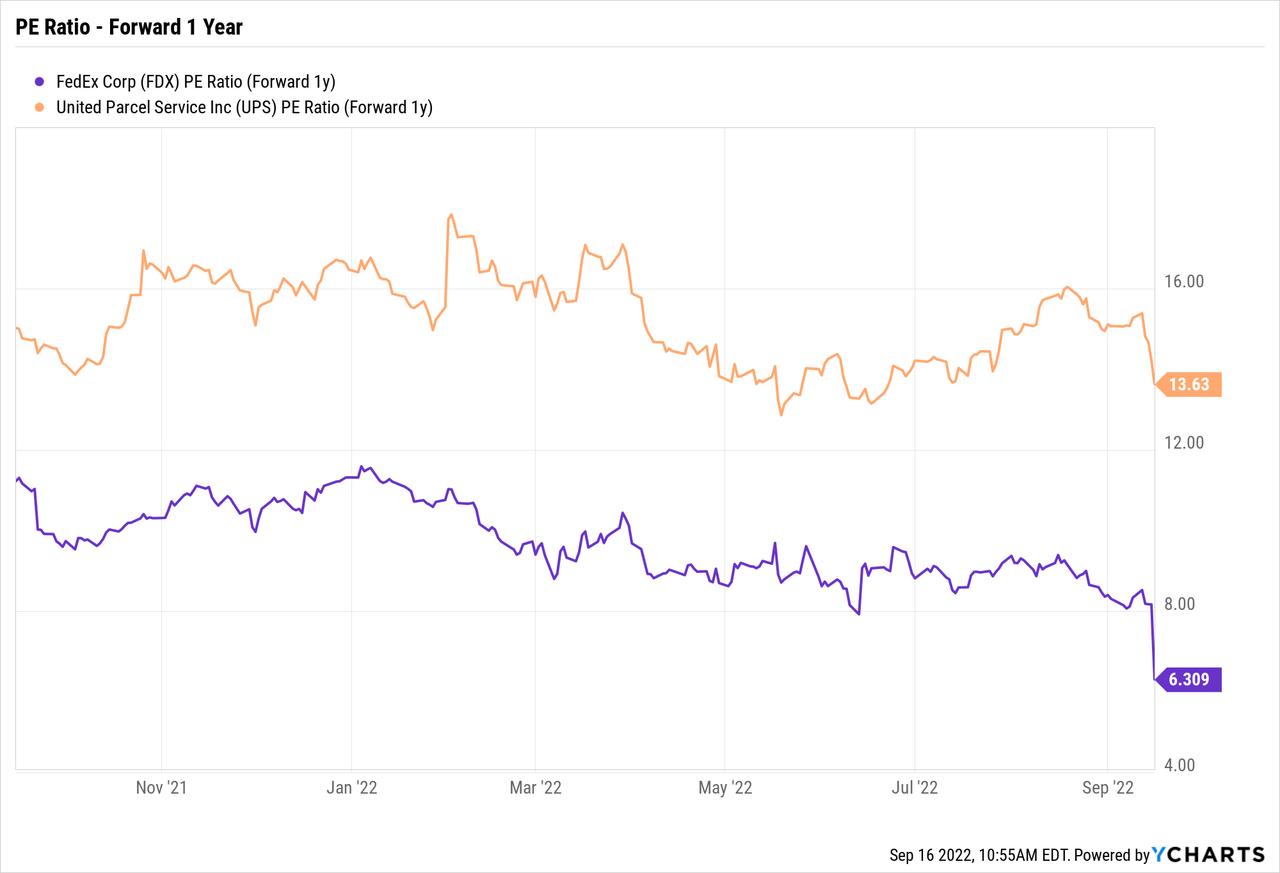

FedEx Stock – Widening Discount

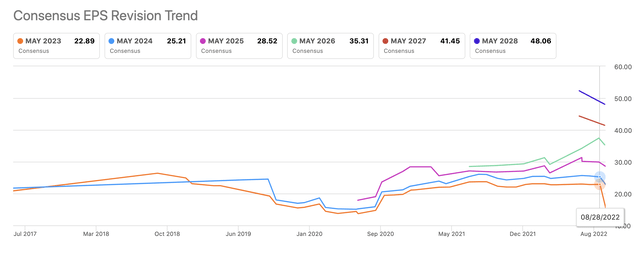

Analysts entered September with expectations for FedEx to earn nearly $23 per share in FY23 based on the guidance from the company. The consensus numbers had the package delivery company earning over $25 in FY24.

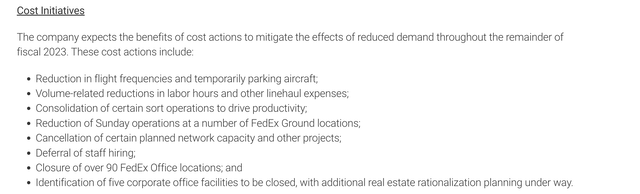

The stock has fallen 23% in a general disconnect from the earnings potential of FedEx once the macro weakness is resolved. The company has a long list of initiatives to solve the cost issues leading to the dramatic EPS cut.

Source: FedEx FQ1’23 preliminary release

FedEx isn’t guaranteed to solve these issues, but the company appears to face a much larger internal issue. No company should see a $300 million hit to revenues lead a larger dip in net income. The business apparently has no method of adjusting the cost structure when package volumes don’t meet expectations, but the company should be able to fix these problems with the above cost initiatives.

UPS continues to trade closer to 15x forward earnings providing the opportunity for FedEx to close the gap under the new CEO. If the company restores the earnings power for FY24 back to $25, the stock has the opportunity to trade back anywhere from $250 (recent 10x multiple) to $375 (15x peer multiple).

Takeaway

The key investor takeaway is that FedEx has a lot of internal problems to solve while the global macro issues aren’t helping the business. Investors shouldn’t rush into buying the stock. After the dust settles, FedEx is just too cheap trading close to $150 with strong capital returns to buoy the stock until business improves.

Be the first to comment